LenFi V2 Introduces Hybrid Lending on Cardano

This Thursday, LenFi, the first lending and borrowing platform on Cardano will be releasing the V2 version of its protocol.

This Thursday, LenFi, the first lending and borrowing platform on Cardano will be releasing the V2 version of its protocol. With two comprehensive audits completed and a bug bounty initiative underway, LenFi is emphasizing the security and robustness of its protocol. The introduction of V2 heralds a shift to a hybrid lending model, expanding the platform’s capabilities and offerings to include pooled lending.

Journey to Launch

LenFi, a decentralized open-source lending and borrowing protocol on the Cardano blockchain, is set to launch LenFi V2, a development eagerly awaited by the community. The Cardano community has been anxiously waiting as the protocol underwent multiple audits to ensure maximum security. An initial audit was announced on August 12th and would be conducted by Anastasia Labs, laying the groundwork for a secure platform. This dedication to security was further solidified with a second audit by TxPipe, announced on November 15th, cementing LenFi V2’s launch on a foundation of stringent security protocols. On February 8th, LenFi announced the completion of the final audit and the start of a bug bounty program. With the launch date of February 22nd shared later in the month, the community’s anticipation has reached its peak, eager to see the new chapter for LenFi unfold.

V2 Features

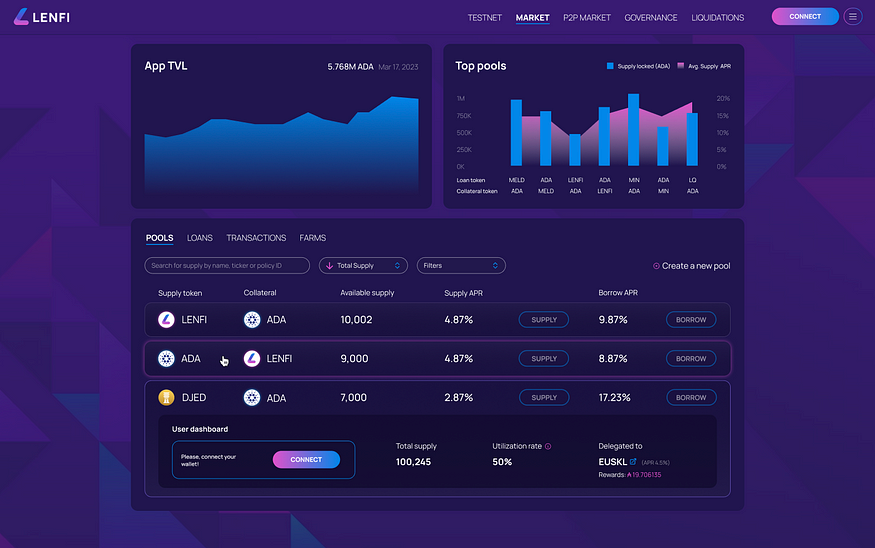

LenFi V2 offers users a hybrid lending model where both the pooled and peer-to-peer (P2P) lending are available on the platform.

Pooled Lending: LenFi V2 will introduce pooled lending alongside its peer-to-peer lending, enabling users to access liquidity pools for lending and borrowing. This feature enhances flexibility and choice, supporting a wide variety of Cardano native tokens (CNTs). With smart contracts written in Aiken, LenFi V2 is set to offer substantially higher throughput to protocol users.

A unique aspect of pooled lending in LenFi V2 is the introduction of Pool Manager NFTs. These NFTs provide pool managers with special privileges like delegating to a stake pool, registering, and deregistering stake pools. This functionality enables the liquidity pool to generate additional yields through staked ADA, enhancing the overall return for liquidity providers.

Peer-to-Peer Lending: Users who wish to utilize the orderbook style p2p Lending model will still have access to this feature with the launch of LenFi V2. An improved version of the p2p Orderbook lending will be released within the future.

Flash Loans: Flash loans on LenFi V2 permit users to borrow any amount from the liquidity pool with the loan plus a fee being returned in the same transaction. This functionality is useful for facilitating seamless execution of DeFi strategies like arbitrage.

Types of Lending

Liquidity Pool Lending: Liquidity pool lending aggregates funds from multiple investors to provide loans, with interest rates determined by supply and demand dynamics. This model’s strength lies in its risk diversification, offering stable returns to investors by spreading out exposure across numerous loans. However, the trade-off is that lenders have limited control over loan specifics, such as borrower selection and individual loan terms, which might lead to lower returns compared to more actively managed investments.

Peer-to-Peer Lending: Peer-to-peer (P2P) lending facilitates direct financial transactions between individual lenders and borrowers, bypassing traditional financial intermediaries. This approach allows for potentially higher returns for lenders due to the personalized negotiation of loan terms and interest rates. For borrowers, it offers the flexibility to find terms that match their specific needs. The downside is the increased risk for lenders, as they bear the full brunt of borrower default risk, necessitating thorough due diligence to mitigate potential losses.

Hybrid Model:

A hybrid lending model leveraging both Peer-to-Peer (P2P) and Liquidity Pool mechanisms offers a balanced approach, combining the security and ease of liquidity pools with the higher potential returns and flexibility of P2P lending. This dual strategy not only broadens the platform’s appeal by catering to diverse investor and borrower preferences. The integration of both models in one platform provides users with a variety of financial products, making it a more attractive and versatile financial ecosystem.

Chat with Mantas

In an exclusive chat with Mantas, co-founder of LenFi, we discussed the upcoming V2 launch.

Q: I understand that LenFi staking won’t be live at launch, but wanted to confirm if other features such as flash loans will be live?

Mantas: “The flashloans are a controversial topic. In essence, you can borrow from the pool as much as you want, if you pay the fee and pay back the pool. In the same transaction. However, it’s different from Aave flashloans where you have to repay on the same block.”

Q: What is the team’s plan after V2? Taking some well-deserved time off or are you onto the next things?

Mantas: “Safety module. Here is where the token will come into the game.”

Q: Did you have anything else you wanted to share in the article with the community regarding V2 and what the team has built so far?

Mantas: “It’s hard and easy. It’s politics and community. Interesting experience. We learned a lot in all.”

Conclusion

The launch of LenFi V2 is a momentous occasion for the Cardano DeFi ecosystem, offering enhanced security, performance, and flexibility in lending and borrowing. With its innovative hybrid lending model and introduction of Pool Manager NFTs, LenFi V2 is poised to broaden the horizons of DeFi on Cardano. It will be interesting to see how LenFi V2 and the broader decentralized finance landscape on Cardano develops in the coming months and years.

You can find out more about LenFi at the following link: https://lenfi.gitbook.io/docs/

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!