Terraform Labs Bankruptcy Plan Approved by Court - Coincu

14 hours ago - Around 2 mins mins to read Key Points: A U.S. judge approved Terraform Labs bankruptcy plan to wind down operations following its settlement with the SEC over investor...

14 hours ago - Around 2 mins mins to read

Key Points:

- A U.S. judge approved Terraform Labs bankruptcy plan to wind down operations following its settlement with the SEC over investor fraud.

- Co-founder Do Kwon was held liable for $110 million and must transfer assets to cover penalties and compensate defrauded investors.

According to Reuters, a U.S. Bankruptcy Court has sealed the wind-down operations of Terraform Labs bankruptcy plan, taking the process a notch further.

Read more: Three Arrows Liquidators Seek $1.3 Billion from TerraForm Labs

US Court Gives Nod to Terraform Labs Bankruptcy Wind-Down Plan

U.S. Bankruptcy Judge Brendan Shannon’s decision came after Terraform settled a fraud case against investors with the U.S. Securities and Exchange Commission. Shannon termed the Terraform Labs bankruptcy plan as a “welcome alternative” to sustained litigation over investor losses.

Terraform Labs filed for bankruptcy in January 2024, after a jury found that the company defrauded investors and hastened the implosion of its Terra ecosystem in 2022. Under the SEC settlement, Terraform will be required to pay $4.47 billion in penalties, although the regulator will only receive payment after the company satisfies claims with regard to cryptocurrency losses. Terraform said it was impossible to estimate the total value of these losses at present.

Co-founder Do Kwon was also found liable and was ordered to pay $110 million, plus more in prejudgment interest. Kwon is also ordered to turn over a variety of assets, including PYTH tokens, to Terraform’s bankruptcy estate to be utilized in paying the monetary penalties and to repay investors through the liquidating trust.

Aftermath of the Collapse of Terra Ecosystem on Crypto Market and Stakeholders

The SEC alleged that Kwon and Terraform misled investors, particularly over the stability of TerraUSD, a stablecoin designed to keep a constant value of $1. In May 2022, when that collapsed, a market-wide crash led to widespread bankruptcies within the crypto sector.

Though Terraform Labs will pay between $184.5 million and $442.2 million to affected crypto purchasers and stakeholders, it is not clear how much of those settlements the SEC will actually recover. The bankruptcy liquidation process for Terraform will be treated as senior to any disbursement to the SEC.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

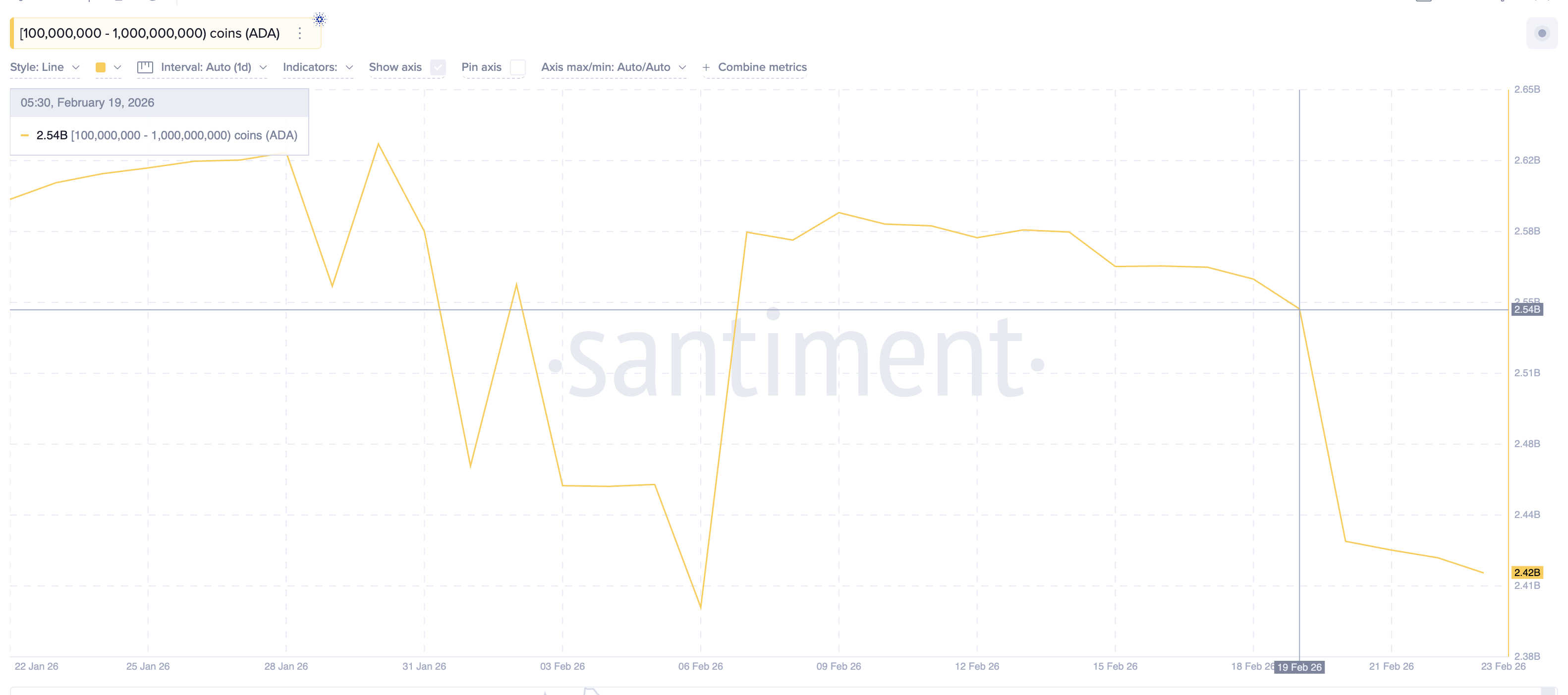

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!