Solana's Resurgence Post-FTX Collapse: Can It Sustain the Recovery?

What Happened To Solana?What’s Driving Solana’s Resurgence?What Is Next For SOL?Final Thoughts Solana is experiencing its most bullish month so far, with significant increases in key metrics such as trading...

Solana is experiencing its most bullish month so far, with significant increases in key metrics such as trading volume, token price, and total value locked. The network is displaying positive momentum across the board, with its Total Value Locked (TVL) surging from $427 million on November 1 to $576 million currently.

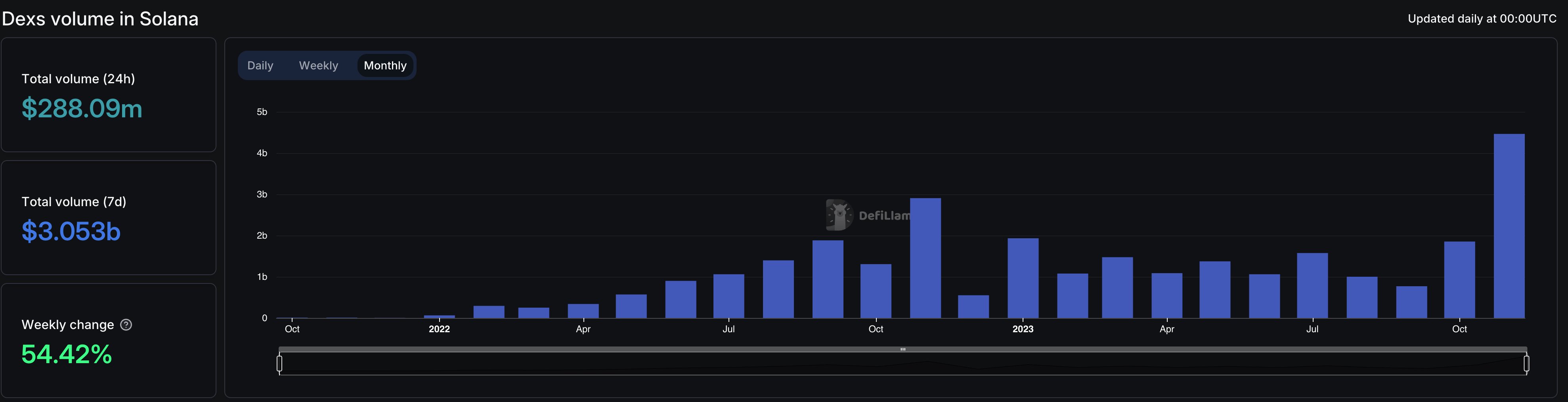

During the same period, its daily transaction volume has significantly risen from $241 million to $353 million as of yesterday. The weekly volumes also reached a new high of $2.1 billion, exceeding the same week last year by over 33%.

Solana:

– ATH in Monthly DEX Volume high with over $4.4B

– ATH in weekly DEX Volume with over $1.9B

– New Yearly $SOL Highs, at $68

– Flipped Cardano, USDC in Market CapNovember 2022 was Solana’s worst month ever

November 2023 has been Solana’s best month ever. pic.twitter.com/uHLCOEEQco

— Step Data Insights (@StepDataInsight) November 19, 2023

DEXs on Solana recorded a monthly volume of $5.1 billion in November, as per DefiLlama, exceeding the previous peak of $2.8 billion in November 2022. (This positive trend in decentralized exchange usage extends beyond Solana, as DEX usage across the broader crypto ecosystem has been on the rise since mid-September. They have handled over $26 billion—the highest since March earlier this year.)

In addition to the optimistic outlook for decentralized exchange usage, Solana’s native token, SOL, is also on an upward trend. It attained a yearly high of $65.42 on November 16, according to Coinmarketcap data.

What Happened To Solana?

The recent resurgence in SOL’s price highlights its resilience in the crypto space. Approximately a year ago, the collapse of FTX affected SOL negatively; its price plummeted from around $33 to $9.96. Notably, the TVL on the chain plummeted by almost 70% to $303 million during the public collapse of FTX, further amplifying doubts about the sustainability of the Solana ecosystem.

Also, the blockchain has faced recurring outages, whie raised concerns about the underlying technology’s resilience and the team’s ability to tackle such issues while continuing the protocol’s development.

In May 2022, the network was down for seven hours due to a bot invasion. Additionally, in June 2022, a consensus failure caused by a bug led to another outage, contributing to a drop in SOL’s price during that period.

The outages, coupled with the collapse of FTX, prompted questions about the viability of the Solana chain itself. SOL’s price decline was further exacerbated by the broader market downturn, where the entire crypto market lost over 70% of its value during the 2022 bear market.

What’s Driving Solana’s Resurgence?

Despite facing challenges, Solana managed to emerge stronger and even achieved its best monthly performance just a year later. The network has reached unprecedented levels in decentralized exchange (DEX) volume, and its native token has outperformed almost every other established asset in the crypto market.

This impressive performance can be attributed to numerous innovative projects building on the network. Established and new decentralized physical infrastructure (DePIN) projects, including Helium, Render, Hivemapper, and Nosana, are generating significant buzz for Solana as they find the network suitable for their use cases.

The anticipated launch of Firedancer, a highly awaited new validator client and scaling solution, is also expected to boost Solana’s throughput to 1 million transactions per second.

In a recent media conversation, a security researcher at Solana, Matias Barrios highlighted ongoing enhancements to the network’s infrastructure. Barrios emphasized the positive impact of these upgrades, noting a significant reduction in outages, particularly with none reported during Q2 and Q3. He expressed optimism within the community due to the extensive technical modifications underway, specifically mentioning the awaited introduction of Firedancer.

Barrios predicts these changes will result in “more resiliency, improved uptime, and a better-established blockchain.”

What Is Next For SOL?

Looking at the live chart, SOL is currently trading at the $56 price point, with a positive bullish outlook. Its all-time high (ATH) price rests at $260, indicating substantial upside potential in a bull market. In the short term, a consolidation seems to be forming between the $51.56 and $59.77 price points, following its mini-rally from the $21 region.

The overall market outlook could influence SOL’s next move, with a bullish scenario leading to a sharp move to the $80 price point, and a downward scenario likely targeting the $40 price point. Macro conditions in the market, especially Bitcoin’s price movements, will play a significant role in SOL’s next move.

Final Thoughts

With recent upgrades, Solana has secured a significant market share as one of the top Layer 1 blockchains, ensuring its continued relevance. These ongoing upgrades enhance the chain’s robustness and, thus, position it in a favourable spot to capitalize on any positive momentum in the wide crypto market.

As the market remains bullish on Bitcoin and the Bitcoin halving approaches next year, traders and investors should expect volatility in the lead-up to the event. While uncertainties persist, one thing is certain—Solana’s recent performance has positioned it as a noteworthy player in the crypto landscape.

Disclaimer: This piece is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles (news reports, market analyses) like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Don't miss out!

Subscribe To Our Newsletter

Give it a try. You can unsubscribe at any time.

SNEKbot by DexHunter on CARDANO

Cardano's Telegram Trading Bot live on Cardano mainnet!TRADE NOW!