Cardano Set for Q4 Breakout? Analyst Reveals Bullish ADA Price Targets - The Market Periodical

Key Insights: Cardano analyst reveals Q4-Q1 historically best periods with $7-$8 price targets ahead ADA currently sits at a 37 risk score indicating pre-bull market positioning phase IOG launches Midnight...

Key Insights:

- Cardano analyst reveals Q4-Q1 historically best periods with $7-$8 price targets ahead

- ADA currently sits at a 37 risk score indicating pre-bull market positioning phase

- IOG launches Midnight token claim in Q4 2025, suggesting bullish timing strategy

Cardano analyst Dan Gambardello reveals Q4-Q1 historically yield the best ADA performance quarters. The crypto is at 37 risk score that signifies pre-bull market positioning today.

The Q4 2025 timeline for the Midnight token release by IOG indicates that the team is hoping for improved times in the future. Quarterly analysis indicates $7-$8 price targets in case the top trendline is hit successfully.

Historical Q4-Q1 Patterns Suggest Cardano Breakout Potential

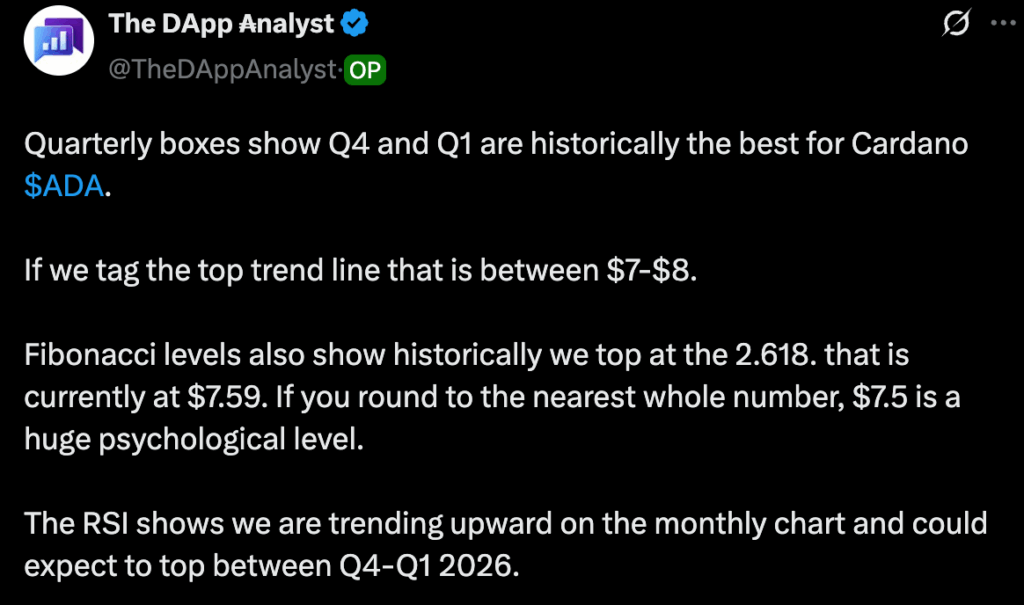

Gambardello referenced quarterly analysis that Q4 and Q1 have historically provided the most Cardano performance.

The analyst demonstrated solid evidence in a number of cycles supporting seasonal trends. Previous pumps have been cyclical at Q4-Q1 periods like recent market activity.

Historical records indicate that November-December pumps with January-March extension patterns commonly.

Last cycle delivered major gains from October through March, covering the Q4-Q1 period. The pattern held during bear market recovery phases with October-November timing.

Gambardello noted chart analysis revealing $7-$8 price targets if top trendline gets tagged.

The RSI shows upward trending momentum on the monthly timeframe, supporting the bullish thesis. The analyst anticipates topping between Q4 2025 and Q1 2026 based on cycles.

However, Gambardello mentioned disagreement with using “expect” preferring “anticipate” for timing predictions. N

obody can definitively time cycle tops according to his analysis framework. The business cycle makes timing uncertain for large moves.

Quantitative tightening is decelerating as pro-crypto legislation brings regulatory clarity forward. The combination of the factors establishes bullish setup relative to past cycles.

Cardano Risk Model Sits At 37

Gambardello noted that Cardano’s 37 current risk score is indicative of pre-bull market positioning.

The risk model reflects compression and suppression, building consolidation here. Analogous 36 risk score throughout accumulation phases was revealed by February data consistently.

Historical analysis positions September 2020 at 35 risk score before major movements. The 30s and 40s mark is the Cardano price parabolic movement anticipation time. Parabolic breakout phases during cycles have risk levels of the 50s, 60s, and 70s.

