University of Edinburgh Releases First Tool in Decentralization Index

As decentralization becomes a central theme within the blockchain community, there’s an increasing recognition of the need to systematically evaluate the levels of decentralization within blockchain networks.

As decentralization becomes a central theme within the blockchain community, there’s an increasing recognition of the need to systematically evaluate the levels of decentralization within blockchain networks. In response to this need, the University of Edinburgh has spearheaded the creation of the Edinburgh Decentralization Index (EDI). This initiative aims to provide a detailed and open-source framework for evaluating blockchain networks, highlighting the industry’s shift towards distributed ecosystems and emphasizing the critical need for transparency and standardization in blockchain assessments.

Edinburgh Decentralization Index Dashboard

On March 1st, 2024, the unveiling of the EDI Dashboard’s alpha version represented a significant step forward in blockchain transparency. Spearheaded by the University of Edinburgh and funded by a grant from Input Output Global (IOG), this open-source index was a result of a collaborative effort with multiple universities. By pooling their diverse academic insights and technical expertise, the partnership aimed to ensure the tool’s relevance and adaptability across different blockchain contexts.

The Decentralization Index is crafted to be objective and unbiased, with the aim of developing into an industry-wide accepted benchmark for assessing decentralization as it progresses over time.

How Does The EDI Measure Decentralization?

Edinburg Decentralization Index Nakatamoto Coefficient

The Edinburgh Decentralization Index (EDI) employs a variety of metrics to evaluate the decentralization levels of Layer 1 blockchains, including Bitcoin, Bitcoin Cash, Cardano, Ethereum, Litecoin, Tezos, and Zcash. Understanding these metrics can help stakeholders assess the robustness and fairness of different blockchain networks.

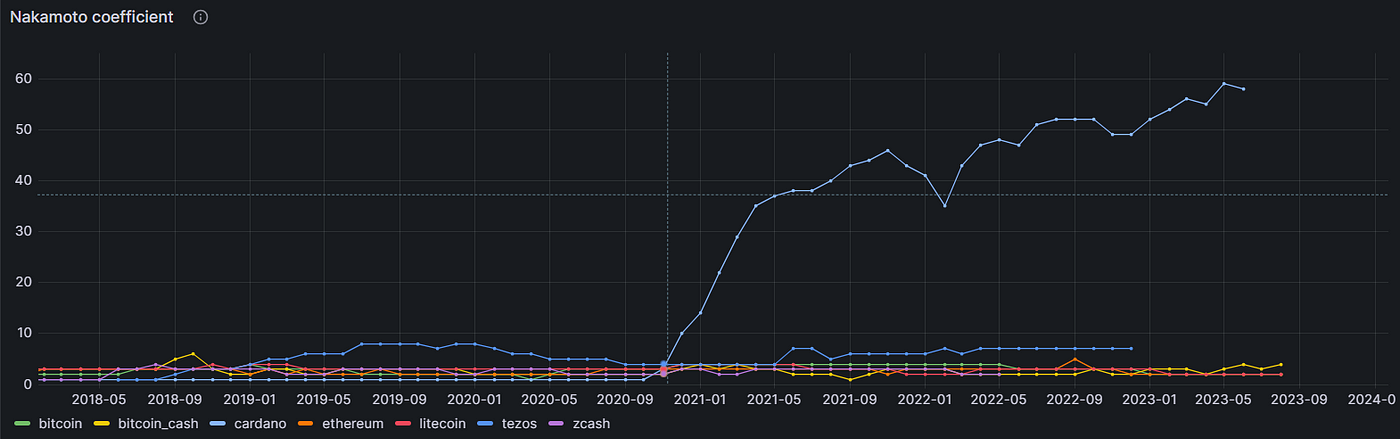

Nakamoto Coefficient: This metric indicates the minimum number of entities required to control over 50% of mining or staking power, thus highlighting potential vulnerabilities in the network’s decentralization. A higher Nakamoto Coefficient suggests a more resilient and distributed network, making it a crucial measure for assessing security against collusion or attacks.

