How to Stake Cardano – A Complete Guide - BitcoinEthereumNews.com

While crypto mining and staking are both competitive methods of creating new coins and increasing the circulation of the total cryptocurrencies, they achieve this differently. For example, crypto mining is a...

While crypto mining and staking are both competitive methods of creating new coins and increasing the circulation of the total cryptocurrencies, they achieve this differently. For example, crypto mining is a complex process that involves expensive, decentralized computer networks to verify and secure blockchain.

On the other hand, crypto staking is a straightforward way of earning rewards from holding your crypto for a certain period to support the blockchain operation.

If you compare the two methods, earning from your cryptocurrency is much easier with staking. Unlike mining, staking doesn’t need expensive equipment in all cases, such as a powerful CPU, a good internet connection, or constant maintenance.

For Cardano investors, crypto staking is one of the best ways to grow their portfolio. That’s because when you stake ADA, you will get additional crypto just from holding it locked and working within the network. Additionally, you will always have custody of your coin, meaning the staking pools have no control over your asset.

What is Cardano (ADA)?

ADA is the digital currency that powers Cardano, a 3rd generation blockchain platform. It is named after Augusta Ada King, the first computer programmer who lived between 1815 and 1852. As Cardano’s currency, ADA is used in the platform’s proof of stake (PoS) consensus mechanism to reward its users for participating in the staking pool.

Although ADA and ETH are similar in multiple ways, including employing a similar blockchain securing mechanism (PoS), ADA is relatively cheaper than ETH. That’s essential as the Cardano ecosystem is planned to offer advanced dapp capabilities that need low operation costs to be profitable.

Moreover, while ETH is more market-established, ADA has substantial backing. It has a strong team and money for development, and its system is open for review.

In addition, the Cardano blockchain is thought to have more potential for scaling than Ethereum or Bitcoin. Its transactions happen quickly, lowering energy usage and the general cost of operation.

