How to Invest $20k? | 5 Best Ways to Grow Your Money

Having $20k in savings is a commendable milestone. However, if you want to see that money grow, you’ll need a thorough long-term investment strategy. In this guide, you will find ideas for how to invest $20k,...

Having $20k in savings is a commendable milestone. However, if you want to see that money grow, you’ll need a thorough long-term investment strategy.

In this guide, you will find ideas for how to invest $20k, the pros and cons of those approaches, what to consider before you start investing, as well as more conservative options for saving toward retirement.

Finbold is compensated if you access certain of the products or services offered by eToro USA LLC and/or eToro USA Securities Inc. Any testimonials contained in this communication may not be representative of the experience of other eToro customers and such testimonials are not guarantees of future performance or success.

What kind of investor are you?

Before you determine how to invest that $20k, answer these questions:

- What is my investing goal? Is it to save for an upcoming expense, such as a car or a down payment for a house, or are you saving for retirement? This is important because a short-term goal will require a different approach to a long-term goal;

- What is my risk tolerance? Investing is inherently risky, and your risk tolerance will determine your asset allocation;

- How much do I want to be involved? Decide which investing approach suits you best: active or passive investing. If you focus on the long term and aren’t just looking for short-term gains, both techniques can be lucrative. However, we urge beginners to focus on passive investing strategies rather than trying to beat the market. Additionally, if you’re new to investing, consider getting help from a financial advisor.

Ultimately, your age, risk tolerance, investment time horizon, and financial goals all factor into your investment style. And understanding who you are as an investor can help you adjust your method as you age and your financial goals change.

Before we continue

This guide is built on the premise that your $20,000 of extra cash is indeed extra and that you do not have any outstanding debt, especially high-interest credit card debt. Additional information on the factors that should be considered before investing can be found below. So before allocating your $20k, be sure to make those evaluations.

Best ways to invest $20k

Whether from a sudden windfall, inheritance, or good old-fashioned saving, you have a spare $20k burning a hole in your pocket. Your next step is figuring out how to put this cash to work. And while this might not seem like a life-changing sum of money, if invested appropriately over time, it could grow into a sizeable nest egg.

Various options are available to you. But ultimately, the best way to invest $20k is to choose the financial instrument (or several) that meets your specific needs to help you reach your future financial goals.

Below you will find our pick for the five best ways to invest $20k:

- Stock market;

- Index funds and ETFs;

- Real estate — REITs;

- Retirement savings;

- Cryptocurrencies.

Now, let’s really dive in!

1. Stock market

In this section: How to invest $20k in the stock market?

Investment type: Long-term growth

Risk Level: Varies

Broker to consider: Regulated, industry-leading low-cost trading platform eToro.

Finbold is compensated if you access certain of the products or services offered by eToro USA LLC and/or eToro USA Securities Inc. Any testimonials contained in this communication may not be representative of the experience of other eToro customers and such testimonials are not guarantees of future performance or success.

Disciplined investing in the stock market over decades is generally the best way to build long-term wealth. And though returns can vary from year to year, if investors reinvest their profits, they may even see compounding gains, which only grow more handsome as time passes.

For instance, the S&P 500 brought a 26.89% return in 2021 during the post-COVID recovery. And even though the market index was down a whopping -19.44% in 2022, it’s still averaging 10.21% since its inception in 1957.

So, once you know what industry, sector, or company you want to invest in, you can shop for an investing platform. For the hands-on types, this typically means opening an online broker account, such as eToro or Interactive Brokers. Alternatively, for those who require more assistance, investing through a robo-advisor, as well as help from a financial planner or investment advisor for stock recommendations, might be a wise choice.

Remember

While there is potential for hefty gains for portfolios built around individual stocks, there’s also potential for significant losses. That’s why it is paramount to diversify your holdings. Indeed, diversification can protect your investments from market volatility, as different assets may react differently to the same market conditions. So, instead of investing the entire $20k in a single stock, consider spreading it across a variety of companies and industries.

