Cardano Whales Offload 180 Million ADA In 5 Days – Smart Profit-Taking?

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in...

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Cardano is now entering a critical phase after enduring weeks of massive selling pressure and heightened market uncertainty. While the broader crypto market remains fragile due to rising macroeconomic tensions and geopolitical risks, ADA has managed to bounce back, gaining 25% from its early April lows. This recovery has sparked cautious optimism among bulls who believe momentum could continue if key resistance levels are reclaimed.

However, the rebound hasn’t gone unnoticed by larger players. According to on-chain data from Santiment, whales have taken advantage of the recent price upswing to offload more than 180 million ADA in just the past five days. This aggressive distribution suggests that while retail and mid-sized investors may be expecting a rally, some of the largest holders are opting to exit their positions.

The contrasting behavior between whales and smaller cohorts reflects the broader market’s uncertain state. With no resolution in sight to the ongoing trade conflict between the US and China, and fears of a global economic slowdown mounting, bullish conviction remains fragile. The coming days will be pivotal for Cardano, as price action and on-chain signals continue to diverge in a market desperate for clarity.

Cardano Whale Activity Sparks Debate Over Trend Direction

Cardano is now testing a critical demand zone that may determine whether the recent recovery is sustainable or simply a temporary pause in a larger downtrend. After a steady decline that began in early March, ADA is attempting to establish support as global macroeconomic tensions continue to pressure financial markets.

With investors growing increasingly risk-averse, many have chosen to offload both altcoins and Bitcoin to shield their portfolios from escalating volatility and negative sentiment surrounding trade conflicts, inflation, and regulatory uncertainty.

Despite these headwinds, some analysts believe a potential breakout could emerge once current economic pressures begin to ease. But recent whale behavior has raised concerns. According to top analyst Ali Martinez, whales took advantage of ADA’s recent price upswing by offloading over 180 million tokens in just the past five days. This move has sparked debate over whether whales are simply securing profits before further uncertainty—or signaling a deeper continuation of the downtrend.

If Cardano manages to hold its current support levels and attract renewed buying interest, a short-term rally may still be in play. However, failure to defend this zone could confirm bearish continuation, pushing ADA into lower territory. With market sentiment split and high-stakes developments unfolding globally, ADA’s next move could set the tone for its performance throughout the quarter.

ADA Stalls Below Resistance As Bulls Face Critical Test

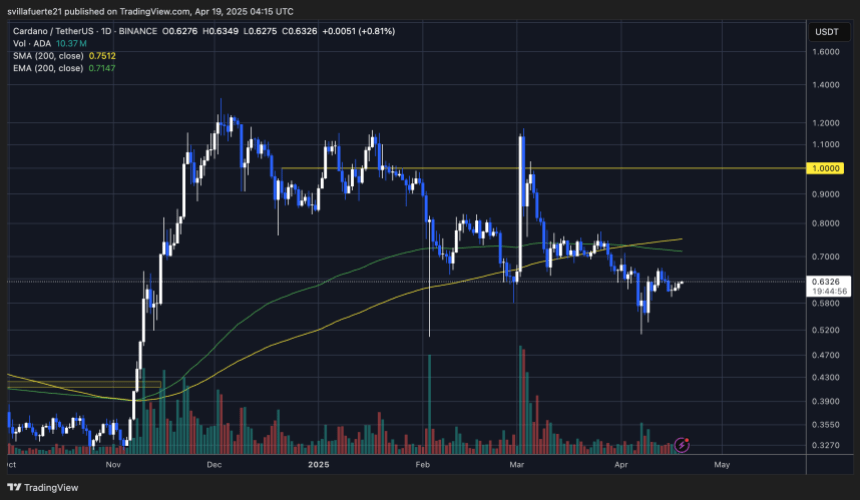

Cardano (ADA) is currently trading at $0.63 after several days of sideways movement and failed attempts to break above the $0.66 resistance zone. This level has capped recent upside momentum, signaling that bulls are struggling to gain control in the current environment of macroeconomic uncertainty and risk-off investor sentiment.

To confirm a true bullish reversal and break the broader downtrend, ADA must reclaim the $0.75 level, which is aligned with the 200-day moving average. A decisive move above this mark would reestablish long-term strength and could open the door to a sustained recovery rally. Until then, ADA remains in a vulnerable position, caught between key resistance and fragile support.

On the downside, losing the $0.60 level could trigger another wave of selling pressure. Such a move would likely push the price back toward the $0.50 support zone, a level not seen since earlier this year. As global markets remain on edge amid geopolitical tensions and investor uncertainty, ADA’s next move will depend on whether bulls can generate enough momentum to flip key resistance or risk further downside if sellers take over.

Featured image from Dall-E, chart from TradingView

Sebastian's journey into the world of crypto began four years ago, driven by a fascination with the potential of blockchain technology to revolutionize financial systems. His initial exploration focused on understanding the intricacies of various crypto projects, particularly those focused on building innovative financial solutions. Through countless hours of research and learning, Sebastian developed a deep understanding of the underlying technologies, market dynamics, and potential applications of cryptocurrencies.

To share his insights with others, Sebastian became an active contributor to online discussions on platforms like X and LinkedIn. His focus on fintech and crypto-related topics quickly established him as a trusted voice in the online crypto community. Sebastian's goal was to educate and inform his audience about the latest trends and insights in the rapidly evolving crypto landscape.

To further enhance his expertise, Sebastian pursued a UC Berkeley Fintech: Frameworks, Applications, and Strategies certification. This rigorous program equipped him with valuable skills and knowledge regarding Financial Technology, bridging the gap between traditional finance and decentralized finance. The certification deepened his understanding of the broader financial landscape and its intersection with blockchain technology.

Sebastian's passion for finance and writing is evident in his work. He enjoys delving into financial research, analyzing market trends, and exploring the latest developments in the crypto space. In his spare time, Sebastian can often be found immersed in charts, studying 10-K reports, or engaging in thought-provoking discussions about the future of finance.

Sebastian's journey as a crypto pioneer has been marked by a relentless pursuit of knowledge and a dedication to sharing his insights. His ability to navigate the complex world of crypto, combined with his passion for financial research and communication, makes him a valuable contributor to the industry. As the crypto landscape continues to evolve, Sebastian remains at the forefront, providing valuable insights and helping to shape the future of this revolutionary technology.

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!