Top 10 Best Cardano Staking Pool With APY Calculated [2023]

Staking crypto is a great way to earn passive income. However, to maximize your earnings, you need to be able to identify the best stake pools and what they have to offer. So, we are going to walk you through...

![Top 10 Best Cardano Staking Pool With APY Calculated [2023]](https://coinwire.com/wp-content/uploads/2023/02/best-cardano-staking-pool.png)

Staking crypto is a great way to earn passive income. However, to maximize your earnings, you need to be able to identify the best stake pools and what they have to offer. So, we are going to walk you through the best Cardano staking pools, explaining each pool and what makes it a top choice for your ADA staking needs.

Best Cardano ADA Staking Pools Overview

Cryptocurrency staking is a popular strategy for generating extra income from crypto ownership. Because traders who deposit funds in staking pools generate liquidity for a particular trading pair, exchanges reward them with some interest paid in digital currency. With the right staking knowledge, the returns can generate decent profits. Using this best Cardano staking pools article, ADA traders can identify platforms that will generate the best return on investment for Cardano staking.

Key Insights

Here are the key insights you will draw from this best Cardano stake pools listicle.

- A list of 15 most rewarding ADA staking platforms, categorized by their annual percentage yield (APY) for a flexible staking duration.

- Detailed summaries about what each platform offers.

- Factors to consider when choosing a staking pool.

Where to Stake Cardano

The best way to stake ADA is through a centralized crypto exchange or a crypto wallet. Each platform has pros and cons that encourage or discourage certain users from using it. Below, we will analyze each platform’s strengths and weaknesses to help you make a more informed decision.

Centralized Exchanges

Crypto exchanges are trading platforms where users can buy or sell cryptocurrency assets. When it comes to Cardano staking, there are multiple crypto exchanges where one can stake ADA.

The leading Cardano staking crypto exchanges include OKX, KuCoin, Coinbase, etoro, Kraken, and Nexo. Exchanges have significant pros as staking platforms, but they also have cons. Let’s analyze the merits and demerits of staking ADA on crypto exchanges.

Pros

- Security: Crypto exchanges often undergo a lot of auditing and verification processes. These ensure fewer cases of hacking or asset losses.

- Reliability: Because of their high levels of security and the extent of infrastructure, crypto exchanges are reliable and have minimal downtime, if any.

- Multiple use cases: With crypto exchanges, investors can do more than just stake Cardano. They can trade Cardano or other coins or digital assets.

Cons

- High costs: Often, crypto trading platforms may have higher transactional costs than other Cardano staking methods like crypto wallets.

- Custodial nature: The tokens you stake on crypto exchanges are held exclusively by the exchange. This custodial ownership structure tends to limit the decentralized nature of a token like Cardano.

Wallets

Leading crypto wallets like Exodus Wallet and Youhodler are great examples of ADA staking wallets. Such staking pools have their benefits and their shortcomings. Here are a few pros and cons of using crypto wallets as stake pools.

Pros

- Custodial ownership: Most crypto wallets allow users to own and manage the tokens in their portfolio, which may be more convenient for particular users.

- Relatively affordable: Unlike crypto exchanges, crypto wallets may charge lower transaction fees.

- Simpler to use: While Crypto exchanges are designed for traders, wallets are made for general users, so their interface and features may be easier to navigate.

Cons

- They may not be as secure: Crypto wallets aren’t as strictly regulated as most crypto exchanges. This can expose them to security breaches, especially if they are hot wallets.

What Is the Best Cardano Staking Pool?

Let’s explore a Cardano stake pool ranking to determine the best platforms to stake your Cardano coins for maximum rewards.

OKX

APY for an adjustable staking duration: 2.15%

The Seychelles-based crypto trading company OKX is another top staking pool for Cardano tokens. The exchange, previously known as OKEx, is famous for the wide range of cryptocurrencies it supports and the stake pools it offers.

When staking Cardano on OKX, traders can lock their coins for an adjustable or fixed time frame. The adjustable time frame allows staking for any period above 15 days and generates 2.15% APY. On the other hand, the fixed-time frame categories on OKX are 30, 60, or 120 days, and they attract higher APY.