Pros and cons of investing in the stock market

Pros

- High returns: Investing in the stock market can potentially generate higher returns than more conservative asset classes such as bonds;

- Liquidity: Stocks are highly liquid, meaning you can easily buy and sell them at any time;

- Low barrier of entry: Most retail brokers offer commission-free trading and no account minimums, so you can start investing with as little as $10;

- Build long-term wealth: Generally, stocks yield a generous annualized return over the long term. For example, as of March 7, 2023, the 10-year annualized return for the S&P 500 was 12.9%. So at the minimum, you’ll be able to stay ahead of inflation.

Cons

- Returns are not guaranteed: While stocks can outperform many financial assets over long periods, they may not do well over your chosen investing period;

- No short-term gains: Generating profits through stocks generally takes decades, not weeks or months;

- Volatility: Share prices rise and fall minute to minute, taking the investor on an emotional rollercoaster. The best is, therefore, to check your investment only periodically;

- Time: When buying individual stocks, you must manage your portfolio yourself. That means regularly following various company health indicators as well as overall market conditions and adapting the asset allocation in your portfolio as necessary. Unfortunately, doing all of that can take a lot of work.

Dividend Investing

Many investors look to dividend stocks to generate additional income through dividend payments in addition to capital appreciation of the stock price. However, when selecting dividend-paying stocks, choose more than just the ones with the highest dividend yields. A high dividend might allude to a business in distress, i.e., the yield could be above average only because the company’s shares have fallen in response to financial difficulty. So before you put your money in a dividend stock, investigate the company’s free cash flow, historical dividend payout ratio, as well as other financial health metrics.

2. Index funds and ETFs

In this section: How to invest $20k in index funds and ETFs?

Investment type: Long-term growth

Risk Level: Varies

Broker to consider: Regulated, secure platform Interactive Brokers.

Passive investing is a long-term investment strategy for building wealth in which investors buy and hold a diversified portfolio of financial instruments with minimal active trading in the market.

Index investing is the most common form of passive investing. In this buy-and-hold strategy, investors purchase exchange-traded funds (ETFs) or mutual funds that track major market benchmarks and hold them over a long time horizon. The objective is to reproduce the financial index performance overall, to match, not beat, the market.

The three most broadly tracked indexes in the United States are:

- The S&P 500;

- Dow Jones Industrial Average;

- Nasdaq Composite.

Pros and cons of investing in index funds and ETFs

Pros

- Low costs: The lack of frequent trading means transaction costs (commissions, etc.) are low with a passive strategy. In addition, while management fees charged by funds are unavoidable, most ETFs fees range from as little as 0.05% to about 1%;

- Less risk: Indexing, by its very nature, offers greater diversification, minimizing portfolio risk;

- Tax efficiency: The buy-and-hold method doesn’t generally result in a massive capital gains tax for the year;

- Convenience: Owning an index is far less complicated to manage than a portfolio of individual stocks that require constant research and adjustment;

- Simplicity: Taking a hands-off investment approach can eliminate many of the biases and uncertainties that can arise when you pick stocks individually.

Cons

- Volatility: Index funds follow their benchmark index regardless of the state of the markets, meaning if the market conditions are poor, the index funds will also follow the indexes downward. In this case, a good active manager may be able to limit the downside by hedging the portfolio or moving positions to cash;

- Slow gains: Buying and holding can be a winning tactic in the long haul, but evening out the risks also flatten out the rewards;

- Many index funds are formed on a market capitalization basis: For example, the S&P 500 gives higher weights to large-cap companies. So, if, say, behemoths such as Amazon.com Inc. (NASDAQ: AMZN) and Meta Platforms Inc. (NASDAQ: META) experienced a weak quarter, it would have a significant impact on the entire index.

3. Real estate – REITs

In this section: How to invest $20k in real estate through REITs?

Investment type: Long-term growth and diversification

Risk Level: Medium

Broker to consider Regulated comprehensive multi-asset trading platform Interactive Brokers.

