Token Spotlight: OPTIM

OPTIM is the utility and governance token of Optim Finance, the leading yield product in the Cardano Ecosystem.

OPTIM is the utility and governance token of Optim Finance, the leading yield product in the Cardano Ecosystem. This yield product allows ecosystem participants to borrow staking power through Optim Bonds for various purposes, such as bootstrapping a stake pool, or to make the most out of an ISPO. This article delves into OPTIM, its tokenomics, utility, and more.

OPTIM Distribution & Tokenomics

OPTIM Distribution Pro page on TapTools

OPTIM has a total supply of 100 million tokens. Currently 13.59 million of these tokens are in circulation, equivalent to 13.6% of the token supply. At 0.596 ADA per OPTIM, this gives the token a Market Cap of $4,729,682 and a Diluted Market Cap of $34,811,611, placing it at #31 in the Top 50 tokens on Cardano.

There are currently 1,460 wallets holding OPTIM, down 2.08% over the last 30 days. The token has a Median Holder Balance of 581.88 OPTIM, equivalent to 345.25 ADA, and an Average Holder Age of 130.03 days, highlighting the community that has been supporting the project since the token launch.

The above image details the tokenomics of the OPTIM token. The two largest allocations are for Public tokens and team tokens.

Liquidity

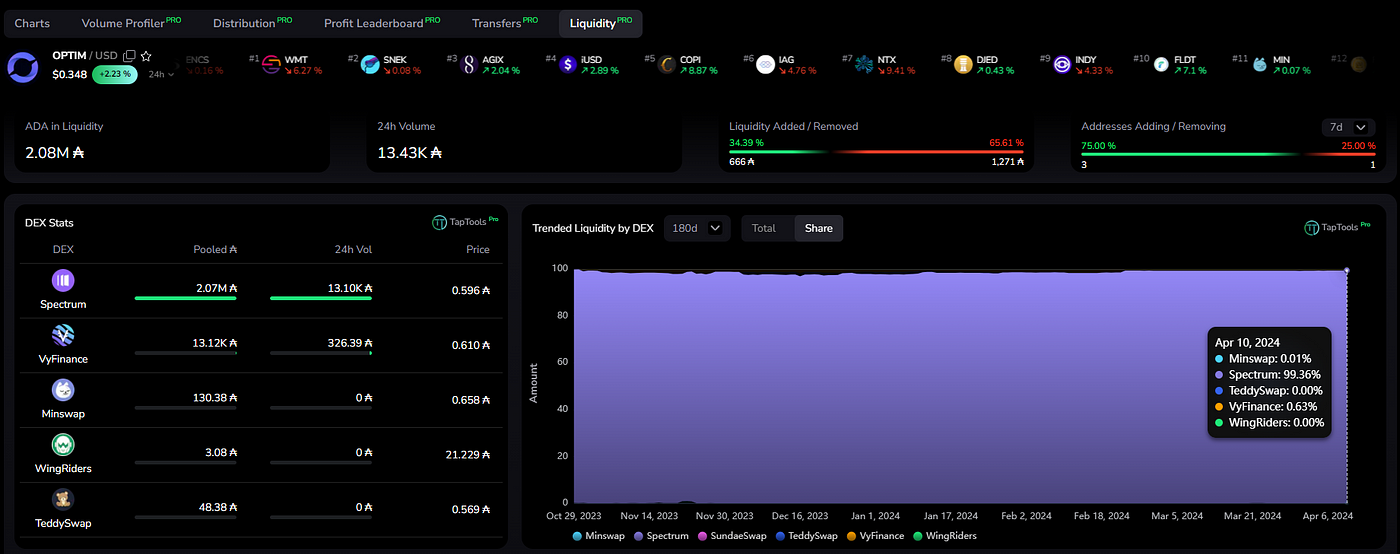

OPTIM Liquidity Pro page on TapTools

OPTIM currently has 2.08 million ADA in liquidity across five Decentralized Exchanges on the Cardano blockchain. The vast majority of this liquidity is on Spectrum Finance which holders 99.36% of the tokens total liquidity, followed by VyFinance which holds 0.63%, and Minswap being the third most liquid DEX with 0.01% of the total liquidity for OPTIM.

Volume

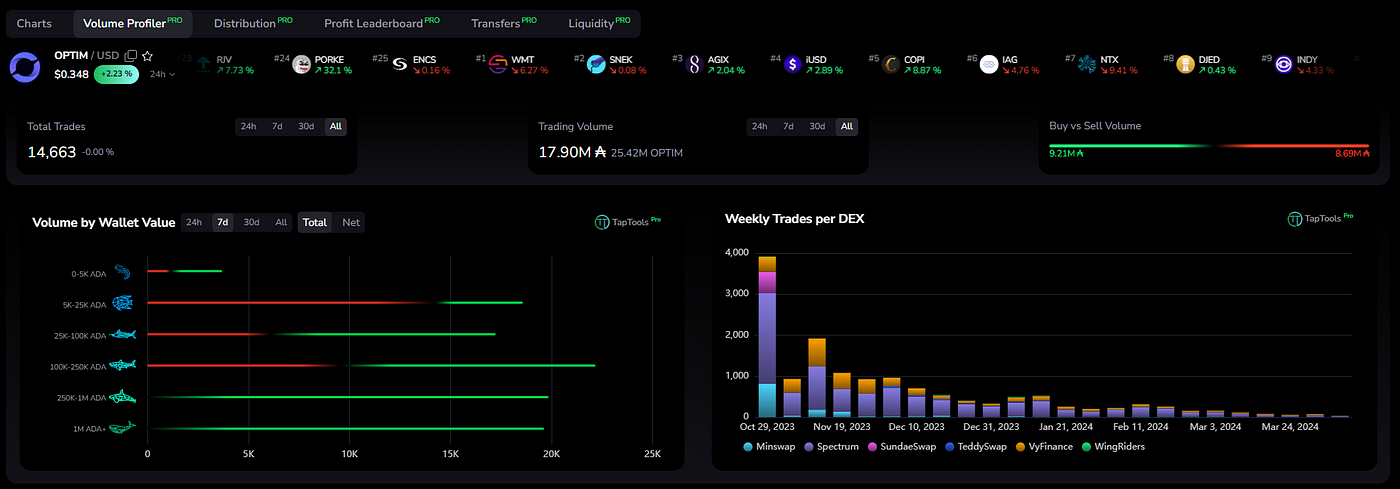

OPTIM Volume Profiler Pro page on TapTools

OPTIM has a Lifetime Trading Volume of 17.9 million ADA, equivalent to 25.42 million OPTIM. 9.21 million of this was Buy Volume and 8.69 million was Sell Volume. The volume distribution is even between most wallet classes, with the Shark wallet size (100–250K ADA) taking a slight lead on total trading volume for the token.

Utility

We’ll now delve into the utility that OPTIM offers its holders.

Governance

OPTIM holders can engage in governance and directly influence the protocol’s future through governance actions.

Fee Sharing

OPTIM holders will potentially be able to receive a portion of fees generated by the Optim protocol if the ODAO initiates a fee switch.

Conclusion

Optim Finance stands at the forefront of innovation within the Cardano Decentralized Finance space, offering powerful yield products and staking mechanisms designed to enhance ecosystem growth and scalability. At the center of this innovation is the OPTIM token, serving primarily as a governance tool that allows holders to shape the future direction of the protocol. As Optim continues to refine and expand its offerings, it will be interesting to observe how it shapes the broader Cardano ecosystem moving forward.

You can find out more about Optim Finance at the following link: https://www.optim.finance/

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!