Orcfax’s Decentralized CNT feeds and our upcoming On-demand feeds

2023 was a busy year for the Orcfax project; the beginning of the year saw the successful transition from a Catalyst funded R&D project to a community-funded Cardano infrastructure player, and after extensive research, a successful prototype, Orcfax released its ADA-USD / USD-ADA mainnet price feed to the Cardano community and has continued to subsidize publications as a thank you for all of the support we received.

2023 was a busy year for the Orcfax project; the beginning of the year saw the successful transition from a Catalyst funded R&D project to a community-funded Cardano infrastructure player, and after extensive research, a successful prototype, Orcfax released its ADA-USD / USD-ADA mainnet price feed to the Cardano community and has continued to subsidize publications as a thank you for all of the support we received.

With 2023 in the rearview, we haven’t let go of that momentum. 2024 is bringing exciting upgrades and optimizations to Orcfax infrastructural components that we can’t wait to share with our community, and a suite of new oracle feeds are coming to mainnet; the first of these feeds that we are announcing will be the much anticipated Orcfax Cardano Native Token (CNT) feeds! Integrators will soon be able to request price values for any Cardano Native Token needed by their smart contracts to execute business logic.

But if you’re new here and need some context, Orcfax is a Cardano native oracle designed to publish trustworthy data on-chain for use by dApp smart contracts. The subject of this data can be nearly limitless in possibilities, and can include changes in currency price pairs, supply-chain activity, insurance, as well as data on-chain (e.g. the prices of Cardano native tokens or CNTs) — the latter being the focus of this article.

