Understanding the security budget

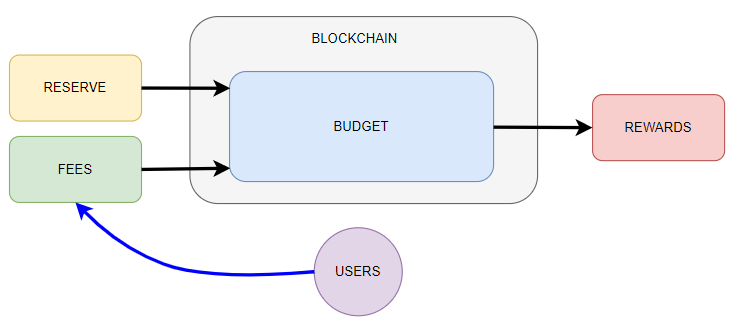

Every public blockchain network needs to reward those who care about its security and decentralization. This is a similar mechanism to a company paying its employees. In order for a network to pay for services, it needs to have...

Every public blockchain network needs to reward those who care about its security and decentralization. This is a similar mechanism to a company paying its employees. In order for a network to pay for services, it needs to have a steady and sustainable income. Let's take a look at how the economics of blockchains work and how Cardano is prepared for the future.

Two pillars of income

Every blockchain network must have a sufficient number of coins to maintain its security. Assuming there is demand for the coins and the coins have a market value, there will be people who will do useful work for the network. As a reward, they expect to receive the native coins of the blockchain network. This is how it works in the case of Cardano, Bitcoin, and Ethereum. Getting rewards is automatic and protocol-driven.

The first pillar of the network's budget is made up of coins that the network releases according to defined rules. If the network has a capped number of coins, which is the case for both Cardano and Bitcoin, the network has a limited number of coins it can gradually release. Let's call it a reserve. The reserve can last for several years or decades, but it will run out at some point.

It is uncertain how long the reserve will last, as no one can estimate the market value of coins in the future. While the cost of running a node is fixed and unchanging in the short term, cryptocurrencies are highly volatile. The rule of thumb is that the higher the value of the coins, the longer the coins will be sufficient for rewards.

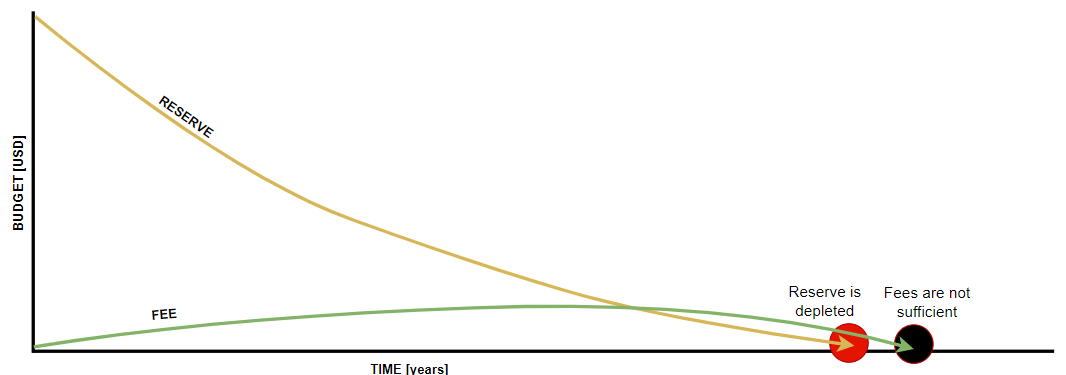

The developers expect that the reserve will run out one day. So what will be used to pay the rewards? The second pillar comes into play, which is made up of revenues from transactions and other fees. As the number of users grows, the amount of fees collected grows. The total budget is always made up of both pillars. The importance of the second pillar is expected to grow as the number of coins in reserve decreases. At the beginning of the blockchain network, the first pillar is important and will be gradually replaced by the second pillar over time. In the future, the networks will depend mainly on the fees collected, as the reserve will be almost or completely depleted.

The second pillar is essentially inexhaustible and can be a permanent revenue stream for the network, but only if there is demand for transactions and other DeFi services. If the network is in use by many users, it can theoretically be there forever. If only a small number of people use the network in the future, the fees collected will not be enough to pay the rewards and the network will disappear. It will not be economically viable for people to run full nodes and produce blocks.

Unfortunately, it is uncertain whether the second pillar will be sufficient to ensure the rewards and security of the network. This is why some economic models have infinite inflation of new coins. The total number of coins in the system will grow indefinitely. Thanks to inflation, the network will not depend only on fees.

You can see in the figure that the security budget is still roughly the same throughout the lifetime of the network. After the reserve is almost depleted (or completely depleted), the network's income is made up of transaction fees. If the security budget is completely depleted, the value of the coins is not important and it only matters how much users are willing to pay in fees.

