Will Cardano (ADA) go “parabolic” in 2022?

One question just about everyone has on their mind right now, whether it be Cardano’s native token ADA or another coin is “Is this going to go parabolic next year? next month? When can I cash out & go buy my Lambo?”

One question just about everyone has on their mind right now, whether it be Cardano’s native token ADA or another coin is “Is this going to go parabolic next year? next month? When can I cash out & go buy my Lambo?”

Truthfully I don’t know, & neither does anyone else for certain. However there are some things that we do know, & today, I want to hone in on Cardano & what's going on behind the scenes right now to let you decide for yourself how 2022 will treat your ADA holdings.

The Bitcoin Effect

First I want to talk about something I, just now coined, called the “bitcoin effect” in short this is the power of decentralization of a blockchain & just how often the importance of it is overlooked.

Something else to look at in stride with the “Bitcoin Effect” is also the “Network Effects”, using Metcalfe’s Law that states “that a network’s value is proportional to the square of the number of nodes in the network” — For example, if a network has 10 users, its inherent value is 100 (10×10=100).

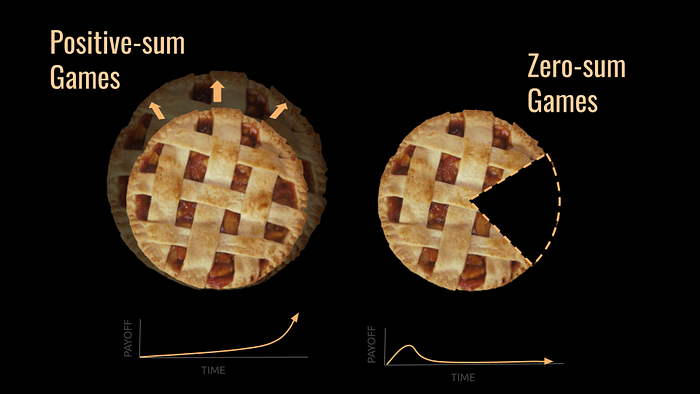

So how are these two effects relevant to one each other you may be asking? Well, first we have decentralization. There is a long list of reasons why decentralization matters but the main point is that it prevents any one person or corporation from taking control of the network & the cryptocurrency itself, this inherently creates more positive-sum situations rather than zero-sum situations where no one has to lose for someone else to win using trustless systems.

positive-sum games vs zero-sum games

positive-sum games vs zero-sum games

Of course, nothing is perfect, but decentralization allows for a truly free market & also great chances for people to benefit themselves without having to put down someone else.

Now back to the effects of decentralization & in turn with the mentioned “Network Effects”. If this part is getting too long without any mention of price, just bear with me for a little bit longer... we’ll get there.

Bitcoin over the past decade has showcased the power of both working together, whether you got into cryptocurrency & heard of Bitcoin this year or 6 years ago, the reason you have taken the dive is most likely because you are tired of the traditional systems & want a chance at something that seems much more attainable where you are put on a more even playing field.

This playing field has grown in users rapidly over the past year even, & the reason being is very closely linked to many people wanting the same thing… a way out of 8% annual returns in traditional stock markets where the largest corporations become more in control as time goes on & the government continues to print more money like it’s infinite fairy dust.

In pair with so many people searching for a way out & finding it in decentralized solutions where someone doesn't always have to lose for another person to win we have the rapid growth of the network due to the increasing appeal into the bridge from traditional finance to decentralized blockchains like Bitcoin, Ethereum & Cardano. As I mentioned earlier, the network effect states that the value of a given network is equal to the number of users in said network squared. So when a blockchain goes from 10 users to 1,000 users its value goes from 100 all the way to 1,000,000.

Often times the power of decentralization is overlooked because it doesn’t seem relevant when “we can just get more users & grow our blockchain to the moon” However the main reason major chains like Bitcoin & Etherereum remain operational & people work on them is because they are decentralized.

Decentralization doesn’t always mean hyper-efficiency but it does mean we can have things that are resistant to being internally manipulated & make our own footprints building whatever we please, & build said things in a sandbox not owned by anyone person or corporation.

Surveying the past results of exponential “network effects”.

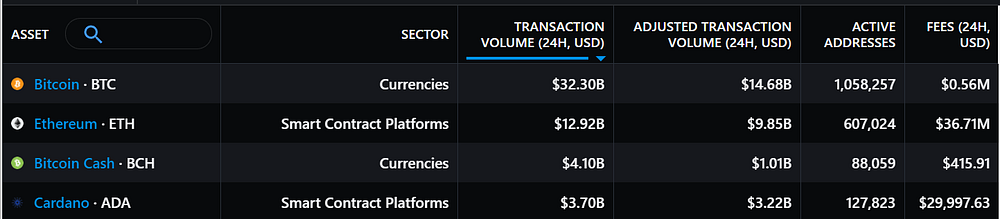

First, we have Ethereum, a blockchain currently with a market capitalization (coin value x coin supply) of ~470 Billion dollars, over half of Bitcoin’s 900 billion dollar market cap & currently 11 times bigger than ADA’s market cap of 41 billion.