Occasionally, the platform also offers flash deals. These bonus deals offer clients who stake during the deal’s duration a chance to make as much as 500% APY for staked ADA tokens. Although flash deals are not exclusive to Cardano stake pools, they are still a chance for Cardano traders to make a quick buck from staking the coins. The rewards for all staked ADA tokens on OKX are paid hourly.

| Minimum and Maximum Staking Amounts | Minimum – Unspecified Maximum – Unspecified |

|---|---|

| 30-day Staking APY | 4.3% |

| 60-day Staking APY | 4.84% |

| 120-day Staking APY | 16.12% |

KuCoin

APY for an adjustable staking duration: 3.11%

KuCoin is one of the best crypto staking pools for staking ADA. The platform is designed for intermediate to advanced traders, and comes with impressive features to help traders earn from crypto. From trading bots, to cloud mining options, KuCoin has a host of features to explore. However, the platform’s highlight is its staking options.

On KuCoin, users can use traditional staking options or apply for soft staking. Soft staking allows users to stake their tokens without having to lock them up. This reduces the risk associated with staking making the platform one of the best staking pool not only for ADA tokens, but for other digital currencies as well.

If users opt for the traditional staking method on KuCoin, they choose whether to lock their coins for a flexible or fixed period. Flexible staking for ADA on KuCoin generates an APY of 3.11%. This value rises for the fixed period options that can be 14 or 30 days. KuCoin traders receive staking rewards daily.

| Minimum and Maximum Staking Amounts | Minimum – 0.01 ETH Maximum – Unspecified |

|---|---|

| 14-day Staking APY | 6.21% |

| 30-day Staking APY | 8.62% |

Coinbase

APY for an adjustable staking duration: 3.11%

Another exchange for impressive Cardano staking deals is Coinbase. Coinbase crypto exchange is renowned for the massive number of crypto it supports and the range of its trading options. The platform is also famous for having lucrative staking pools for multiple altcoins like Cardano.

Traders can stake ADA tokens on Coinbase flexibly or inflexibly. Adjustable staking periods generate 3.11% APY for the staked tokens. However, Coinbase only issues rewards for first-time holdings when users stake ADA for 20 to 25 days. When they complete this period, they receive their staking rewards after every five to seven days.

| Minimum and Maximum Staking Amounts | Minimum – $1 worth of ADA Maximum – Unspecified |

|---|---|

| 20-25 day Staking APY for initial holdings | 3.11% |

Exodus Wallet

APY for an adjustable staking duration: 4.09%

Among the leading Cardano staking pools is the Exodus software wallet. Exodus Wallet is a blockchain wallet that allows users to store their crypto assets. This wallet is an enticing ADA staking option because it has a pool-finding feature that helps users identify the best staking pools for ADA tokens.

Using the platform’s API provider, Everstake, ADA traders on Exodus don’t go through the hassle of searching for pools with the highest returns. Instead, Everstake automatically redirects staked funds to the best available pool at the time of staking.

Cardano staking on Exodus wallet generates 4.09% APY and has a flexible staking time frame. However, first-time users need to stake their coins for at least 20 days to get rewards. The staging rewards are paid five days after the end of the staking period.

| Minimum and Maximum Staking Amounts | Minimum – 5.5 ADA Maximum – Unspecified |

|---|---|

| 20-day Staking APY for initial holdings | 4.09% |

eToro

APY for an adjustable staking duration: 5.6%

Traders looking for a simple yet efficient platform to stake Cardano will find eToro very convenient. This crypto exchange is generally known for its intuitive user interface and beginner-centric features, like copy trading, that make it easier for novice traders to carry out crypto trades.

