Cardano’s Platform Advantage

How Cardano’s Network Effects Will Differ From the Competition

By Christopher Broveleit

It’s been said that the world’s greatest salesman was whoever sold the first telephone. With no one to call, it had little value to that first adopter. As adoption grew, however, the value grew exponentially. This non-linear growth, derived from the inter-connectedness of a network, is what is known as Metcalfe’s Law:

A network’s impact is the square of the number of nodes in the network

Today, “platform” is a convoluted word. To most, especially engineers, it means a technological infrastructure that facilitates capabilities and connectivity. However, to the most successful businesses of the past decade, such as Facebook, Uber, and Amazon, it means one thing: network orchestration all in the pursuit of Metcalfe’s law.

For the past 20 years, these networked firms’ valuations have increased at an astonishing rate. Apps go from something someone mentioned at the bar to unicorn status faster than it takes for the firm to raise another round of financing. This rapid acceleration is an artifact of network effects between users and investors, the very instrument driving the adoption of the network itself. This social behavior, empowered by technology, is what defines a 21st-century business. When done well, it is a self-fulfilling prophecy achieved by “fake it till you make it”; where making it means arriving at the point of accelerated perpetual motion through an economic engine fueled by the plurality of complimenting user life cycles. The more people believe in a marketplace, the more they use it. The more they use it, the incentive to join the marketplace grows. With all these 21st century platforms birthed from a fiction and enabled by the internet, it's easy to imagine the next generation of this evolution being empowered by shared truths and decentralization. And in when taking a look at cryptocurrencies, we see yet again that history rhymes.

Cryptocurrencies as Platforms

Cryptocurrencies share the same nature as platform businesses. A blockchain maintained and adopted by a single party has no innate worth or use case. As the adoption grows and diversifies, so does its utility and ultimately its value. For cryptocurrencies, this correlation with price and Metcalfe’s law is something that has been pointed out most notably by Raoul Pal:

So how do these networks grow? How do they evolve from 21 bitcoins for a Pizza to Microstrategy buying billions worth a year? The history of cryptocurrencies and their growth is first founded in fiction that evolves into a utility, that utility requires security guarantees which attract infrastructure which incentives side-switching where node operators become HODLers, and a perpetual motion accelerates via network effects. Bitcoin started as a mailing list of technocrats interested in digital money. The idea was turned into a shared fiction centered around the manifest of the cypherpunks. Finally, Bitcoin reached maturity when network effects were borne between miners and other anti-inflationary futurists. And while many in the Ethereum community exhibit the same toxicity towards Cardano that Bitcoiners do to them, they forget that at one time Ethereum itself was a fiction. It did not have NFTs, smart contracts, or DAOs such as those described by Vitalik at Bitcoin Miami 2014.

Recognizing the correlation of cryptocurrencies’ values to Metcalfe’s law and the common design patterns that facilitate these networks' growth enables us to pull apart the different projects and their communities and begins to give us context as to how the currency is and will perform in the marketplace. Yet today, these lessons are largely lost amongst most investors and enthusiasts. While masted by the centralized platforms of today, crypto hasn’t quite figured out that a cryptocurrency’s value isn’t derived from its functionality but rather its ability to orchestrate a network that is often bootstrapped by a shared fiction. And that is why I believe Cardano has the brightest future amongst all cryptocurrencies.

Cardano not only has the strongest shared fiction across the entire space, but it also has the most conscious and advanced platform architecture. I am not talking about Haskell. I am talking about network effects, cumulative value, housing the core interaction, as well some key aces IOHK and the community has up their sleeve.

The Shared Fiction: A Better, More Fair, World

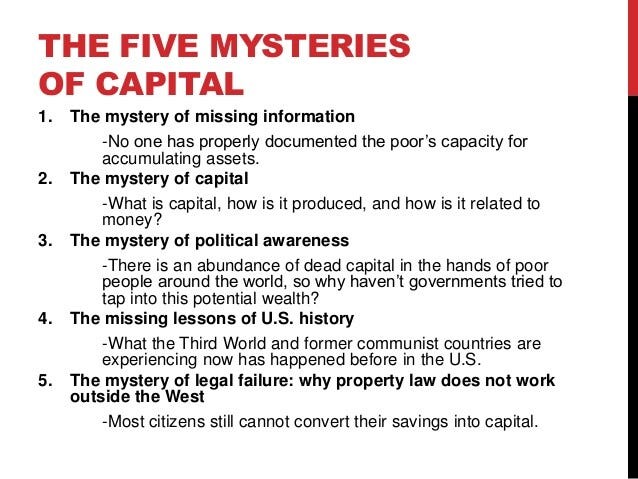

Before Cardano was ever minted, a future of a more inclusive and prosperous global financial system was dreamt by millions. A future where business owners and individuals could seek credit, markets, and financial services such as health, home, and life insurance to achieve a better quality of life. Just as revealed in the book The Mystery of Capital: Why Capitalism Succeeded in the West and Fails Everywhere Else by Hernan De Soto, the key thing the disenfranchised lacked was identity and societal norms that enable property ownership, and access to markets.

