Cardano Price Targets $1.18 Breakout With 300% Upside Potential - The Market Periodical

Key Insights: Cardano price approaches 4-year triangle breakout with $1.18 as key resistance. Analysts cite ADA’s 1:3 risk-reward ratio, focusing on the $1.88 and $3.10 levels. A sustained high above $1.33...

Key Insights:

- Cardano price approaches 4-year triangle breakout with $1.18 as key resistance.

- Analysts cite ADA’s 1:3 risk-reward ratio, focusing on the $1.88 and $3.10 levels.

- A sustained high above $1.33 would likely sustain the strong uptrend and continue it toward long-term highs.

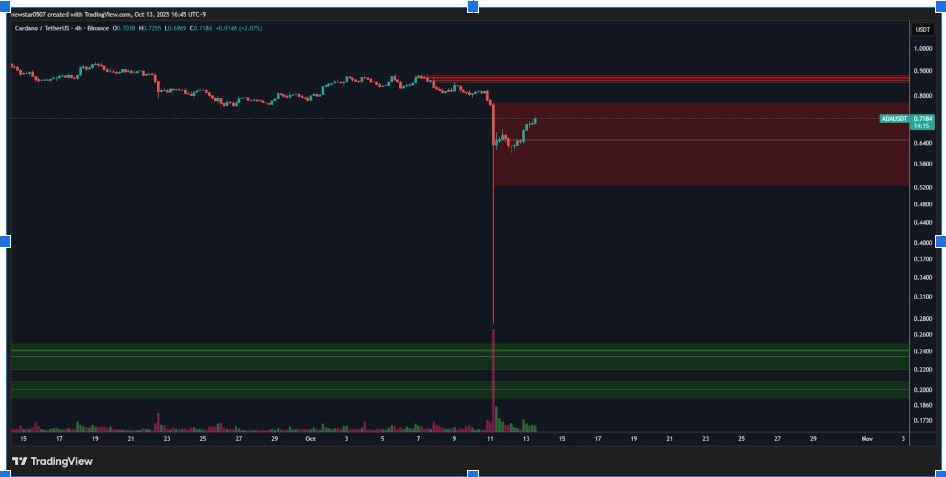

Following recent volatility, the Cardano price has stabilized, indicating resilience as bullish technical setups begin to emerge. The coin was trading at around $0.72 at the time of writing.

However, it has continued to bounce higher after a sharp correction earlier this month. Analysts say the ADA price is approaching a key price level. The next breakout could shape its mid-term trend.

Cardano Price Holds Strong Risk-Reward Structure

Analyst Steph Is Crypto shared a good risk-reward ratio for Cardano. This suggests a potential upside that significantly offsets its downside.

Analysts identify $0.65 as a key level of support for the Cardano price. Resistance levels are set at $1.18, $1.88, and $3.10. This chart shows a vast green area of potential profit if the bullish move continues

Furthermore, this pattern suggests that the ADA price presents an attractive proposition for traders seeking long-term growth opportunities. Cardano shows a favorable 1:3 risk-reward ratio. It stands out as a technically stable large-cap asset after the market crash.

Hence, a continued weekly close above $1.18 may indicate a new structural reversal. This could propel the momentum further towards the following resistance zones.

Symmetrical Triangle Breakout Appears Imminent

Growk Finance stated that the Cardano price is exhibiting the first technical signs of recovery after its recent sell-off. The analyst noted that the ADA price is about to break out of a four-year symmetrical triangle pattern.

Historically, such formations are often followed by major breakout occurrences when price volatility narrows down dramatically to the apex.

Additionally, Growk Finance noted that the short-term trend has become mildly bullish, with the price currently consolidating around $0.72. A breakout above the downward resistance line could signify the start of another upward leg for the Cardano price.

The breakout would be confirmed by a daily close above $1.18, indicating substantial accumulation and rising institutional participation. Growk commented that the market has limited time left before a significant shift occurs.

Bullish Scenario for Cardano Price Depends on $1.33 Breakout Level

Furthermore, analyst Mr. Brownstone presented two main scenarios for Cardano’s price: a bullish “Yellow Count” and a corrective “White Count.”

The positive result is to break the bearish trend above $1.33, creating a higher high formation on the chart. Until that happens, Brownstone presents accumulation in a range of $0.45 to $0.65. This is defined as the accumulation box.

The Elliott Wave structure also implies that ADA price remains in the corrective phase. Yet, it is approaching a possible transition point. A clean break above $1.33 would validate the beginning of wave (3). It is usually the most powerful in the Elliott Wave cycles.

Thus, Brownstone’s analysis aligned with the overall optimism regarding the Cardano price. This shifts the trend to growth after breaking through the resistance levels. Any prolonged jump above $1.33 can solicit more liquidity inflows and new market interests.

Sell Wall Persists Below $0.775 Resistance

Market analyst CW notes a strong sell wall between $0.70 and $0.775. This creates a near-term barrier to ADA’s upward movement.

This level has repeatedly rejected upward attempts, suggesting sellers remain active at this zone. Nonetheless, its capacity to recover at $0.65 indicates high underlying demand despite recent volatility.

Additionally, CW’s chart revealed deep green accumulation zones below $0.45. This indicates institutional interest at lower levels. If liquidity becomes concentrated within these levels, the ADA price is likely to switch to a new accumulation-to-expansion cycle phase.

Cardano price reaction near $0.775 is crucial. It will determine if the trend turns bullish or stays range-bound for now.

Crispus is a distinguished Financial Analyst at, bringing over 12 years of expertise in cryptocurrency markets, specializing in Bitcoin and altcoins. Renowned for his sharp insights at the nexus of market trends and breaking news, Crispus delivers actionable analysis to empower investors. His work is prominently featured across leading platforms, including BanklessTimes, CoinJournal, HypeIndex, SeekingAlpha, Forbes, InvestingCube, Investing.com, and MoneyTransfers.com, cementing his reputation as a trusted voice in the financial world.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!