Weekly Token Spotlight: $SOC

$SOC is the utility and governance token of the Ape Society ecosystem. $SOC recently underwent a rebranding in what is known as the Renaissance.

$SOC is the utility and governance token of the Ape Society ecosystem. $SOC recently underwent a rebranding in what is known as the Renaissance. The token also powers the recently launched Levvy Finance, one of the most used dApps on Cardano. In this article, we’ll delve into the tokenomics, distribution, utility of the token, and more.

$SOC Tokenomics & Distribution

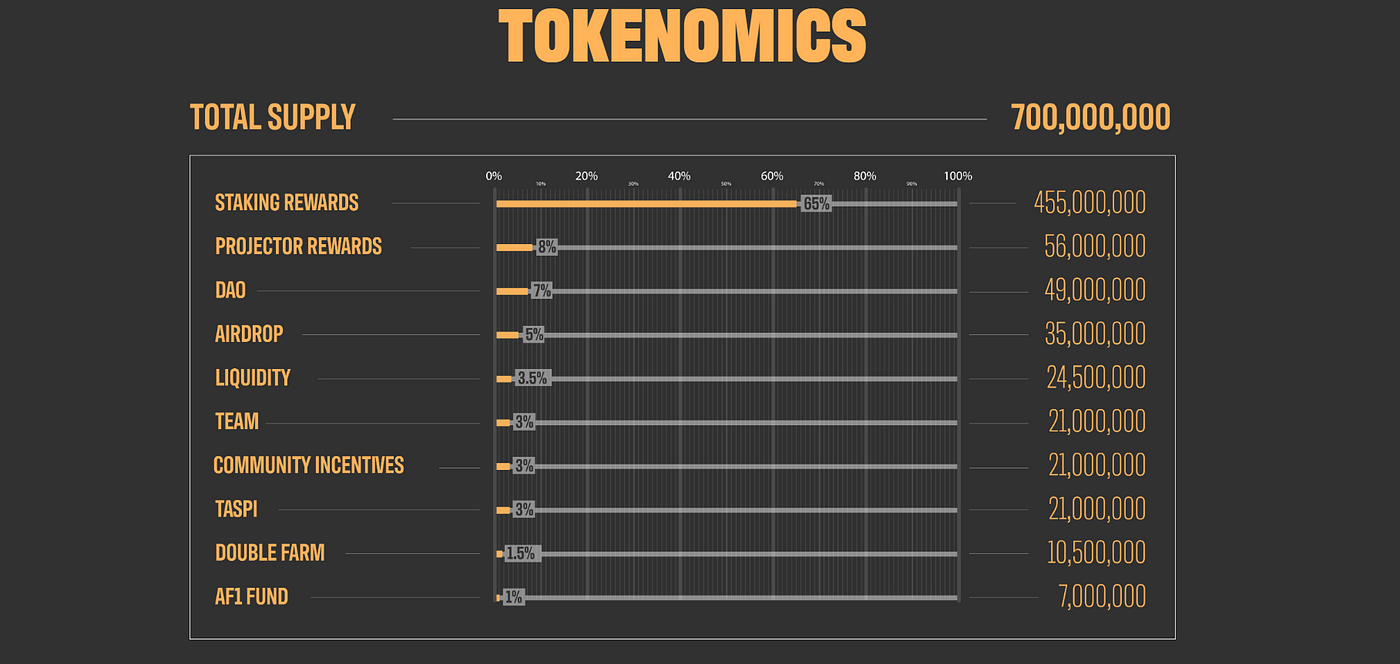

$SOC has a total supply of 513.17 Million tokens. Currently 439.71 million of these are in circulation, equivalent to 85.7% of the total supply. At 0.080 ADA per $SOC, this gives the token a market cap of $19,055,099 and a fully diluted market cap of $22,238,422, placing it at #15 in the Top 50 on TapTools.

