Charles Hoskinson projects Bitcoin could hit $250,000 by 2026 amid institutional demand surge - Crypto Economy

TL;DR Cardano founder predicts Bitcoin could reach $250,000 by 2026, driven by supply scarcity and institutional demand. He cites growing access via ETFs and wealth managers, alongside Bitcoin’s nascent...

TL;DR

- Cardano founder predicts Bitcoin could reach $250,000 by 2026, driven by supply scarcity and institutional demand.

- He cites growing access via ETFs and wealth managers, alongside Bitcoin’s nascent integration with DeFi.

- Risks include high correlation with tech stocks and potential regulatory uncertainty.

Charles Hoskinson, founder of Cardano, believes Bitcoin could reach $250,000 by 2026, supported by economic fundamentals rather than speculation. His view rests on a basic principle: limited supply meets growing demand. With Bitcoin’s total issuance capped at 21 million coins, and large investors steadily increasing their exposure, Hoskinson argues that the price structure naturally favors upward pressure.

He explained that institutional and governmental adoption continues to expand, while traditional finance is simplifying access for retail investors. Morgan Stanley, for instance, now permits its private wealth advisers to recommend Bitcoin to their clients. Hoskinson emphasized that even small portfolio allocations from funds and wealth managers can heavily influence price, given Bitcoin’s constrained supply.

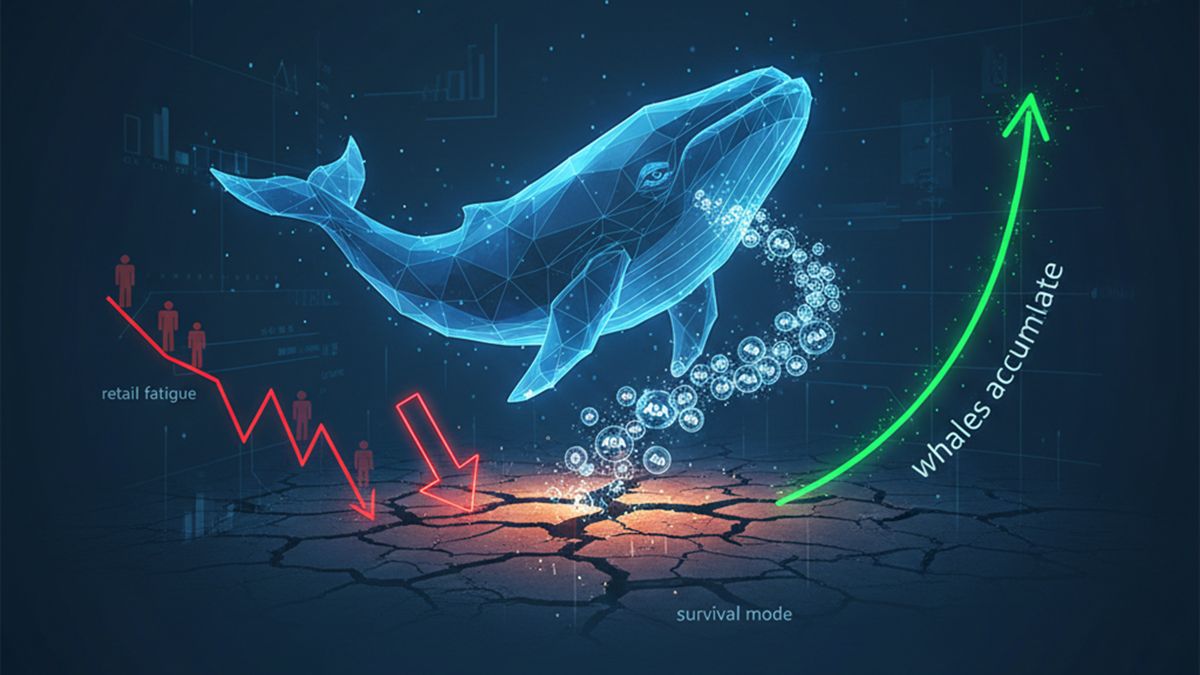

Institutional capital sustains long-term demand

Hoskinson stated that the same macro forces that once drove Bitcoin to six-figure territory remain intact. Institutional investors, unlike short-term traders, maintain a steady accumulation strategy, creating consistent buying pressure. The ongoing development of financial products tied to Bitcoin — such as ETFs and custodial solutions — continues to expand access, further amplifying market depth.

He also highlighted a new dimension of Bitcoin’s evolution: its gradual integration into decentralized finance (DeFi). Emerging systems now allow holders to earn yield without relinquishing custody of their coins. Should these tools succeed, a substantial portion of Bitcoin’s idle value could circulate into broader crypto markets, supporting liquidity and innovation across sectors.

Hoskinson pointed out that the intersection of traditional finance and DeFi infrastructure may define the next growth phase. “Institutional buyers tend to act with patience and scale,” he noted. “They’re not chasing momentum; they’re repositioning global portfolios.”

Altcoin and macroeconomic risks

While Hoskinson acknowledged that capital could flow from Bitcoin into altcoins, he cautioned that the pattern may differ from 2021. During that cycle, Bitcoin’s $68,000 peak coincided with Ethereum’s record highs and Cardano’s $3 valuation. This time, the global backdrop is more uncertain.

He referenced regulatory ambiguity in the United States, ongoing scrutiny of crypto exchanges, and a potential overvaluation within artificial intelligence (AI) equities, particularly in companies like Nvidia, which recently achieved record market capitalization.

Hoskinson warned that if the tech sector corrects, digital assets could face parallel declines, as crypto remains correlated with technology stocks. However, he reiterated that Bitcoin’s monetary properties — fixed supply, growing institutional presence, and increasing financial integration — distinguish it from speculative assets.

“Bitcoin isn’t driven by excitement anymore; it’s driven by structure, scarcity, and macroeconomic need,” he said.

For Hoskinson, 2026 could represent a maturation phase rather than a speculative boom. If institutional inflows continue and on-chain finance matures, Bitcoin’s trajectory could reflect a shift toward utility-based valuation, placing it at the core of both digital and traditional financial systems.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!