How to Invest in Bitcoin 2023

In case you’re trying to acquire publicity to Bitcoin – you possibly can make investments on this top-rated cryptocurrency in lower than 10 minutes through a trusted on-line dealer. On this information, we...

In case you’re trying to acquire publicity to Bitcoin – you possibly can make investments on this top-rated cryptocurrency in lower than 10 minutes through a trusted on-line dealer. On this information, we evaluation tips on how to spend money on Bitcoin with a low-cost and controlled brokerage website.

We additionally talk about whether or not Bitcoin represents a viable funding and what dangers that you must take into account earlier than continuing.

The way to Put money into Bitcoin 2023 – Fast Information

You may spend money on Bitcoin proper now through the SEC-regulated dealer eToro – which lets you get began with a minimal buy of simply $10.

Comply with the steps beneath to purchase Bitcoin with eToro:

- ✅Step 1: Open an Account: First register a free account on eToro.com. This requires you to enter some private data and get in touch with particulars, and add a replica of your ID.

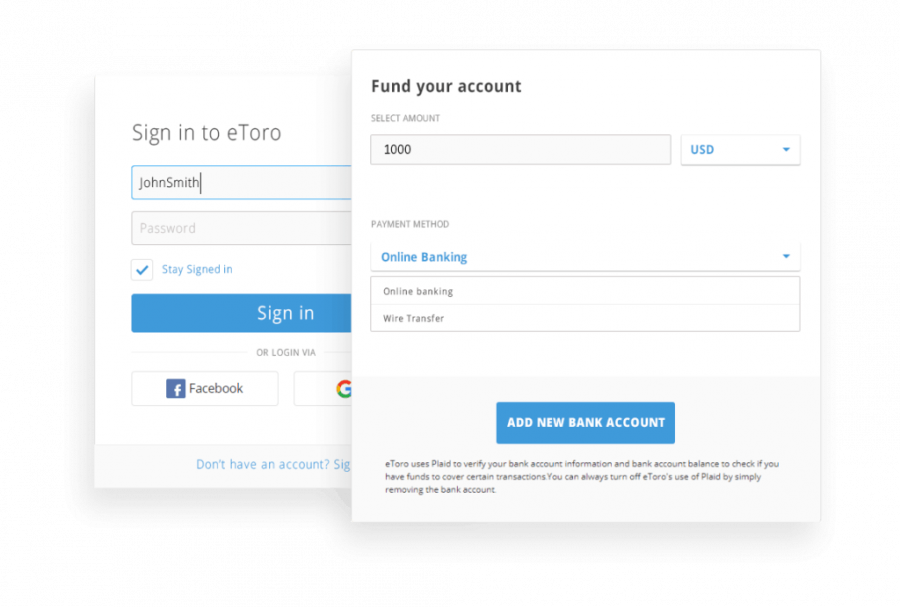

- 💳Step 2: Deposit Funds: US purchasers can deposit funds into their eToro account fee-free and from a minimal of simply $10. Select from a web-based financial institution switch, Paypal, debit/bank card, or ACH.

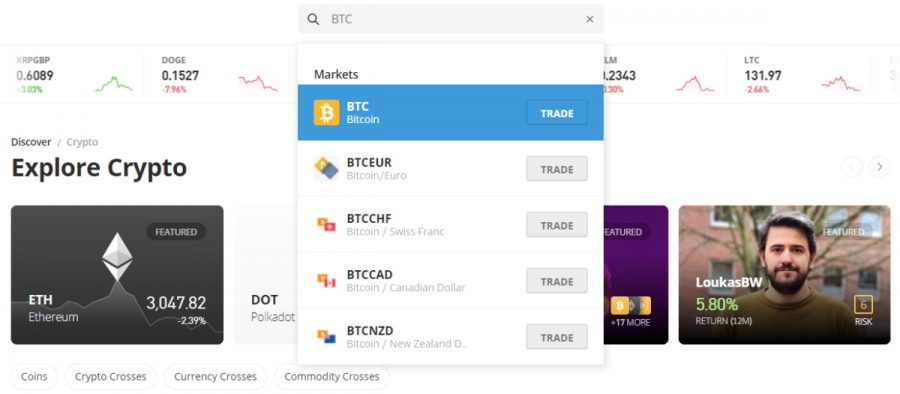

- 🔎Step 3: Seek for Bitcoin: Along with cryptocurrencies, eToro hosts 1000’s of different monetary devices. As such, the best approach to spend money on Bitcoin is to enter ‘BTC’ into the search bar and click on on ‘Commerce’.

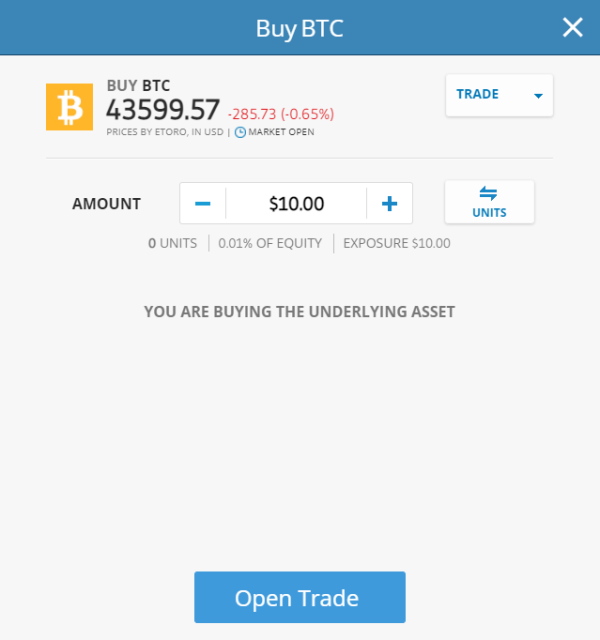

- 🛒Step 4: Put money into Bitcoin: You’ll now see an order field seem – merely enter the sum of money you wish to spend money on Bitcoin and click on on ‘Open Commerce’ to verify.