In addition to the stock market, you might also want to invest in real estate. Though $20k might not be enough for a down payment for an investment property, you can still get exposure to real estate by investing in REITs.

REITs are companies that own, operate, or finance income-generating real estate. REITs (as well as REIT mutual funds and REIT ETFs) are publicly traded and can be bought or sold via a brokerage account, making them the most liquid real estate investment available.

Pros and cons of investing in REITs

Pros

- Provides value appreciation and rental income without the hassle of actually buying, managing, and selling properties;

- REITs offer some of the highest dividend yields on the market;

- Returns over the past 20 years have outperformed the S&P 500, as well as the rate of inflation;

- REITs are publicly traded like stocks, making them highly liquid assets (unlike physical real estate investments);

- Offers a ready-diversified real estate portfolio for any budget without requiring much time or expertise.

Cons

- Dividends are taxed as regular income;

- Hypersensitive to interest rates.

- Some REITs might have high management and transaction fees;

- Because 90% of a REITs taxable income is paid out as dividends, only 10% is reinvested into the REIT to buy new holdings, resulting in slow growth.

Note

Investors might also consider real estate crowdfunding platforms to get exposure to the real estate market. These platforms pool money from several investors to fund a real estate project or investment. However, as a relatively new and unregulated practice, these financial instruments are more prone to fraud as well as more complicated to conduct due diligence on and should thus be approached with caution.

4. Retirement savings

In this section: How to invest $20k for retirement?

Investment type: Long-term growth and retirement

Risk Level: Low

Bolstering your retirement savings is an excellent use of $20,000. Indeed, a retirement account can slowly build your nest egg and support your long-term financial needs.

Here are some options for parking your money safely for decent (albeit modest compared to riskier instruments such as stocks) returns in retirement:

Individual retirement accounts (IRAs)

An IRA is your go-to choice if you don’t have a retirement account with your employer. It’s also a great alternative if you want different investment offerings than those offered by your workplace retirement plan. When you open an IRA, you can invest in various asset classes, including stocks, bonds, ETFs, and mutual funds.

There are two types of IRAs: a traditional IRA, which gives you an upfront tax deduction, and a Roth IRA, which provides tax-free retirement withdrawals. In 2023, you can contribute $6,500 (or $7,500 for those over age 50) per year into an IRA, leaving you with an additional $2,500 to $3,500 to invest elsewhere.

Pros and cons of IRAs

Pros

- Tax-free growth on your assets;

- Tax deductions, whether upfront or on withdrawal;

- More investment choices as opposed to workplace retirement plans.

Cons

- Contribution limits;

- Penalties for early withdrawal.

Certificate of deposit (CD) laddering

A certificate of deposit is an FDIC-insured savings account that holds a fixed sum of money for a set period in exchange for interest, with longer periods generally having higher rates.

A CD ladder is a strategy that takes advantage of the various interest rates offered for different time periods and is created by allocating the same amount of money across CDs with varying maturity dates. Buying multiple CDs at different maturities can be a good choice for risk-averse investors who want to take advantage of the long-term CDs’ higher interest rates while maintaining the flexibility of short-term CDs.

Pros and cons of CD laddering

Pros

- Highly safe as money held in a CD is insured;

- Predictable and practically guaranteed returns;

- The flexibility of short-term CDs and the benefit of higher interest rates offered by longer-term CDs;

- Laddering helps to leverage changing interest rates and create liquidity.

Cons

- Penalties for early withdrawals;

- Rates may not be high enough to outpace inflation;

- You could get stuck with lower rates when you redeposit your shorter-term CDs, making less interest than if you had kept all your money in a long-term CD with a higher rate.

Retirement annuities

An annuity is a financial product offered through insurance companies that provide a fixed stream of payments to an individual, typically in the form of monthly income in retirement. Because invested funds are illiquid as well as subject to withdrawal penalties, they are not recommended for younger individuals or those with liquidity needs.

