Cardano Price Eyes $0.75 Rally As Analysts Highlight Key Buy Zones - The Market Periodical

Key Insights: Cardano price may find major support at $0.54 before rebounding towards $0.75. Breakout projections indicate potential upside to $0.765 and a long-term target of $2.70. Regulatory clarity under...

Key Insights:

- Cardano price may find major support at $0.54 before rebounding towards $0.75.

- Breakout projections indicate potential upside to $0.765 and a long-term target of $2.70.

- Regulatory clarity under the CLARITY Act could increase the institutional appeal of ADA.

Cardano price is consolidating within a multi-month channel, showing signs of a potential recovery. Analysts identify $0.54 as a key support level that could trigger a turnaround. Multiple projections are now indicating a potential long-term move to $2.70.

Cardano Price Finds Strong Support Near $0.54

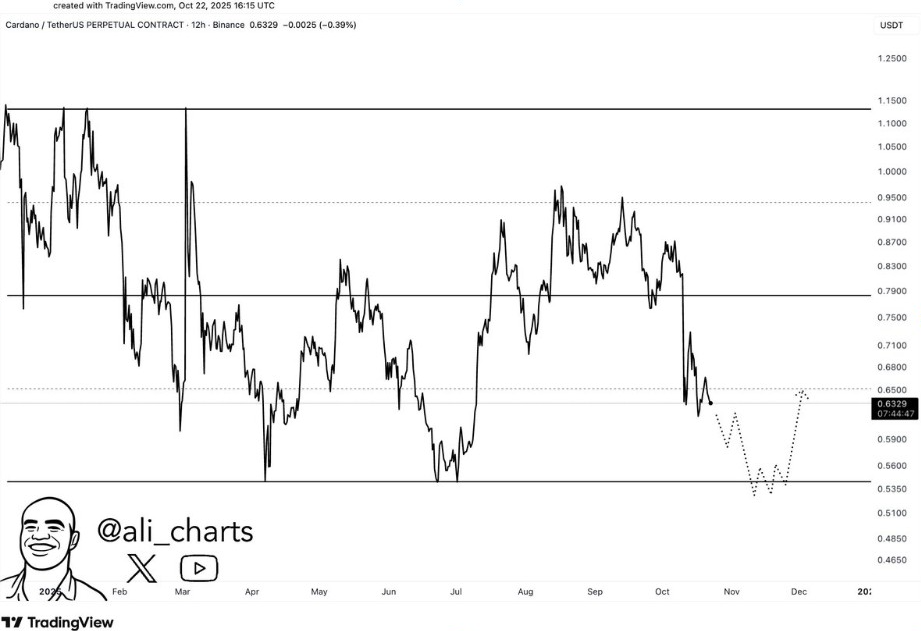

ADA price action is approaching a significant support level at $0.54, identified by analyst Ali. Cardano price is currently trading near $0.63, showing signs of consolidation. A dip toward the accumulation zone may precede a potential rebound.

Historically, the $0.54 zone has been an attractive area for buying pressure and the start of medium-term rebounds. A continued hold above this region would be bullish structural support.

Technical formations suggest consolidation ahead of a potential upside toward $0.70 in the near term. A rebound from the current level may push the ADA price back into its consolidation range. The target zone lies between $0.75 and $0.80.

Market players are closely monitoring this region. They are also considering it a good area to enter the market if the price holds above the support level.

Breakout Setup Suggests Short-Term Upside Potential for Cardano Price

Furthermore, Rafaela Rigo’s chart depicted the Cardano price forming a descending wedge pattern. This indicates a potential near-term breakout attempt. The setup is consistent with improving volume dynamics, which signals possible reversal momentum.

A breakout above the wedge’s upper boundary could trigger upward momentum. ADA price may then reach the $0.765 price level. The projection aligned with a 24.8% potential upside of the current range.

This target aligns with the next significant resistance. This reinforces it as a crucial pivot point. Additionally, momentum indicators have begun to stabilize, and this supports short-term recovery prospects. The trendline resistance has been tested many times.

Also, a solid close above this line could confirm a reversal. Investors are now watching the $0.70-$0.76 range as a probable rebound target over the subsequent few sessions.

Multi-Year Compression Channel Points to $2.70

Similarly, analyst BitcoinSensus marked a larger ascending structure that has shaped the Cardano price trend for several years. The weekly chart indicates that the ADA price is respecting both the top and bottom channels.

It is forming repeating cycles of compression before a potential major rally. Each previous compression resulted in significant percentage improvements, ranging from 200% to 300%.

The current formation, if it continues its history, could have a potential rally of up to 550%. This projection puts the long-term price target at $2.70.

Additionally, the upper boundary near $2.70 represents a measured move estimate based on past expansions. A sustained breakout above the short-term resistance zones would confirm this long-term path.

The structure indicates the potential for longer accumulation periods followed by larger impulsive rallies. According to BitcoinSensus, the channel remains intact, and ADA continues to honor historical symmetry.

The pattern supports the idea that long-term investors could benefit from current discounted prices. This holds as long as the Cardano price maintains its trend structure.

Regulatory Clarity Strengthens Fundamental Outlook

Meanwhile, Cardano’s ecosystem is drawing attention due to its high levels of decentralization. The CLARITY Act is a bipartisan bill under review in the U.S. It proposes that the ADA should not be classified as a security. Instead, it would be treated as a digital commodity.

This development could enhance institutional confidence in the asset. Cardano’s proof-of-stake design features over 2,800 active pools, with no single entity holding more than 20% of the total supply.

This level of decentralization makes ADA one of the most transparent and secure blockchain networks. Furthermore, a favorable regulatory outcome may strengthen market sentiment and liquidity inflows.

Analysts say that such clarity would cement ADA’s position alongside Bitcoin and Ethereum as established decentralized assets. Coupled with a sound technical structure, these fundamentals lend weight to the current bullish narrative.

Crispus is a distinguished Financial Analyst at, bringing over 12 years of expertise in cryptocurrency markets, specializing in Bitcoin and altcoins. Renowned for his sharp insights at the nexus of market trends and breaking news, Crispus delivers actionable analysis to empower investors. His work is prominently featured across leading platforms, including BanklessTimes, CoinJournal, HypeIndex, SeekingAlpha, Forbes, InvestingCube, Investing.com, and MoneyTransfers.com, cementing his reputation as a trusted voice in the financial world.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!