Solana vs Ethereum: A Detailed Comparison of Layer 1 Solutions

The realm of blockchain technology is abuzz with fervent debate, and at the epicenter of this discourse lies the fierce rivalry between Solana (SOL) vs Ethereum (ETH). Both blockchains are vying for dominance...

The realm of blockchain technology is abuzz with fervent debate, and at the epicenter of this discourse lies the fierce rivalry between Solana (SOL) vs Ethereum (ETH). Both blockchains are vying for dominance in the Layer 1 arena, each touting a unique blend of features and functionalities. Navigating this complex landscape can be perplexing, particularly for those seeking to discern the nuances that distinguish these two titans.

This blog aims to be your definitive guide, meticulously dissecting the intricacies of Solana vs Ethereum. Join us as we delve into the intricacies of these platforms to decipher which one reigns supreme.

Key differences between Solana and Ethereum

When comparing Solana and Ethereum as Layer 1 solutions, several key differences emerge that are significant for developers and investors alike. Take a look:

A representation of Solana vs Ethereum – Image via Freepik

1. Solana vs Ethereum: Background

Solana was developed as a response to certain limitations of Ethereum. It’s sometimes labeled as an “Ethereum killer” due to its innovative features. The network was founded by Anatoly Yakovenko.

His team comprised notable tech executives, including Greg Fitzgerald, Stephen Akridge, and three others. In 2019, Solana successfully raised $20 million in a Series A funding round. This significant financial milestone was led by Multicoin Capital.

The Solana mainnet officially went live in March 2020. The platform rapidly gained traction with a significant partnership with the decentralized exchange (DEX) Serum. Serum made its debut on August 31, 2020, marking one of the pioneering open-source projects to be developed on the Solana blockchain.

On the other hand, Ethereum was conceived in 2013 and launched subsequently in 2015 by Vitalik Buterin and his team of seven others. It marked a significant evolution in the crypto space as the first second-generation cryptocurrency, introducing programmable smart contracts.

The network had one of the largest initial coin offerings (ICOs) at the time, raising $18 million. This marked the beginning of Ethereum’s ascent.

2. Solana vs Ethereum: Consensus mechanism

Solana employs a unique hybrid model combining Proof-of-Stake (PoS) with Proof-of-History (PoH). PoH introduces a historical record of events, helping the network agree on the time sequencing of events.

This hybrid approach enables Solana to process transactions faster and at lower costs compared to Ethereum.

Ethereum originally used Proof-of-Work (PoW), requiring computationally intensive mining, but transitioned to PoS in its Ethereum 2.0 upgrade, also known as The Merge. This move significantly reduced the energy consumption.

Deepen your understanding of Ethereum’s capabilities by exploring the potential use cases of Ethereum 2.0.

3. Solana vs Ethereum: Speed and scalability

Solana boasts a theoretical maximum capacity of 710,000 transactions per second (TPS) on a standard gigabit network and an impressive potential of up to 28.4 million TPS on a 40-gigabit network. However, in practical terms, the network currently processes an average of 5,000 to 10,000 TPS, with remarkably short block times of around 400 milliseconds.

A key feature of Solana is its scalability at the base layer. It is designed to naturally scale in tandem with Moore’s Law, avoiding the need for extra layers or sharding. This is largely attributed to its innovative Turbine block propagation protocol and the Gulf Stream, both integral to its high performance.

In comparison, Ethereum 2.0 averages around 20-30 TPS, with a theoretical maximum capacity of 100,000 TPS. To address its scalability challenges, Ethereum utilizes various Layer 2 solutions, including state channels, sidechains, and rollups.

These technologies provide crucial scalability and throughput improvements without compromising the network’s security and integrity.

Grasp the technical nuances of Ethereum sharding to compare its scalability solutions with those of Solana

Where does Solana stand compared to Ethereum? – Image via Solana

4. Solana vs Ethereum: Native currency

Solana’s native currency, SOL, is a multifaceted asset. It’s used for transaction fees and powers a unique rent mechanism. Validator and delegator rewards for contributing to network security are paid in SOL.

SOL is divisible into smaller units called Lamports, with one Lamport equaling 0.000000001 SOL. Initially, 500 million SOL were created, with an inflation rate starting at 8% and reducing annually by 15%, eventually stabilizing at 1.5%.

