SEC Approves First US Multi-Crypto ETP — Insights from Grayscale CEO

The U.S. Securities and Exchange Commission (SEC) has greenlit the first multi-asset cryptocurrency exchange-traded product (ETP) in the United States, authorizing Grayscale’s Digital Large Cap Fund (GLDC)...

The U.S. Securities and Exchange Commission (SEC) has greenlit the first multi-asset cryptocurrency exchange-traded product (ETP) in the United States, authorizing Grayscale’s Digital Large Cap Fund (GLDC) for public listing. This groundbreaking development offers investors exposure to five leading cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Solana (SOL), and Cardano (ADA).

The approval, disclosed in a filing on Wednesday, signifies a notable milestone for the digital asset sector and follows the successful launches of U.S. spot Bitcoin ETFs. Multi-asset crypto ETPs simplify institutional and retail access to diversified digital holdings, removing the need for direct account setup on crypto exchanges or direct token purchases.

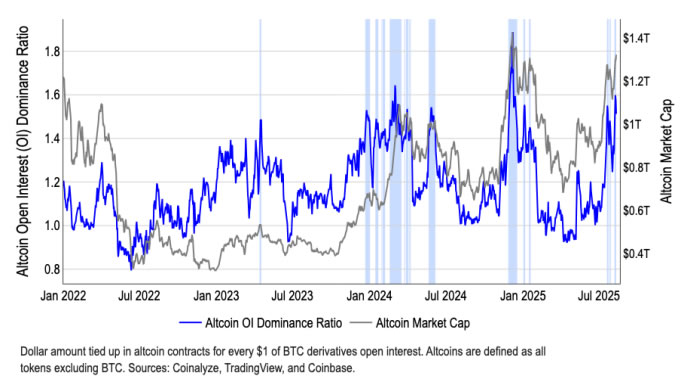

Amid rising market optimism and speculation about an impending altcoin season—a period where alternative cryptocurrencies outperform Bitcoin—investors are increasingly eyeing the broader crypto markets. On August 15, Coinbase projected a “full-scale altcoin season” starting in September, citing historical market patterns and increasing altcoin open interest dominance, as shown in recent reports.

Coinbase’s research analyst David Duong indicated that current market conditions support expectations of a broader altcoin rally as September approaches. This potential shift emphasizes growing confidence in the evolving crypto markets and the increasing role of DeFi and NFTs within the digital economy.

Grayscale’s crypto ETP gains SEC approval under new listing standards

The SEC’s approval leverages recent “generic listing standards” designed to streamline the process for spot crypto ETFs on major exchanges such as Nasdaq, NYSE Arca, and Cboe BZX. This framework reduces the need for individual application reviews, accelerating approval timelines for digital asset-based products.

“Grayscale’s Digital Large Cap Fund $GDLC has been approved for trading under these new standards,” announced Grayscale CEO Peter Mintzberg via X (formerly Twitter). He emphasized that the team is working swiftly to bring this innovative multi-asset crypto ETF to market, which features Bitcoin, Ethereum, XRP, Solana, and Cardano.

“The Grayscale team is working expeditiously to bring the *FIRST* multi-asset crypto ETF with Bitcoin, Ethereum, XRP, Solana, and Cardano to market.”

Mintzberg expressed gratitude toward the SEC Crypto Task Force for their efforts in fostering clearer regulatory guidance for the industry. Established in January under SEC acting Chair Mark Uyeda and led by Commissioner Hester Peirce, often known as “Crypto Mom,” the task force signifies a shift toward more balanced regulation after years of enforcement actions targeting major industry players.

The SEC’s move has been seen as a positive step toward regulatory clarity, potentially paving the way for more mainstream acceptance of crypto-based investment products. The industry continues to await further approvals and clarity as the market persists in its dynamic evolution within the broader crypto markets and blockchain ecosystem.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. Read the full disclaimer

Affiliate Disclosure

This article may contain affiliate links. See our Affiliate Disclosure for more information.

Get real-time cryptocurrency news, blockchain updates, market analysis, and expert insights. Explore the latest trends in Bitcoin, Ethereum, DeFi, and Web3.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!