De Soto’s Five Mysteries of Capital as presented here: https://www.slideshare.net/vivgrigg/mystery-of-capital-de-soto

De Soto’s Five Mysteries of Capital as presented here: https://www.slideshare.net/vivgrigg/mystery-of-capital-de-sotoThis is the foundation stone of ADA, the pursuit of networking the global poor into a more inclusive financial operating system (FOS) that is enabled through identity, community, and shared truths. From there, the cryptocurrency is founded in very intense seriousness that is borne out of duty to protect these very precious details and luxuries that permit the wealthy to be wealthy. It is founded in academic research, rigorously architected, and formally verified. For the excited few that want the future now, it is a lot more than they have patience for. But for those that are paying attention, it is the untapped potential of the world.

What is Cardano? | Charles Hoskinson and Lex Fridman

Lex Fridman Podcast full episode: https://www.youtube.com/watch?v=FKh8hjJNhWcPlease support this podcast by checking…

Network Effects: How Cardano and Bitcoin are Going to Change the Game this Quarter

Never before have we been on the precipice of such adoption from one side of a network. Today with low and even negative interest rates and inflationary spending by the governments of the US and China, we live in a world where saving money means bucking the system. Bitcoin in the next few months will hit a supercycle, not because of its programmed halvening, but because external forces are driving a massive expansion of its user base that will further incentivize its mining and mass adoption.

Bitcoin’s Network Effects

Bitcoin’s Network EffectsThis network structure was expanded when Ethereum pitched its fiction in Miami 2014 that appealed to developers. The idea was to be enabled by the protocol to reorganize the world. It absolutely boomed, birthing the ICO craze that defined 2017 and captured the imagination of millions. Since then, Ethereum products have become more advanced, grown, and as a result, become expensive. As a result, Ethereum can no longer facilitate the majority of interactions between developers and users that it was built for. Now the network’s members have plagiarized the fiction of anti-inflationary currency from the Bitcoin community whilst arguing high fees are a metric of success. Once the place to build the new world, Ethereum is still that … for the rich… plus bitcoin. Calling a spade a spade, the platform has devolved to lacking a hedgehog concept, intoxicated by bag-tied maximalism. Ask someone that is 18, 22… ETH isn’t cool. Topshot on Flow or Pancake Swap on BSC… that's something they can use and ultimately socialize around.

Ethereum’s Network Effects

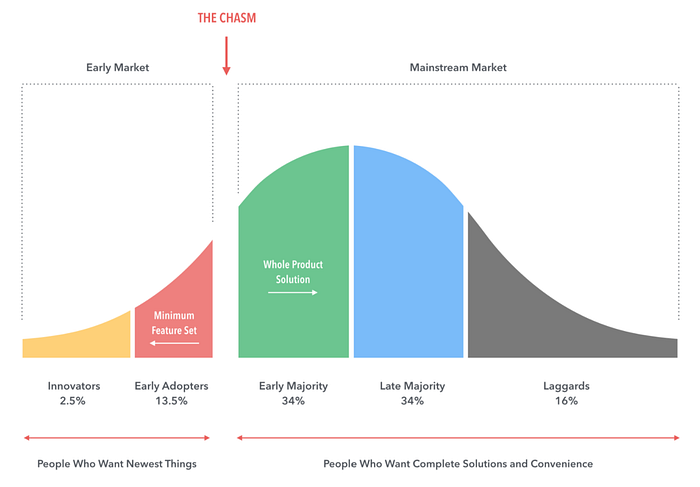

Ethereum’s Network EffectsWithin this truth, we start to begin to see another pattern. At first, there are innovators that want to define the future, then the investors or early adopters that are looking to change the way things are done and are willing to pay for it, then the pragmatic early majority take notice of the benefits of the early adopters, and finally, the market settles as pragmatists pick market leaders that are so large that they have an entire ecosystem and second market products built around them to complement their deficiencies. This pattern of technology adoption across markets is described in Geoffrey Moore’s renowned book Crossing the Chasm where an emphasis is made to bridge the gap between early adopters and the early majority to gain your place as the market leader. It is in this gap that flippenings are made.

Today, the innovators and early adopters largely are made up of North Americans in NYC, Quebec, and SF. As mentioned before, there is a key prediction by Charles and shared belief in the Cardano community that the first meaningful adoption, Real-Fi, of cryptocurrencies won’t come from the West but rather Africa and the financially disenfranchised. If correct, Cardano is in a pole position to come out of the chasm and present itself as the ideal choice for the early majority.