5. Solana vs Ethereum: Staking

Solana’s staking model is more flexible compared to Ethereum’s. There is no strict minimum amount required to stake SOL.

However, to take part in the consensus process, one must possess a vote account with a rent-exempt reserve of 0.02685864 SOL. Additionally, participating in voting necessitates the submission of a vote transaction for every block that the validator concurs with, potentially incurring a daily cost of up to 1.1 SOL

Ethereum requires a minimum of 32 ETH to become a full validator and directly participate in the staking process. This amount is quite substantial and represents a significant investment.

However, for those who do not have 32 ETH or prefer not to stake that amount, there are options to join staking pools, where multiple participants can combine their resources to meet the minimum staking requirement.

6. Solana vs Ethereum: Smart contracts

Solana programs (smart contracts) are commonly written using the Rust language, although support for C/C++ is also available. While Ethereum’s Ethereum Virtual Machine (EVM) offers a more mature and tested environment, Solana’s choice of programming languages aims to leverage the performance benefits these languages offer.

This makes it a compelling alternative for developers prioritizing efficiency and speed in blockchain applications.

In contrast, Ethereum primarily uses Solidity, a high-level programming language. Developers write their smart contract code in Solidity, which is then compiled into Ethereum bytecode to be executed on the EVM. The network also supports other languages, notably Vyper.

For more advanced developers, there’s Yul and its extension, Yul+. Additionally, those interested in contributing to the development of new technologies can explore Fe, a nascent smart contract language still in the early stages of development.

Explore Solana’s future potential in-depth, including whether SOL could reach $1000 by 2040.

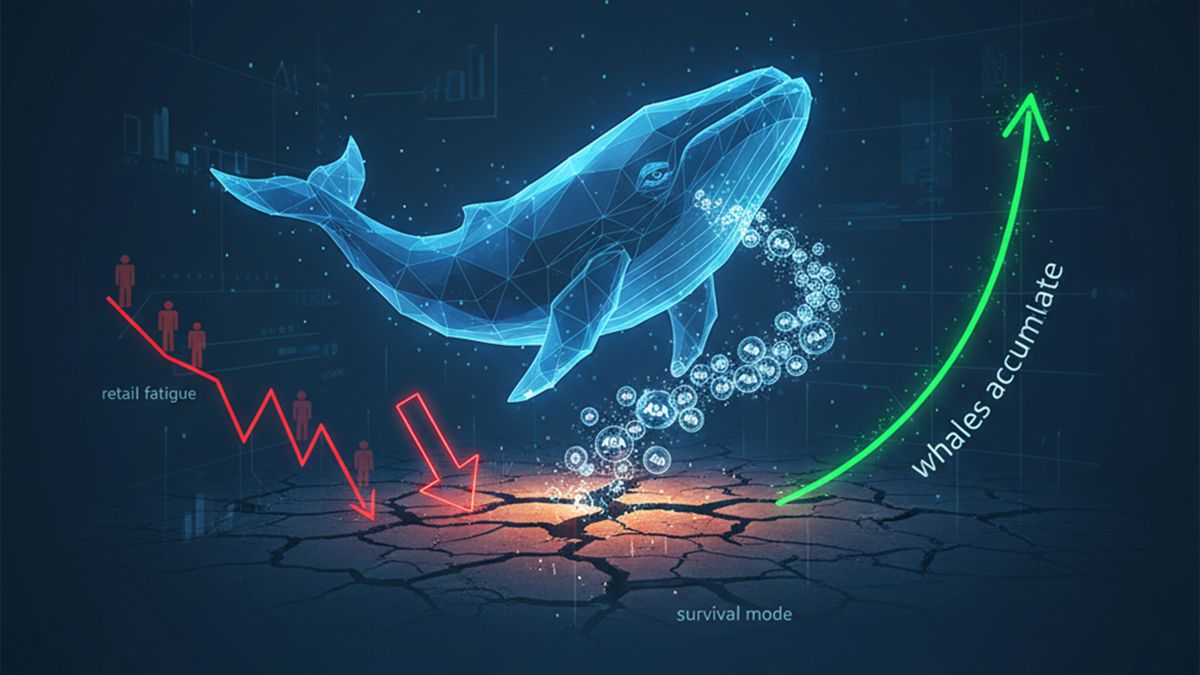

Is Ethereum better than Solana? – Image via Ethereum

7. Solana vs Ethereum: Transaction fees

Solana is quite affordable, with the average transaction cost being merely a fraction of a cent, around $0.00025. This low fee structure makes Solana highly appealing to users seeking cost-effective blockchain transactions.

