How Much Bitcoin Should You Buy in 2023?

Disclaimer: The Business Discuss part options insights from crypto business gamers and isn’t part of the editorial content material of Cryptonews.com.Bitcoin stays one of the crucial enticing asset lessons to...

Disclaimer: The Business Discuss part options insights from crypto business gamers and isn’t part of the editorial content material of Cryptonews.com.

Bitcoin stays one of the crucial enticing asset lessons to spend money on – contemplating that the digital forex has generated positive factors of over 200% within the final 5 years.

Furthermore, Bitcoin is now buying and selling 70% under its former peak of $69,000 – so the digital forex may be bought on a budget.

However that begs the query – “How a lot Bitcoin ought to I purchase?“. Learn on to guage probably the most risk-averse strategy to acquire publicity to Bitcoin as we speak.

How A lot Bitcoin Ought to I Purchase – Key Elements to Assist You Determine

These asking the query – “how a lot Bitcoin ought to I purchase?” ought to first think about the important thing factors mentioned under.

- Discretionary Earnings – It goes with out saying that when asking your self “how a lot Bitcoin ought to I purchase?” – the quantity ought to by no means exceed discretionary earnings. This refers to cash out there in any case core bills have been lined – resembling mortgage funds, meals, journey, and debt.

- Greenback-Price Common – A notable technique taken by risk-averse buyers is to slowly drip-feed cash into Bitcoin on the finish of every week or month. This technique is named dollar-cost averaging and it ensures that investments are made progressively, versus a lump sum. Furthermore, dollar-cost averaging permits buyers to keep away from being over-exposed to a single price worth (e.g. shopping for on the peak of the bull run).

- Be Ready for Volatility – Since its inception in 2009, Bitcoin has generated unprecedented returns prompting many buyers to surprise if Bitcoin is an effective funding. Nonetheless, Bitcoin goes via super-volatile market cycles, with present costs buying and selling 70% under the digital asset’s former all-time excessive. Subsequently, when assessing how a lot to spend money on Bitcoin, buyers ought to think about that the worth of the funding can decline significantly within the brief time period.

- Urge for food for Danger – All investments include an inherent stage of danger. Nonetheless, when in comparison with the likes of blue-chip and dividend shares, authorities bonds, and actual property – Bitcoin is considerably riskier. As such, buyers want to contemplate that there’s a likelihood that the Bitcoin funding may end up in some and even all the cash being misplaced.

- Do not Put All Eggs in One Basket – Probably the greatest methods to strategy Bitcoin is to make sure that investments are unfold out throughout different property. A typical diversification technique is to additionally spend money on the very best altcoins – whether or not that is Ethereum, Litecoin, or Cardano. Furthermore, for added upside potential, many buyers think about crypto presales – which supply entry to a brand new digital asset being its trade itemizing. As of writing, probably the most trending crypto presales embody Sprint 2 Commerce and IMPT.

Finally, when assessing “How a lot ought to I spend money on Bitcoin?” – there are numerous components to bear in mind.

Learn on to be taught some high methods that may help find the optimum Bitcoin funding stake in addition to deciding whether or not it’s too late to purchase Bitcoin in 2023.

How one can Determine How A lot to Spend money on Bitcoin

Studying the way to generate income with cryptocurrency would not should be a sophisticated ordeal. Not solely within the case of Bitcoin, however all potential funding selections require an in-depth evaluation of how a lot to allocate.

Whereas it may be tempting to go all-in on Bitcoin attributable to its unprecedented previous efficiency, this is not a clever transfer to take. As an alternative, it is best to strategy Bitcoin and different cryptocurrencies in a risk-averse method.

We are going to now take a a lot nearer have a look at what to contemplate when evaluating how a lot to spend money on Bitcoin to generate income.

1. An Analysis of Discretionary Earnings

Earlier than making any investments – whether or not that is Bitcoin or every other asset class for that matter, it’s essential to take a step again and assess how a lot discretionary earnings is out there.

In a nutshell, discretionary earnings refers back to the sum of money left over after core bills. Suppose alongside the strains of on a regular basis bills like meals and journey, along with mortgage funds, utilities, and a 401 (okay) plan.