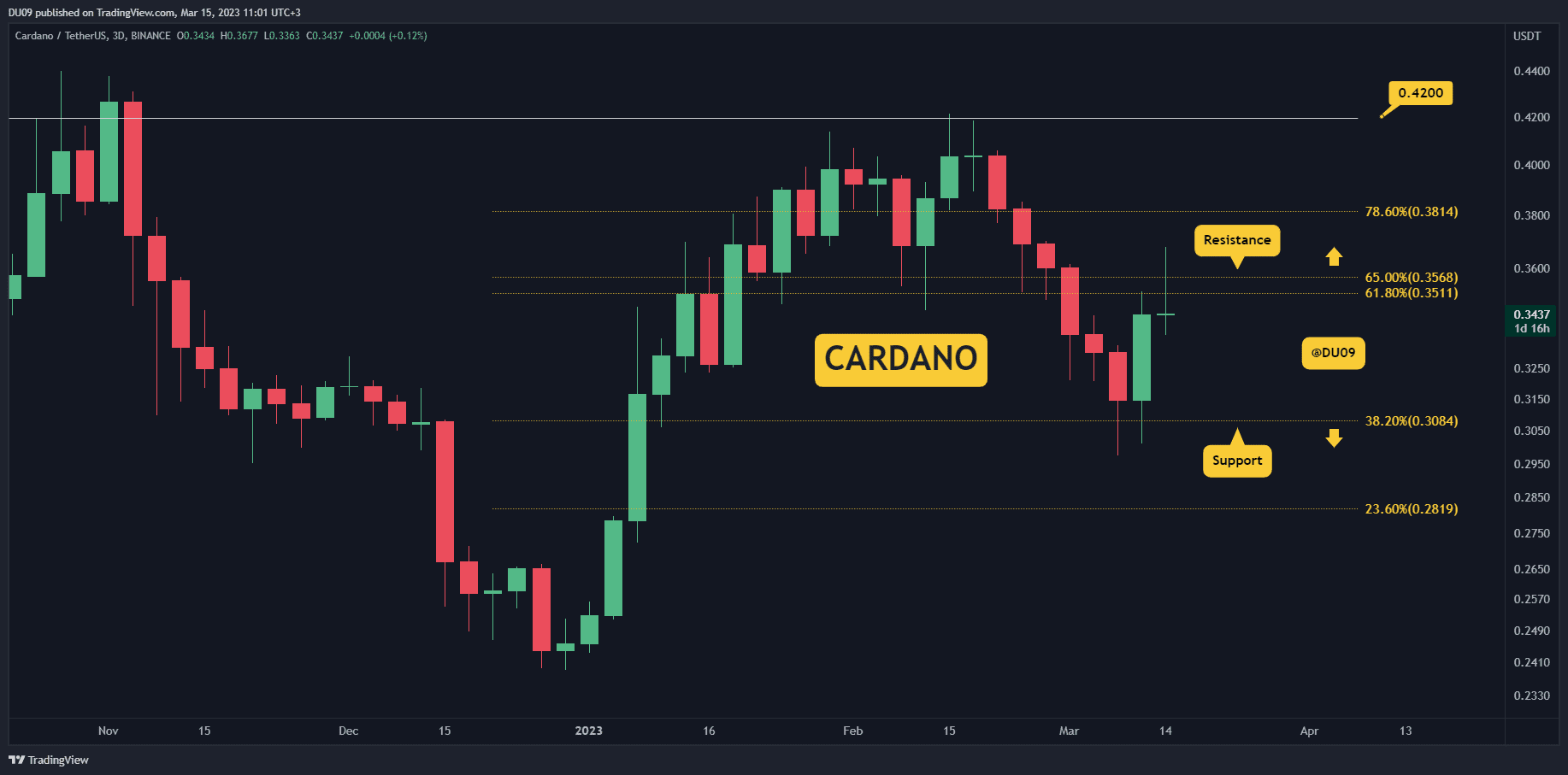

But just like with other cryptocurrencies, ADA prices have significantly fluctuated since it was launched in the crypto market in 2017. And while various platforms predict a better future for Cardano, its price dropped as hard as the rest of the crypto assets during the bear market.

Yet, given that Cardano is an unfinished product, ADA can still improve and become a more promising investment. However, like other cryptocurrencies, the coin is volatile hence calling for carefully planned investment.

How to Stake Cardano on your own

You can attempt to start staking ADA on your own without much of a problem or investment. The entry bar is quite low. Theoretically, there is no minimum stake amount needed to start a pool.

However, you will need to deposit 500 ADA to the blockchain when registering the pool and an additional amount for fees.

On the technical side, to build a node, run it, and connect it to the Cardano main net, you need to build a station with:

- Linux operating system;

- At least 2 cores 2GHz processor;

- At least 8 GB RAM;

- At least 24 GB hard drive space;

- A good internet connection, about 1 GB of bandwidth per hour, plus a public IP4 address.

However, keep in mind that although it’s quite easy to get started, it’s quite tough to be successful on your own. One of the essential factors the Cardano staking mechanism chooses slot leaders (validators) is correlated to the number of coins a node holds.

This means that although you may start on your own, to be profitable, you will ultimately need to attract delegators to your pool to raise the total pool stake.

And for reference, the average stake pool’s annual returns have been estimated at around 3 – 5%.

ADA Staking with a pool

Crypto staking is popular among crypto investors, especially beginners. This is because it serves as a straightforward process that doesn’t require special knowledge or equipment to participate in, especially when you do that by joining a staking pool.

However, knowing how to stake Cardano is critical to successfully participating in the process.

1. Set up your Cryptocurrency Wallet

A cryptocurrency wallet is an application that functions as a regular wallet, allowing you to store your passkeys. In other words, it serves as the interface that enables you to access your crypto. Some of the platforms that support Cardano staking are:

- Binance

- Kraken

- Yoroi

- Daedalus

- Coinbase

- KuCoin

- Crypto.com

2. Deposit the ADA Token into your Wallet

Once you have created an exchange wallet, deposit your ADA tokens. You can purchase the tokens directly on the exchange or using your wallet.

Alternatively, you can transfer tokens you already have into the exchange wallet.

3. Select the Best Staking Pool for Cardano

Staking pools are groups of people that validate transactions on a platform. They are referred to as delegation from wallet hardware. ADA provides insights into each staking pool to help you better select the most appropriate one. Remember, your choice of staking pool will affect your reward.

When choosing a staking pool, it is vital to consider its performance, decentralization, community, and specs. For example, a staking pool with a single operator is safer than a gigantic enterprise. Similarly, choosing a staking pool with good marketing strategies and growth potential is best.

4. Navigate to Staking

Once you have selected your preferred staking pool, the next is to start staking Cardano. On your exchange wallet, select “Cardano”, enter the amount of ADA tokens you want to stake, and click ‘stake now.’

Most platforms will require you to choose your staking duration (like creating a fixed bank account), which shows how long your ADA tokens will be locked away. If you withdraw the token before the expiry of the selected period, your stake will be considered null, and therefore no rewards will be earned.

Benefits of Staking Cardano

Crypto staking is among the safest methods of earning from your cryptocurrency. Also, you cannot lose your token from staking, only some of the value of the staked asset due to market fluctuation and decreases in value.

Besides what we already mentioned, here are some benefits of staking Cardano.

Generates passive income

While the amount of passive income generated from staking ADA differs depending on the staking pool, it can generate an annual profit of 3% to 5%.