By following the quickfire information above, you may have simply discovered tips on how to purchase Bitcoin with an SEC-regulated dealer in lower than 10 minutes.

Carry on studying do you have to require a extra in-depth walkthrough of the funding course of.

The place to Put money into Bitcoin

It is very important assess the perfect place to spend money on Bitcoin in your private necessities.

As an illustration, some platforms are geared in the direction of novices occupied with studying tips on how to get into crypto, whereas others are extra suited to large-scale traders that search high-level buying and selling instruments.

With this in thoughts, when excited about the place to spend money on Bitcoin – take into account the number of pre-vetted brokers reviewed beneath.

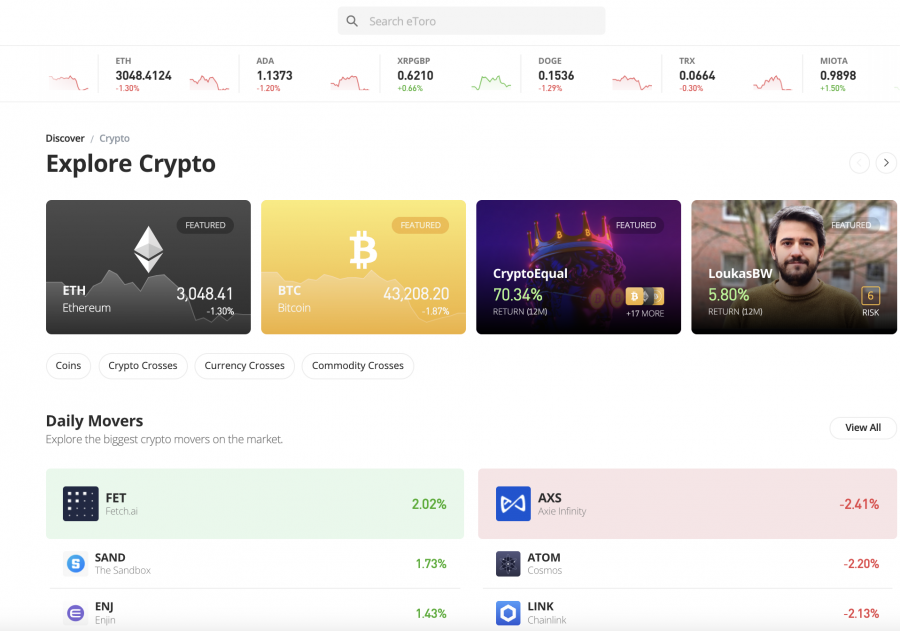

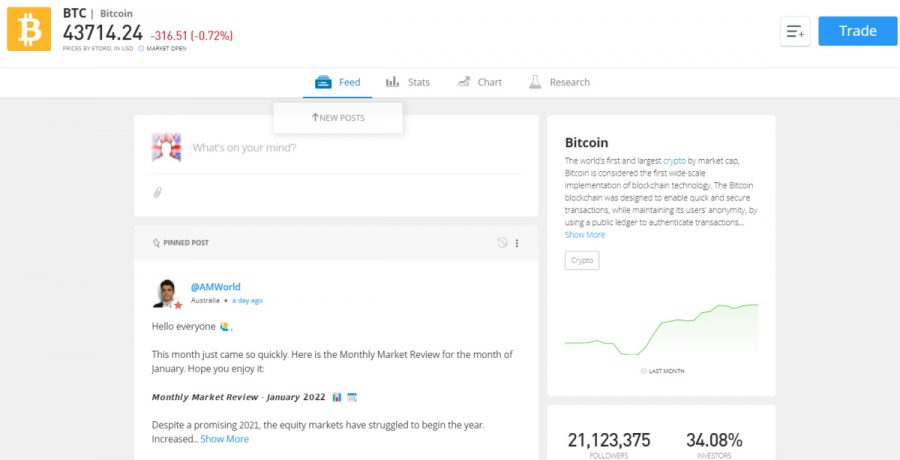

1. eToro – General Finest Place to Put money into Bitcoin 2023

We used eToro as our instance dealer within the quickfire information above, not least as a result of that is the general finest place to spend money on Bitcoin and purchase cryptocurrency. Put merely, you possibly can open a verified account in minutes at eToro and also you solely have to danger $10 to spend money on Bitcoin in a secure and safe method.

Fee sorts accepted at eToro embody debit/bank cards issued by Visa and MasterCard, e-wallets like Paypal and Neteller, and conventional financial institution transfers. So whether or not you need to purchase Bitcoin with PayPal, financial institution switch, or every other methodology, the selection is yours.

Furthermore, in case you’re from the US, you gained’t pay any deposit or withdrawal charges – no matter which cost methodology you go for. As soon as your account is funded in US {dollars}, eToro then means that you can purchase Bitcoin on a spread-only foundation (from 0.75%).