The best feature to leverage on this crypto broker platform is its automatic staking feature. eToro users don’t have to stake their ADA coins manually. As soon as a trader buys ADA tokens, they automatically get the option to auto-stake it. Auto-staking comes at an extra cost, but it is worth the investment.

eToro’s flexible staking options are also highly rewarding. Traders can earn about 5 to 6% APY, and all staking options have flexible time frames. The exchange’s users also benefit from a monthly report on the amount earned from their staking efforts. Staking rewards are also disbursed per month.

| Minimum and Maximum Staking Amounts | Minimum – 1$ worth of ADA Maximum – Unspecified |

|---|---|

| Staking APY for initial holdings | 5.6% |

Youhodler

APY for an adjustable staking duration: 5.65%

For traders seeking impressive benefits for their Cardano staking efforts, Youhodler. The platform is among the best alternatives for ADA staking, offering users impressive returns on investment.

Youhodler users can stake ADA tokens on the platform for flexible duration, and end up earning as much as 5.65% APY. The exchange also generates compounded interest for the staked ADA, further improving the user’s earning prospects.

However, Youhodlers most impressive aspect where ADA staking is concerned is the exchange’s Dual Assets feature. Using Dual Assets, ADA traders can stake their coins for 12 hours to two days and earn returns as high as 230%. This high-yield strategy positions Youholder as an impressive ADA stake pool.

| Minimum and Maximum Staking Amounts | Minimum – 1$ worth of ADA Maximum – Unspecified |

|---|---|

| Staking APY for initial holdings | 5.65% |

Kraken

APY for an adjustable staking duration: 6%

United States-based cryptocurrency exchange, Kraken, is among the top 8 best ADA staking pools, with good reason. Although it is known more for being one of the earliest Bitcoin exchanges listed globally, Kraken has also made a name for itself where crypto staking is concerned.

Kraken users can stake crypto, in this case ADA, without any lock-up periods and enjoy some of the highest returns in the crypto market. These returns can be as high as 6% APY and users receive them as weekly payouts.

Besides these lucrative returns, Kraken is a preferred ADA tokens staking pool because of the flexibility it offers. Since staking is not fixed to any schedule, users can exit a staking position quickly in case they identify the need to trade ADA. The exchange offers a simple “staking wallet to spot wallet” transfer process that is available to users regardless of their subscription tier.

| Minimum and Maximum Staking Amounts | Minimum – 1$ worth of ADA Maximum – Unspecified |

|---|---|

| Staking APY for initial holdings | 5.65% |

Nexo

APY for an adjustable staking duration: 6-7%

Blockchain lending platform Nexo takes the top spot on this Cardano staking pool listicle. Although it offers nearly the same rate as Kraken, for an adjustable staking time frame, this lender’s Cardano staking options are quite varied, opening it up for more staking benefits.

The first benefit that comes with this platform is its loyalty-tier reward system. Nexo classifies users based on the amount of Nexo tokens they have in their accounts. Users with up to 1% of Nexo coins in their portfolio are in the Base tier, earning 6% APY, while those with at least 10% Nexo tokens are in the Platinum tier which offers 7% APY. The two middle tiers, Silver and Gold, require at least 1-5% and 5-10% Nexo tokens and pay 6.25% and 6.50% APY respectively.

Nexo users can also opt to receive staking rewards in kind. This means the payment they get is made using the currency they are staking. However, traders who choose this option receive lower APY compared to traders on the same tier who choose to receive payments in NEXO, Nexo’s native currency. For instance, Base tier traders paid in kind will receive 4% APY, while those in other tiers receive 4.25%, 4.50%, and 5% respectively.

| Minimum and Maximum Staking Amounts | Minimum – Unspecified Maximum – Unspecified |

|---|---|

| 30-day Staking APY | 7% |

| 90-day Staking APY | 8% |

What Is Cardano Staking?

Staking is one of the most popular ways to earn from cryptocurrencies. The process involves locking up or submitting the tokens in a trader’s account to a staking pool, which is used as liquidity on the staking platform. As a reward, traders receive interest based on the staking pool’s stated APY and the amount of staked tokens.

Cardano staking works similarly, though it may have a few variations. First, the platform assigns individuals known as stake pool operators to oversee the staking process. To be a stake pool operator, one needs a deep understanding of the Cardano network and top-tier hardware to distribute ADA staking returns.

