Cardano Stuck in the Mud — Whales Bail, Momentum Stalls – BlockNews

Cardano remains stuck below key resistance at $0.65, with weak momentum, low trading volume, and RSI under the neutral mark signaling limited buyer strength. Long-term holders are exiting, as a spike in the Age Consumed metric suggests many are cashing out amid market uncertainty. Whales dumped over 100 million ADA, reinforcing bearish sentiment and increasing

- Cardano remains stuck below key resistance at $0.65, with weak momentum, low trading volume, and RSI under the neutral mark signaling limited buyer strength.

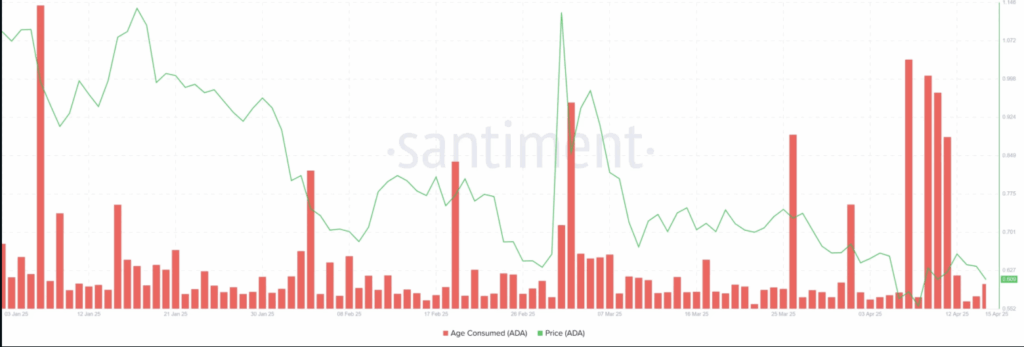

- Long-term holders are exiting, as a spike in the Age Consumed metric suggests many are cashing out amid market uncertainty.

- Whales dumped over 100 million ADA, reinforcing bearish sentiment and increasing the risk of a drop back toward the $0.55 support zone.

Cardano (ADA) just can’t seem to catch a break. As of April 16, it’s hanging around $0.61, stuck below that stubborn resistance near $0.65. There was a brief bounce from $0.55, but it didn’t last long — bulls just couldn’t push it past the big levels, and the bearish pressure’s still very much in play.

Momentum? Yeah, Not Great.

The 50-day EMA is acting like a ceiling at around $0.695 — and ADA’s been living under it since early March. Every attempt to climb back above it has fizzled out. Basically, unless ADA reclaims that line, it’s tough to see any serious upward momentum coming through.

Fibonacci levels are telling a similar story. ADA did bounce from the 0.786 Fib support at $0.549, but now it’s facing resistance at the 0.618 Fib — around $0.718. The next big target would be $0.837, but that’s kind of a pipe dream unless ADA can clear $0.70 and hold it.

The RSI? Sitting around 43.5 — still under the neutral 50 line, which means buying power is weak. Like, really weak. And volume? Pretty flat too. No serious demand stepping in yet. So all this sideways action isn’t really backed by conviction.

Still Bearish Unless $0.65 Turns Into Support

Right now, the biggest thing bulls need is a flip of $0.65 into support. If that happens, maybe we see ADA test $0.70 again and — who knows — maybe even higher. But if that flip doesn’t come soon, the bearish structure stays intact, and ADA could slide back down to test the $0.55 zone all over again.

Long-Term Holders Hit the Exit

On-chain signals are flashing red too. The Age Consumed metric — which tracks older ADA moving — just spiked. That usually means long-term holders are selling, and yeah, that’s exactly what seems to be happening here. When ADA got a little bounce earlier in the week, some of those folks likely saw an opportunity to cash out. Who can blame them?

Market mood’s definitely shifted. It went from kinda hopeful to pretty cautious — fast. And the data backs it up.

Whales Dump Over 100 Million ADA

It gets worse. According to analyst Ali Martinez, whales just dumped over 100 million ADA in the past week. That’s not a small move. When big holders start cutting exposure, it’s usually a sign that they’re not feeling super confident about near-term price action.

Add it all up — the failed breakout, weak momentum, long-term holders exiting, whales selling — and it paints a clear picture: Cardano is still under pressure, and unless something changes fast, the path of least resistance might still be down.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!