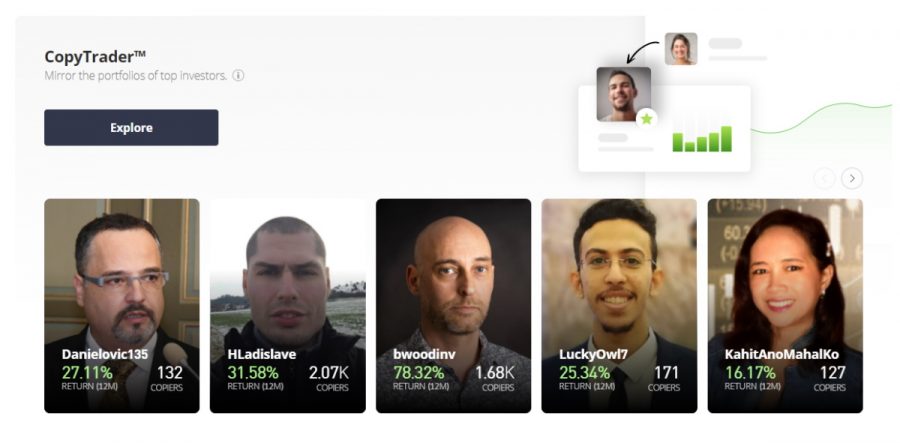

Which means as an alternative of paying a variable fee, you merely have to cowl the hole between the purchase and promote value. eToro can also be helpful if you’re trying to spend money on different cryptocurrencies – with the dealer supporting 70+ digital tokens. Therefore, you should buy Solana, Dogecoin, Ethereum, Polkadot, The Graph, and extra with the press of a button. You may also spend money on shares, ETFs, commodities, indices, and foreign exchange. In case you’re strapped for time or have little to no expertise within the funding area – you may also take into account the eToro Copy Buying and selling software.

This lets you choose an skilled dealer that you simply just like the look of after which copy their ongoing investments. This comes at no extra charge and requires a minimal outlay of simply $200. You may also spend money on a pre-made basket of cryptocurrencies through the CryptoPortfolio software – which is professionally managed and rebalanced by the eToro staff.

In terms of security, eToro is regulated on a number of fronts. That is inclusive of the SEC (with FINRA membership), FCA, ASIC, and CySEC. The platform is house to over 23 million purchasers from all over the world – and it’s planning to go public later this 12 months. Lastly, if you wish to spend money on Bitcoin through your smartphone, you possibly can obtain the eToro app and use the eToro crypto bank card to conveniently spend your crypto holdings as and whenever you need.

Cryptoassets are a extremely risky unregulated funding product. No UK or EU investor safety.

2. Webull – Put money into Cryptocurrency With Simply $1

The method of investing in Bitcoin doesn’t require a big capital outlay whenever you use a web-based dealer like Webull. Not solely does the user-friendly platform help you open an account with out assembly a minimal deposit – however you possibly can spend money on Bitcoin from simply $1 upwards.

The method of investing in Bitcoin doesn’t require a big capital outlay whenever you use a web-based dealer like Webull. Not solely does the user-friendly platform help you open an account with out assembly a minimal deposit – however you possibly can spend money on Bitcoin from simply $1 upwards.

And as such, it will swimsuit first-timers that want to check the Bitcoin markets out earlier than risking larger sums. At Webull, this $1 minimal extends to all the different cryptocurrencies supported on the platform – which incorporates all the pieces from Shiba Inu, Dogecoin, and Litecoin to Ethereum, Chainlink, and Fundamental Consideration Token. Furthermore, Webull helps different asset courses on its platform – comparable to US-listed shares, ETFs, and choices.

Though Webull is usually utilized by informal merchants, the platform does provide a number of superior instruments and options that can enchantment to seasoned traders. This contains at least 12 charting instruments and 50+ technical indicators. When it comes to charges, you possibly can spend money on cryptocurrency – and every other supported monetary instrument, at 0% fee. No deposit charges apply on ACH transactions, however financial institution wires are charged at $8.

Cryptoassets are a extremely risky unregulated funding product. No UK or EU investor safety.

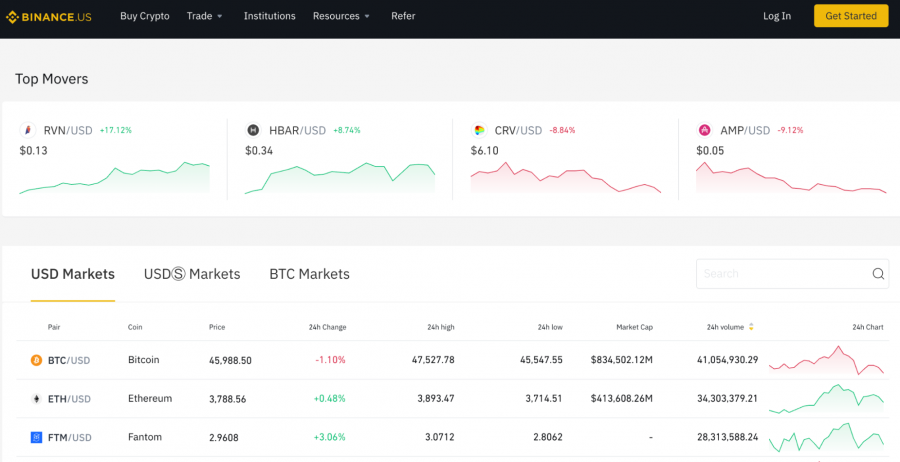

3. Binance – Put money into Bitcoin and 60+ Different Cryptocurrencies

The Binance US platform allows People to spend money on Bitcoin and 60+ different supported cryptocurrencies. As such, it is a good choice if you’re planning to create a diversified portfolio of digital currencies. A few of the hottest tokens obtainable along with Bitcoin embody Ethereum, Litecoin, Dogecoin, and Cardano.

The Binance US platform allows People to spend money on Bitcoin and 60+ different supported cryptocurrencies. As such, it is a good choice if you’re planning to create a diversified portfolio of digital currencies. A few of the hottest tokens obtainable along with Bitcoin embody Ethereum, Litecoin, Dogecoin, and Cardano.