When traders stake their ADA in ADA stake pools, they are essentially delegating the funds to staking pool operators for a duration known as an epoch. An epoch, by Cardano standards, is a period of 432,000 one-second intervals, roughly five days. An epoch is often the least time it takes to stake and receive an ADA staking reward. All rewards are paid in ADA unless the staking platform has varied payment options.

How to Choose the Best Staking Pool on Cardano

Cryptocurrency staking is lucrative when you know how to do it right. The process requires a good understanding of basic crypto concepts and knowledge of the right staking pools. But how do you identify suitable Cardano staking pools? Here are a few pointers

Yield

The Annual Percentage Yield (APY) is the leading tell-tale sign of a good Cardano staking platform. APY is the percentage interest that your staked tokens will accrue. Comparing APY is critical in finding the right staking pool because a higher APY means a higher Return on Stake(ROS).

Saturation

In staking lingo, saturation refers to the size of a staking pool. A big pool is great because it mints more blocks and has the potential to earn more. But, a highly saturated staking pool means rewards will be divided among more traders. Therefore, traders in highly saturated pools get lower ROS. The Cardano network, however, tries to curb this situation as much as possible by limiting the reward rates that a staking pool can receive.

Pool Fees and Margins

Some Cardano staking pools charge fees for staking on them. Conversely, a margin is a percentage charge that the pool takes from its total rewards after deducting the pool fees. The lower the pool’s staking fees and margins, the more the rewards in a pool. This makes pool fees and margins a critical consideration when choosing an ADA stake pool.

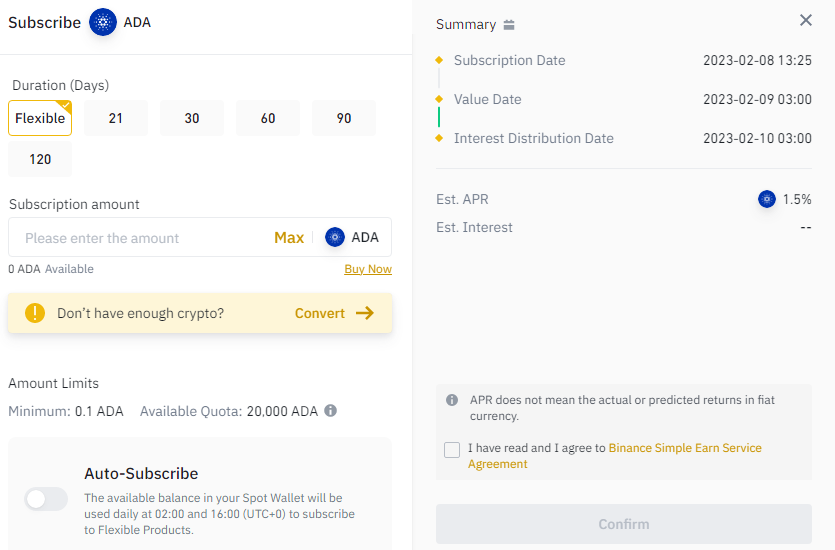

How to Stake Cardano on Binance

Staking Cardano on Binance is a simple two-step process involving creating a Binance account and setting up staking. Let’s explore how to start staking Cardano on Binance.

Step 1: Creating a Binance account.

If you do not have a Binance account, follow the steps in this guide to learn how to create a Binance account. But, if you already have a Binance account, proceed to step 2.

Step 2: Setting up ADA staking on Binance.

The staking feature on Binance supports ADA staking. Here are the step-by-step instructions for setting up Cardano staking on Binance.