Ethereum has an inflationary model. Ethereum 2.0 will issue 1600 ETH coins every day. However, to keep inflation from being unnecessarily high, transaction fees will be burned. In theory, if no one uses Ethereum 2.0, the new ETH coins would cover the network's cost. However, due to high inflation, the coins could quickly lose market value, so even 1600 ETH per day might not be worth much in dollar value.

Notice that the utility of any network is the most important thing, as it drives up demand for coins. Moreover, people pay fees. Only networks with a high network effect have a chance to survive in a highly competitive environment. The quality of technology and its adoption are likely to be the deciding factors.

Burning coins is a new concept. Many other projects have infinite inflation without the burning of coins.

The economic model influences the size of staking rewards paid to stakeholders. Cardano has an APR of around 5%, as the number of ADA coins is finite. ADA coins will be more scarce, like gold, so there is a greater chance that they will have a higher market value.

If another network has an inflationary model, it may have a higher APR, say 10, or even 20%. For example, Polkadot has an APR of around 14%, Cosmos 18%, etc. Coins are likely to be less scarce and have a lower market value. However, digital scarcity is not the only factor affecting demand.

Cardano monetary policy

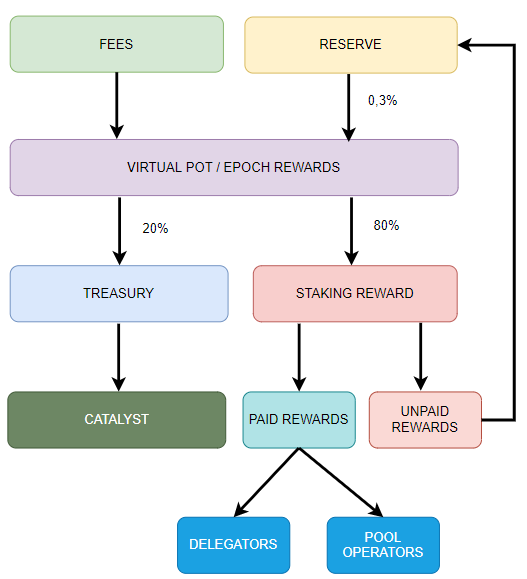

The Cardano economic model includes a project treasury, which not every project needs to have. Bitcoin, for example, does not have a project treasury, so rewards only go to miners.

Cardano pays rewards per epoch, which is every 5 days. Cardano has something called a virtual pot, which receives all the fees collected per epoch and 0.3% of the reserve. 20% of the virtual pot then goes into the treasury and 80% is used for staking rewards. It's important to note that the staking reward is not paid in full and some of it goes back into reserve. The entire staking reward would only be paid out if there was a preferred number of saturated pools, all pools would manage to mint all blocks, etc. However, these ideal conditions are never met, so a portion of the staking reward is consumed and a portion is returned to the reserve.

If you're wondering how quickly the reserve will be consumed, then it is expected that one-half will be consumed in about 4 to 5 years. That means if you take the current number of ADA coins in the reserve, which at the time of writing is just over 10,000,000,000, we'll get to roughly 5,000,000,000 sometime in 2027. By analogy, we'd arrive at 2,500,000,000 in about 2032.

Bitcoin cuts rewards by exactly half approximately every 4 years. Every 10 minutes, the protocol pays out a reward of 6.25 BTC from the reserve. After halving, it will be only 3.125 BTC. This process depletes the reserve over time. Over 91% of BTC coins are now mined.

Cardano releases ADA coins from the Reserve every 5 days and does not have the large monetary shocks that would be similar to Bitcoin halving. The process of monetary expansion is more gradual, but the depletion of ADA coins from the reserve will also occur at some point.

What is a security budget?

A security budget is a specific incentive that represents the total amount of money the network pays for its security. Put differently, the security budget consists of paid fees of all users plus coins that can be taken from the reserve, in order to keep the network running and secure from attacks. The security budget protects the network against the 51% attack.

Decentralized networks are only protected through economic incentives that encourage people to behave honestly. Networks are protected by human greed and the desire to get a reward from the network. If a network does not have a sufficient budget to pay rewards, it becomes more vulnerable. People lose the incentive to protect the network and an attacker can gain economic advantage and successfully carry out a 51% attack.

The problem for decentralized networks, in general, is that once the coins in the reserve run out or the amount paid out starts to shrink significantly, the security budget will have to rely largely on the fees collected. If people do not pay the fees, the budget will be very low and the network will not be sufficiently secure.

You can see in the figure that once the reserve is depleted, the amount of transaction fees collected is not enough to secure the network. Networks that are not used after the reserve is exhausted will cease to exist because there is not enough money for rewards and security.

Once the reserve is depleted, the network must collect a similar amount of coins in transaction fees to the number of coins taken from the reserve in the past. Ideally, the network should collect even more coins, as the requirements for more security increase as adoption increases. There is a real concern that the networks will not survive on transaction fees.

