Crypto Market Update

Bitcoin broke through the 3 month old downtrend. Onchain data still backs up a bullish narrative

.png)

Bitcoin broke through the 3 month old downtrend

Onchain data still backs up a bullish narrative

Market sentiment is now mixed. Although price action is pointing to an uptrend, CPI results and geopolitical tension warrants caution

Price Action

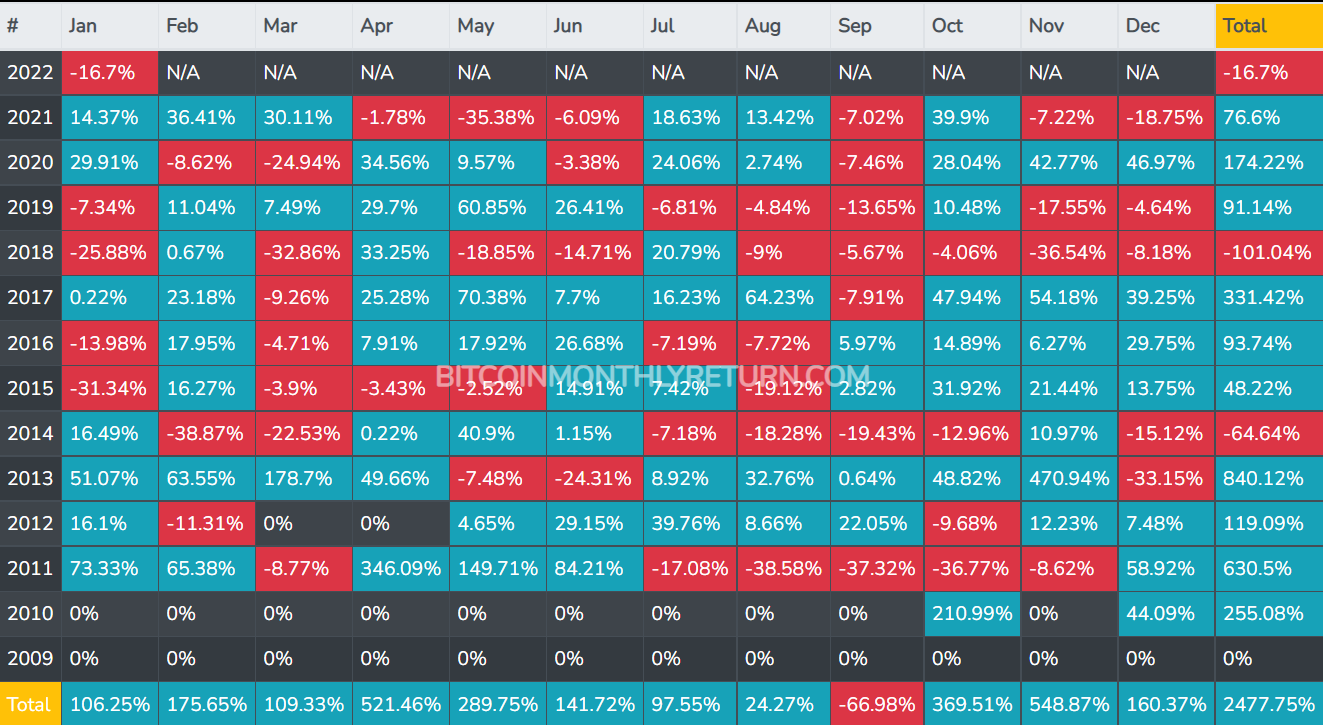

January was brutal for BTC, as the price plummeted from $48k to $33k. This marks the third worst January in Bitcoins history, with a ROI of -16.7%

Not all is bad news though. After the low on the 25th, $BTC bounced and has been on a steady uptrend ever since, putting in higher highs and higher lows on the shorter time frames. It also broke a descending trendline that was acting as resistance since the previous ATH, back in November.