Pros and cons of annuities

Pros

- Provides income for life;

- Can be customized for your specific requirements;

- You only pay taxes once you withdraw the funds.

Cons

- High maintenance costs and commission fees;

- Hefty surrender fees for early withdrawals;

- Any net returns you receive are taxed as ordinary income, which, depending on your tax bracket, could be a lot higher than the capital gains tax rate.

Note

When buying an annuity, ensure you’re dealing with a trustworthy insurance company that’s likely to be around and make good on its promises when it’s time to start drawing your payments.

Treasury Bonds

Treasury bonds (T-bonds) are debt instruments in which investors lend the US government the purchase amount of the bond in exchange for an interest rate during the bond’s life as well as the face value of the bond at maturity. All treasury securities have zero default risk since they are guaranteed by the full faith and credit of the United States government. Remember, treasury yields can fluctuate depending on the market and economic conditions.

Pros and cons of treasury bonds

Pros

- Stable income stream;

- No risk of losing your principal (original investment) since treasuries have a government guarantee;

- Can be sold before their maturity in the secondary market;

- Can be purchased individually or through mutual funds or ETFs.

Cons

- Returns may not be enough to beat inflation;

- In a rising interest rate environment, fixed-rate bonds will underperform compared to newly issued bonds;

- Selling before maturity can result in a loss.

Remember to take advantage of employer-sponsored retirement options

While a cash deposit into an employer-sponsored retirement plan such as a 401(k) is typically not an option, these plans, when offered, are the leading instruments for retirement planning. Not only because they come with tax advantages (you can deduct your 401(k) contributions from your tax return in the year you make them) but also because employers may offer full or partial matching of your contributions. If your company offers this feature, signing up for the plan is heavily advised. It’s essentially free money!

5. Cryptocurrencies

In this section: How to invest $20k in cryptocurrencies?

Investment type: Alternative investment and diversification

Risk Level: High

Broker to consider Regulated multi-asset investing platform eToro.

Finbold is compensated if you access certain of the products or services offered by eToro USA LLC and/or eToro USA Securities Inc. Any testimonials contained in this communication may not be representative of the experience of other eToro customers and such testimonials are not guarantees of future performance or success.

Investors with a greater risk appetite can consider investing in cryptocurrencies. Crypto investing can take many shapes, from buying the underlying cryptocurrency, such as Bitcoin (BTC) or Ethereum (ETH), to investing in companies in the cryptocurrency or blockchain space, such as Coinbase (NASDAQ: COIN) or Roblox (NYSE: RBLX).

However, keep in mind that cryptocurrencies are considered high-risk investments. As relatively new and untested financial instruments, the prices of crypto assets, even the most established ones, are much more volatile than those of more conservative instruments like stocks. And while volatility can create opportunities for jaw-dropping returns, the reality is, most investors end up empty-handed.

More concerningly, the price of cryptocurrencies could also be affected by future regulatory shifts, in the worst case, even rendering crypto assets worthless. As a result, if you do decide to invest, it’s essential to keep an eye on any new developments in the cryptocurrency space that could affect your holdings.

In addition, because of the abundance of choice within the crypto market, with thousands of crypto assets in circulation, it’s paramount that you research any digital coin before buying it. Finally, given the riskiness of cryptocurrency as an asset class, it’s imperative only to invest money you can afford to lose.