In idea, something above this determine is classed as discretionary earnings and thus – may be utilized for non-essential purchases.

In different phrases, when assessing “how a lot Bitcoin ought to I purchase?” – the chosen quantity shouldn’t exceed the discretionary earnings that has been recognized.

Let’s break down a hypothetical instance to assist exhibit this level:

- We’ll that after tax and social safety, an investor has $3,000 price of month-to-month earnings

- Of this determine, $2,000 is allotted for core, on a regular basis bills

- $500 is put aside for financial savings and a 401 (okay) plan

- This leaves $500 in discretionary earnings

Now, you will need to notice that when exploring how a lot do you have to spend money on Bitcoin, it would not be clever to allocate 100% of the out there discretionary earnings.

Quite the opposite, assuming that the investor has $500 on the finish of the month, a extra risk-averse technique can be to diversify the funds throughout a number of property.

Though we cowl diversification in additional element shortly, this may embody $100 for Bitcoin, $100 for crypto presales like Sprint 2 Commerce, and the stability within the S&P 500 index.

Finally, an important factor is realizing precisely how a lot cash will probably be left on the finish of every month, in any case bills are lined. Nothing above this quantity ought to be thought of when assessing how a lot Bitcoin to purchase.

2. Deploy a Greenback-Price Common Technique

An much more risk-averse strategy to reply the query – “How a lot Bitcoin ought to I purchase?” – is to attend till the top of every month, maybe just a few days earlier than the subsequent wage will probably be deposited.

In different phrases, simply earlier than payday, any disposal earnings left over may be utilized for Bitcoin and different investments. This represents a sensible strategy to strategy Bitcoin, contemplating that each one bills have already been lined and payday is across the nook.

Now, this technique truly coincides with dollar-cost averaging. For these unaware, dollar-cost averaging is the method of investing in an asset on a set day every month, moderately than going ‘gung ho’ and injecting one lump sum.

This can be a tried and examined technique not solely within the case of Bitcoin however broader inventory market indexes just like the S&P 500 and the Dow Jones. The rationale for that is that dollar-cost averaging removes the necessity to try to time the market. Furthermore, it additionally alleviates the chance of being over-exposed to a single price worth.

- As an example, think about that people who invested a lump sum into Bitcoin in November 2021 at $69,000 at the moment are losses of 70%.

- After all, the funding will solely yield a loss if the investor sells their Bitcoin.

- However nonetheless, the investor will stay at a loss till the worth of Bitcoin returns to $69,000.

Now think about a risk-averse investor that conducts a dollar-cost averaging technique. Positive, at its peak, month-to-month investments would have been made in the direction of the highest of the bull run. Nonetheless, as Bitcoin continued to say no within the continuing months, every month-to-month funding would have resulted in a decrease price worth.

Let’s take a look at an instance of dollar-cost averaging within the context of Bitcoin:

- We’ll say that an investor has $600 on the finish of every month

- The investor decides to purchase $300 price of every month, just a few days earlier than payday

- In months 1, 2, and three – the investor will get a value worth of $69,000, $40,000, and $30,000

- In months 4, 5, and 6, the investor will get a value worth of $25,000, $20,000, and $20,000

As per the above, the investor has made six month-to-month investments into Bitcoin at $300 every. Owing to the dollar-cost averaging technique, the investor has a median price worth of $34,000.

Because of this ought to Bitcoin ultimately return to its former all-time excessive of $69,000 – the investor would generate a revenue of 102%. Alternatively, an investor that went all-in when Bitcoin peaked at $69,000 would solely break even as soon as this worth level is revisited.

3. Perceive the Volatility of Bitcoin

Having the ability to precisely predict the worth actions of BTC is just about inconceivable, however researching the historic knowledge and present indicators is essential. Though Bitcoin trades in a extremely liquid market, it’s nonetheless a super-volatile asset class. Way more so than the likes of US Treasuries or shares. Whereas dollar-cost averaging all the time has the possibility to experience out risky crypto waves in the long term, you will need to have the dangers that this invitations nonetheless.

- In spite of everything, we talked about above that after peaking at $69,000 in late 2021, Bitcoin has since declined by 70%.