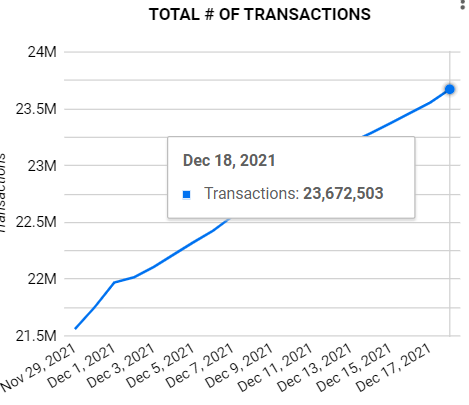

Although Ethereum & Bitcoin are far larger in market cap than our friend Cardano, the transaction volume on Cardano has remained in the top 5 blockchains for a large portion 2021. Even right now the transaction volume on Cardano in the past 24 hours is ~1/3 of Ethereum while being 1/11th of the price.

Why does this matter though? Well, it matters mostly because transaction volume shows that users are active on the network, & the more active users or as shown in the image above under “active addresses” the more valued the network is.

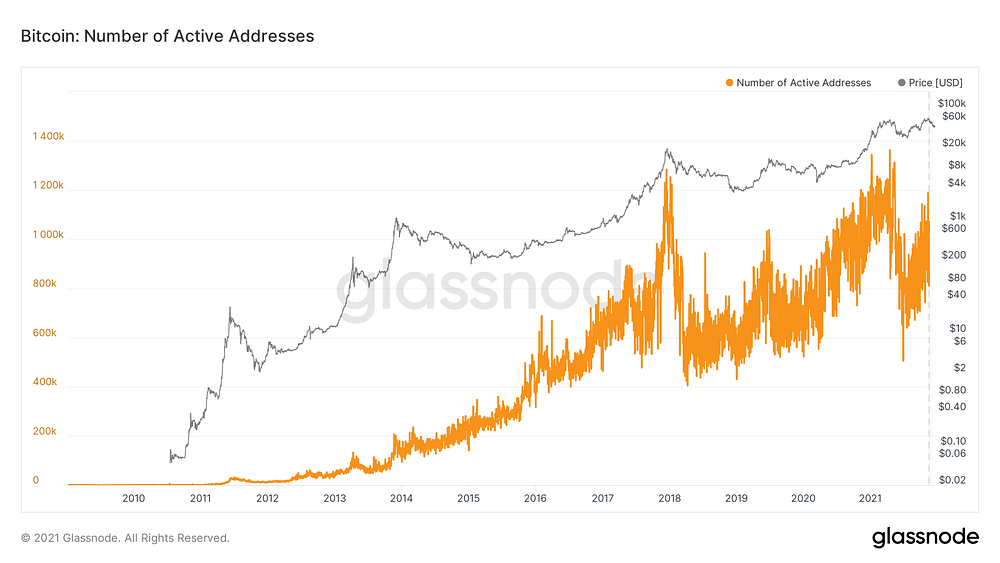

The prices of crypto markets especially now are clearly not pegged to amount the number of users on the network, with 50%+ crashes being a reoccurring event, clearly, the markets aren't always rational & the true dollar value of each network is not known. What is known is that the more users on a network, the more people talk about it, the more people utilize their sandboxes & the more people get interested in the possibilities of what this new technology could do for them. Over time, these network effects are propagated & do correlate to the price of each underlying asset, below are some examples of active addresses to price for Bitcoin.

The dApp Leap

Let’s talk about the dApp wars coming to Cardano (dApp standing for “decentralized application”). Also with network effects in mind & getting more users to increase the inherent value of the network, I want to discuss Ethereums thriving dApp ecosystem & compare it with what I believe we’ll be seeing come to Cardano in 2022.

dApps range from all sorts of use cases, from web browsers (Brave) to protocols that let you autonomously borrow & lend money. The one thing each dApp has in common is that they are decentralized. (shocker, I know)

There are thousands of dApps across different blockchains that allow users to utilize the power of blockchains to use trustless systems like a DEX (Decentralized Exchange) that will allow them to swap cryptocurrencies as much as they please without checking to see their credit score first or asking for their first & last name.

Ethereum’s dApp leap

On Ethereum, dApps like DEXs & other protocols like DAOs (Decentralized Autonomous Organizations), & DeFi (Decentralized Finance) lending & borrowing are very well progressed. When comparing Cardano to Ethereum in this regard as of right now, Ethereum clearly has the years of experience in this category… & to me, this is great, although Cardano uses a different accounting model for its blockchain, there are many things we can learn from what Ethereum accomplished in the dApp sector over the past few years, the best part is… majority of it is open source!

