Predicting Solana’s Q4: Is SOL ready for $200? – Crypto News Aggregator

Solana’s rally has shown signs of exhaustion after a recent breakout past $150. On-chain data shows mixed signals on whether SOL price could rally to $200. Solana [SOL] traded at $144 at press time. Despite...

- Solana’s rally has shown signs of exhaustion after a recent breakout past $150.

- On-chain data shows mixed signals on whether SOL price could rally to $200.

Solana [SOL] traded at $144 at press time. Despite its recent bounce from a multi-month support level, SOL remains down by around 6% in the last 30 days.

Last week, Solana saw a healthy recovery, with the price rallying from $127 to $151. These gains were largely driven by support from the broader cryptocurrency market, as Bitcoin [BTC] and most altcoins reported gains.

As Solana’s rally shows signs of exhaustion, does on-chain data support a long-term bullish outlook that could take prices to $200?

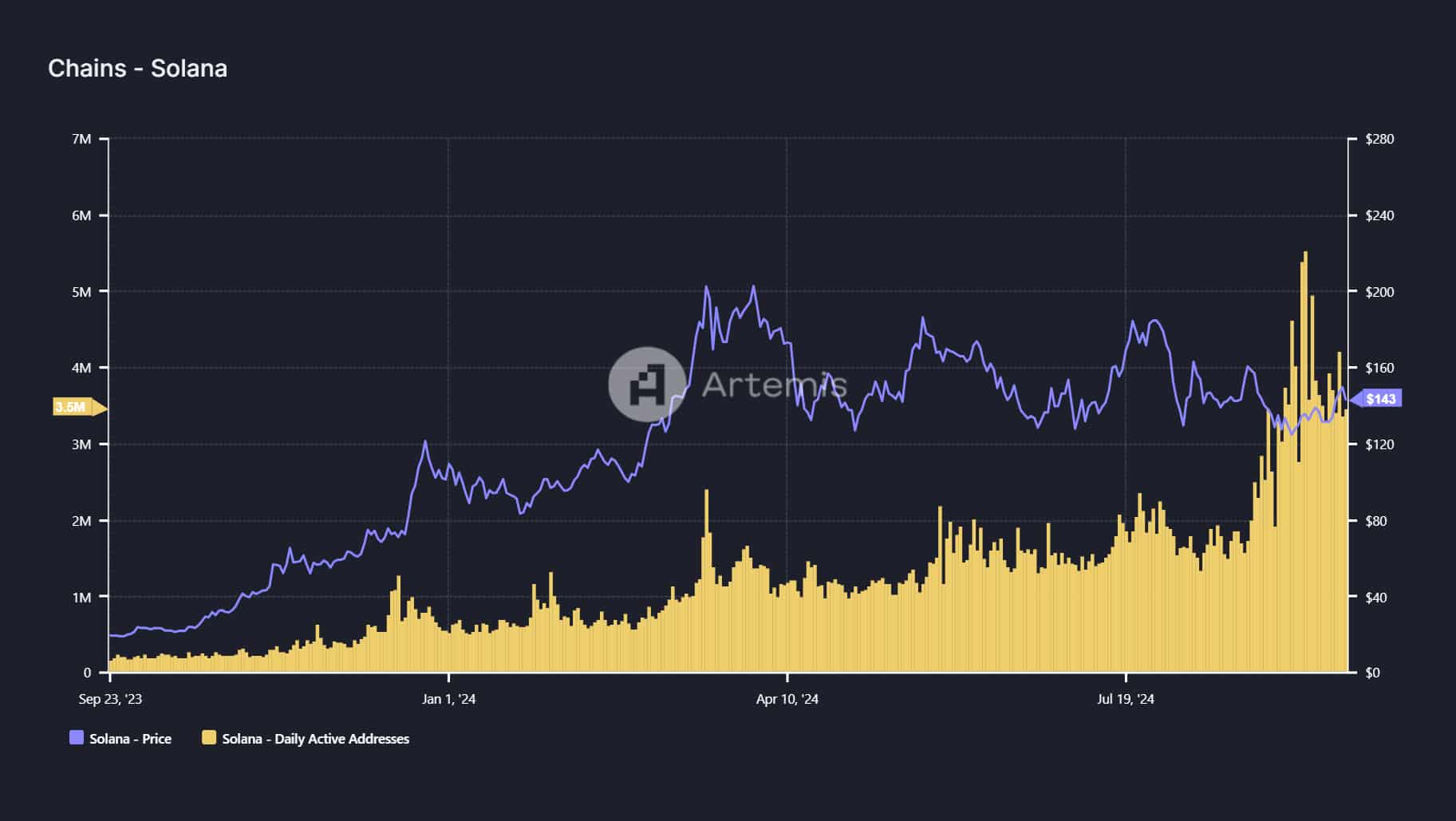

Solana’s active addresses

Data from Artemis shows that while the monthly active addresses on Solana recently hit a record high, the daily active addresses suggest that short-term engagement has slowed.

Solana’s daily active addresses reached a one-year high of 5.5M addresses on the 19th of September. This metric has since dropped to 3.5M addresses.

A decline in Solana’s daily active addresses indicates that network usage is slowing down. For SOL price to rally to $200, there needs to be an uptick of activity on the network.

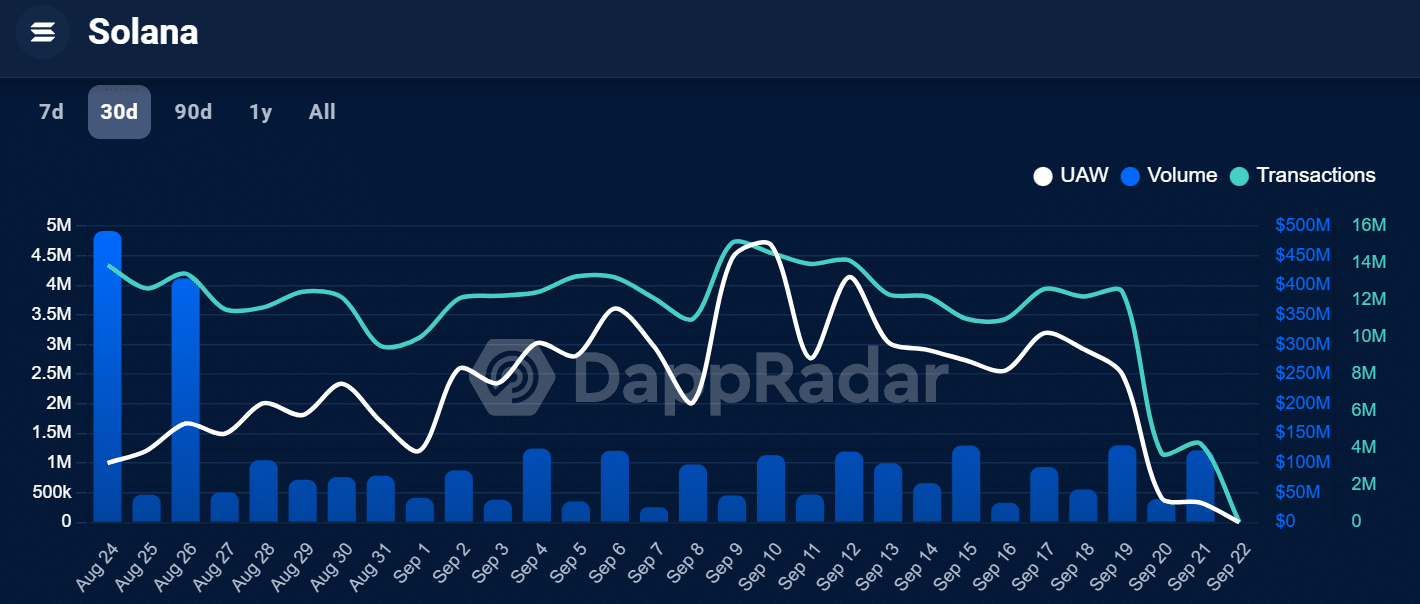

dApp volumes remain low

Data from DappRadar shows that in the last 30 days, decentralized application (DApp) activity on Solana has been notably low.