Binance US additionally helps a wave of DeFi (Decentralized Finance) tokens – which incorporates the likes of Chainlink and VeChain. When it comes to paying in your Bitcoin funding, the charges will rely upon the cost methodology that you simply go for. As an illustration, in case you desire the comfort of utilizing a debit or bank card, it will set you again 4.5% in transaction charges – along with a 0.5% fee. Alternatively, ACH and home wire switch deposits are free – so it’s simply the 0.5% fee that you’ll pay.

In case you determine to make use of Binance to change digital tokens – as an example, Bitcoin to Ethereum or Cardano to Litecoin, then the fee stands at simply 0.1% per slide. Furthermore, in case you commerce giant volumes, this fee is lowered even additional. To open an account at Binance, you’ll need to add some ID. After that, you possibly can proceed to spend money on Bitcoin on the click on of a button. Lastly, Binance additionally affords instructional supplies and OTC companies.

In case you determine to make use of Binance to change digital tokens – as an example, Bitcoin to Ethereum or Cardano to Litecoin, then the fee stands at simply 0.1% per slide. Furthermore, in case you commerce giant volumes, this fee is lowered even additional. To open an account at Binance, you’ll need to add some ID. After that, you possibly can proceed to spend money on Bitcoin on the click on of a button. Lastly, Binance additionally affords instructional supplies and OTC companies.

Cryptoassets are a extremely risky unregulated funding product. No UK or EU investor safety.

4. Coinbase – Put money into Bitcoin through a Newbie-Pleasant Platform

The following dealer to contemplate when excited about the place to spend money on Bitcoin is Coinbase. This NASDAQ-listed cryptocurrency dealer is now utilized by tens of hundreds of thousands of purchasers – lots of that are primarily based within the US. The platform affords a secure and handy approach to spend money on Bitcoin and dozens of different cryptocurrencies – so it’s perfect for novices.

The following dealer to contemplate when excited about the place to spend money on Bitcoin is Coinbase. This NASDAQ-listed cryptocurrency dealer is now utilized by tens of hundreds of thousands of purchasers – lots of that are primarily based within the US. The platform affords a secure and handy approach to spend money on Bitcoin and dozens of different cryptocurrencies – so it’s perfect for novices.

Nevertheless, no matter how you plan on paying in your Bitcoin funding, Coinbase is much more costly than the opposite brokers mentioned so far. For instance, in case you deposit funds through ACH and proceed to spend money on Bitcoin as soon as the cash arrives – it will value you 1.5% in charges. Paying in your Bitcoin funding immediately with a debit/bank card will set you again 3.99%.

Taking this into consideration, fee-conscious traders may be higher off utilizing eToro. However, Coinbase additionally stands out for its dedication to safety. Amongst many different safeguards, 98% of shopper funds are stored offline in cold storage and all account customers should arrange two-factor authentication. Moreover, you possibly can place a 48-hour time lock on withdrawal requests, which ensures that you’ve got enough time to behave ought to your account grow to be compromised.

Cryptoassets are a extremely risky unregulated funding product. No UK or EU investor safety.

5. Kraken Professional – Put money into Bitcoin through an Superior Buying and selling Suite

In case you’re an lively dealer that’s trying to acquire publicity to Bitcoin through subtle instruments, Kraken Professional might be the most suitable choice in your skillset. This top-rated cryptocurrency change was launched means again in 2011 – which makes it one of the crucial established on this area. US purchasers can deposit funds solely with a home financial institution wire or crypto. ACH funds are solely accepted when making a withdrawal.

In case you’re an lively dealer that’s trying to acquire publicity to Bitcoin through subtle instruments, Kraken Professional might be the most suitable choice in your skillset. This top-rated cryptocurrency change was launched means again in 2011 – which makes it one of the crucial established on this area. US purchasers can deposit funds solely with a home financial institution wire or crypto. ACH funds are solely accepted when making a withdrawal.

As regards to the Kraken Professional platform itself, one can find a big suite of superior order sorts and charting instruments. The latter contains the power to attract pattern strains and overlays, in addition to entry technical indicators. When it comes to buying and selling charges, Kraken Professional costs market makers and takers 0.16% and 0.26% respectively. Lowers commissions are supplied when buying and selling volumes hit sure milestones, ranging from $50,000 inside a 30-day interval.

Cryptoassets are a extremely risky unregulated funding product. No UK or EU investor safety.

Ought to I Put money into Bitcoin?

After getting determined which on-line dealer is an effective match in your buying and selling objectives and talent set, it’s time to do some unbiased analysis.

By this, we imply diving deep into whether or not or not a Bitcoin funding is correct in your portfolio.

To assist clear the mist, beneath we talk about 5 key the reason why you may select to spend money on Bitcoin proper now.

Bitcoin is Nonetheless an Rising Asset Class

Many market commentators argue that Bitcoin in 2022 is the Apple or Microsoft of the Eighties. In different phrases, when you think about that Bitcoin was launched as not too long ago as 2009, the idea of cryptocurrencies and blockchain know-how continues to be in its infancy.

And as such, by investing in Bitcoin at the moment, you may have the chance to achieve publicity to an rising asset class that’s but to succeed in its full potential.

