Is This The Reason Why Whales Are Bullish On Cardano? Is A Push To $2 In The Works?

The crypto business over the weekend has sailed through turbulence, which has pushed the numbers of the business. To a notable degree, prior to making its way to a new week. As a result, the market cap of the...

The crypto business over the weekend has sailed through turbulence, which has pushed the numbers of the business. To a notable degree, prior to making its way to a new week. As a result, the market cap of the business has taken a dip to $1.87 Trillion. Which, however, has risen a marginal 0.4% over the previous day.

In succession, the industry’s seventh-largest cryptocurrency Cardano has sailed through the market’s storm appreciably. Although the digital asset did bog down to its expected support levels, however, it has debunked a slip of 30%. Partisans of the tech, now continue to advocate Cardano, whilst hinting at its on-chain metrics.

Are The On-chain Metrics Bullish Enough?

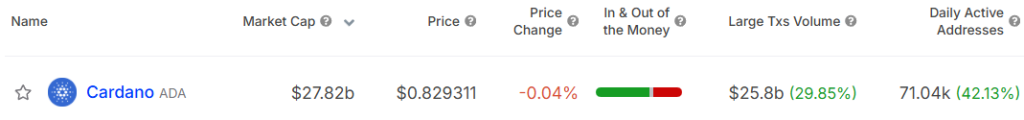

Cardano’s ADA despite its run from the support levels is still below the $1, which has been a bummer for hodlers. As a number of them are yet to retrieve their gains. Successively learning from sources, 8% of holders are in the money, while 89% are out of the money. In addition, the concentration of large holders who own more than 1% of the circulating supply is presently at 16%.

Consequently, whilst 8% of the holders have been holding for over a year. 74% of them have been holding for a duration of 1-12 months, and about 18% have been holding for less than a month. The net network growth is presently bullish at 1.84%, while the concentration of the holder’s position is neutral at -0.05%. And larger transactions accounting for over $100k have been bearish at -0.84%.

Successively, the network size, with over 4 M wallets, makes it one of the most held cryptos in the business. As more nodes join the network, the value of the network soars higher. Owing to a larger network effect and the capability of enacting transactions in a larger ecosystem. In addition, the blocks on the network have been utilized to a greater extent. Which hints at the growing activities coming in from Plutus smart contracts and others.

Conversely, the smart price with a notable spike of 0.33% has been bullish, alongside the Bid-Ask volume imbalance at +1.51%. Coming to derivatives, the momentum of the futures market is also bullish.

Cardano Defeats Bitcoin And Ethereum Yet Again?

Cardano has reclaimed its first position with transaction volume for 24-hours. And the adjusted volumes for 24-hours at $31.13 B, and $29.80 B respectively. Which is greater than that of Bitcoin and Ethereum put together. In the interim, fees for around-the-clock is at $48,021.25.

Successively, partisans of Cardano blockchain are optimistic around the network owing to the on-chain metrics, robust fundamentals, and visionary developments. In contrast, ADA price over the weekend did breach to levels around $0.92, as previously cited by CoinPedia. The digital asset is being praised for a rebound for lows and debunking a further plunge.

In concluding, The number of roll-outs re-instates faith amongst the community, which includes. The incoming DEX’s, an incoming update that doesn’t require a hard fork would reinforce the user experience. Moreover, the expected CIPs, Hydra beta mid-year would be an added benefit. Hopefully, the price compounds along with the stout developments in due course of time. If materialized the digital asset could possibly enter the top-3 list.

The post appeared first on Coinpedia

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!