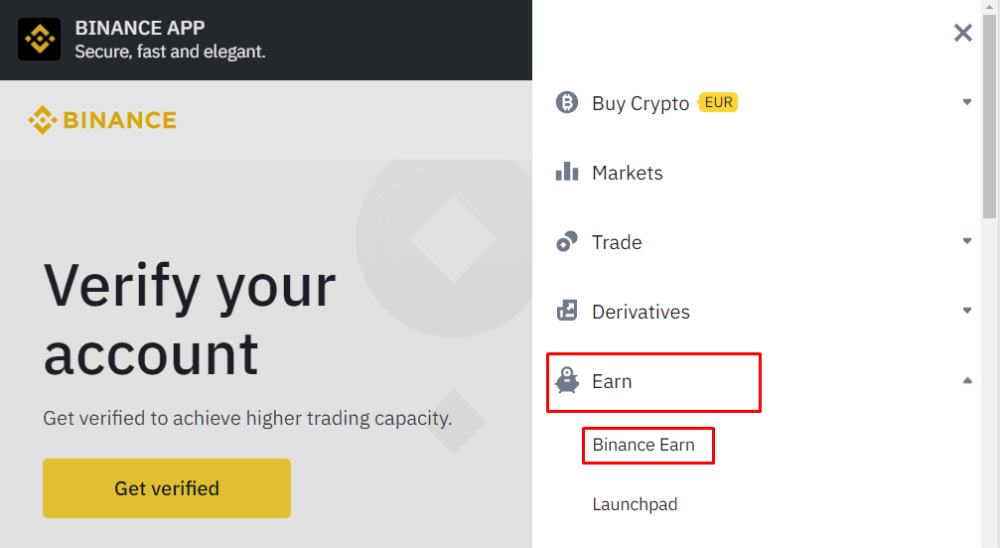

- Login to your Binance account, click on the Menu icon, search for the Earn option, and click the Binance Earn option under it.

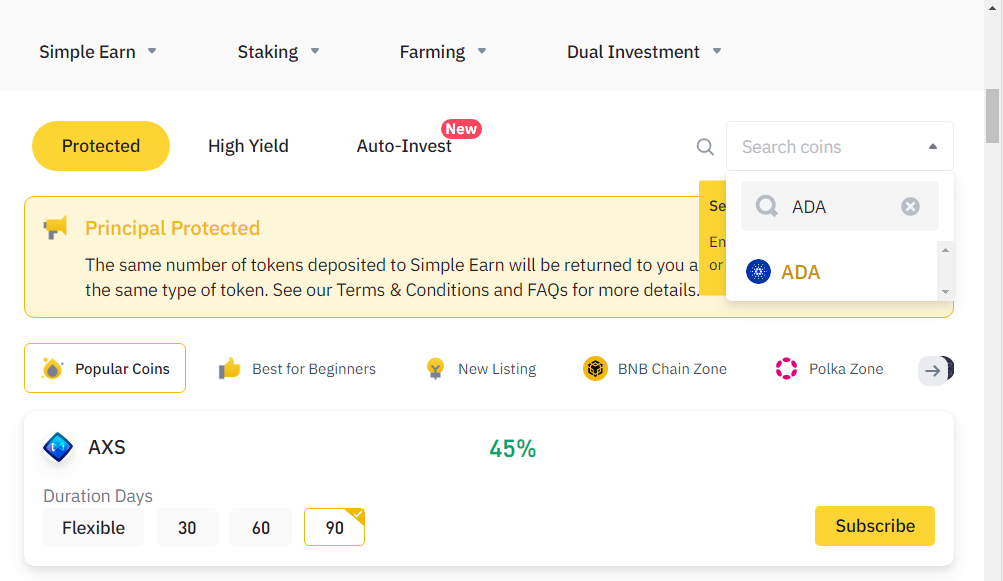

- Use the Search field on the tab that opens to search for the coin you want to stake, in this case, ADA.