Triangulated data collection

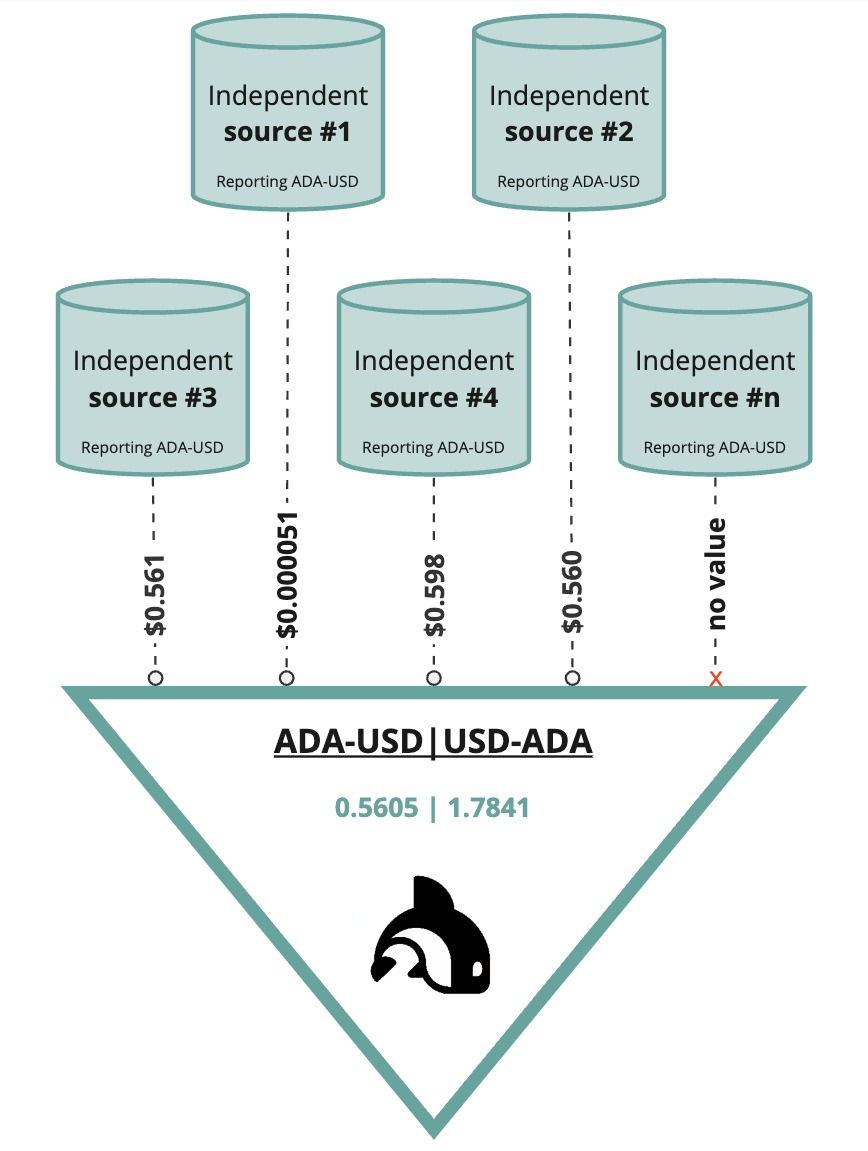

Since the roll out of our ADA-USD / USD-ADA feed, we have made it our mission to educate users on the critical importance of rejecting data derived from single sources and the necessity for source redundancy. Orcfax addresses both of these and avoids single points of failure or attack by leveraging the scientific principle of triangulation; all Orcfax nodes are required to query, and receive data from a minimum of 3 primary sources. This principle of triangulation protects the reliability and authenticity of oracle data. Orcfax nodes are being designed to function even in scenarios where sources fail to return data, are compromised, or report anomalous data. The principle of triangulation, in each of these scenarios, means that nodes remain flexible and resilient given that they meet the threshold for minimum data sources (e.g. nodes query 5 sources, and receive inputs from 4 which meets and exceeds the 3 source min), which enables the network to maintain data integrity and reliability while being unaffected by outliers. So, next time you see your favorite project use a data feed, you might want to ask them if the data is being triangulated!