Crypto staking

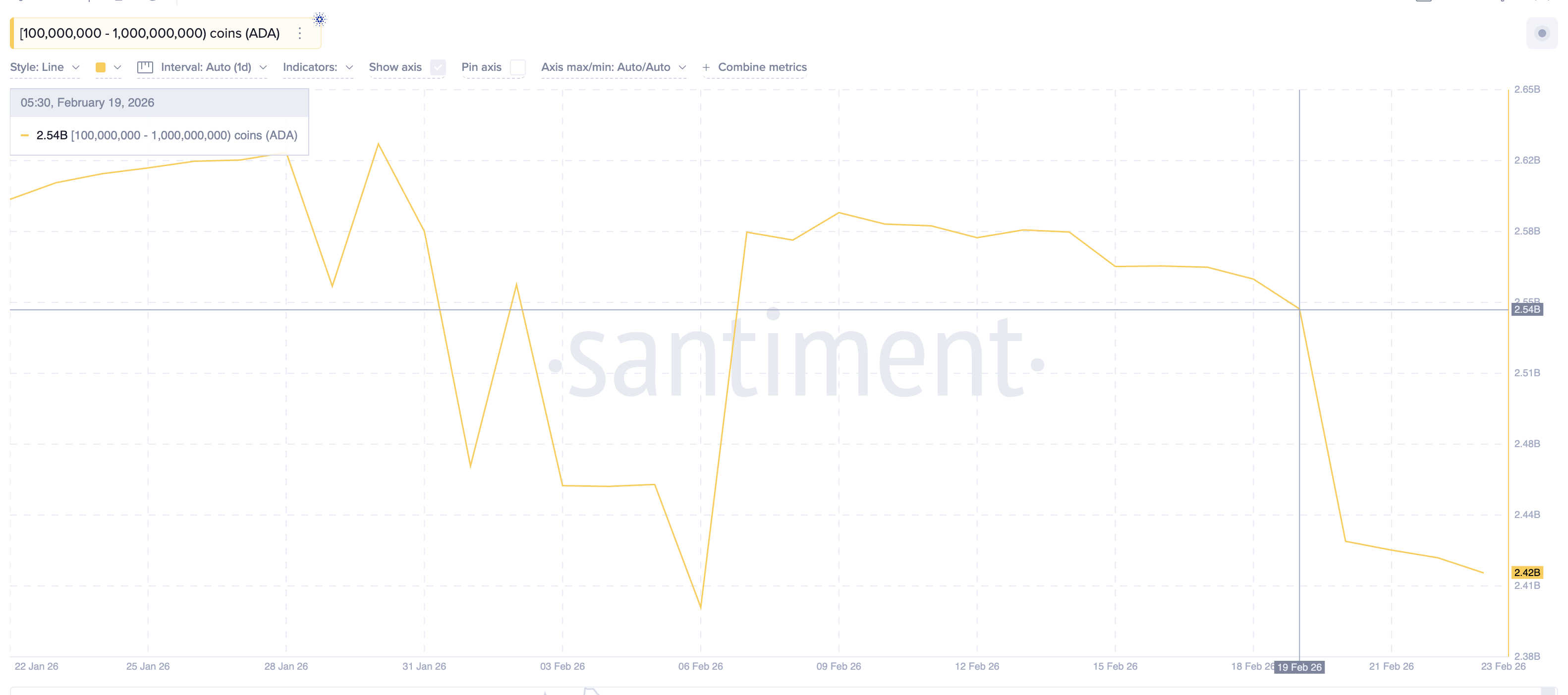

Crypto investors wanting to earn passive income can try staking. Staking in crypto involves committing your crypto assets to support blockchain network operations. In return, you make staking rewards (interest). It’s available with cryptocurrencies, such as Ethereum and Cardano (ADA), that use the proof-of-stake model to process payments. However, before you start, ensure you fully understand how crypto staking works.

Important

Because of the lack of regulation, custody issues, and poor investor education around crypto assets, the prevalence of fraud in the crypto sphere is remarkably high. To avoid being a victim of fraud, thoroughly research the crypto asset you’re about to buy, use a secure device as well as a secure wallet, and only trade with reputable crypto brokers such as eToro or Interactive Brokers.

Pros and cons of investing in cryptocurrencies

Pros

- High-risk, high-reward;

- Offer an alternative investment to more traditional financial markets;

- Crypto trades non-stop.

Cons

- Crypto can be a complicated concept to newcomers;

- Extreme volatility;

- Not (yet) established as a long-term investment vehicle;

- The crypto sphere is ripe with scammers: rug pulls, pump-and-dump schemes, hacking, phishing, etc.

