The Waiting Game

In the shadows of the bear market, a familiar script plays out: crypto influencers, with bravado and optimism, declare the brink of a bull run or forewarn of impending crashes. Yet, tokens drift sideways, making small movements in value while people’s emotions gradually get worn down.

In the shadows of the bear market, a familiar script plays out: crypto influencers, with bravado and optimism, declare the brink of a bull run or forewarn of impending crashes. Yet, tokens drift sideways, making small movements in value while people’s emotions gradually get worn down.

Central to the ebb and flow of this is a steady decrease in liquidity, a phenomenon not unique to cryptocurrency but observed across all global markets. In a dance as old as time, markets move slowly through cycles that repeat roughly every four years. For Bitcoin, while its halving might be on a four-year cycle, its value’s ascension and descension are intrinsically connected to these liquidity cycles.

Many seasoned traders distill their approach into three phases: buy in the bear market, sit on their hands, and sell during the bull’s reign. But herein lies the challenge; such a strategy demands unwavering patience and vision — qualities often scarce within the crypto community.

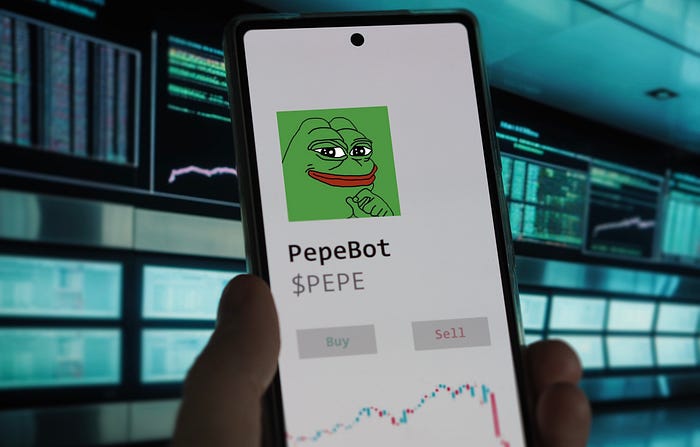

Amidst all the chatter about golden crosses and death crosses, it’s imperative to understand that the flow of liquidity drives significant market shifts — its entry, exit, or redistribution. Some influencers harness this truth, leveraging the promise of the next big memecoin to drain liquidity from unsuspecting and novice traders.

To better understand what’s happening in the markets, you must zoom out and look at the larger picture. Getting a better sense of what’s happening in the rest of the world helps people manage their expectations and time horizon.

For instance, we’ve been speaking with manufacturers and senior business managers in China to understand whether a recession is still looming. This is helpful because US and European firms reveal their expectations for the next six months through their actions abroad rather than soundbites in interviews.

Currently, manufacturing in China is still experiencing a slowdown, with many factories operating at 50% capacity or less. This is partly due to US companies pressuring them to manufacture in Vietnam to weaken the Chinese economy. However, even in Vietnam, factories are operating far below capacity. Orders are currently being placed for delivery to market in Q1 of 2024, and these are below expectations for this time of year, indicating that US and European retailers are still anticipating a recession.

In Shanghai, US businesses are slowly rehiring some of the positions they let go of 6 months ago. However, the pace of recruitment is slow, and unemployment remains high. This knock-on effect damages the housing market as more people can’t afford to live in Tier-1 cities and move back to the countryside.

While the Chinese government is planning a stimulus package for the economy and real estate sector, the opposite is true in the US and Europe. Central banks here are continuing to tighten monetary policy, which has the effect of removing liquidity from the markets.

With less money, people are reluctant to take chances and focus primarily on preserving wealth rather than trying to increase it. This is known as a ‘risk-off’ environment and is the reason that no new money is entering the crypto market.

Without a significant shift in central banking policies, markets will remain trapped in this status quo. While economists may talk about strong labor markets and avoiding a recession, the indications from major retailers and businesses are that they are still planning for one.

The foreseeable future might see the market pulse in its current rhythm, occasionally jolted by liquidity shocks from new memecoins or a wave of ETF approvals. For those patiently awaiting the next bull run, the tide will only turn after central bank policies pivot.

Staying in tune with these factors and having a realistic outlook on bear markets is why we secured and extended our runway. This enables us to continue to build throughout the downturn and weather the storm so that we’re perfectly positioned for when the market turns and the next wave of liquidity begins to flow in.

Join Paribus-

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!