Hoskinson Moves Away From Bitcoin Reserve, Proposes Cardano-Native Treasury Instead - Crypto Economy

TL;DR Charles Hoskinson has scrapped the idea of a Bitcoin-backed reserve and is now touting a treasury built solely on Cardano’s native tokens. The new proposal allocates funds to ADA, the privacy-focused...

TL;DR

- Charles Hoskinson has scrapped the idea of a Bitcoin-backed reserve and is now touting a treasury built solely on Cardano’s native tokens.

- The new proposal allocates funds to ADA, the privacy-focused Midnight token, and the top 50 Cardano assets to spread risk and foster DeFi collaboration.

- Community response is mixed: supporters applaud the homegrown focus, while critics warn the multi-token structure could become unwieldy or unfair.

Cardano‘s co-founder, Charles Hoskinson, has abandoned his previous concept of a Bitcoin reserve and introduced an ambitious new plan: a treasury that relies solely on Cardano’s native assets. In a recent post on X, he outlined a plan to back the network’s future growth using ADA, the privacy-focused Midnight token, and the top 50 native Cardano tokens by market cap. This pivot signals a stronger emphasis on homegrown innovation, setting the stage for an energized DeFi landscape on Cardano.

From Competing Chains to Cardano’s Core

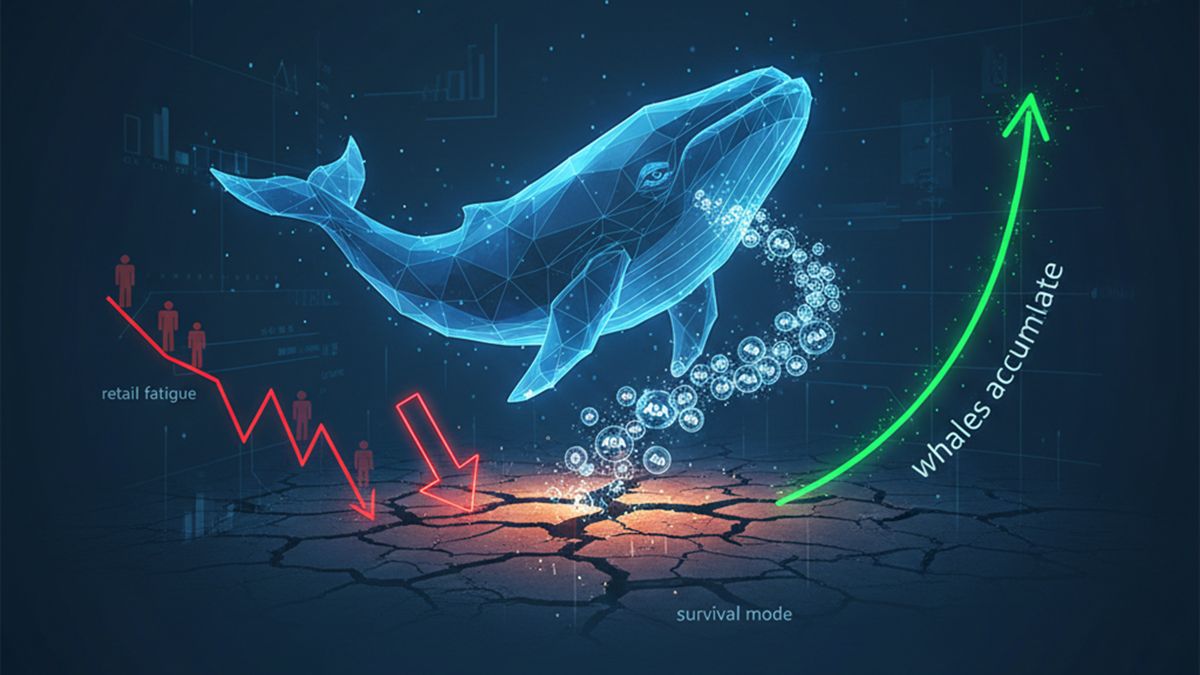

Just weeks ago, Hoskinson sparked debate by suggesting Cardano build up Bitcoin holdings to shore up its treasury. Critics warned that tying Cardano’s fate to a rival blockchain could blur strategic focus. With this shift, he’s choosing to double down on Cardano’s own ecosystem.

By focusing exclusively on on-chain tokens native to Cardano, Hoskinson aims to reinforce the network’s independence, bolster long-term value for $ADA holders, and drive traffic directly into Cardano’s smart contract economy.

A Multitoken Treasury Model

Hoskinson’s proposal calls for a diversified basket comprising:

- $ADA as the foundational store of value

- Midnight, the privacy layer token, for discreet finance use cases

- The top 50 native tokens, ranging from decentralized exchanges like Minswap (MIN) to telecom projects like World Mobile Token (WMTYX)

This model intends to distribute risk across multiple projects, foster collaboration among token teams, and turbocharge total value locked (TVL) through cross-token incentives and joint liquidity pools.

Community Cheers and Raises Eyebrows

Reactions have been split. Advocates laud the move as a major vote of confidence in homegrown projects, predicting it will accelerate DeFi adoption and reward early token investors. Detractors counter that including 50 tokens feels overly generous, some worry the treasury could become unwieldy, or be perceived as favoring certain projects. A few voices even argue the treasury should stick to $ADA alone for clarity and simplicity.

Steering Cardano’s DeFi Destiny

By anchoring the treasury in Cardano-native tokens, Hoskinson is staking his reputation on the network’s ability to self-fund and self-sustain. If successful, this initiative could send ripples through the wider crypto industry, showcasing how a protocol can nurture its ecosystem rather than relying on externals.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!