MuesliSwap Introducing Organic Farming APR

In one sentence: The more people contribute to a pool, the higher the APR. So go ahead and spread the word!

In one sentence: The more people contribute to a pool, the higher the APR. So go ahead and spread the word!

With concentrated liquidity pools on their way, MuesliSwap is preparing itself to become one of Cardano’s key platforms for trading and earning on stablecoins. This requires large amounts of liquidity to enable smooth trading with low price impacts. As a first step on this journey, we are happy to announce the innovative concept of Organic Farming APR.

If you are unfamiliar with Yield Farming, Cardano or MuesliSwap check out this tutorial for a gentle introduction: https://www.youtube.com/watch?v=n4EcIyhzTPU

What’s wrong with traditional farming reward distribution?

Traditionally, each farm has a fixed amount of total rewards emitted per day, regardless of the amount currently staked in the farm. The effect? The more participants a farm attracts, the lower the APR, meaning there is no incentive for current farmers to spread the word. With Organic Farming, we have re-engineered the incentives to achieve the opposite effect: The more fellow farmers the community can attract, the higher the APR for everyone!

What is Organic Farming APR?

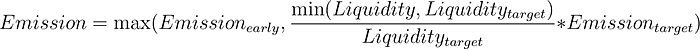

In order to achieve this incentive for attracting farmers, we have come up with a new way of determining reward distribution for Yield farms. We proudly present: the Organic Farming APR formula! Here it is

What are all the min and max’s? In order to incentivize an early group of farmers to join, we set a minimum emission rate to achieve good APR for early adopters. After a tipping point of a certain amount of liquidity, the emission rate grows with the amount of liquidity coming in. This doesn’t just mean that there’s additional reward for newly joined farmers. Everyone gets a rate increase! For example, if farmers can double the amount of liquidity, then everyone’s APR gets doubled! Of course, this can’t go on forever. Once we’ve reached a previously set target liquidity amount, the emission rate stays at a constant maximum. If liquidity gets withdrawn and we fall below the target, incentives kick back in to quickly bring it up to target liquidity again.

Example

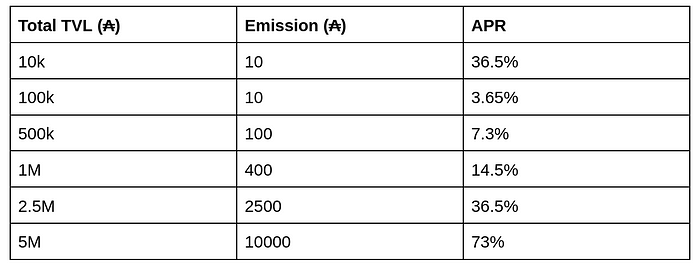

We assume a liquidity pool with a target liquidity of 5M ₳, a minimum emission rate of 10 ₳/day and a maximum emission rate of 10k ₳/day

Wen Moon?

We want to implement this approach with a liquidity pool soon — very soon! Tomorrow, we are going to announce a new yield farming pool that will be incentivized using this formula. Can you guess which token it will be?

Disclaimer: This article is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!