- On the one hand, this is not essentially a problem for an investor that plans to purchase and maintain Bitcoin over a few years, along with shopping for the dip and deploying a dollar-cost averaging technique.

- Nonetheless, if an investor has invested greater than they will afford and subsequently must promote Bitcoin to pay for on a regular basis bills, this may lead to main losses.

Because of this making an evaluation of discretionary and disposal earnings ought to stay a high precedence when assessing how a lot to spend money on Bitcoin.

- Along with this, learners should be ready for the emotional unwanted side effects of Bitcoin’s volatility.

- Many newbies will see that Bitcoin has declined by 25% within the house of two weeks, and subsequently resolve that sufficient is sufficient.

- With that stated, panic promoting ought to be prevented when investing in Bitcoin, as long-term buyers are people who sometimes generated the very best returns.

Probably the greatest methods to cope with volatility is to keep away from often checking the worth of Bitcoin. Newbies are recognized for this, oftentimes checking the worth of their portfolio a number of occasions all through the day. As an alternative, think about checking the worth of Bitcoin on a month-to-month foundation – on the identical time that the subsequent dollar-cost averaging funding is being made.

4. Decide How A lot Urge for food for Danger is Acceptable

One other essential issue to bear in mind is how a lot danger tolerance is appropriate. This can be a difficult metric to guage, as no two buyers are the identical.

For instance, some investing cash into the S&P 500 each month for a number of many years may be considerably assured that over the course of time, the worth of the portfolio will probably be wholesome on the level of retirement. In spite of everything, the S&P 500 has generated common annualized positive factors of 10% since its inception in 1926.

Nonetheless, within the case of Bitcoin, we solely have 14-ish years of buying and selling historical past. Because of this, it will be unwise to spend money on Bitcoin with out contemplating the chance of loss. Actually, many market commentators argue {that a} appropriate quantity of Bitcoin to purchase ought to replicate cash that the investor is ready to lose in its entirety.

Whereas that is considerably excessive, danger mitigation practices ought to be put in place. As soon as once more, this hyperlinks again to our earlier dialogue on dollar-cost averaging and limiting investments to discretionary earnings.

5. Purchase the Dip to Spend money on Bitcoin at a Low-cost Entry Value

Many seasoned buyers will look to extend the dimensions of their stakes in an asset when the broader markets are bearish. On this regard, Bitcoin isn’t any completely different.

As we now have talked about many occasions beforehand, Bitcoin is now buying and selling at $20,000 – which is 70% under its former all-time excessive. Because of this in idea, by buying Bitcoin at present ranges, a reduction of 70% is on provide.

Though Bitcoin was inception as not too long ago as 2009, the digital forex has already gone via a number of bear markets. Most significantly, Bitcoin has all the time recovered.

Let’s take the earlier bear market as a chief instance of why shopping for the dip could be a worthwhile technique to take when investing in long-term cryptocurrencies like Bitcoin:

- After a protracted bull run, Bitcoin peaked at $20,000 towards the shut of 2017

- Bitcoin then entered a protracted bear market, hitting lows of below $4,000 simply 12 months later

- Many buyers that bought Bitcoin at $4,000 would have ultimately made sizable positive factors

- In spite of everything, Bitcoin hit $69,000 simply three years later

- This interprets into positive factors of over 1,600%

It goes with out saying that purchasing cryptos on the dip does require some component of trying to time the market. With that stated, shopping for the dip can run together with a dollar-cost averaging technique.

It’s because investments will probably be made every month no matter how a lot Bitcoin is buying and selling at. Subsequently, when Bitcoin is on the decline, the dollar-cost averaging technique will make purchases nonetheless.

6. Diversify Throughout Many Completely different Crypto Property in Addition to Bitcoin

What’s the greatest crypto portfolio allocation in 2023 to reduce potential losses and maximize income? Diversification is one other tried and examined funding technique utilized by skilled buyers. By diversifying, this ensures that the funding portfolio shouldn’t be over-exposed solely to Bitcoin. Positive, Bitcoin is the unique, de-facto, and most respected cryptocurrency of selection. Nonetheless, in recent times, it has underperformed towards different digital currencies on this house.

- That is particularly the case with crypto presales, lots of which proceed to outperform the broader market.