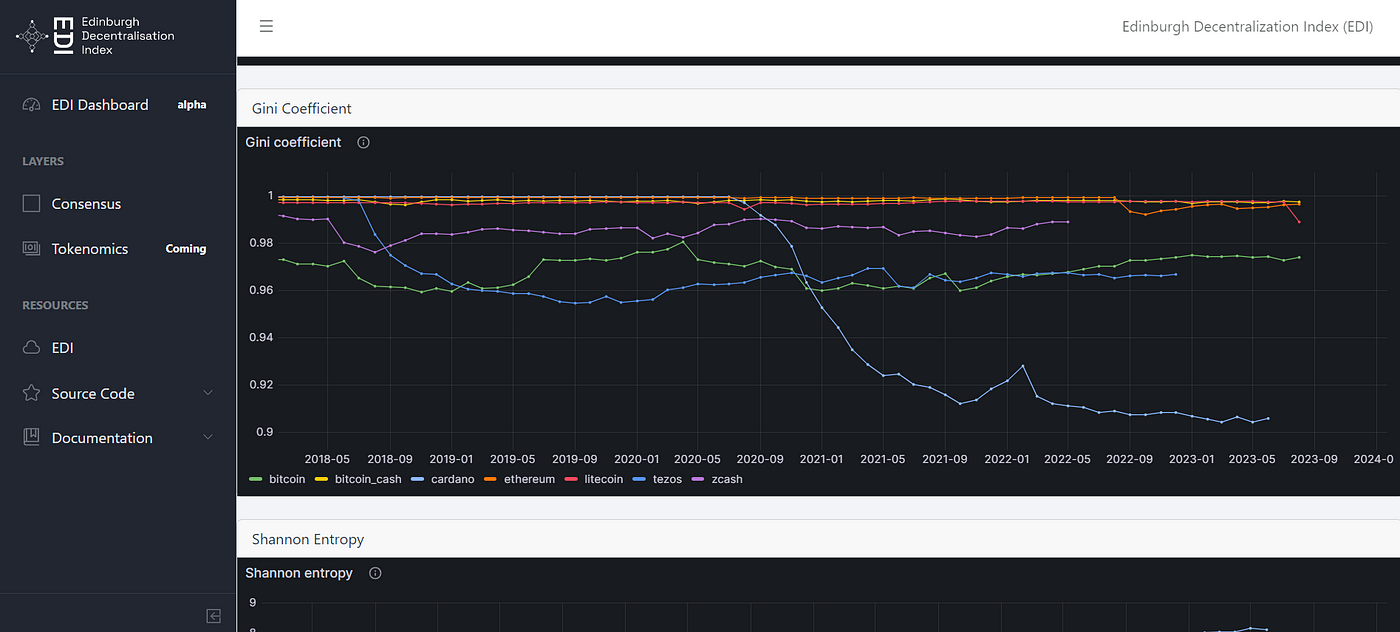

Gini Coefficient: By measuring the inequality within the distribution of block production, the Gini coefficient helps identify the balance of power within the network. A lower Gini coefficient indicates a more equitable distribution, which is essential for ensuring that no single entity has disproportionate control or influence over the network.

Shannon Entropy: This measure of information entropy quantifies the unpredictability and diversity of block producers. Higher Shannon entropy suggests a more decentralized network, reflecting a varied and unpredictable block production that enhances network security and fairness.

Herfindahl-Hirschman Index (HHI): The HHI measures market concentration to evaluate the diversity of block producers. Low HHI values denote a decentralized network with a balanced distribution of power among participants, which is vital for preventing dominance by any single entity.

Theil Index: This index measures the redundancy in a population, with lower values indicating a more equal distribution of block production. By assessing the diversity of participation in the network, the Theil index provides insights into the network’s decentralization and operational fairness.

Max Power Ratio: Representing the proportion of blocks produced by the most dominant entity, this metric sheds light on the extent of control exerted by the largest block producer. A lower max power ratio is preferable for a healthy, decentralized ecosystem, ensuring no single participant overly influences the network.

Tau-Decentralization Index: This index measures the concentration of power by identifying the minimum number of entities controlling more than a specific fraction (e.g., 66%) of mining or staking power. It offers a nuanced view of network control, essential for understanding deeper layers of decentralization beyond the majority control.

These metrics collectively offer a multi-dimensional view of blockchain decentralization, providing valuable insights for users, developers, and regulators to understand and improve the distributed ecosystems of various blockchains.

Shaping the Future of Blockchain

The Edinburgh Decentralization Index (EDI) aims to reshape the blockchain landscape by providing a standardized approach to evaluating decentralization. This could significantly impact the future of blockchain technology, potentially paving the way for widespread adoption. As businesses, institutions, and nation-states begin utilizing blockchains for various purposes like identity management, payment systems, and governance, it could lead to increased adoption of blockchain technologies across both public and private sectors. This, in turn, would drive innovation and enhance efficiency.

By offering clear metrics for decentralization, the EDI facilitates more informed decisions by governments and organizations. For instance, a country might choose to adopt a blockchain like Cardano for its stablecoin initiative. Such applications could enhance public trust in blockchain and stimulate broader usage across various sectors.

Furthermore, with the EDI placing decentralization at the forefront, current and future blockchain systems are likely to be encouraged to become more decentralized and incorporate features such as on-chain governance. This emphasis on decentralization could lead to increased adoption of blockchain technologies for both public and private applications, thereby driving innovation and efficiency.

Conclusion

As the blockchain and cryptocurrency industry focuses more on decentralization in the future, the development of the Edinburgh Decentralization Index (EDI) by the University of Edinburgh will play a crucial role and lay the foundation for future metrics by which blockchains are measured. Moving forward, with the EDI emphasizing decentralization, it will be poised to encourage the adoption of more decentralized approaches within blockchain systems, fostering innovation and efficiency across both public and private applications.

You can view the Edinburgh Decentralization Index Dashboard at the following link: http://blockchainlab.inf.ed.ac.uk/edi-dashboard/#/consensus

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!