Cardano Gains Institutional Visibility Through 21Shares ETF Inclusion - Crypto Economy

TLDR 21Shares integrates ADA into its FTSE Crypto 10 ETFs, facilitating regulated access for traditional investors. Technical analysis identifies $0.50 as vital support to maintain the bullish structure...

TLDR

- 21Shares integrates ADA into its FTSE Crypto 10 ETFs, facilitating regulated access for traditional investors.

- Technical analysis identifies $0.50 as vital support to maintain the bullish structure toward $0.70.

- Short-term price action faces resistance with sell walls accumulated below $0.63.

On its path to mass adoption, the third-generation ecosystem achieves a significant milestone. Cardano (ADA) gained renewed institutional visibility after being officially included by asset manager 21Shares in two of its most prominent financial products: the FTSE Crypto 10 Index ETF (TTOP) and the FTSE Crypto 10 ex-Bitcoin Index ETF (TXBC).

This incorporation allows traditional investors to gain exposure to ADA through regulated, index-based vehicles, a crucial step for the asset’s maturity.

According to the prospectus updated as of October 31, 2025, ADA is listed among the index components with an initial weighting of 0.71%. By entering these funds, Cardano shares the stage with market giants like Bitcoin and Ethereum, as well as other high-performance assets such as Solana, XRP, and Binance Coin.

While the TTOP fund tracks a basket of the ten largest crypto assets, TXBC excludes Bitcoin, redistributing weights among the remaining altcoins, which could favor Cardano’s institutional visibility in diversified portfolios.

Key Technical Levels: The Battle for $0.50

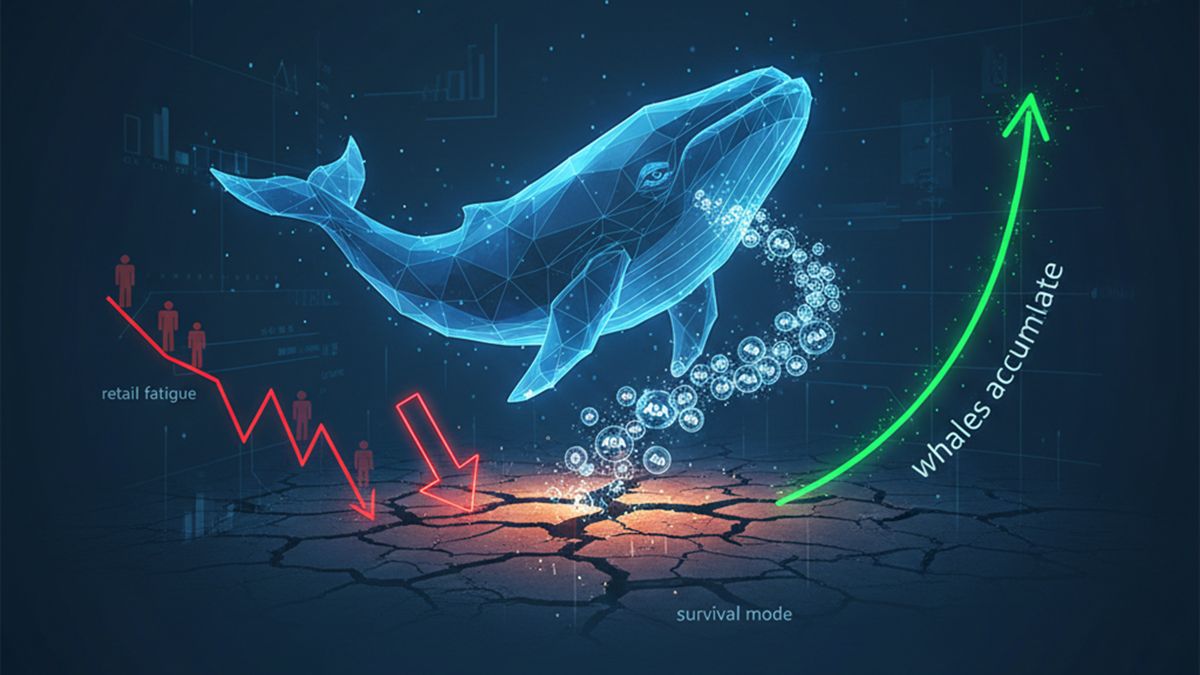

Beyond the fundamental news, price action is at a technical crossroads. Ali Martinez used his X account to report that it is imperative for bulls to defend the $0.50 level. Currently, the token is attempting to stabilize in a range between $0.55 and $0.60, a zone that has historically acted as a pivot between support and resistance.

If the market manages to hold this base, projections point to a possible rebound towards $0.70, a mid-range ceiling visible since August. However, a close below $0.50 would invalidate the bullish setup, opening the door to deeper losses.

In the very short term, the situation is dynamic. According to trader CW, ADA has rebounded after hitting a buy wall in a green demand zone.

However, the order book reveals friction on the way up: there are three sell walls stacked just below $0.63.

For Cardano’s institutional visibility to translate into sustained gains, buying volume must be sufficient to absorb these offers and overcome immediate resistance, avoiding a rejection that returns the price to recent lows.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!