- For instance, in 2022, LBLOCK – the native token of NFT competitors platform Fortunate Block, generated returns of over 6,000% after it launched on PancakeSwap.

- This was after presale buyers paid simply $0.00015 per LBLOCK token.

As we cowl in additional element shortly, there are a selection of stable presales ongoing at this second in time – all of which supply a direct upside. The rationale for that is that the very best upcoming ICOs function a progressive pricing construction.

For instance, the Sprint 2 Commerce presale has 9 phases, every of which will increase the worth of its D2T token as soon as offered. Section one and 9, respectively, are priced at $0.0476 and $0.0662. In essence, which means that the very earliest buyers will get an upside of 40% – and that is earlier than D2T tokens checklist on their first trade.

Why You Shouldn’t Simply Spend money on Bitcoin – Prime Crypto Presales are the Prime Crypto Investments

As famous above, top-of-the-line choices within the crypto market proper now – particularly for these on finances, is to focus on presale campaigns. This presents a horny upside potential while not having to danger important quantities of cash.

Crypto presales ought to, nonetheless, be along with extra established and liquid digital currencies – resembling Bitcoin. It is all about diversification and danger administration – which crypto presales can actually play a component in.

Beneath, we focus on a few of the high trending crypto presales available in the market proper now:

Sprint 2 Commerce (D2T) – General Finest Crypto Presale

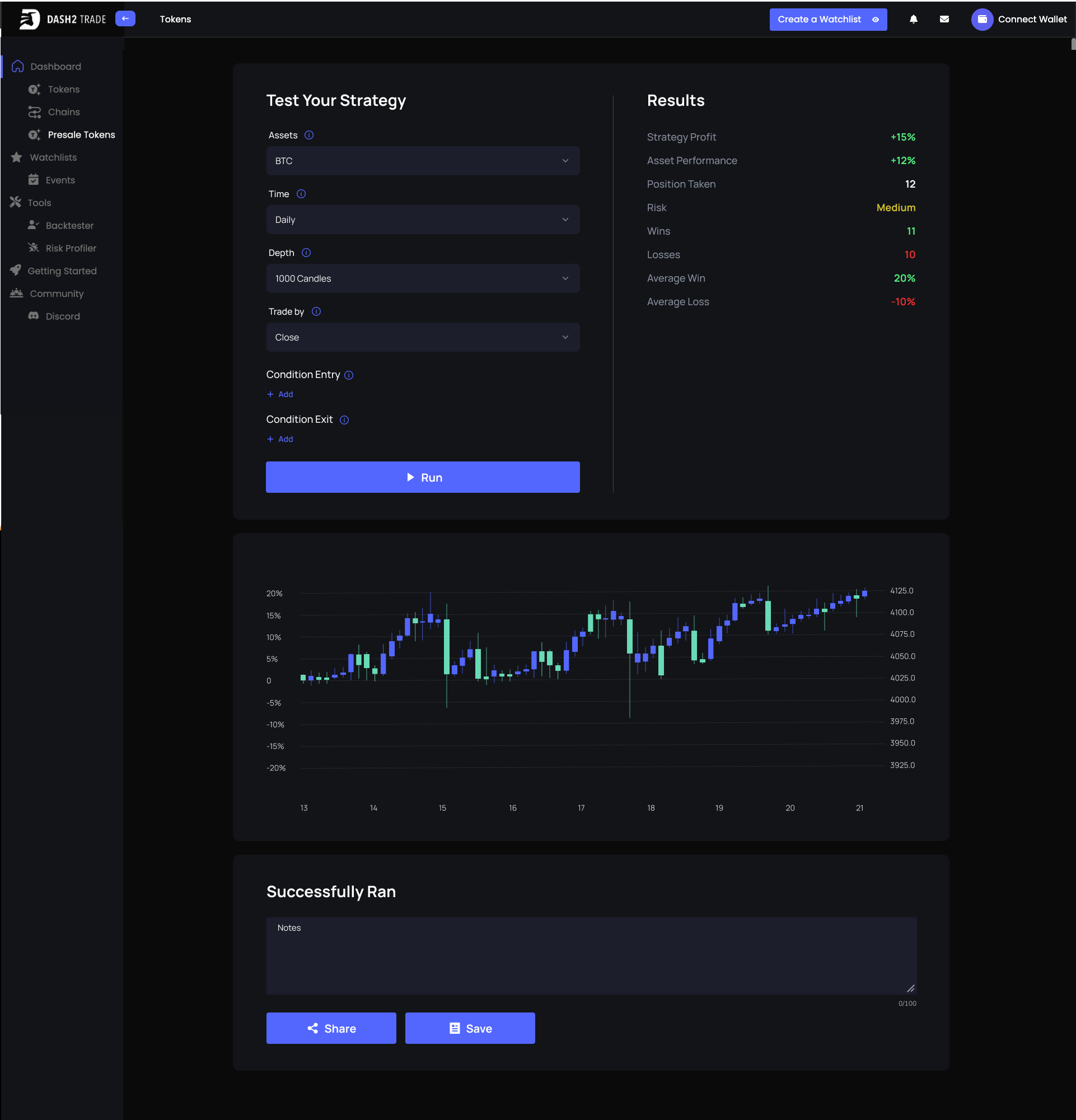

We discovered that the Sprint 2 Commerce presale stands out on this market for a lot of causes. At first – Sprint 2 Commerce is a newly based undertaking that’s working in the direction of a cutting-edge analytics terminal.

A number of the core options that Sprint 2 Commerce subscribers may have entry to incorporate buying and selling indicators, ICO evaluation and rating, on-chain evaluation and whale token actions, social metrics, new trade listings, pricing alerts, professional-grade knowledge, and a backtesting facility for trialing methods.

Every characteristic will probably be out there to month-to-month subscribers that pay their charges in D2T tokens – which fuels the Sprint 2 Commerce ecosystem. The undertaking is backed by the identical staff behind Be taught 2 Commerce – a extremely established crypto indicators platform that has been energetic on this house for a few years. This ensures that D2T token holders are investing in a respectable undertaking.