Crossing that chasm from innovators and early adopters, however, is not easy and will require pragmatic product marketing that focuses on a core market that further enables future markets and applications. This strategy is called the bowling strategy and that first application in its first market is the kingpin For Cardano, that is identity and Africa.

Cardano’s Bowling Alley Strategy

Cardano’s Bowling Alley StrategyLandmark deals like the identity deals in Ethiopia, Georgia, and rumored to be Wyoming are the point of the spear for Cardano. From there financial services are made available. By bootstrapping people that have lacked social institutions with identity and interconnectivity, Cardano will unlock the wealth-generating benefits of open markets. The financially disenfranchised, that is in fact not poor, will have their saved value recorded, secured, and able to be transacted upon in an open and free world. It will unlock the immense value that is locked in the extra-legal word described in DeSoto’s book. With the help of partners such as COTI and their banking solution and Celsius and their lending platform, Cardano is looking to provide a solution to the fifth mystery of De Soto’s book: the mystery of legal failure and why the extra-legal cannot convert their savings into capital. Its partnerships will also provide the same majority winning product combinations described in Moore’s book and will be achieved by the platforms focus on growing the industry as a whole and searching for its “Wifi” moment where interoperability becomes a standard.

So just as the network effects of Ethereum evolved differently than that of Bitcoins by leveraging developers, Cardano and IOHK have created a fiction shared across the community to empower users to create a better tomorrow. The fiction that first birthed SPOs, has attracted a small but growing number of developers and has billions of users that are disenfranchised from the financial world that are desperate for the solutions the Cardano is tailor-made to provide. This avalanche of users has already started with the largest blockchain onboarding project currently going on in Ethiopia. Work is being done to expand the ability of the area to connect with the blockchain with World Mobile’s rollout in Zanzibar. This onslaught of users desperate for credentialing and financial services will be a different approach from Ethereum but provide immense incentive as it will be coming from the most leveraged side of the market: users. Developers chase users, capital chases capital, and as the gates to provide these services come online the pull of the platform will be greater than anything the industry has yet to experience.

Facilitating the Core Interaction, Cumulative Value, and Platform Governance.

While platform design of network effects and the value generated via the different user life cycles can gain you initial adoption, work must be done to maintain relevance. Platforms maintain their importance if they can accomplish three key challenges: continually capturing the core interaction, generating cumulative value for its users, and governing the platform to assure the quality and innovation of the interactions experienced by its users. Cardano has plans for all of these things as well in its roadmap with Basho, Prism, and Voltaire as well its various partnerships.

Each platform, either cryptocurrency or centralized service, has a core interaction that drives adoption from the multiple sides that make up the platform’s market. The network effects that drove the exponential growth of the network can also run back on the platform. This occurs when that core interaction can no longer be “captured” or the platform can not facilitate interaction between the different sides of the network.

Today we are seeing this happen with ETH. The scalability issues of Ethereum have driven fees higher and have led new entrants in the market to seek alternatives such as BSC, AVAX, Solana, and others. Cardano today has fees that are exponentially cheaper than Ethereum. It’s the first true multi-asset ledger (MAL) that provides the ability of anyone to mint their token without a smart contract and have it be accounted for, exchanged, and interacted with just as ADA would. In addition, each of the stake pool operators will in the future run what is called a Hydra head that is a layer 2 scaling solution that can be recursively applied. This is the focus of the Basho era of Cardano and is set to be expanded upon at the summit this week in Laramie. Finally, Cardano has partnered with other digital currencies and communities that offer solutions to applications the protocol won’t excel at, such as with COTI and payments.

Cumulative value is the idea that as your interact on a platform, you gain value that is unique or defined on the platform itself. For many centralized platforms like Uber or Airbnb that is reviews for the services rendered, your role as a consumer, or rewards. For Cardano, they have focused on the most important cumulative rewards possible: your financial identity. Cardano’s focus on providing financial services to those that are not able to secure them today has also created its most secret weapon: its central role in the future of decentralized applications… regardless of what chain they are on. As Cardano beats these other protocols that are focused in developed markets to the billions looking for a solution, cross-chain architectures are becoming a norm when, as previously mentioned, Cardano has invested heavily in interoperability. There is strong reason to believe that due to the platforms focus on identity and the fact that it is the first to market in some of these developing countries that it will not only onboard the most users into the space, but the nexus hub across multiple chains as users store their most precious assets on its ledger.

And last but not least, Cardano is aiming to achieve on-chain governance through its road mapped era titled Voltaire. Voltaire will see the parameters of the protocol handed over to the community as well as continued funding of initiatives voted on by the community with its Catalyst program. This on-chain voting mechanism, its treasury, and its ever-growing community make Cardano a living entity that can evolve and adapt to the demands, new technologies, and challenges that protocol might face in the future.

Source: https://medium.com/@chris.broveleit/cardanos-platform-advantage-a44d1cf83252

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!