Cardano Eyes $1 Target as Bullish Indicators Mount

Cardano price forms rounding-bottom pattern with consecutive bullish candles. Open interest surges to $785.91 million as long positions increase. ADA faces key resistance at 200-day EMA before potential...

- Cardano price forms rounding-bottom pattern with consecutive bullish candles.

- Open interest surges to $785.91 million as long positions increase.

- ADA faces key resistance at 200-day EMA before potential breakout.

Cardano (ADA) appears poised for a potential breakout rally as the broader cryptocurrency market regains momentum following Bitcoin’s recovery above $87,000. Over the past 24 hours, ADA has climbed, maintaining its position above the critical $0.70 psychological level and signaling renewed bullish interest in the eighth-largest cryptocurrency by market capitalization.

ADA is recording its second consecutive positive daily candle. This fresh bullish start to the week has ADA aiming to overcome the significant resistance presented by its 200-day exponential moving average (EMA). If successful, analysts suggest this recovery could potentially trigger a substantial move toward the coveted $1 mark.

Technical analysis of Cardano’s daily chart reveals a short-term rounding-bottom reversal pattern forming from the $0.70 support level. This technical formation completed a morning-star pattern on Sunday with a 1.31% recovery, considered a bullish reversal signal by many traders. The upward momentum has continued with today’s intraday surge of 1.58%, reinforcing the potential for further gains.

However, the recovery isn’t without challenges. The 200-day EMA currently acts as formidable resistance, capping ADA’s upward movement. Complicating matters, the prevailing market downturn and recent consolidation have positioned the 20-day and 200-day EMA lines on the verge of a bearish crossover, which could signal additional weakness if it materializes.

Market observers note that the ongoing recovery in the broader cryptocurrency market could provide ADA with the momentum needed to push through this resistance. A decisive move above the 200-day EMA would likely diminish the chances of the bearish crossover occurring and potentially accelerate the upward movement.

Cardano currently consolidating at $0.70

Price action shows Cardano currently consolidating between the $0.70 support and the 61.80% Fibonacci retracement level at $0.7351. This tight range has pushed the daily Relative Strength Index (RSI) toward the 50 level, indicating neutrality in trend momentum as traders await the next decisive move.

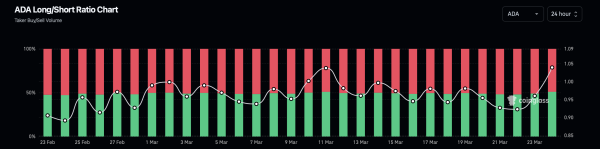

Despite the technical uncertainty, futures market data offers encouraging signs for Cardano bulls. Open interest in ADA futures has surged to $785.91 million, while the long-to-short ratio funding rate has reached a nearly neutral point at 1.0396. This development signals a significant increase in bullish positions over the past three days, though the current funding rate of -0.0029% suggests a slight weakness in immediate bullish sentiment.

Looking ahead, Fibonacci projections indicate that a successful breakout above the 61.80% level could trigger a substantial rally toward the 78.60% Fibonacci retracement. This crucial resistance sits just below the psychologically important $1 mark at $0.9216, representing a potential target for bulls if momentum continues building.

Seasoned Crypto Content Writer, Editor and Journalist who entered the cryptocurrency industry out of sheer passion and love for writing.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!