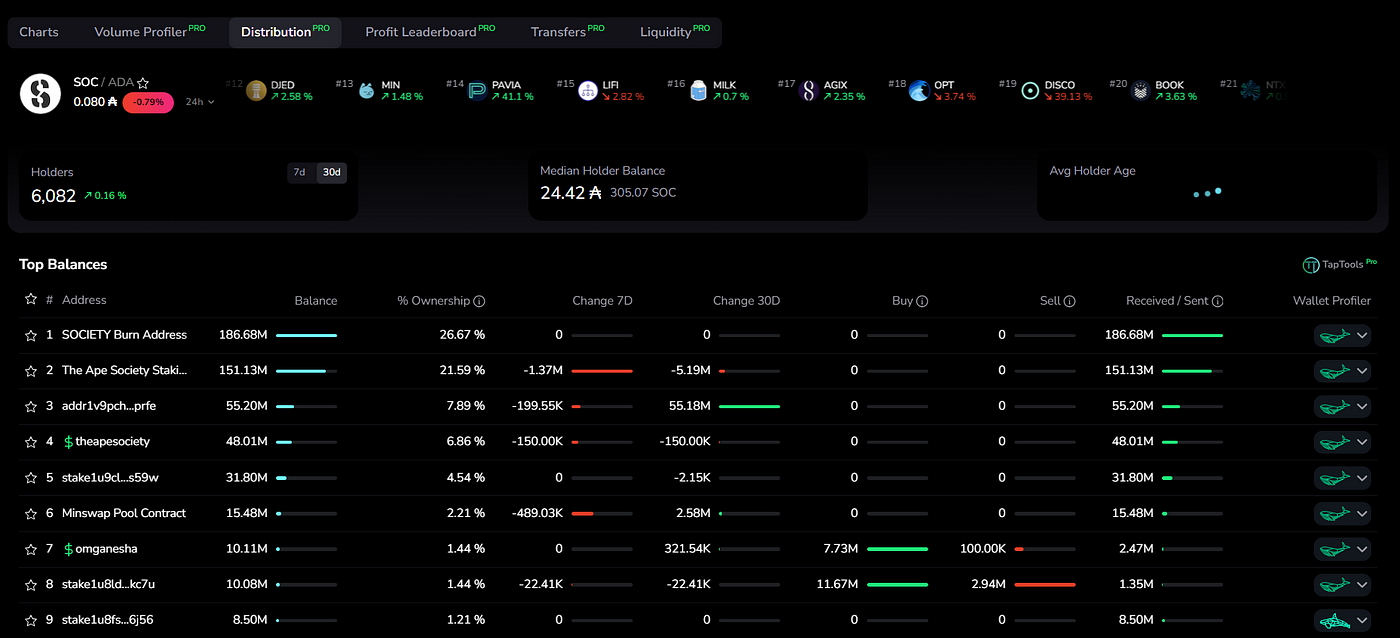

$SOC has 6082 holders, up 0.16% over the last 30 days. The token has a median holder balance of 305.07 $SOC, equivalent to 24.42 ADA, and an average holder age of 407.12 days, signifying a strong community that has been committed to the project.

The above image breaks down the tokenomics of $SOC. The vast majority of the tokens are allocated for staking rewards, projector rewards, as well as The Ape Society DAO.

Liquidity

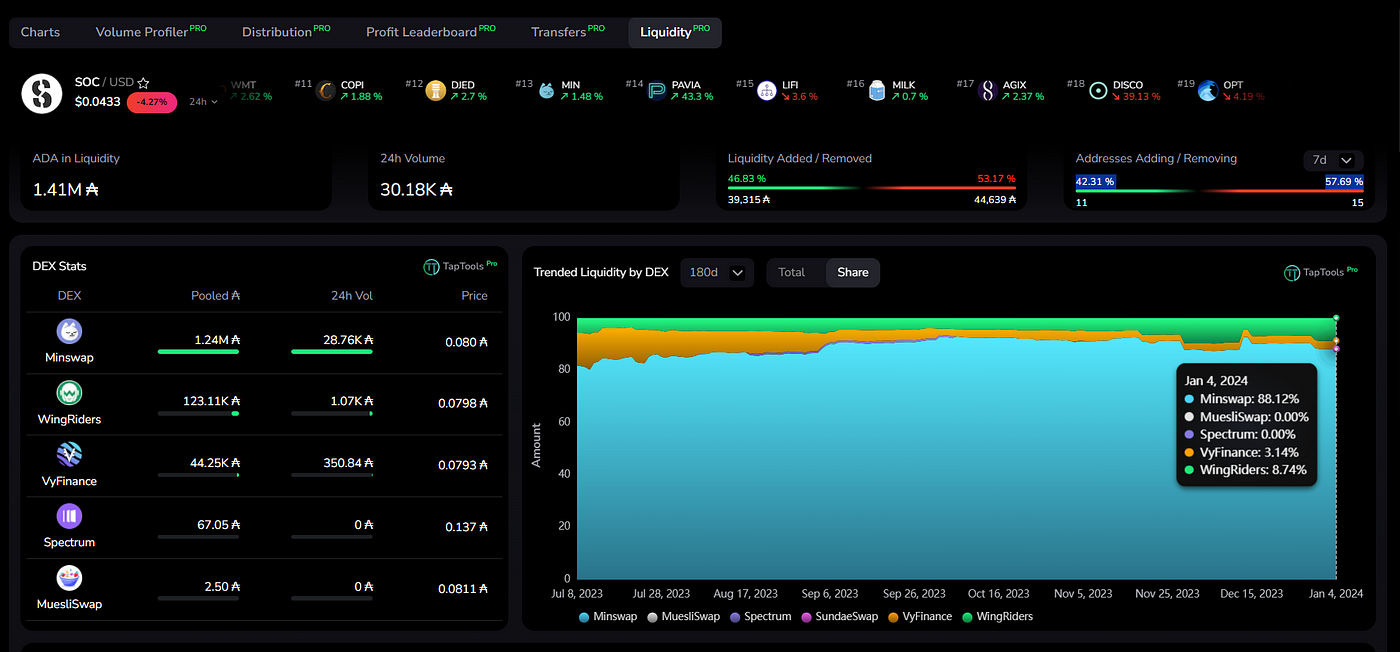

$SOC has 1.41 Million ADA in liquidity across 5 Decentralized Exchanges on Cardano. The vast majority of this liquidity is on Minswap which accounts for 88.12% of the token’s total liquidity. Wingriders is the second most liquid DEX and has 8.74% of the liquidity, followed by Vyfinance which has 3.14%.

