Crypto Market Holds $3.8T as ETF Outflows Hit $674M — Could a Reversal Be Ahead This Week?

Despite $674 million in ETF outflows, the global crypto market remains above $3.8 trillion. Here’s what the latest data reveals about Bitcoin, altcoins, and investor sentiment as a new trading week begins.

The global cryptocurrency market is entering the final days of September with a surprising show of strength. Despite more than $674 million in ETF outflows last week, a figure that would typically rattle investor confidence, the total crypto market capitalization remains firmly above $3.8 trillion as of this morning.

This resilience suggests that, despite ongoing institutional profit-taking, broader market sentiment remains cautiously optimistic. Traders are closely watching whether this week marks the beginning of a fresh recovery phase or if sustained outflows could drag the market lower as we approach Q4.

ETF Outflows Pressure Market Sentiment, But Not Structure

The $674 million in ETF withdrawals primarily stem from U.S. Bitcoin ETFs, which saw heavy redemptions after a month of steady inflows. Analysts attribute this to a combination of profit-taking, quarter-end portfolio adjustments, and rising Treasury yields, all factors that have historically created short-term selling pressure in risk assets.

Yet despite these outflows, the overall market structure remains intact. Bitcoin continues to trade comfortably above key support levels, and altcoins are showing signs of accumulation at lower price zones. This indicates that the capital exiting ETFs is not necessarily leaving crypto entirely, it’s likely rotating into spot positions or other digital assets.

Bitcoin Steadies, Altcoins Begin Accumulation

Bitcoin (BTC) remains the market’s anchor, holding firmly above the $100,000 level even as ETF redemptions mount. Technical indicators show that BTC is consolidating within a tight range, suggesting that the worst of the selling pressure may have passed.

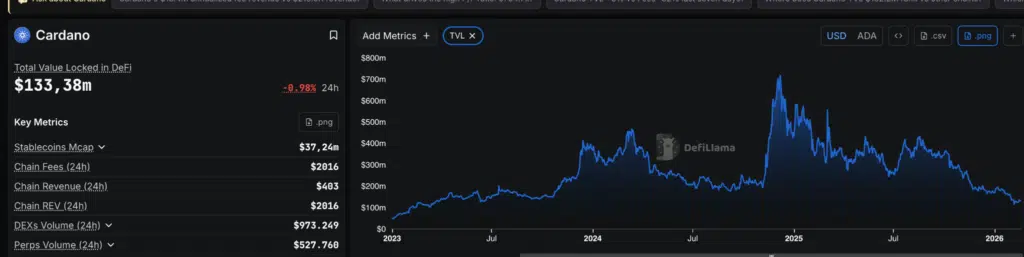

Meanwhile, altcoins are starting to show subtle signs of life. Ethereum (ETH) is attempting to reclaim the $4900 level, while Solana (SOL) and Cardano (ADA) are building momentum after weeks of decline. Market rotation toward high-beta assets, typically a precursor to bullish sentiment, could be a key narrative if Bitcoin stabilizes further this week.

Related article: Market Watch: HIFI Hits $1.24B Volume With +47% Jump, NAORIS Up +60% While AIA Drops to $0.40

Capital Rotation and Retail Participation on the Rise

Another important development is the growing participation from retail investors. On-chain data shows an increase in wallet activity and spot trading volumes, particularly in mid-cap and AI-related tokens. This is often a bullish signal, as it suggests that investors are positioning ahead of a potential Q4 rally, a trend that has historically followed significant ETF outflows.

Additionally, analysts are closely watching stablecoin inflows, which have risen over the past 48 hours. This suggests that sidelined capital is preparing to re-enter the market, possibly fueling a rally if macro conditions remain stable.

What to Watch This Week

With the final trading sessions of September ahead, several key factors will shape the crypto landscape:

- ETF Flow Reversal: If inflows return midweek, it could trigger a breakout above current resistance levels.

- Bitcoin’s $107K Support: Holding this level is crucial for maintaining bullish market structure.

- Altcoin Momentum: Continued accumulation in projects like ADA, SOL, and AVAX could accelerate capital rotation.

A positive confluence of these elements could set the stage for a strong October kickoff, particularly if institutional demand returns after this week’s rebalancing period.

Final Thoughts: Cautious Optimism as Q4 Approaches

Despite significant ETF outflows and macroeconomic headwinds, the crypto market’s ability to hold above $3.8 trillion is a testament to its underlying strength. With Bitcoin maintaining support and altcoins quietly accumulating, conditions are aligning for a potential rebound as the calendar flips to October.

Investors should remain cautious but optimistic. If capital rotation continues and ETF flows stabilize, this week could mark the beginning of a broader recovery, and possibly the foundation for the next leg up in the digital asset cycle.

Olasunkanmi Abudu

Olasunkanmi Abudu is a Web3 content writer with over five years of experience covering blockchain, decentralized finance, and digital assets. He specializes in producing well-researched and accessible content that explains complex technologies and market trends to both general readers and industry professionals.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!