Launching iUSD/ADA Organic Yield Farming

We are excited to announce the launch of a new yield farm on MuesliSwap — iUSD/ADA.

We are excited to announce the launch of a new yield farm on MuesliSwap — iUSD/ADA. It is at the same time a pioneer and the first ever organic yield farm on Cardano. MuesliSwap is preparing itself to be a key platform for trading and earning with Stablecoins. For this reason, we will launch a yield farming program to incentivize liquidity allocation for the synthetic stable coin iUSD on MuesliSwap.

If you are unfamiliar with Yield Farming, Cardano or MuesliSwap check out this tutorial for a gentle introduction: https://www.youtube.com/watch?v=n4EcIyhzTPU

Are you unfamiliar with the concept of synthetic stable coins? Find out more about iUSD in this article: https://indigoprotocol1.medium.com/stablecoins-are-coming-to-cardano-88ae524a43eb

How will the farming look like?

In order to farm on MuesliSwap, you will deposit iUSD and ADA in the MuesliSwap iUSD liquidity pool. The liquidity tokens redeemed for staking will then be staked on the MuesliSwap platform. You will earn rewards in the form of ADA and MYield.

All relevant links can be found here: https://muesliswap.com/earn/farms

How high is the emission/APR?

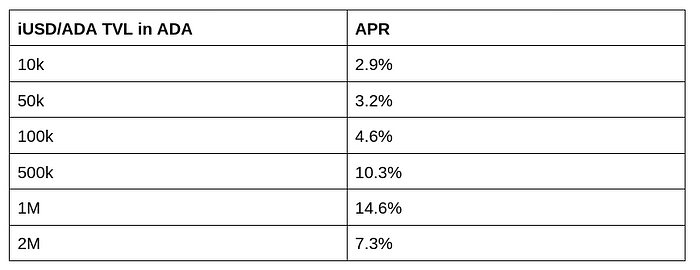

The APR of the iUSD/ADA pool will be governed by our newly introduced Organic Farming emission schedule. In general this means: If the total TVL increases, everyone's APR increases. This goes on until we reach the desired liquidity of the pool. When smooth trading with low price impacts is guaranteed we don’t need more growth — at around 1M ADA.

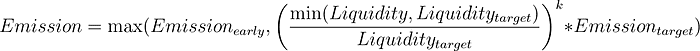

We are using the following formula for governing token emissions, which is a parameterization of the formula we introduced earlier.

The Organic Yield Farming Formula

We choose k=1.5, early Emission = 50 MYield and target Emission = 25,000 MYield at the target Liquidity of 1,000,000 ADA. In the following table you can see concrete examples of the APR based on TVL in the iUSD/ADA pool.

APR based on the formula parameters for different amounts of TVL in the iUSD/ADA Pool on MuesliSwap

Read more about Organic Farming in this Medium Article: https://medium.com/@muesliswap/introducing-organic-farming-apr-abe86b65e785

When does it start? How long will this last?

The yield farm will start today, 7th December 2022 at 21:00 UTC and is scheduled for 30 days. That means the program will be re-adjusted on 4th of January depending on the development of the pool and other staking programs such as Indigo Staking.

What about Indigo staking? Will I need to move my liquidity?

The short schedule of 30 days has a simple reason. Indigo will start its own yield farming program for liquidity pools on the 14th of December, incentivized with INDY tokens.

We are working together with Indigo and the community to have MuesliSwap LP tokens whitelisted for INDY staking. This means that you should be able to freely choose whether you stake at MuesliSwap or Indigo. The early launch of MuesliSwap staking means you can start at MuesliSwap today and move to Indigo later, as there is no lock-up period for staking on MuesliSwap. The only thing that is required to move are the LP tokens, there will be no need to move any liquidity.

If you want to participate in the poll to whitelist MuesliSwap LP tokens for Indigo staking too, check out this link: https://forum.indigoprotocol.io/c/polls/11

It’s not enough! I want an APR of 1000%!!

At MuesliSwap, we are committed to providing long term incentives for users to provide liquidity on our exchange. We are therefore committed to non-inflationary tokenomics and do not offer APRs that will lead to rapid token devaluation.

Further, the pool involves a stable coin and has hence much less risk than other farms. The APR is therefore smaller in comparison to other Yield Farms on MuesliSwap.

It’s too much! APR of 15% is never sustainable!

The Yield Farming program is currently scheduled for 30 days. We will evaluate how effective it was and adjust the token emission after that. We are trying to attract liquidity to MuesliSwap in order to establish ourselves as a key player for stable coin trading and have hence allocated some part of our reserves for the attraction of stable coin liquidity. In order to deplete them not too fast, a maximum reward emission is fixed in the above formula.

Sounds great — Where can I start?

All relevant links can be found here: https://muesliswap.com/earn/farms

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!