Deciphering if Cardano buyers should consider buying this ‘dip’

The post Deciphering if Cardano buyers should consider buying this ‘dip’ appeared on BitcoinEthereumNews.com. Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice. Cardano bears found renewed selling...

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Cardano bears found renewed selling pressure and extended the coin’s descent.

- The crypto’s funding rates and the long/short ratio unveiled some hope for the buyers.

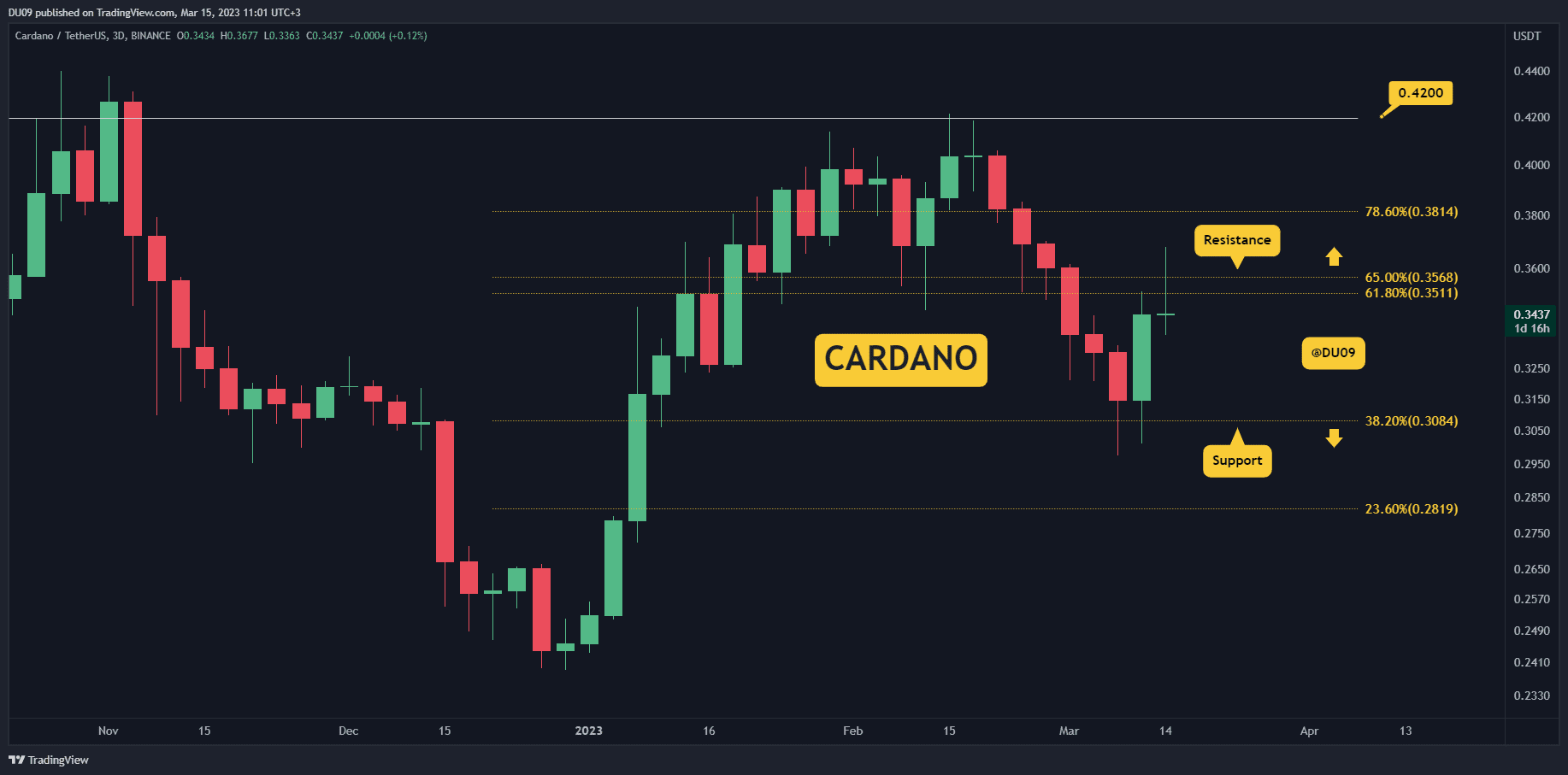

After reversing from the $0.51-resistance on 12 September, Cardano [ADA] expedited its southbound trajectory for over a month now. The entailing descent chalked out a trendline resistance (white, dashed) that has undermined the buying rallies for nearly six weeks.

Here’s AMBCrypto’s price prediction for Cardano [ADA] for 2023-24

With the price action struggling to snap the limitations of its 50 EMA (cyan), the broader trend continued to tilt toward the sellers. A reversal from its newly-found support could spur some buying pressure in the coming sessions.

At press time, ADA was trading at $0.3391, down by 4.34% in the last 24 hours.

Will bears continue finding fresher lows?

For over a month, the 20 EMA (red) and the 50 EMA kept the buying rallies under control by inducing reversals. Thus, the narrative refrained from exhibiting a buying edge for over a month.

After barely maintaining a position above its six-week trendline resistance, ADA fell back into the bearish track over the last two weeks.

The recent symmetrical triangle setup saw an expected breakdown while highlighting a continuation of the downtrend. This resulted in the bears flipping the $0.34 mark from support to immediate resistance.

Thus, a close below the $0.33-support could reignite solid bearish pressure and trigger a selling signal. The first major support level stood at the $0.3078-mark. The recent volatile break has put ADA in a relatively low liquidity zone. Hence, making its price more fragile to highly volatile moves.

Nonetheless, a likely reversal from its multi-monthly lows can aid the buyers in retesting the trendline resistance in the $0.36 zone. A sustained close above the $0.36 level could affirm a near-term bearish invalidation.

The Accumulation/ Distribution (A/D) marked a streak of higher troughs over the last week. This trajectory chalked out a bullish divergence with the price action.

The funding rates witnessed gradual growth

Since mid-September, ADA exhibited weak price sensitivity with its funding rates on Binance. Over the past week, the gradual increase in these rates accompanied a price decline. Should the price action find a rebound from its oversold readings, the price action could potentially bounce back in the coming sessions.

Interestingly, ADA’s long/short ratio over the last four hours revealed a slight edge for the buyers. Finally, the buyers should factor in Bitcoin’s movement and its effects on the wider market to make a profitable move.

Source: https://ambcrypto.com/deciphering-if-cardano-buyers-should-consider-buying-this-dip/

Post navigation

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!