RedStone CEO Warns of Systemic Risks for Trillion-Dollar RWAs

Key Highlights Kaźmierczak admits RWA growth has been slower than expected, with the market sitting at $23B despite more ambitious forecasts. Investors are migrating from 4% T-Bills to complex private credit...

Key Highlights

- Kaźmierczak admits RWA growth has been slower than expected, with the market sitting at $23B despite more ambitious forecasts.

- Investors are migrating from 4% T-Bills to complex private credit which offer 8-10% APY, significantly increasing risk.

- Blockchain has no undo button. A single bad data feed could permanently wipe out billions in collateral.

As the crypto industry attempts to bridge the gap with traditional finance through Real World Assets (RWAs), the underlying infrastructure is facing increasing pressure. Marcin Kaźmierczak, CEO of RedStone Oracles, recently discussed the state of the sector, acknowledging that despite the hype, the adoption of tokenized assets has been slower than anticipated.

In an exclusive insight with The Crypto Times, Kaźmierczak provided a straightforward assessment of the market, the technical risks facing oracle providers, and the shift from government treasuries to private credit.

A reality check on RWA adoption

When asked which RWA category had surprised him with its scaling over the last year, Kaźmierczak’s answer was blunt: “None of them.”

He noted that the sector has not grown as fast as he anticipated, currently sitting at approximately $23 billion in tokenized assets, a figure he initially expected to be much higher. While he maintains a forecast of reaching $200 billion by the end of 2026, he highlights a shift in demand.

While US Treasury bills currently dominate the space offering ~4% yields, Kaźmierczak observes a migration toward private credit. This sector, often involving large asset managers like Apollo, offers higher potential yields, about 8-10%, but introduces more complexity than simple government debt.

The no reversal element

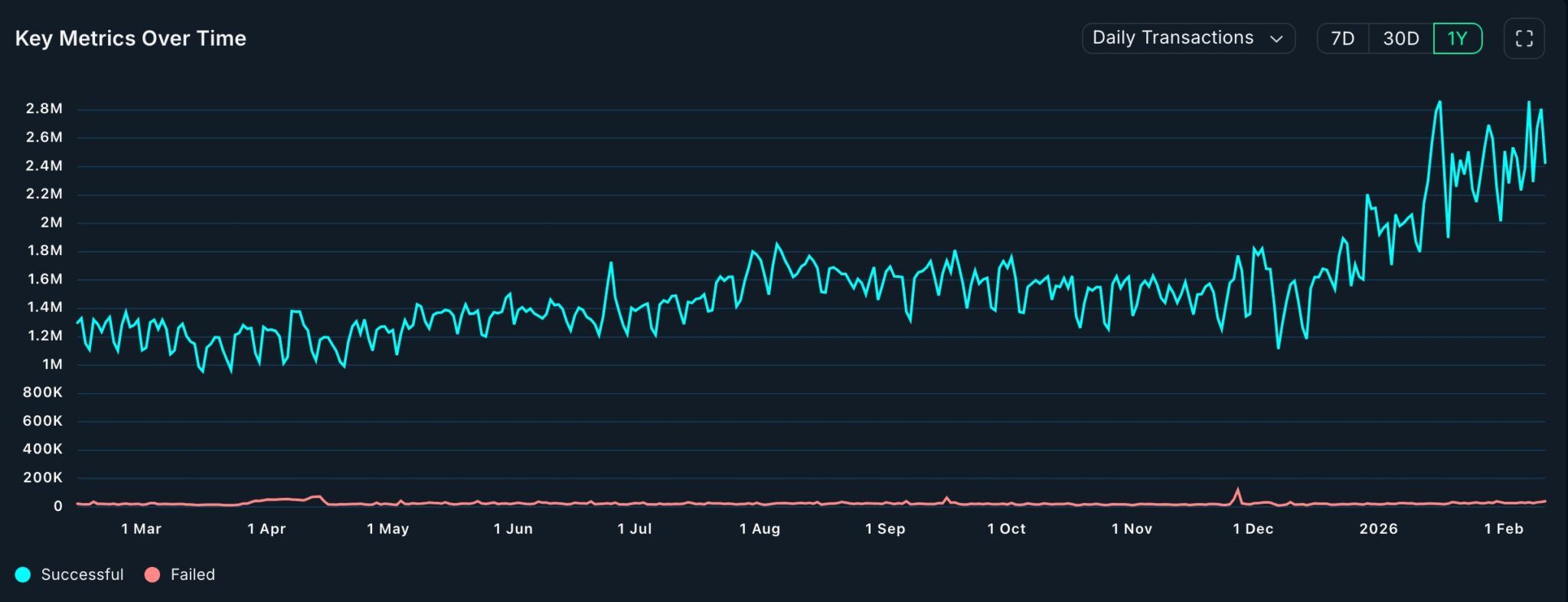

As the second-largest oracle provider securing roughly $8 billion in assets, RedStone’s role highlights a critical vulnerability in the blockchain stack. Oracles serve as the bridge feeding off-chain data such as stock prices or commodity values to on-chain smart contracts.

Kaźmierczak emphasized the systemic risk this creates. Unlike traditional finance, where errors can often be reversed, blockchain transactions are final. If an oracle feeds incorrect data, whether due to a technical glitch or a hack, it can trigger irreversible liquidations and bad debt for protocols. He shared, “So if an oracle delivers a bad price, as I mentioned, for example, 50% discount towards the reality, the liquidation cascade is just going to happen and then the whole milk is spilt and you have a big problem.”

“If we explode tomorrow, over $8 billion would be at risk,” he stated, describing the binary nature of oracle security.

AI security and trust layers

To address these risks, Kaźmierczak detailed RedStone’s reliance on automated monitoring, describing the present world where “AI fights AI.” The firm uses AI models to detect price anomalies and potential manipulation attempts before they impact the feed.

However, he stressed that technology alone isn’t enough; the firm maintains a “human-in-the-loop” approach with engineering teams on standby to intervene if automated systems flag critical issues. He shared, “We can actually like take a look, monitor and then either deliver the data on-chain, if that’s true, or backstop that before actually something very bad happens.”

Moving beyond the pilot phase

Despite the slow start, Kaźmierczak is optimistic that the industry is moving past the “pilot” phase. He pointed to recent moves by the Depository Trust and Clearing Company and the NYSE to explore tokenization as evidence of institutional buy-in. He also predicted that consumer fintech apps will eventually abstract the complexity of these assets entirely, offering tokenized yields to users who may be unaware they are interacting with blockchain technology.

However, for that future to materialize, the underlying data layer must remain error-free. As Kaźmierczak noted, in a system without chargebacks or reversals, the accuracy of the oracle is the only thing standing between a functioning market and systemic failure.

Disclaimer: The information researched and reported by The Crypto Times is for informational purposes only and is not a substitute for professional financial advice. Investing in crypto assets involves significant risk due to market volatility. Always Do Your Own Research (DYOR) and consult with a qualified Financial Advisor before making any investment decisions.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!