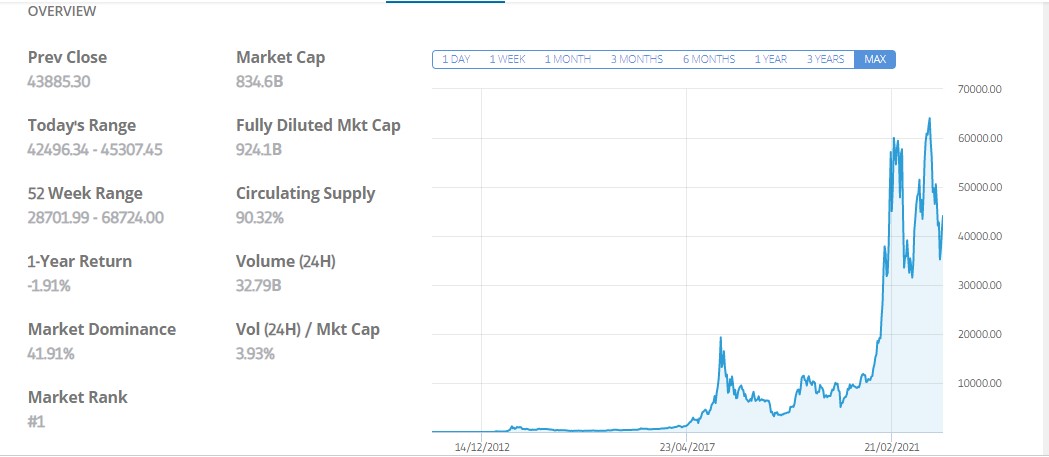

Bitcoin Progress Since 2009

Though Bitcoin was launched in January 2009, it wasn’t till February 2011 that the digital foreign money surpassed a worth of $1 per token. Furthermore, it took an additional two years for Bitcoin to hit $1,000.

Quick ahead to late 2021, and Bitcoin reached an all-time excessive worth of almost $69,000. When evaluating this to the worth of Bitcoin in 2011, this interprets into 10-year returns of over 6.8 million p.c.

In different phrases, in case you invested $1,000 into Bitcoin again in 2011 and bought when the digital foreign money hit $69,000 per token, you’d have cashed out greater than $68 million. This highlights simply how effectively Bitcoin has carried out in such a brief time period.

Bitcoin vs Inventory Markets

Probably the greatest methods to evaluate whether or not or not another asset class like Bitcoin is value shopping for is to check its efficiency towards the broader inventory markets. For this function, an ideal benchmark is the S&P 500 index.

- Over the previous 5 years, the S&P 500 has grown by roughly 94% – which illustrates engaging returns.

- Nevertheless, over the identical interval, Bitcoin has grown by over 3,500% – which dwarfs that of the S&P 500.

Crucially, you will need to observe that your funding portfolio ought to stay effectively diversified. As such, in case you select to spend money on Bitcoin, it’s additionally value allocating some funds to the normal inventory markets – and maybe, bonds too.

Digital Gold

BTC is among the finest cash to mine in 2023. Bitcoin is sometimes called the digital model of gold, not least as a result of the 2 asset courses carry quite a few comparable traits. As an illustration, there’s a finite amount of gold, which means that after the Earth’s total provide is mined, nothing extra can enter circulation.

- Equally, Bitcoin can also be finite, as solely 21 million tokens will ever be created. Moreover, similar to gold, the circulating provide will increase at regular intervals.

- Within the case of Bitcoin, this occurs each 10 minutes, albeit, each 4 years or so, the quantity minted per block is halved.

One other attribute that each Bitcoin and gold share is that each asset courses are seen as a hedge towards the broader monetary markets. Extra particularly, when the inflation ranges are rising and the inventory markets are down, Bitcoin and gold provide engaging hedging alternatives.

Curiosity

Some platforms, comparable to Aqru, now help you earn curiosity on Bitcoin. This implies you possibly can earn in your funding in a passive means, with Aqru providing a really excessive 7% rate of interest with flexibe account phrases.

Simple to Make investments and Extremely Liquid

First-time Bitcoin traders are sometimes involved that the method of shopping for the digital foreign money is advanced. Furthermore, there may be additionally a false impression that there are obstacles in relation to cashing out. Nevertheless, this couldn’t be farther from the reality.

In the beginning, anybody can spend money on Bitcoin from the consolation of house in a matter of minutes with a debit/bank card or financial institution switch. This may be achieved safely and conveniently through an SEC-regulated cryptocurrency dealer.

Second, Bitcoin operates in a multi-trillion greenback cryptocurrency buying and selling trade that by no means sleeps. As such, 24 hours per day, 7 days per week – you possibly can simply money out your Bitcoin funding again to US {dollars} via your chosen on-line dealer.

What’s the Finest Option to Put money into Bitcoin?

There are basically two methods to spend money on Bitcoin in 2023.

You may both purchase BTC tokens through a web-based change or dealer, or spend money on shares that provide direct publicity to the digital foreign money.

Having stated this you may additionally acquire publicity to the crypto market through crypto CFDs. For instance, in case you opened an account with the main crypto bots Bitcoin Prime, or Bitcoin Dealer, you may speculate on the worth actions of BTC crosses through contracts for distinction. Furthermore, the perfect half about utilizing a crypto robotic is that it does all of the work for primarily based on standards and parameters that you simply configure.

Shopping for Bitcoin

It goes with out saying that the best approach to spend money on Bitcoin is to easily open an account with a web-based dealer and buy some tokens.

In doing so, you’ll retain full possession of your digital belongings till you’re able to money out. And, your income or losses will straight correlate with the market value of Bitcoin.

That’s to say, in case you invested $500 into Bitcoin and its worth subsequently will increase by 25%, you make a revenue of $125.