Orcfax triangulation principle visualized

Feeds for Cardano Native Tokens

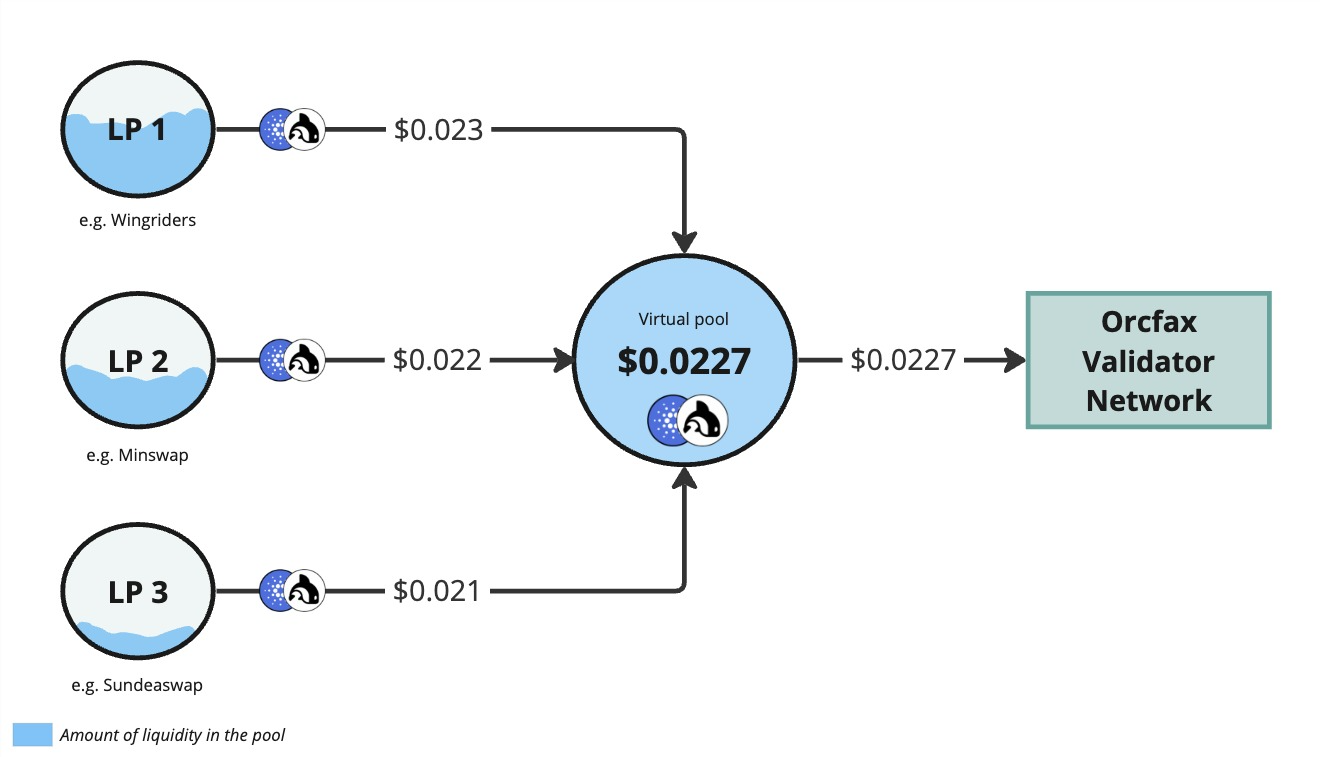

The same data collection principles and standards used in Orcfax price feeds will also be leveraged in our new CNT feeds. Orcfax has chosen to leverage DEX Liquidity pools because they provide a unique and efficient price discovery mechanism. Within the pool, a token pair derives comparative value according to a simple mathematical formula that calculates price, in real time, as users affect the token-to-token ratio by adding or removing from either side. Because of this innate price discovery mechanism in liquidity pools, Orcfax now has the ability to provide a simple and elegant solution for decentralized Cardano Native Token feeds.

Orcfax virtual liquidity pool visualized

Regardless of the target tokens requested by integrators, Orcfax will leverage its network of validator nodes to execute the collection process. Each node will be responsible for querying the cardano ledger, in order to collect the total liquidity per token pair on each DEX. These liquidity values are then summed up in order to derive one virtual liquidity pool for that token pair. This will then reflect the aggregated price of that token pair, as observed by the node. This approach removes the risk of low liquidity DEXes skewing the price to allow manipulation. Each Orcfax node will perform the same process and share their prices with the rest of the validator network in order to normalize, validate and finally publish on the Cardano blockchain. This data can then be used as trustworthy reference inputs to trigger different kinds of business logic in Cardano smart contracts and dApps.

Publication models

How this data is brought on-chain depends entirely on the use case and the needs of integrating dApps; there are many different oracle use cases, and each needs something different from Orcfax. While there can be overlap in the data needs of smart contracts, many of these use cases have their own distinct requirements regarding when data is needed. Because of the varied needs of our integrators, Orcfax is developing publication options that allow integrators to choose services that best meet their needs. Orcfax feeds will now support two distinct publication models: our existing heartbeat model, and a new on-demand model.

By providing the ability for consumers to choose the publication model, Orcfax will enable dApps to increase flexibility and cost efficiency by choosing how best to receive their data: hourly, daily or when there’s a real-time requirement for the data (e.g. liquidations).

The heartbeat publication model

Our ADA/USD feed went live on mainnet by leveraging the first of these publication options– an Orcfax hourly heartbeat publication model with deviation monitoring. The heartbeat publication model gives integrators the ability to access data at regular intervals which can be set according to their needs (e.g. every 5 minutes, once per hour, etc.). This model can be further enhanced when paired with a monitoring feature which adds a deviation formula; heartbeat publication models with deviation add improved precision by guarantying data at both a consistent interval and when user-stipulated thresholds have been met (e.g. publish immediately before the next heartbeat if price changes by x%).

Heartbeat publication visualized

In the heartbeat publication model, nodes request and cache primary source data every minute. Publications are made at a fixed rate (in this case on the hour) and additional publications can be triggered by utilizing the monitoring function in the event of deviations. This publication model is often referred to as a Push based oracle, as the oracle service is parameterized to publish (push) data, and does so continuously at predefined intervals so long as the feed remains funded.