DApp volumes on the blockchain have dropped to $121M, a huge difference from the over $400M recorded in late August.

A similar drop is also seen in the number of transactions and the Unique Active Wallets (UAWs).

For SOL to extend its gains, there needs to be more demand for the token as users interact with dApps created on the blockchain.

DeFi TVL surpasses $5 billion

The decentralized finance (DeFi) Total Value Locked (TVL) on the Solana blockchain has increased above $5 billion for the first time this month.

According to DeFiLlama, Solana has added more than $500M to its TVL within two weeks.

A DeFi boom on the Solana blockchain could have a positive impact on price as people interacting with the protocols created on the network demand SOL to settle transactions.

One of the protocols driving a DeFi boom on the blockchain is Jupiter, whose TVL recently reached an all-time high.

Read Solana’s [SOL] Price Prediction 2024–2025

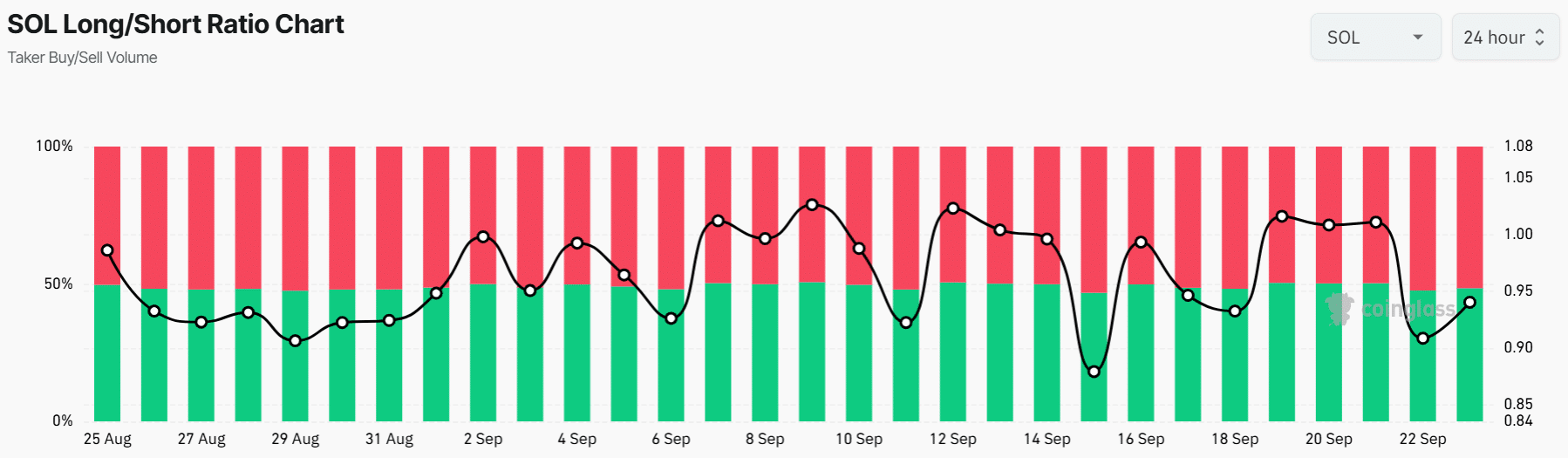

As Solana’s network metrics show mixed signals, the long/short ratio shows there are slightly more short positions than long positions.

This suggests that traders are not strongly convinced of Solana’s ability to extend gains to $200 in the short term.

Post navigation

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!