Previous cycle peaked at 94 risk score with exit planning targets. Members utilize triggers of risk score at 85-90-100 levels for taking profit. The intelligence system assists in planning exits for periods of high risk score in the future.

SEC Chair Paul Atkins announced that liquid staking would not be considered a securities offering, providing regulatory certainty.

The action is welcome news for Cardano’s liquid staking protocol across the crypto space. Pro-crypto policies offer favorable environment for ADA price action potential.

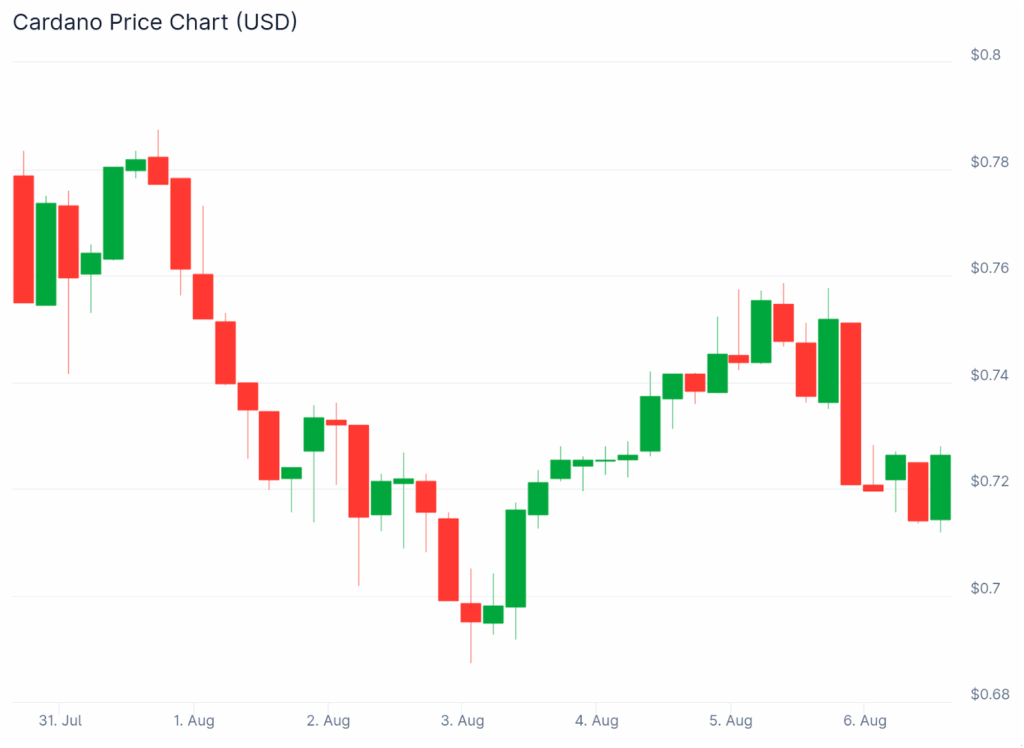

Cardano Chart Reveals Descending Triangle Breakout Formation

Gambardello recognized two confluences of patterns occurring on Cardano’s current daily chart.

Descending triangle breakout occurred with price cruising back to apex area. The pattern suggests potential support around 60 cents if apex fails.

An inverse head and shoulders pattern on the daily chart is creating bullish setup.

Right shoulder requires over $1.00 confirmation for neckline breakout confirmation. Target is roughly $1.80 upside based on breakout point chosen.

The present price of about 72 cents is backed by 50-day moving average. Gambardello talked of a potential fall to 67-60 cents, Fibonacci retracement levels. The analyst employs swing low to swing high Fibonacci support levels.

RSI momentum oscillator reversal signals continuation bullish when confirmed on daily. MACD trending toward zero histogram with signal line crossing gives further confirmation.

In our view, the ADA developed a cup and handle pattern while whales developed positions recently.

But bearish market conditions caused 7% loss in seven days. Fourteen-day performance shows a 17% fall, even though the underlying patterns of accumulation continued.

Gambardello highlighted 1400 days since the all-time high compared to 1000-1100 days historically. The extended timeline reflects business cycle lag impacting altcoin seasons.

Moses K is a crypto journalist covering markets, regulation, and blockchain trends. He has written for The Coin Republic, Coinchapter, Cryptopolitan, Cryptotale, Coinspeaker, and MPost. Known for his concise, data-driven reporting, Moses focuses on price analysis, on-chain metrics, and policy developments shaping the global digital asset landscape.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!