Crypto Market Faces $1.28 Billion Liquidation After Trump’s Speech – BlockNews.com

😲 Over $1.28 billion in crypto liquidations hit the market, with Bitcoin dropping 2.2% to $103,500 while altcoins like Solana fell over 9%. Analysts warn of heightened volatility as traders react to U.S. economic data and shifting Federal Reserve expectations. Speculation about a U.S. Bitcoin Strategic Reserve persists, but its odds of creation in Trump’s first

- Over $1.28 billion in crypto liquidations hit the market, with Bitcoin dropping 2.2% to $103,500 while altcoins like Solana fell over 9%.

- Analysts warn of heightened volatility as traders react to U.S. economic data and shifting Federal Reserve expectations.

- Speculation about a U.S. Bitcoin Strategic Reserve persists, but its odds of creation in Trump’s first 100 days dropped to 38%.

The cryptocurrency market endured a chaotic 24 hours, with sharp declines and massive liquidations shaking up traders. While Bitcoin held its ground relatively well, major altcoins like Solana and Cardano took significant hits, underscoring the volatility across digital assets.

Liquidations and Shifting Market Sentiment

Data from Coinglass shows that over 386,000 traders were liquidated, totaling an eye-popping $1.28 billion in losses. Long positions accounted for the majority at $816 million, with short liquidations making up $307 million, reflecting a rapid shift in market sentiment. Traders scrambled to adapt as prices moved unpredictably, leaving many caught off guard.

Bitcoin’s Stability Amid Altcoin Losses

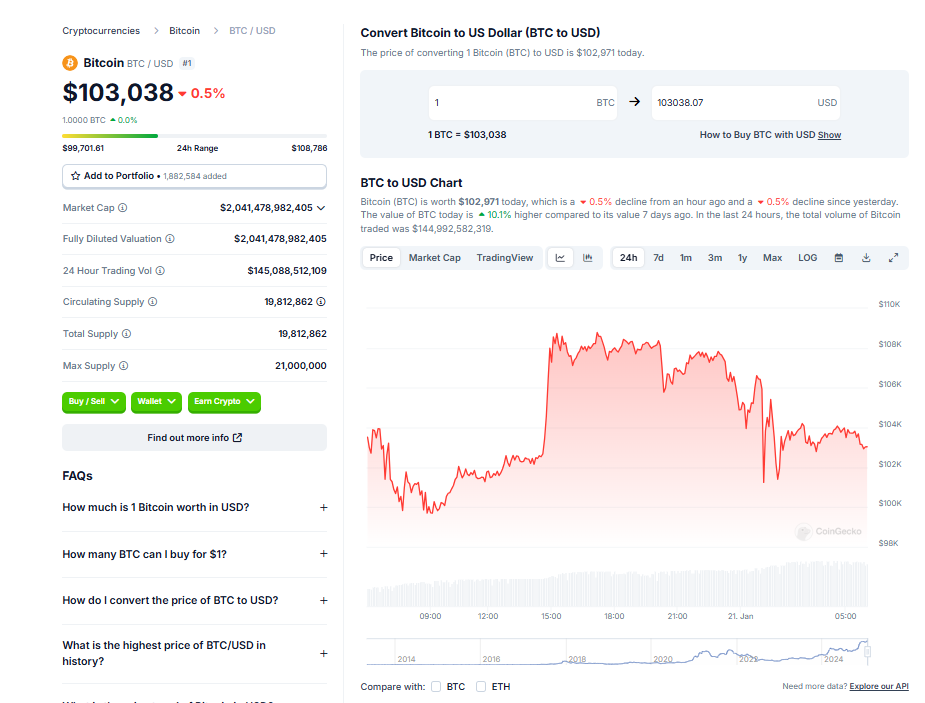

Bitcoin, which recently reached a high of $109,000, was trading around $103,500 at press time—a modest 2.2% dip over the past day. In contrast, altcoins bore the brunt of the sell-off, with Solana plunging over 9% and Cardano slipping more than 5%. Analysts suggest this shift highlights growing risk aversion, with capital flowing into safer assets like stablecoins.

Expert Takes on Volatility

Lukman Otunuga, Senior Market Analyst at FXTM, warned that bitcoin’s sensitivity to U.S. economic data and Federal Reserve expectations could trigger further volatility. Analysts at QCP Capital noted elevated funding rates on platforms like Deribit, suggesting some underlying optimism, but cautioned that the market appears to be consolidating after its recent rally.

Speculation on a U.S. Bitcoin Reserve

Adding to the market’s turbulence is speculation about a potential U.S. Bitcoin Strategic Reserve (SBR). Polymarket estimates the odds of President Trump establishing an SBR within his first 100 days at 38%, down from earlier optimism. The concept involves the U.S. holding bitcoin as a strategic asset, akin to gold reserves, but experts like Bitget CEO Gracy Chen remain skeptical, citing the complexity of aligning regulatory and economic frameworks.

This whirlwind of activity underscores the crypto market’s precarious balance between optimism and caution. Traders face ongoing uncertainty, with wild price swings and speculative policies shaping the road ahead.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!