Galaxy launches $75M tokenized CLO on Avalanche

Key Highlights Galaxy closed its debut tokenized CLO, issued directly on the Avalanche blockchain. Grove anchored the deal with a $50 million allocation, part of its expanding onchain credit strategy. The...

Key Highlights

- Galaxy closed its debut tokenized CLO, issued directly on the Avalanche blockchain.

- Grove anchored the deal with a $50 million allocation, part of its expanding onchain credit strategy.

- The structure brings institutional private credit onchain with tokenized tranches and real-time settlement.

Galaxy Digital has completed its first tokenized collateralized loan obligation (CLO), issuing the structure on the Avalanche blockchain and securing a $50 million anchor allocation from Grove. The transaction, announced on January 15, marks a new step in bringing institutional private credit onto public blockchain infrastructure.

The deal, known as Galaxy CLO 2025-1, closed at roughly $75 million and will support Galaxy’s lending operations. By issuing the CLO’s debt tranches on Avalanche, Galaxy blends traditional securitization with onchain settlement, clearer transparency, and more efficient trading.

— Avalanche🔺 (@avax) January 15, 2026Avalanche,Technology Built for Institutions.

Galaxy is introducing a first-of-its-kind tokenized CLO, issued exclusively on Avalanche with a $50M allocation from Grove🧵 pic.twitter.com/vYzVVvrZOF

Galaxy brings structured credit onchain

Galaxy CLO 2025-1 represents the firm’s first issuance in the collateralized loan obligation market. The CLO supports an uncommitted credit facility for Arch Lending, a Galaxy Ventures–backed platform that issues overcollateralized loans secured by assets like Bitcoin and Ethereum.

The debt tranches were issued directly on Avalanche, letting the CLO settle and operate onchain without the usual back-office friction. Tokens are expected to be listed on INX’s regulated trading platform, giving qualified investors access to the product without relying on traditional settlement rails.

Galaxy said the structure is designed to scale up to $200 million as new loans are added, using a debt capital markets framework that institutional investors already understand. Senior tranches carry a coupon of SOFR plus 570 basis points, with monthly distributions and an initial maturity set for December 2026.

Grove deepens its onchain credit strategy

Grove’s $50 million allocation anchors the CLO and builds on its broader commitment to tokenized real-world assets on Avalanche. The protocol has already deployed more than $250 million into onchain credit and treasury products, positioning Avalanche as a core settlement layer for its institutional strategy.

“This transaction marks another meaningful step forward for onchain credit, demonstrating how familiar securitization structures can be brought onchain without compromising institutional standards,” said Sam Paderewski, Co-Founder of Grove Labs. Rather than a one-off allocation, Grove has signaled its plans to operate a meaningful share of its credit activity on public blockchain infrastructure.

Impact: Avalanche’s role in institutional finance

The deal adds to a growing wave of institutional credit products turning to Avalanche. Firms such as Apollo, KKR, and Janus Henderson have already brought tokenized funds to the network, drawn by its reliable settlement, low costs, and consistent finality.

Because Avalanche works smoothly with Ethereum-based tools, asset managers can issue structured products while automating tasks like reporting, collateral tracking, and compliance. As private credit keeps expanding, tokenized CLOs like Galaxy’s show how blockchains are being pushed beyond simple assets into more complex financial structures.

Galaxy’s tokenized CLO shows how institutional credit is slowly finding its way onchain, pairing familiar debt structures with blockchain-based settlement. With Grove anchoring the deal and Avalanche hosting the issuance, the move reflects growing trust in public blockchains for handling large private credit transactions.

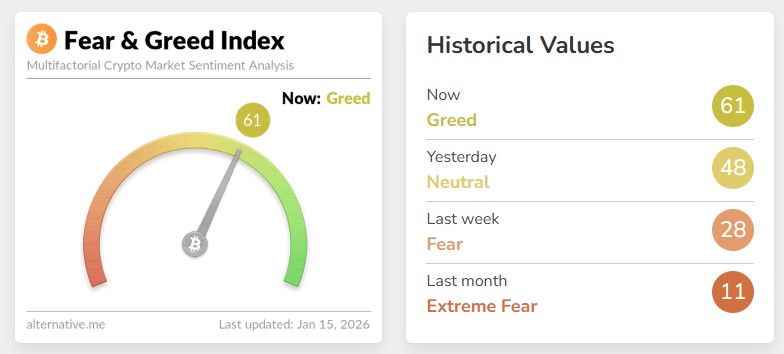

That confidence comes as Avalanche’s native token, AVAX, trades at $14.32, according to CoinMarketCap. The network holds a market capitalization of $6.17 billion, with 24-hour trading volume at $460 million, despite a recent dip in daily activity. If similar deals follow, tokenized CLOs could offer a practical path for debt markets to adopt faster settlement and greater transparency without straying from institutional standards.

Also read: Warren Urges OCC to Halt Trump-linked Crypto Bank Bid

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!