On the longer timeframes, we can see that it is still trading below the bullmarket support band (which encompasses the area between the 20 week simple moving average and the 21 week exponential moving average). The bulls cannot claim victory until we are above this indicator.

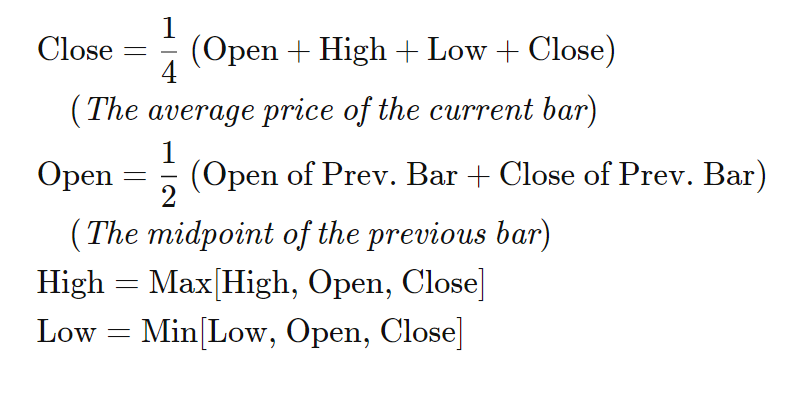

Another way we can look at price movement is through the Heikin Ashi candles. These candles don’t just take into account arbitrary open and close prices, but factor in the average price for that week.

This outputs a much better outlook on trends. It is especially useful on longer time frames.

Looking at the BTC weekly chart, we can see that a trend was broke last week, giving us the first green candle in 12 weeks. This doesn’t mean that price can’t drop any further, but it is a reversal signal that we should take into account

Onchain Data

The NUPL (Net Unrealized Profit/Loss) seems to have bounced and is now rising slowly again. Ideally, we don’t see it drop again, since entering the red area could mean a capitulation event and a prolonged bear market.

Another interesting onchain metric we can look at is the percent balance on exchanges. That is, what percentage of the BTC circulating supply is currently on exchanges being traded, and not being stored in non custodial wallets.

This metric is in a 3.5 year low at around 13.25%. Less bitcoin on exchanges indicates a high demand for long term holding, and can also lead to a supply shock if retail interest picks up.

Market Sentiment

With the recent uptrend, market sentiment seems to have picked up momentum as well. The Fear&Greed Index is now above 40 after spending over a month below it