Note

Before the COVID-19 pandemic, adding cryptocurrencies to your investment portfolio was an excellent way of diversifying your holdings because of crypto’s lack of correlation with the broader market. However, according to IMF research, amid growing adoption by retail and institutional investors, the correlation of crypto assets with the stock market has increased significantly, limiting their perceived hedging abilities and “raising the risk of contagion across financial markets.”

How to safely invest $20k — things to consider

Though you may be eager to begin investing your $20k, it’s crucial to assess your financial standing as a whole and ensure the following factors are satisfied first:

- High-interest debt is paid off: Ensure you have repaid any high-interest debt before investing. That includes credit card debt and debt from other loans, such as payday loans. For instance, the average credit card interest rate in 2022 was 19.42%, significantly higher than the average annual stock market return. Low-interest debts such as mortgages or auto loans, on the other hand, do not need to be repaid before you start investing;

- You have an emergency fund: Establish an emergency fund in case of unexpected expenses, such as medical bills, car repairs, or job loss, before you start investing. A good rule of thumb for most people is to put aside six months of living expenses on a deposit account where there’s no risk of losing principal, like a savings or money market account. Importantly, having that cash available will also mitigate the need to withdraw money from your portfolio, use high-interest credit cards, or take out loans;

- Space out your investments: Instead of investing all of your money once, try utilizing a dollar-cost averaging (DCA) strategy, in which the total amount to be invested is divided into periodic purchases of a target asset over a period of time. Spreading out your investment this way can lower the overall impact of price volatility and decrease the average cost per share;

- Don’t put all your eggs in one basket: To spread your risk and protect yourself from large losses, allocate investments across various financial instruments, industries, and other categories. In addition, a diversified asset allocation is essential because it has a massive impact on whether you will meet your financial goal. For example, if you don’t add adequate risk to your portfolio, your investments may not earn a significant enough return to meet your goal;

- Stay wary of fraud: Scams are getting increasingly sophisticated. Fraudsters are often particularly articulate and charming as well as financially knowledgeable, with credible websites, testimonials, and documents that are difficult to distinguish from the real deal. But as always, if it sounds too good to be true, it probably is. That’s why researching and understanding an investment is so important before you give someone your money. Start by looking for the company’s financial statements on the Securities and Exchange Commission’s (SEC’s) EDGAR filing system. Check out the Financial Conduct Authority (FCA) list of warning signs here, as well as the SEC’s list of questions to ask about your investments here.

Note

Conclusion

Whether you should save, pay off outstanding debt, or invest $20k is a personal decision and depends on your unique financial situation and goals. As your circumstances change, adjust your investment strategy but stay committed to building wealth for the long haul.

Ultimately, investing requires guts as well as discipline, and no matter which financial vehicles you use to grow your nest egg, your investment performance will see both gains and losses over the years. But remain persistent and focused on the future, and you may soon find yourself looking up how to invest $100k.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about how to invest $20k

What to do with $20k?

With $20k, you can invest in individual stocks, ETFs and mutual funds, REITs, and cryptocurrencies, as well as toward your retirement (401k, CDs, IRAs, government bonds, etc.).

How to invest $20k?

The best way to invest $20k is to spread it across various asset classes, including stocks, index funds, and REITs, as well as more conservative options such as bonds or CDs.

Where to invest $20k?

Where you invest your $20k will depend on your age, risk tolerance, investment time horizon, and financial goals. However, a well-diversified portfolio will combine several financial instruments with various risk levels.

How to invest $20k for passive income?

There are several options for investing $20k for passive income, including index fund investing, dividend investing, crypto staking, and investing in REITs.

How to invest $20k in real estate?

The best and most accessible way to invest $20k in real estate is to invest in REITs, which provide investors with ready-diversified real estate portfolios, hefty dividend yields, and high levels of liquidity (particularly compared to physical real estate investments).

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!