The ability to deposit or withdraw your token anytime makes it even better unless you use a fixed account like Binance. If you are a holder of Cardano of whichever amount, staking it is the best alternative to earning from it than letting it lie idle in your wallet.

No risk of loss

While Cardano is volatile like any other crypto, you will not risk losing it by staking. First, it doesn’t leave your wallet, meaning no staking pool controls it. The only risk comes when its value goes down.

Easy deposit and withdrawal

Unlike most crypto wallets, the ADA wallet allows users to deposit and withdraw tokens when needed.

The fact that you choose your staking period makes it better since you only select a period that you can stand locking your token. It is also worth noting that you risk losing earning rewards if you withdraw your locked token before its expiry time.

Cons of staking Cardano

Loss of funds in case lost passkey

Every investment has its downsides, and so does staking Cardano. Usually, Cardano staking involves no risk, but the absolute risk comes when you lose your wallet’s passkey.

Like all other crypto wallets, there is no way you can recover a digital wallet’s lost password, meaning you risk losing all your tokens if you lose your wallet’s private keys.

High staking fees

Another con of Cardano staking is the increased staking fee, especially when using a staking pool. If you are not keen, a staking pool can take a significant amount from your profit as a staking fee.

And as stated earlier, Cardano is volatile, and its prices are unpredictable. And while the tokens are safe in your wallet, an unforeseen drop in value can lead to an unimaginable decrease in staking reward. For this reason, buying ADA for staking purposes only can be risky. Its constant price fluctuation is enough warning that it’s not a stable investment.

Can be difficult to start a staking pool

Although staking ADA on your own has a low entry bar, it’s quite difficult to scale up your operation.

From this side, a Cardano staking operation isn’t a casual way of earning passive income. Instead, it is a full-on business to which you must dedicate time, effort, and planning.

How Does Cardano Staking Differ from Ethereum?

Minimum staking requirements

Although Cardano and Ethereum use similar mechanisms (PoS), they work differently.

Ethereum requirement for running a validator node is 32 ETH. As for Cardano, although there is no minimal stake to start a node, you will need to lock 500 ADA plus fees to start a staking pool.

But if you plan to delegate to a staking pool, there is no minimum for either of them.

Rewards earned and the lock-up period

In Ethereum’s case, you may lock up Eth on popular crypto exchanges such as Coinbase and Binance. And if you are an ADA user, you can stake your tokens in staking pools on approved wallets like Yoroi and Daedalus.

However, you can unstake your ADA at any time while, in Ethereum’s case, the staked Eth and the rewards are still awaiting the update to unlock them.

As for annual rewards, the APY varies from one staking calculator to another and from one pool to another in both ETH and ADA’s case. However, the percentages vary between 3-5%.

Various digital wallets support Cardano staking, as stated earlier. Here are the best places to stake ADA, explained.

Daedalus: the safest place to stake ADA

Here are the steps to stake ADA on Daedalus:

- Download and install a Daedalus wallet

- Open the wallet’s delegation center

- Browse through the stake pools and choose what to join

- Delegate your ADA

Daedalus is the original PC crypto wallet for Cardano; it allows users to access the entire model of the Cardano blockchain.

Yoroi: the best browser extension for staking ADA

Here are the steps to stake ADA on Yoroi

- Open your Yoroi mobile wallet and select the DELEGATE menu option

- Browse for a pool of your choice

- See the wallet amount to delegate

- Success!

Unlike Daedalus, Yoroi is a browser extension, meaning it is lightweight. Its advantage is that it can filter the staking pools based on cost, size, and ROI, thus helping users select the most suitable option.

Exodus wallet: the most versatile

Here are the steps for staking ADA on the Exodus wallet using a desktop device:

- Open up the Exodus wallet and proceed to the Rewards tab

- Select Cardano (ADA) and click Get Reward

- Click Stake ADA

On a mobile device:

- Proceed to the Settings icon and open the Cardano wallet on the Exodus wallet

- Select Earn Rewards

- Proceed to Stake ADA

Exodus is the most versatile wallet that allows users to stake over 100 different coins. It makes the best place to stake Cardano since it enables you to control your wallet, making it safer.

Recap of Cardano’s potential and benefits

Staking Cardano is generally and technically safe, given that its digital currency never leaves your wallet. It also features minimal staking requirements compared to its closest competitor, Ethereum.

And as you earn from staking your Cardano, you are also helping make blockchain operations faster and more stable.

* The information in this article and the links provided are for general information purposes only and should not constitute any financial or investment advice. We advise you to do your own research or consult a professional before making financial decisions. Please acknowledge that we are not responsible for any loss caused by any information present on this website.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!