Volume

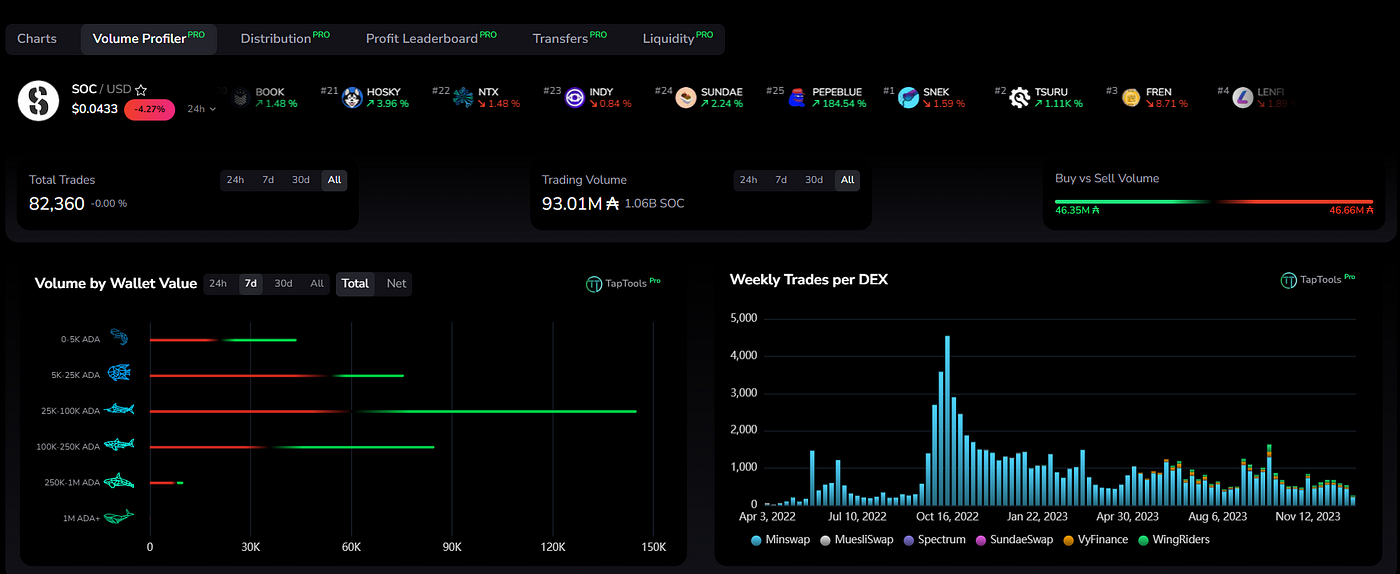

There have been 82,360 $SOC trades on Cardano DEXs totaling 93.01 Million ADA in trading volume equivalent to 1.06B $SOC. The token has 46.35 million ADA in buy volume and 46.66 million ADA in sell volume.

Utility

SOC is the governance and utility token of The Ape Society ecosystem. We’ll now delve into the various utility the token has to offer.

Governance

SOC holders can engage in governance and directly influence Levvy Finances future. The Decentralized DAO is responsible for important decisions, including voting on parameter changes and the introduction of new tokens on the lending and borrowing platform.

Levvy Pro

$SOC holders can stake 7500 tokens to unlock Levvy Pro on the Levvy Finance platform which provides multiple benefits including extended loans, beta features, and will include email notifications and detailed stats in the future. When tokens are unstaked, a 10% fee is charged on the deposit and burned.

SOC Staking

Holders of $SOC can stake their tokens to earn $ADA generated from fees paid by lenders and borrowers on Levvy for Tokens. At the time of writing 79,366,614 $SOC tokens were staked to earn passive income.

Conclusion

In summary, $SOC plays a crucial role as the utility and governance token in the Ape Society ecosystem, particularly within Levvy Finance. Its significance is evident in governance, Levvy Pro benefits, and staking opportunities. This article explored $SOC’s tokenomics, distribution, liquidity, volume, and utility, highlighting its rank as the 15th largest DEX token on Cardano. Looking ahead, it will be interesting to observe how $SOC’s role in Cardano’s decentralized finance space evolves.

You can find out more about SOC at the following link: https://www.soc.finance/

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!