With all of the use cases & benefits, Ethereum’s dApps have given its blockchain & users coming to use its blockchain this created a massive network effect. More users creating more demand, creating more developers, creating more dApps, creating more users, & the cycle repeats (exponentially), leaping into huge amounts of users & developers in no time at all.

Cardano’s dApp leap

So, what if Cardano had dApps? Well… it does! Smart Contracts were deployed back in September of 2021 & although things have been slow & steady with development, things are looking very strong for 2022 with quite a few dApps already live on Cardano’s main network & even more on the test network right now.

Some of the dApps already launched on mainnet include an order book style DEX (MuesliSwap), NFT Marketplaces (CNFT.io, jpg.store), to name a few of many) as well as wallets build to interact directly with smart contracts & dApps like Nami Wallet.

Many people had the misconception that right after smart contracts were deployed in September that all the dApps would come online instantly, this wasn't the case but since September a ton of ground has been made & things are finally starting to heat up with new DEXs & protocols popping up very frequently now.

Something major to take note of is a very special DEX, SundaeSwap. with hundreds of thousands of followers & people using their current testnet it's clear there is demand for top-of-the-line dApps, SundaeSwap being one of the smoothest in the game from what I've tested so far. In the first, ~2 weeks since their testnet launch Nami wallet alone has gained over 50,000+ active users & is now up to over 100,000… and this is just for the testnet.

So back to that thing… you know the network effect thing where the number of users in the network squared is the value of the network. I hope you can see where I’m going. With 50,000 more users onboarded to a dApp cable wallet like Nami, it gives me a ton of confidence that people are ready to go & users will grow exponentially from here.

Essentially this is just the beginning in my eyes of a massive leap for the Cardano ecosystem, the first years spent perfecting the foundation of Cardano decentralization (Byron & Shelley Eras pictured below), now we are ready to push into an era full of people building dApps with the launch of Goguen back in September.

Why do dApps matter?

Okay, but why do all of these dApps matter? How are they going to bring in more users? How can I benefit from using them? Why would I use a DEX over my normal exchange like Binance or another CEX (Centralized Exchange)?

dApps matter for a few reasons…

- dApps bring on more users, more users bring on more users, cycle repeats

- dApps give people tools that better them or the systems/ecosystems they are built to sustain in a trustless way (exclude the middle man)

- dApps that are truly decentralized are practically unstoppable, meaning no one can shut them down, this allows for truly free markets.

- most dApps don’t collect your data, & keep your real-life identity anonymous to the protocol you’re using.

- with dApps we can take full control of a decentralized blockchain like Cardano to build whatever may be suitable to be not in the control of any one person or entity.

- etc, etc…

As mentioned above, you can benefit from dApps in a lot of ways. You can use a DeFi dApp to get loans on your assets without the burden of your lacking credit score. With dApps, almost everything is open source & they run on smart contracts so you can benefit by using trustless systems, you can become your own bank. This doesn't mean you can be careless however, there are malicious dApps out there, & incentive is only growing as crypto does, so please be careful when connecting your wallet to any dApp & do your research ahead of time.

With being your own bank in mind & taking on that huge responsibility let me answer the question “Why would I use a DEX over my current exchange?”

You will most likely still need to use a CEX to turn your fiat into crypto, but after that, you can switch over to a DEX & put all the power in your own hands, or you could just keep using the exchange… but here’s the thing… when you have say 1,000 ADA on an exchange it isn’t fully yours. Exchanges have downtime & withdrawal pauses all the time. In order to have access to your funds 24/7 you need to be able to hold them in your own wallet (the one you would use with a DEX) like Nami.

DEXs are also great because when the markets go crazy & everyone is selling or buying if you’re on a DEX you won't suffer from the greedy centralized exchanges having to pause withdrawals, you can trade on the DEX as freely as anyone else so long as there is liquidity at that time

These are a few of many examples, & of course, there can be drawbacks to using dApps over Centralized applications. Decentralization isn't always super efficient & instant fast as of right now, but rest assured these dApps will create much more fair alternatives than are current centralized solutions.

Are we there yet?

Right now things are heating up with dApps, & 2022 is looking to be extremely promising on a fundamental level for bringing in exponential amounts of users.

There are many concerns coming from everyone wondering where the crypto market is going to go next, in reality, no one really knows…

One thing I do know however is that I won’t be selling my Cardano anytime soon & I’ll be holding on tight as the underlying fundamentals of ADA increase day by day & the amount of users grows on an exponential scale with new dApps to bring better systems to people all over the globe.

Overall I'd say one way or another that Cardano is going to go “parabolic” in terms of users & transactional volume over the next few months as top-tier dApps get deployed on the mainnet.

I know this prediction may not be as bold as you would have wished, but the truth is markets can be very irrational, often times the price rises more on news than it does just fundamentals… this is a very speculative market after all.

That’s all for now, if you want to see this article in video format you can watch it → here ←

Source: https://medium.com/@jackfriks/will-cardano-ada-go-parabolic-in-2022-5888f4aedb33

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!