Investing in Bitcoin Shares

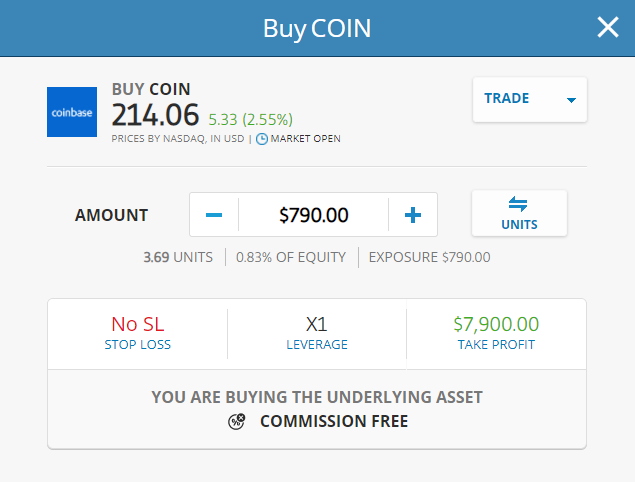

The opposite choice is to purchase some shares that correlate to the Bitcoin market. In case you’re questioning tips on how to spend money on Bitcoin shares, the most suitable choice is to have a look at Coinbase.

As talked about earlier, Coinbase is a big US-based cryptocurrency dealer that’s publicly listed on the NASDAQ. In idea, when the worth of Bitcoin and the broader cryptocurrency markets are in an upward pattern, this could have a optimistic impact on Coinbase shares.

As talked about earlier, Coinbase is a big US-based cryptocurrency dealer that’s publicly listed on the NASDAQ. In idea, when the worth of Bitcoin and the broader cryptocurrency markets are in an upward pattern, this could have a optimistic impact on Coinbase shares.

Nevertheless, the correlation won’t ever be like-for-like. In spite of everything, there are various different variables to take note of whenever you purchase shares – comparable to the corporate’s steadiness sheet, quarterly earnings, debt ranges, and extra.

As soon as once more, because of this shopping for Bitcoin is one of the best ways to spend money on the digital asset.

Put money into Bitcoin vs Buying and selling Bitcoin

One other factor to contemplate when studying tips on how to spend money on Bitcoin is the particular buying and selling technique that you simply undertake.

For instance, extra skilled traders will typically look to time the markets – which implies actively inserting trades.

Which means the investor may spend money on Bitcoin when the markets are overly sturdy, and offload when it seems that the upward pattern is starting to reverse. Then, they could look forward to the markets to right earlier than as soon as once more coming into a brand new place.

Then again, novices will likely be higher suited to a longer-term funding technique. Normally, it will see you spend money on Bitcoin after which preserve maintain of your digital belongings for a number of months or years.

This feature means that you may spend much less time researching the markets and watching over the worth of your place. As a substitute, you possibly can sit again and ‘HODL’ till you are feeling it’s the proper time to promote.

Be aware: The time period ‘HODL’ is a play on the phrase ‘maintain’. In Bitcoin jargon, this merely means holding onto your funding in the long term – and never promoting when the markets undergo short-term pricing spikes.

How A lot to Put money into Bitcoin

Ever puzzled how a lot you need to spend money on cryptocurrency in 2023? No matter which asset class you’re investing in – you will need to have a transparent plan when it comes to stakes. By this, we imply excited about how a lot cash you possibly can realistically afford to lose when investing in Bitcoin – primarily based in your funds and tolerance for danger.

- For instance, though Bitcoin is a extremely liquid asset – which implies that you may money out at any given time, additionally it is extremely risky and speculative.

- Which means ought to that you must money out your Bitcoin tokens to fund an emergency expense – you may get again lower than you initially invested.

- This is the reason you need to solely make investments quantities that you’re comfy with.

One other factor to notice is that you need to keep away from going ‘all-in’ when investing in Bitcoin. As a substitute, your portfolio ought to include a a lot bigger proportion of conventional asset courses – comparable to index funds, ETFs, and blue-chip shares.

This can assist steadiness out the dangers concerned with Bitcoin – and guarantee that you’re not overexposed to a single asset. Subsequently, when making an attempt to reply the query of ‘how a lot Bitcoin do you have to purchase?’ you’ll have to assess your danger tolerance and decide how a lot you possibly can afford to lose.

Furthermore, and as we cowl in additional element shortly, as an alternative of investing a lump sum into Bitcoin – it’s finest to inject small however common quantities through a dollar-cost common technique.

Selecting a Bitcoin Pockets for Investing

One other facet that usually places newbies off from investing in Bitcoin are the steps concerned in conserving the digital tokens secure. It is because Bitcoin – like all different cryptocurrencies, is saved in a ‘pockets’.

- These Bitcoin wallets typically come within the type of a cell app, albeit, desktop software program, {hardware} units, and on-line storage choices additionally exist.

- Whatever the pockets kind you have chose to make use of when storing your Bitcoin tokens, it’s essential that you simply undertake a variety of safety procedures.

- This contains by no means giving out your personal keys, organising two-factor authentication (if supplied by the pockets), and sticking with respected and trusted suppliers.

- In spite of everything, if the worst occurs and your pockets is compromised, then there may be each probability that your Bitcoin funds will likely be stolen.

If this does occur, you’ll have nowhere to show. This is the reason we propose contemplating SEC-regulated dealer eToro in your Bitcoin storage necessities.

It is because when you spend money on Bitcoin through the eToro web site, the tokens will likely be safeguarded by eToro’s institutional-grade safety instruments.

Which means you don’t want to fret about studying the ropes of pockets safety instruments and dangers, because the tokens will likely be stored secure by eToro till you determine to money out.

Bitcoin Funding Methods

Seasoned merchants won’t ever spend money on Bitcoin with out first having a pre-defined technique in place.

There are lots of Bitcoin funding methods to contemplate, albeit, the one that you simply go for will sometimes rely in your monetary objectives and the way a lot danger you’re prepared to take.

With this in thoughts, when studying tips on how to spend money on Bitcoin – take into account a number of the methods mentioned beneath.

Greenback-Price Common to Keep away from Volatility

We talked about earlier that Bitcoin may be a particularly risky asset class at occasions. As a beginner investor, this may be intimidating.