The very best factor concerning the Sprint 2 Commerce presale is that it’s only in section two. Because of this buyers can safe a direct upside earlier than D2T is listed on a crypto trade. Section two costs D2T at simply $0.05, earlier than growing to $0.0513. To this point, in simply over one week for the reason that presale went dwell, Sprint 2 Commerce has raised greater than $3.6 million.

To spend money on the Sprint 2 Commerce presale, buyers can make the most of Ethereum or Tether. The presale is being performed on the Sprint 2 Commerce web site, so it is only a case of connecting a crypto pockets like MetaMask and confirming the swap.

Finally, D2T carries all the required hallmarks to turn out to be the very best future cryptocurrency for long-term positive factors.

Spend money on Sprint 2 Commerce Presale Now

IMPT – Trending Challenge Constructing a Carbon Credit score Ecosystem

Subsequent up we now have IMPT – which is probably probably the most sustainable cryptocurrency to spend money on. In a nutshell, IMPT is focusing on the high-growth carbon credit score market via crypto, blockchain expertise, and sensible contracts. The primary idea is that in shopping for IMPT tokens, the digital property may be transformed to carbon credit.

Carbon credit are in excessive demand proper now, contemplating that in lots of nations corporations are restricted within the emissions they will emit annually. And naturally, if an organization requires extra allowances, they need to buy carbon credit from the open market. Nonetheless, carbon credit score buying and selling, in its present type, is often facilitated by OTC (Over-the-Counter) exchanges.

Because of this small-to-medium corporations usually get a nasty deal. Not solely that, however the OTC markets are not often accessible to retail buyers. Because of this IMPT could possibly be one of many fastest-growing cryptocurrencies to purchase proper now.

The IMPT presale – which is at the moment in section two, accepts each Ethereum and Tether. At the moment, costs quantity to $0.023 for each IMPT token bought. The worth will as soon as once more enhance after the present batch of IMPT tokens is offered. As such, early buyers are rewarded.

Spend money on IMPT Presale Now

Calvaria – P2E Battle Card Recreation With Blockchain Rewards

For final diversification – along with Bitcoin, Sprint 2 Commerce, and IMPT, buyers may additionally think about Calvaria. This undertaking can be in its presale section – having raised over $1 million up to now. The Calvaria presale levels transfer quite a bit quicker when in comparison with the norm, contemplating that we’re already in section three.

