Why this strategy is the best bet for Cardano traders

The post Why this strategy is the best bet for Cardano traders appeared on BitcoinEthereumNews.com. The Cardano market was easing after a boastful week that saw prices surge from $1.45 to a local high of $2.25. Low volatility could...

The Cardano market was easing after a boastful week that saw prices surge from $1.45 to a local high of $2.25. Low volatility could now see ADA trade between two crucial points which would dictate the next direction of a price swing. At the time of writing, ADA traded at $2.11 and slipped down to the fourth position in the crypto rankings after briefly overtaking Binance Coin.

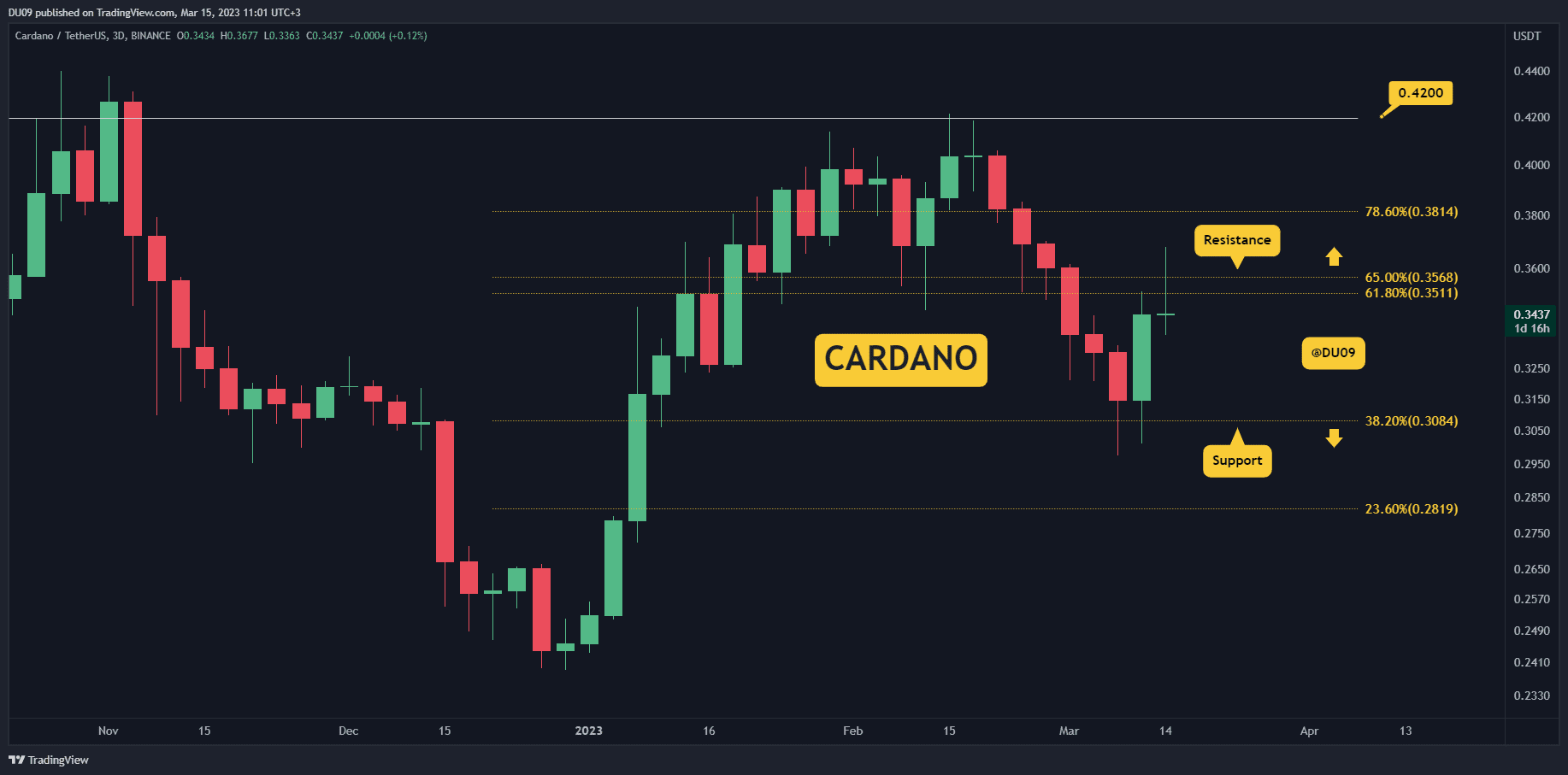

Cardano 4-hour Chart

Source: ADA/USD, TradingView

The 4-hour chart was a better gauge of ADA’s mid-long term trajectory as it highlighted some important market changes. For one, the candles closed below their 20-SMA (red) for the first time since 8th August as upwards pressure decelerated after ADA failed to topple 38.2% Fibonacci Extension ($2.31).

Secondly, Bollinger Bands converged on the lesser timeframe which depicted a decline in volatility. In case ADA enters a period of consolidation, the region between $2.16 and $2.102 would be of particular significance for bulls to maintain an overall advantage. From there, a push toward the 50% Fibonacci Extension ($2.31) and higher would be possible. On the other hand, bears would need to target a close below 12th August swing of $1.88 to snatch away market control.

Reasoning

Key indicators on ADA were going through a much needed reset. Relative Strength Index moved south from the upper zone and found support around the mid-line. Meanwhile, daily RSI was still within the overbought zone, which meant that prices could stabilize at slightly lower levels moving forward.

The declining nature of Awesome Oscillator presented some near-term challenges but the same was at comfortable levels on the daily chart. This divergence meant that ADA could be set for an additional short-term decline, but nothing too drastic to cause panic. MACD’s downward trajectory presented a similar statement as the AO.

Over here, it’s also worth mentioning that ADA formed a bull flag on its 4-hour chart and an immediate rise above the 38.2% Fibonacci Extension could trigger a sharp hike. However, chances of such a move were slim.

Conclusion

Cardano was expected to settle into a consolidation phase between $2.16 and $2.102 before the next major market swing. In case the price toppled $2.31 over the next 24 hours, ADA bulls could run amuck once again. Since there were a number of scenarios possible, traders were advised to adopt a wait and watch strategy before entering a position.

Source: https://ambcrypto.com/why-this-strategy-is-the-best-bet-for-cardano-traders/

Post navigation

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!