- For instance, in mid-2021, Bitcoin went from highs of $61,000 to lows of $31,000 within the area of only a few months.

- Nevertheless, only a few months later, Bitcoin then hit all-time highs of just about $69,000.

Crucially, this emotional rollercoaster journey may be mitigated by dollar-cost averaging your investments.

This merely means investing smaller quantities at common intervals. As an illustration, you may elect to speculate $100 per 30 days – no matter how Bitcoin is performing.

In doing so, you’ll common out your break-even level on every funding. If adopting this Bitcoin funding technique, it’s finest to make use of a dealer that helps small stakes.

At eToro, as an example, you solely want to fulfill a $10 minimal. As such, by depositing $120, you possibly can make investments $10 per 30 days for a complete 12 months.

Keep Secure With SEC-Regulated Bitcoin Brokers

The following technique to undertake when studying tips on how to spend money on Bitcoin is to make sure that you solely make purchases from a trusted dealer that takes safety and regulation critically.

You are able to do this with ease by sticking with Bitcoin brokers which might be approved and controlled by the SEC.

The choice to that is to make use of an unlicensed cryptocurrency change that gives nothing in the best way of regulatory safety.

Though such exchanges may provide super-low charges and an assortment of options, you possibly can by no means make sure that your Bitcoin funds are in secure arms.

Have an Funding Goal in Place

One other technique to think about using when investing in Bitcoin is to have clear targets in place.

- For instance, let’s suppose that you simply need to make good points of 75% out of your Bitcoin funding.

- In case you make investments when the worth of Bitcoin is $40,000 – which means that the digital foreign money must exceed a worth of $70,000 per token.

If and when your goal is met, you possibly can then elect to promote your Bitcoin tokens again to money. The simplest means of deploying a goal Bitcoin value is through a take-profit order.

For these unaware, take-profit orders – which can be found at platforms like eToro and Binance, help you specify an actual value that you simply want to promote your funding.

When this value is triggered by the markets (for instance, $70,000), your chosen dealer will robotically shut your place.

Along with take-profits, additionally it is value contemplating a stop-loss order whenever you spend money on Bitcoin. This works in the identical means as a take-profit however in reverse.

- As an illustration, you may determine that probably the most you’re ready to lose out of your Bitcoin funding is 20%.

- If the worth of Bitcoin stands at $40,000 on the time of the funding, you would want to set your stop-loss at $32,000.

- If the required value is triggered, then the dealer will robotically shut your place.

In the end, by inserting each take-profits and stop-losses, which means that you don’t have to always verify the worth of Bitcoin, as your chosen dealer will shut your commerce when certainly one of your orders is triggered.

The way to Put money into Bitcoin & Make Cash – Instance

In case you’re questioning tips on how to earn a living from a Bitcoin funding, this part of our newbie’s information will clarify the method with some easy examples.

Fractional Funding

The very first thing to say is that until you want to make investments 1000’s of {dollars} to buy a single Bitcoin, you may be shopping for a fraction of 1 token.

The excellent news is that the returns in your funding will work out in precisely the identical means as shopping for a full Bitcoin.

For instance:

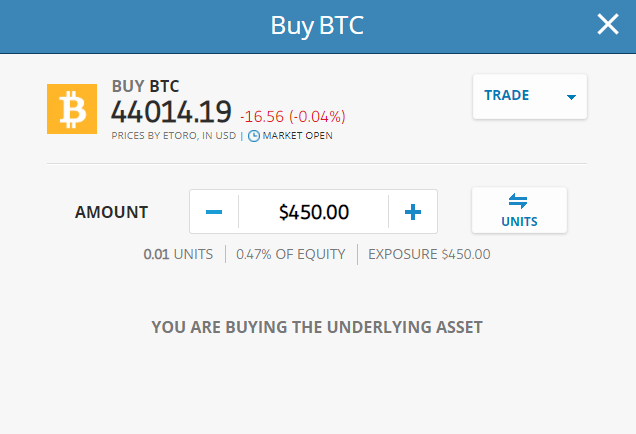

- Let’s suppose that you simply need to spend money on Bitcoin when the digital asset is priced at $45,000

- You determine to speculate a complete of $450

- Which means you’re shopping for 1% of a single Bitcoin token – or 0.01 items.

- We’ll then say that a number of months later, Bitcoin is priced at $53,500 – or 30% larger

- In your stake of $450, which means that your funding is now value $585

As per the above, it doesn’t matter in case you personal a full Bitcoin or only a tiny fraction of 1 token – your good points and losses will likely be decided by the proportion quantity that the digital asset will increase or decreases.

Lengthy-Time period Purchase and Maintain Technique

On this instance of tips on how to earn a living by investing in Bitcoin, we’ll take a look at what returns you’d have made had you entered the market 5 years in the past.

- Within the 5 years previous to penning this information, Bitcoin was priced at simply over $1,000 per token

- We’ll say that you simply determined to speculate a complete of $5,000 at this entry value

- As of writing, Bitcoin is buying and selling across the $42,000 degree

- This interprets into 5-year returns of over 4,000%

Within the above instance, you invested $5,000 5 years in the past and also you at the moment are returns of 4,000%. And as such, in case you have been to money out, you’d obtain over $200,000. For extra particulars on the perfect long run crypto investments be sure you learn our full information.

Quick-Time period Technique

Now let’s take a look at a real-world instance of how a short-term Bitcoin commerce may pan out.

- Let’s say that you simply invested $2,000 into Bitcoin in mid-July 2021 – when the digital token was priced at simply over $30,000

- Simply three months later, Bitcoin was priced at $64,000 per token

- This represents progress of roughly 110%

- As such, you determine to money out your funding

As per the above, within the area of simply three months, you made a 110% revenue on a $2,000 Bitcoin funding. Subsequently, your complete cash-out quantity would have stood at $4,200.