Initially, the presale supplied a worth of 100 RAI for each 1 USDT. Nonetheless, section three is providing simply 60 RAI, and the next stage will convert to 40 RAI. As such, there’s nonetheless loads of upside to focus on.

When it comes to its product, Calvaria is launching a P2E (play-to-earn) sport set in a futuristic setting. Gamers can earn and purchase battle card NFTs that are then used to compete with different customers. Profitable gamers will earn RAI tokens, which might then be transformed into different digital property.

Spend money on Calvaria Presale Now

How A lot Ought to You Spend money on Bitcoin? What the Consultants Say

Whereas third-party recommendation ought to be taken with a grain of salt, it may be helpful to guage what business consultants counsel relating to Bitcoin stakes.

The overall rule of thumb throughout the board is that buyers ought to by no means allocate greater than 5% of the general portfolio to Bitcoin – and cryptocurrency normally.

It’s because Bitcoin is seen as a high-risk asset, so the portfolio ought to be balanced out with different, extra established asset lessons. It will sometimes embody the likes of bonds and shares, along with index funds and maybe an allocation of gold and actual property.

- With that stated, there are additionally business commentators who argue a barely greater share is probably appropriate.

- For instance, Alex Doll, president of Anfield Wealth Administration in Cleveland, argues that high-risk property like Bitcoin ought to be capped at 10%.

Licensed monetary planner at FIT Advisors, Anjali Jariwala, is extra risk-averse on this respect. Jariwala notes that she suggests capping cryptocurrency investments to three% of the general portfolio allocation.

There is not, nonetheless, a one measurement suits all reply relating to assessing how a lot to spend money on Bitcoin. As we now have proven extensively earlier, all of it boils down to non-public danger tolerance, long-term monetary objectives, and the way a lot volatility buyers really feel snug with.

Furthermore, probably the most pertinent takeaway is that buyers ought to solely think about using discretionary earnings when making Bitcoin and crypto purchases. This implies solely investing funds after core bills have been lined.

Conclusion

Discovering the so-called candy spot when evaluating how a lot to spend money on Bitcoin is an important job that ought to be taken earlier than risking any cash. Newbies, specifically, ought to make sure that they think about tried and examined danger administration methods, resembling dollar-cost averaging, finances planning, and diversification.

Concerning the latter level, crypto presales are proving well-liked with buyers desirous about studying the way to get into cryptocurrency within the first place. Contemplating the risk-adjusted upside on provide. At this second in time, top-rated undertaking Sprint 2 Commerce is providing its D2T through a presale launch. Early buyers will safe the very best worth potential, with D2T at the moment being offered at simply $0.05 per token.

Spend money on Sprint 2 Commerce Presale Now

FAQs

How a lot Bitcoin did Elon Musk purchase?

When it comes to his private funding, the quantity of Bitcoin that Elon Musk at the moment owns has not been made public. We do, nonetheless, know that Tesla – which Elon Musk is the CEO of, invested greater than $1.5 billion in Bitcoin as a way to extra effectively make the most of free money circulation. Though Tesla has since offered nearly all of its Bitcoin holdings, the agency famous in its most up-to-date earnings name that it nonetheless holds $218 million price.

How a lot Bitcoin ought to a newbie purchase?

Whereas there isn’t a hurt in investing in Bitcoin as a newbie, first-time buyers ought to make sure that they continue to be cautious. Think about how a lot discretionary earnings is out there on the finish of every month and maybe think about a dollar-cost averaging technique. This ought to be along with making a diversified portfolio that additionally comprises different cryptocurrencies. Finally, learners ought to perceive that they will lose some and even all of their Bitcoin funding.

Is $100 price investing in Bitcoin?

It’s potential to take a position only a few {dollars} into Bitcoin, so there isn’t a quantity too small on this regard. An important issue to contemplate is that Bitcoin funding quantities ought to be based mostly on the investor’s disposal earnings, danger tolerance, finances, and long-term monetary objectives. Some buyers will think about allocating $100 every month into Bitcoin through a dollar-cost averaging technique. That is maybe a extra risk-averse manner to purchase Bitcoin in distinction to investing one lump sum.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!