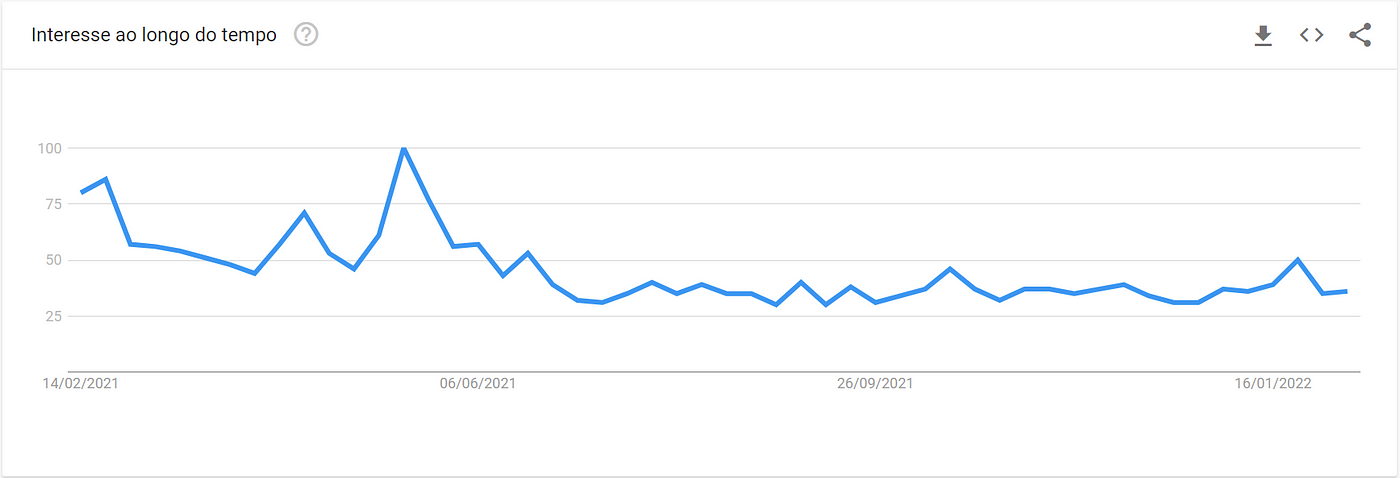

The search trends for “Bitcoin” are slowly going up as well, after hiting a bottom at 29 interest points, and is now at 36.

Meanwhile, as tensions between the Ukraine and Russia increase, the FED released the US YoY inflation rate numbers, and panic ensued. Although the rational thought in the long term is to invest in deflationary assets to leverage Fiat inflation, the short-term threat of a recession is causing some uncertainty in the market.

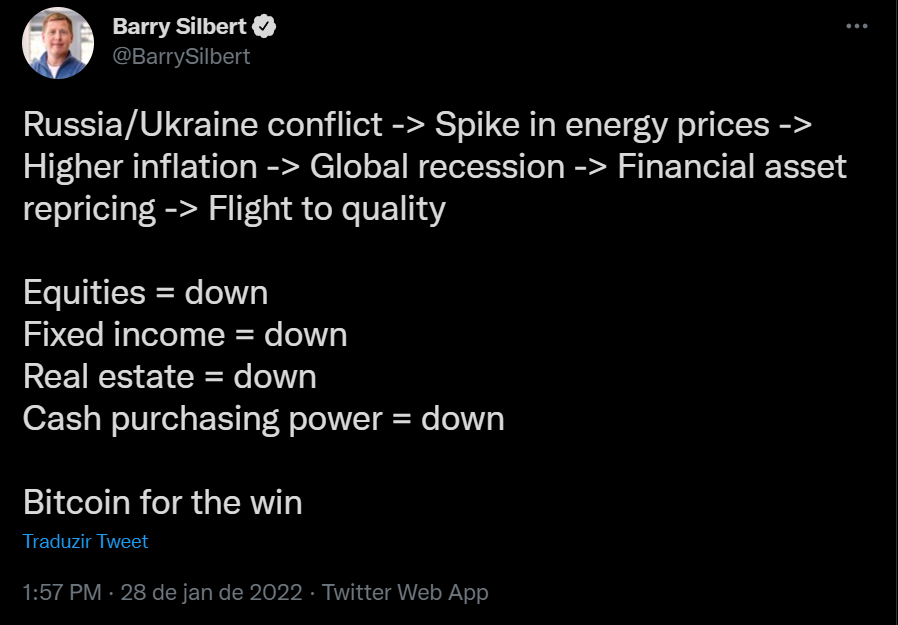

Barry Silbert, Founder of the Digital Currency Group, believes Bitcoin is the winner that comes out of the geopolitical tension that has been felt recently

Benjamin Cohen, owner of the ever so popular Youtube channel Into the cryptoverse, is liking how the chart looks. He does believe that the reversal is not yet confirmed and that the real test comes after going above the bull market support band and comes back to test it.

Michael Saylor, whose company, MicroStrategy, has been accumulating thousands of $BTC over the last year, seems unphased by the recent news, and keeps posting bullish sentiment thoughts

There was a clear cut on the downtrend at the end of January, but it remains to be seen if this is a true shift on the market or just a bounce. The news hasn’t helped Bitcoin, and the momentum has recently shifted again. Bitcoin seems to be in limbo, deciding where to go.

Regardless, seems that holding Bitcoin is still seen as the best hedge against inflation, in the long run

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!

.png)