The amount of transaction fees collected depends on many factors. In particular, the network effect and the amount of fees people are willing to pay. From a user point of view, it is always better when fees are low, transactions are processed quickly and the network does not suffer from scalability problems. If the network does not scale well, it will depend on people being willing to pay very expensive fees for poor-quality transaction services. Say hundreds to thousands of dollars per transaction, which the network will process in a matter of days.

Some like to theorize whether users will pay expensive and slow transaction fees on Bitcoin, or use alternative networks like Cardano that will scale better and also offer additional on-chain services. Already, Cardano processes about the same number of transactions as Bitcoin. Ethereum is doing about 6x better than Bitcoin, and that's despite the fact that transactions are very expensive. At the moment, it looks like people are only willing to pay higher fees for DeFi services. There is not much demand for Bitcoin transactions.

Decentralized networks can only pay out their native coins without knowing what the coins are worth in the market. It is possible to calculate how much it would cost to attack the network.

To attack Cardano you must have 51% of the coins used for staking. At the time of writing this is approximately 25,000,000,000 ADA coins which have a market value of 0.5 USD. An attacker would need to have 12,500,000,000 USD worth of coins. If the attacker did not have the coins and wanted to buy them, he would cause a large demand in the market and the value of the ADA coins would rise. Eventually, the attacker would find that he had invested a huge amount of dollars in the attack and was attacking his own wealth.

In the case of Bitcoin, the security budget against a 51% attack consists of a block reward and fees. We would have to take into account the actual value of the BTC coins and the length of the attack. The Bitcoin network collects roughly 0.25 BTC in fees, so the total reward for a successful miner is 6.25 BTC + 0.25 BTC, which is 6.5 BTC. The current market value of BTC is roughly 20,000 USD, so the attack would come out to about 130,000 USD.

Attacking one block is not worthwhile, for a successful double-spend attack it makes sense to attack for an hour or more. A two-hour attack on Bitcoin would cost about 1,500,000 USD. The attacker would have to have mining hardware, which is a physical obstacle. However, the cost of a two-hour attack on Bitcoin is about 8,300 times less than the double-spend attack on Cardano.

A few more reflections

Take the numbers as an illustration of how the security budget works. It is important to note that currently a large part of the budget is made up of coins in the reserve. Attacking networks is therefore still relatively expensive. The problem will arise when networks have to rely on transaction fees. Cardano collects roughly $10,000 in transaction fees in 24 hours. Bitcoin collects $300,000 for the same period. That's not much in either case.

In 2032, 10 years from now, the block reward will be only 0.78 BTC. We know that Bitcoin will not change much in terms of scalability. If Bitcoin security is to remain the same as today, Bitcoin needs to collect, say, $100,000 in fees every 10 minutes. We don't know the exact amount because we can't predict the market value of BTC. If the blocks were full and there were 3,000 transactions, the average transaction fee would be $35. If we neglect the block reward and only count transaction fees, we find that the security budget for one day is roughly 15,000,000 USD. Is that a lot or a little for a store of value?

The scalability of the Cardano protocol will grow. With enhancements like Ouroboros Leios, the team can increase the current scalability by several orders of magnitude. If the block time of the Cardano network remained at 20 seconds, the network would produce roughly 4,300 blocks per day. Due to transaction references, the network could easily fit 10,000 transactions into a block. So it would process 43,000,000 transactions per day. What will be the usual fee for an on-chain transaction in 10 or 20 years? We don't know, but if it were 10 cents, Cardano would have a revenue of $4,300,000 per day.

Let's not forget that the cost of running a PoS network is significantly lower than for PoW networks. While in Bitcoin a large part of the rewards goes to pay for electricity, in Cardano the income can be used to reward pool operators and delegators. A portion goes to the project treasury. A delegator with a 0.01 stake could receive a daily reward in the hundreds of dollars, which is still a strong economic incentive to hold ADA.

Of course, it must be taken into account that Cardano will only have a sufficient security budget if people use the services built on it and demand for them grows.

Conclusion

The demand for cryptocurrencies will significantly affect the security budget. As the value of the coins increases, the security budget problem will be delayed into the future as the coins in reserve will cover the cost of running the network and protect it against a 51% attack. It is almost certain that in a few decades networks will depend on how much people pay for on-chain services. Direct use of the network will be important. Holding coins in wallets (hodling) will not earn the network anything.

I think it will be significantly easier for platforms like Cardano to deal with the declining number of coins in reserve. Cardano's success lies in creating an alternative financial system that people will use every day. Bitcoin is seen as digital gold. People mostly hold gold and don't use it much. Bitcoin needs the market value of BTC coins to skyrocket every halving. Once that stops, you'll hear about the security budget problem again.

I expect a narrative shift. People will start to see ADA as an asset that is similar to BTC, i.e. another digital gold. Ethereum may help this, as ETH is also considered "ultrasound money". The Bitcoin ecosystem may become more like DeFi and new services may emerge on top of it. However, it is questionable how Bitcoin itself will benefit from this, as I cannot imagine tokens being created directly on the blockchain.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!