Cardano: What traders should know about when to book their profits

The post Cardano: What traders should know about when to book their profits appeared on BitcoinEthereumNews.com. Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be taken as investment advice After its...

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be taken as investment advice

After its third attempt in over a week, Cardano finally closed above the $2.96 price ceiling and formed a new ATH above $3. Some additional targets were plotted using the Fibonacci Extension tool, while emphasis lay on a few support lines in case of a retracement.

At the time of writing, Cardano was valued at $3.05 with a market cap of $98.2 billion.

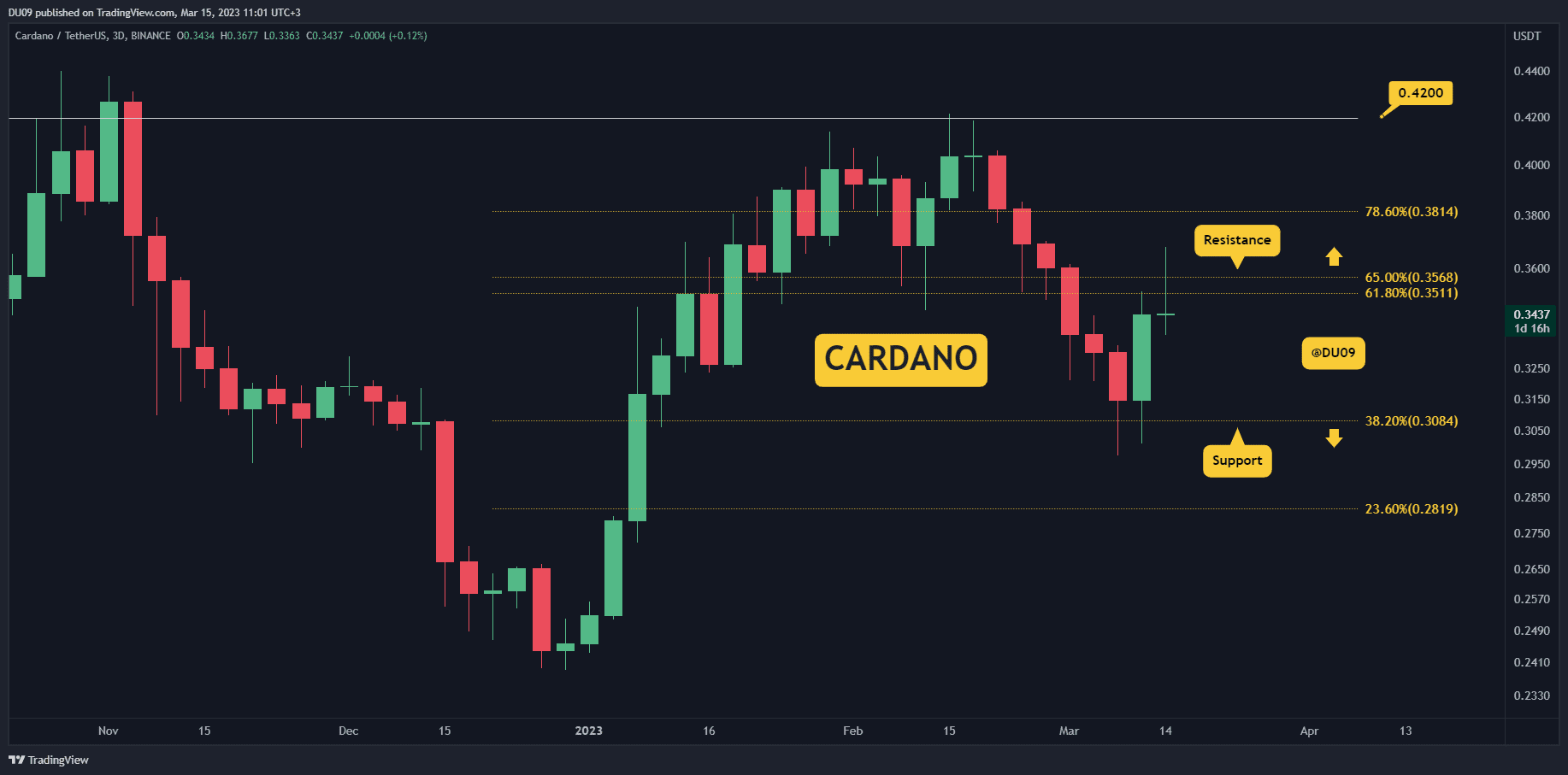

Cardano Daily Chart

Source: ADA/USD, TradingView

ADA has not disappointed on the charts since its price picked up from a monthly low of $1 in late July. Since then, ADA’s value has increased by a staggering 205% – The highest gain percentage among the top 10 coins by market cap. Buyers have preserved ADA’s trajectory by snapping higher lows consistently for over a month. This is why ADA was backed to eventually close above its ascending triangle setup and the $3 price level.

The Fibonacci Extension tool was plotted on ADA’s impulsive retracement from $2.96 to $2.47, which took place last week. This identified important target areas at the 50% and 61.8% Fibonacci levels. A greater emphasis was placed on the latter Fib level as this seemed to be a viable take-profit from ADA’s bullish pattern.

When sellers do drive the price south, the first line of defense would lie at the newly flipped $2.96 zone. In case of a sharper sell-off, support lines at $2.70 and $2.46 would look to crunch selling pressure.

Reasoning

The MACD accurately charted ADA’s recent trajectory. Bearish momentum has been gradually receding over the past few days, with the same transpiring into a bullish crossover. The On Balance Volume also captured the hike in buying pressure and traded at multi-month highs. Such highs were last observed when ADA traded at $2.46 in mid-May, just before the wider crypto sell-off.

Meanwhile, the RSI pierced above the overbought territory and could trigger a near-term market decline. However, a close above the 38.2% Fibonacci level would likely push RSI deeper into the upper zone.

Conclusion

Now that ADA has closed above $2.96, traders can set their sights on some important price levels. Over the course of the next week, the 61.8% Fibonacci Extension level would be the next point of contact from where traders can exit their positions.

Meanwhile, the market is also vulnerable to an immediate throwback to $2.96 due to the RSI’s overbought nature.

Source: https://ambcrypto.com/cardano-what-traders-should-know-about-when-to-book-their-profits/

Post navigation

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!