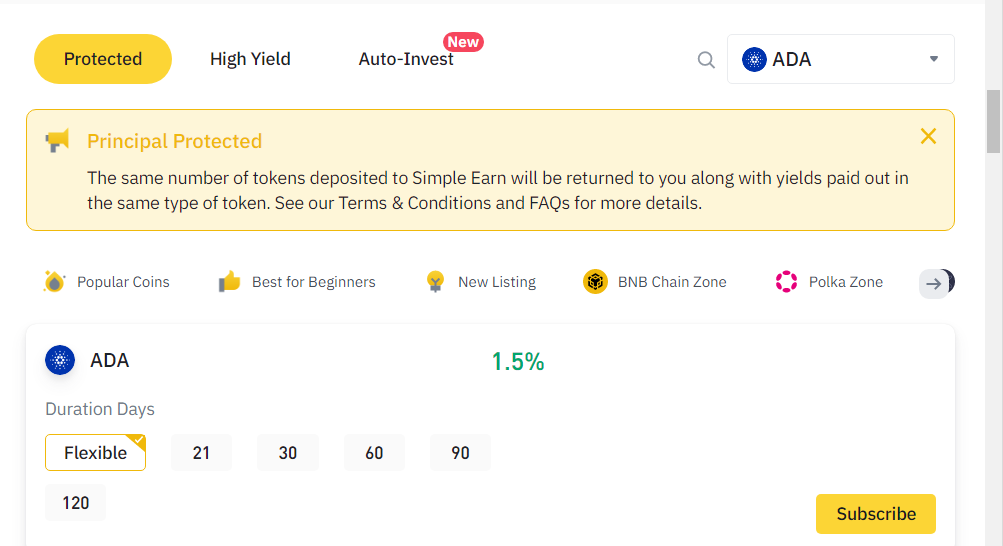

- Once you find the coin, click on it, select your preferred stalking duration, and click Subscribe.

- Enter the amount of Cardano you want to stake in the Subscription amount field.

Read and agree to Binance’s terms and conditions, then tap the Confirm button to initiate staking.

FAQs

Which is the best Cardano staking pool?

Three main factors determine the best place to stake Cardano ADA. The first is APY, which determines the percentage of interest earned when staking. Other than that, you need to consider the pool’s size and the low fees and margins charged on the pool.

Based on these factors, some of the best Cardano staking pools include Nexo, Kraken, Youhodler, eToro, Exodus Wallet, Coinbase KuCoin, OKX, BiTrue, ByBit, Binance, Huobi Global, and Crypto.com.

How much Cardano do you need for staking?

Identifying a staking pool helps you know how much Cardano to stake. Some pools have a minimum and maximum amount you can stake, while others don’t have limits or do not specify the limits.

Can I stake ADA Coins on Binance?

Yes. Binance has an ADA stake option that is relatively lucrative. Binance’s ADA stake pool offers users 1.5% APY for a flexible staking duration. For fixed durations, the exchange offers 2.7% for 30-day staking, 3.2% for 60-day staking, 4.2% for 90-day staking, and 5.29% for 120-day staking.

Is crypto staking safe?

Cryptocurrency staking is a safe venture when carried out on a trustworthy stake pool. However, staking is risky, especially for staking pools with lock-up periods. Having your tokens locked up for a designated period means that if the coin’s value begins to plummet while in lock-up, you can not sell it off to prevent losses. Also, you can’t capitalize on price spikes to make a profit.

Who is a Validator on Cardano?

A Cardano validator is somebody who has their own Cardano node. Nodes are dedicated servers that facilitate the decentralized framework of the Cardano ecosystem. Validators use these nodes to validate transactions and monitor how pools interact with the Cardano blockchain network and the Cardano community. They are responsible for processing transactions and generating blocks in the Cardano ecosystem.

What Is the best wallet for staking Cardano?

The best Cardano wallet for staking is Youhoder with an APY of 5.65%. This wallet offers the highest APY for adjustable staking periods. Compared to other wallets like Exodus Wallet, whose APY is around 4.5%, Youhodler is a better stake pool for ADA.

Is staking Cardano worth it?

Staking Cardano is worth it. You can generate an average Cardano staking APY of 4% for flexible staking periods.

However, staking is compressed and can come with many challenges. For instance, you can easily lose money on staked tokens if their value plummets during the staking period because you can’t sell your shares.

What is the highest yield for staking Cardano?

The average yield you can get for staking Cardano is 4% annually. This may go higher depending on the stake pool you select. Staking yields also increase depending on the staking duration. The longer the duration, the more the payout.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!