Trading Optim Liquidity Bonds

MuesliSwap features a highly efficient orderbook. This opens MuesliSwap as a secondary market for Liquidity Bonds issued by Optim Finance.

MuesliSwap features a highly efficient orderbook. This opens MuesliSwap as a secondary market for Liquidity Bonds issued by Optim Finance.

What are Liquidity Bonds?

Liquidity Bonds are financial products very specific to the Cardano staking framework. Lenders lend the staking rights to their ADA to a borrower. The lender locks ADA in a smart contract. They receive one OBOND token for each 100 ADA locked. The smart contract allows a borrower to attach their staking key to the locked ADA, as long as the borrower pays interest to the lender. The interest and locked ADA may be redeemed by the holder of the OBOND token.

You can read more about Optim Finance financial products on their own explanation page: https://app.optim.finance/faq

What is an OBOND token worth?

The value of an OBOND token depends of course on a lot of factors. It is very certain that the token can be redeemed for at least 100 ADA from the contract at the end of the lending period.

On top of that, the lender can expect some interest to accumulate on the token. The exact amount depends on the interest rate of the borrowing pool, the duration until the end of the lending period and all other factors that can be assessed from the Optim dashboard.

How can I trade OBOND tokens?

MuesliSwap has integrated the OBOND tokens into their order book. Search for tokens called “OBOND” to find bond positions. You can place orders for selling or buying OBONDs using the “Limit Swap” feature, which lets you place limit orders in the MuesliSwap orderbook.

Here are shortcuts to the trading page of the first two issued OBONDs on MuesliSwap:

MuesliSwap | Cardano DEX

Swap, earn and invest on Cardano's leading DeFi ecosystem 🥛. MuesliSwap is the first native, scalable decentralized…

A concrete example:

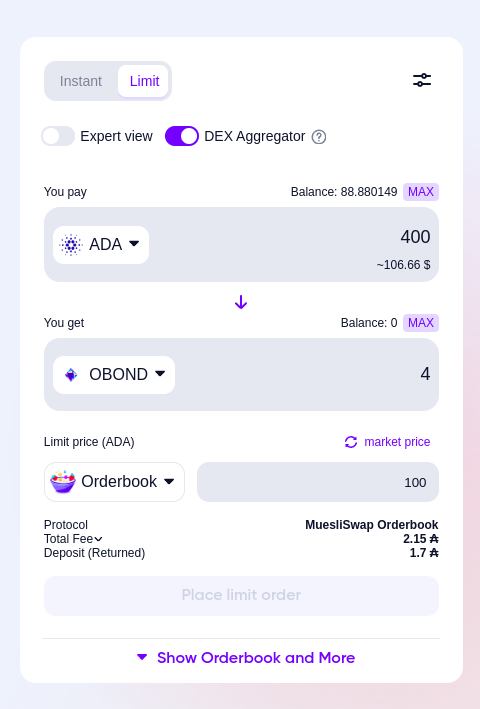

As OBONDs are likely to be worth at least 100 ADA, we want to place a buy order for OBONDs at 100 ADA / OBOND. On the trading page for OBOND (“Swap” -> Select “OBOND” as the lower token), we choose “Limit” on the top. This allows us to set a custom price on the lower right. We set that limit to 100. We would be willing to buy up to four OBONDs at this price, so we enter 4 next to the OBOND field. If another user would sell less OBONDs, this order will be partially filled, so we don’t need to place several smaller orders.

We are now satisfied with this configuration and click on “Place limit order”. Sign the transaction that you are prompted for and that’s it! You should now be able to see your order in the Orderbook, which is displayed in “Expert” mode.

Why are there no Liquidity Pools for OBONDs?

OBONDs are difficult to trade through AMMs, due to their indivisible nature. This makes the secondary market of OBONDs a prime use case for the MuesliSwap order book.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!