The benefit of the heartbeat (or push) publication model is that integrators receive data continuously. However, if the dApp provides services which only need data inputs for specific actions, at unpredictable times, or to verify components of a transaction, then this model can be nonoptimal or costly given the rate at which data is received versus instances of data use.

The on-demand publication model

The Orcfax CNT feeds will debut alongside the reveal of a new Orcfax publication model– our highly anticipated on-demand model. The on-demand publication model allows complete flexibility and gives dApps even more control of data use by allowing them to request data collection, validation and publication whenever it’s needed by their smart contracts. If an Orcfax feed consumer needs a more current update for a given datum feed (e.g. ADA/FACT) than is available on-chain or through an existing heartbeat publication, then a dApp can request an updated datum by posting an utxo with a specific datum in an orders smart contract. This request is observed by the validator scripts, and a validator node will be selected to submit the requested datum to the feeds smart contract. The dApp can then use a script to inspect the requested datum and build a dApp transaction. All these actions can happen within the same block.

On-demand publication visualized

This publication model is often referred to as a Pull based oracle, as the oracle service is directly triggered by requests made through a smart contract.

The benefit of the on-demand (or pull) publication model is that integrators experience greater control over when data is made available. This service dramatically increases feed utility for dApps with use cases that can’t justify a consistent heartbeat. Instead, the on demand publication model allows their smart contracts, and/or users to trigger Orcfax publication workflows for the data they need, when they need it.

Benefits

When dApps spend resources to develop ad hoc oracle solutions, they introduce needless risk into their protocols. The next DeFi boom will be underpinned by the ubiquitous use of decentralized and auditable oracle feeds. DApps can reduce their risk, improve community optics, and maximize efficiency by utilizing decentralized (and independently validated) data in their smart contracts; the following table illustrates the Orcfax vision for decentralized oracle feeds on Cardano and lays out key differences between the Orcfax solution and those provided by other projects in an effort to assist the Cardano community in being more informed and critical regarding the urgent needs for these services.

link to the Orcfax Oracle Vision doc

Protocol services that are not being purpose built as an oracle solution, with the explicit intention of addressing the “oracle problem,” should refrain from developing risky ad hoc solutions to their data needs, and instead leverage decentralized oracle feeds. Orcfax can help dApps focus on their core services by doing the data gathering, aggregation, and validation work for them, which would otherwise unnecessarily slow down their smart contracts, significantly increase execution costs, and inject new risk vectors.

And if it wasn’t enough for Orcfax to participate in enabling the next chapter in DeFi by bringing decentralized data on-chain, our team has committed itself to ensuring that those services are affordable! We have taken the inline datum back to the drawing board, and what came back is the most cost-efficient oracle solution on Cardano. The data still benefits from the same design decisions highlighted in our ADA-USD / USD-ADA feed, but now the datum has been streamlined to focus strictly on the datapoints required by dApps and their smart contracts. By reducing the content within the datum, Orcfax has dramatically improved readability and access.

But we didn’t abandon our position regarding the necessity for contextual metadata for the information being published on chain; the rest of the structured metadata that was removed from the in-line datum, which provides that critical archival context, intelligibility, and tools to aid in auditability, now resides in the transaction metadata. This decision to restructure the Orcfax oracle datum simultaneously improves the integration experience for dApps, increases precision, and offers improved indexability.

A number of integrators have already begun conversations with our business team about integrating our upcoming CNT feeds, and our CEO Peter recently participated in an interview explaining their value.

In order to aid in the onboarding process, preprod access to the optimized datum format will be made available in the coming weeks. This will be followed by the preprod CNT feeds with its optimized schema version.

If your project isn’t one which has already reached out to our business team, it’s time to jump in and position services for the next chapter in Cardano DeFi; dApps that leverage decentralized and independently verified oracle feeds benefit from reduced risk, increased community support, improve efficiency, and are better able to focus on core services by eliminating dependance on ad hoc oracle-like solutions.

More about Orcfax

Website: https://orcfax.io/

SNEKbot by DexHunter on CARDANO

Cardano's Telegram Trading Bot live on Cardano mainnet!TRADE NOW!