When is the Finest Time to Put money into Bitcoin?

Until you’re a seasoned investor with a agency understanding of technical evaluation and high-level analysis, there is no such thing as a worth in trying to time the market. However is it too late to purchase Bitcoin?

Quite the opposite, as an alternative of making an attempt to spend money on Bitcoin on the proper time – the beforehand mentioned dollar-cost averaging technique will likely be much more efficient.

It is because you may be investing in Bitcoin in the long term by allocating smaller quantities to the digital token – however at common intervals.

And as such, you don’t want to fret about whether or not or not you may have timed the market accurately – as every funding will likely be averaged out.

The way to Put money into Bitcoin – Tutorial

This part of our information will clarify tips on how to spend money on Bitcoin through SEC-regulated dealer eToro.

You’ll learn to open a verified account, deposit funds, and place an funding order in lower than 10 minutes.

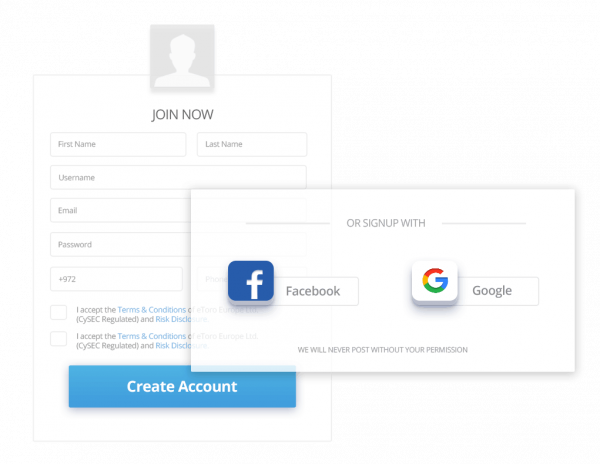

Step 1: Open an Account

Step one is to go to the eToro web site and click on on the ‘Be a part of Now’ button – which one can find on the prime of the homepage. A registration kind will then seem in your display screen.

Initially, you’ll need to enter your first and final identify, e-mail deal with, cellular phone quantity, and a selected username and password.

Subsequent, you’ll want to offer some extra private particulars – comparable to your date of beginning and residential deal with.

Subsequent, you’ll want to offer some extra private particulars – comparable to your date of beginning and residential deal with.

Lastly, to finish the registration course of, you’ll need to confirm your cellular phone quantity by coming into the SMS code that eToro sends to you.

Step 2: Identification Verification

In lower than 1-2 minutes, you possibly can confirm your eToro account by importing some ID. This can enhance your deposit limits and make you eligible to request withdrawals.

To get verified, you possibly can add a replica of your driver’s license, passport, or state-issued ID. To show your residency standing, add a not too long ago issued financial institution assertion or electrical energy/water invoice.

Step 3: Make a Deposit

In case you are depositing funds in US {dollars}, then no charges apply. At eToro, you possibly can select from a debit/bank card or an e-wallet to have your deposit processed immediately.

In case you’re joyful to attend 1-3 working days, ACH and financial institution wire transfers are additionally supported. The minimal deposit at eToro for US purchasers is simply $10.

Step 4: Seek for Bitcoin

It’s best to now have a verified eToro account with at the very least $10 in funds. In that case, you possibly can spend money on Bitcoin.

To go straight to the right funding web page, use the search bar by coming into ‘BTC’ and clicking on ‘Commerce’.

Step 5: Put money into Bitcoin

An order field will now seem in your buying and selling display screen. That is the place that you must let eToro understand how a lot cash you need to spend money on Bitcoin.

This may be any quantity from $10, albeit, within the instance above, we’re investing a complete of $50. Lastly, when you click on on the ‘Open Commerce’ button, eToro will perform your Bitcoin funding immediately. Now you’re able to learn to spend Bitcoin in 2023.

Step 6: The way to Promote Bitcoin

You may preserve observe of your Bitcoin funding by heading over to your eToro portfolio. At any given time, you possibly can elect to promote your Bitcoin funding.

Simply look out for the cog button subsequent to Bitcoin, and click on on ‘Shut’. eToro will then promote your Bitcoin tokens again to US {dollars} at the perfect obtainable value.

Conclusion

This information has defined the significance of researching the markets and contemplating the dangers concerned earlier than investing in Bitcoin.

We’ve additionally reviewed the perfect Bitcoin brokers and exchanges to contemplate, and which methods are value adopting.

If you wish to spend money on Bitcoin proper now – it takes simply 10 minutes to open an account and place your order at SEC-regulated dealer eToro.

Cryptoassets are a extremely risky unregulated funding product. No UK or EU investor safety.

Learn extra:

Ceaselessly Requested Questions When Investing in Bitcoin

Is Bitcoin funding in 2023?

Can I spend money on Bitcoin with $1?

How do I spend money on Bitcoin?

What’s the minimal to spend money on Bitcoin?

How a lot ought to I spend money on Bitcoin?

What’s the finest website to spend money on Bitcoin?

If I make investments $100 in Bitcoin at the moment in 2022 how a lot is it value in 2023?

What’s one of the best ways to spend money on Bitcoin?

Is it too late to spend money on Bitcoin?

Ought to I spend money on Bitcoin or Ethereum?

Do you have to spend money on Bitcoin?

![]()

Kane Pepi is an skilled monetary and cryptocurrency author with over 2,000+ printed articles, guides, and market insights within the public area. Knowledgeable area of interest topics embody asset valuation and evaluation, portfolio administration, and the prevention of monetary crime. Kane is especially expert in explaining advanced monetary subjects in a user-friendly…

View full profile ›

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!