Ethereum’s transaction fees tend to be more expensive, particularly during periods of peak network usage. The blockchain’s fee system, based on “gas fees” required to process transactions, is known for its volatility.

As of January 2024, the average gas fee on the Ethereum network is around 20 GWEI, equating to an average transaction cost of roughly $0.677.

8. Solana vs Ethereum: Token standards

Solana employs the Solana Program Library (SPL) token standard. These tokens support various functionalities like fungibility, non-fungibility, and custom token features.

Ethereum introduced the ERC-20 token standard, which has become the industry standard for fungible tokens. ERC-20 tokens are interchangeable, making them ideal for various use cases such as ICOs, stablecoins, and governance tokens.

Additionally, Ethereum offers ERC-721 for non-fungible tokens (NFTs). Other popular standards include: ERC-777, ERC-1155, and ERC-4626.

9. Solana vs Ethereum: Market position

According to CoinMarketCap, Solana is the fifth largest cryptocurrency by market capitalization. At the time of writing, the trading price of SOL stood at $104, with a market capitalization of $45,374,115,036.

SOL’s price has appreciated a whopping 12400% overall, with 435,495,970 coins in circulation as of January 2024.

On the other hand, Ethereum is ranked as the second-largest cryptocurrency. ETH traded at $2,313 with a market capitalization of $278,057,747,602.

The circulating supply of ETH was 120,183,304, and it has seen a price appreciation of around 81600% in total.

While comparing Solana and Ethereum, check the current market conversion rate from 1 ETH to SOL using our convenient conversion tool.

Solana or Ethereum: Which one is better? – Image via Solana and Ethereum

10. Solana vs Ethereum: Network size

Data from DeFiLlama indicated that as of January 2024, Solana’s Total Value Locked (TVL) stood at approximately $1.62 million, while Ethereum boasted a significantly higher TVL of about $32.5 billion. The disparity in TVL between the two networks is nearly 200%, suggesting a stronger preference among financial applications for Ethereum’s platform.

While Solana is gradually gaining traction with financial institutions, it faces a considerable challenge in matching the extensive network size established by Ethereum.

11. Solana vs Ethereum: Decentralization and downtime

Solana operates with a relatively smaller pool of validator nodes, numbering around 1,755 currently. The limited number raises some concerns about potential centralization and the risk of influence by major stakeholders.

Moreover, Solana has experienced several network outages since its inception due to overwhelming transaction loads.

In contrast, Ethereum boasts a large and geographically diverse network of nodes. The Ethereum network is open for participation, allowing anyone to run a node. This widespread participation fosters a stronger resistance to censorship and manipulation, reinforcing the network’s decentralized nature.

Lastly, the blockchain has had a more stable operational history. While Ethereum has experienced issues like network congestion, particularly during high-demand periods like the CryptoKitties craze, the network has never gone offline.

These differences underline the distinct design philosophies and technological approaches of the two platforms, each catering to different needs and use cases in the blockchain space.

Consider the other side of the coin by delving into potential bearish scenarios for Ethereum and their implications.

Best crypto to buy in 2024

The verdict

In the race for blockchain supremacy, Solana and Ethereum are formidable contenders, each with its own set of advantages and limitations. Solana’s blazing-fast transaction speeds and low fees make it an attractive option for many, especially in the world of DeFi and NFTs.

On the other hand, Ethereum’s established network and wide-ranging ecosystem continue to attract developers and investors. The choice between Solana and Ethereum ultimately depends on your specific needs and objectives.

As these platforms continue to evolve, keeping an eye on their developments and innovations will be crucial. So, whether you lean towards Solana’s efficiency or Ethereum’s versatility, both have a role to play in the blockchain revolution.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!