Cardano Price Sees 4% Bounce, But Max Keiser Predicts a 90% Crash

Cardano Price Sees 4% Bounce, But Max Keiser Predicts a 90% CrashCardano (ADA) has seen a 4% price surge in the last 24 hours, sparking renewed optimism among investors. However, prominent critic and Bitcoin...

Cardano Price Sees 4% Bounce, But Max Keiser Predicts a 90% Crash

Cardano (ADA) has seen a 4% price surge in the last 24 hours, sparking renewed optimism among investors. However, prominent critic and Bitcoin advocate Max Keiser remains unconvinced, predicting a staggering 90% drop for Cardano in the coming months. While this forecast may seem extreme, there are some factors worth considering. Let’s delve deeper into what lies ahead for the cryptocurrency often dubbed the “Ethereum-killer.”

Max Keiser Predicts ADA Price Could Plummet by 90%

In a recent tweet, Max Keiser, a well-known Bitcoin maximalist, forecasted that ADA price could fall by another 90% against Bitcoin within the next six months. Should ADA/USDT experience such a drastic decline, it would bring the price down to approximately $0.03, reducing Cardano’s market cap to just $1 billion. This prediction, however, seems unlikely given the network’s recent advancements and the broader positive sentiment in the crypto space, especially after Elon Musk voiced support for the industry during Donald Trump’s rally.

Despite Keiser’s bearish outlook, some in the Cardano community view such a dramatic price drop as a potential buying opportunity, suggesting it would create an attractive entry point for new investors.

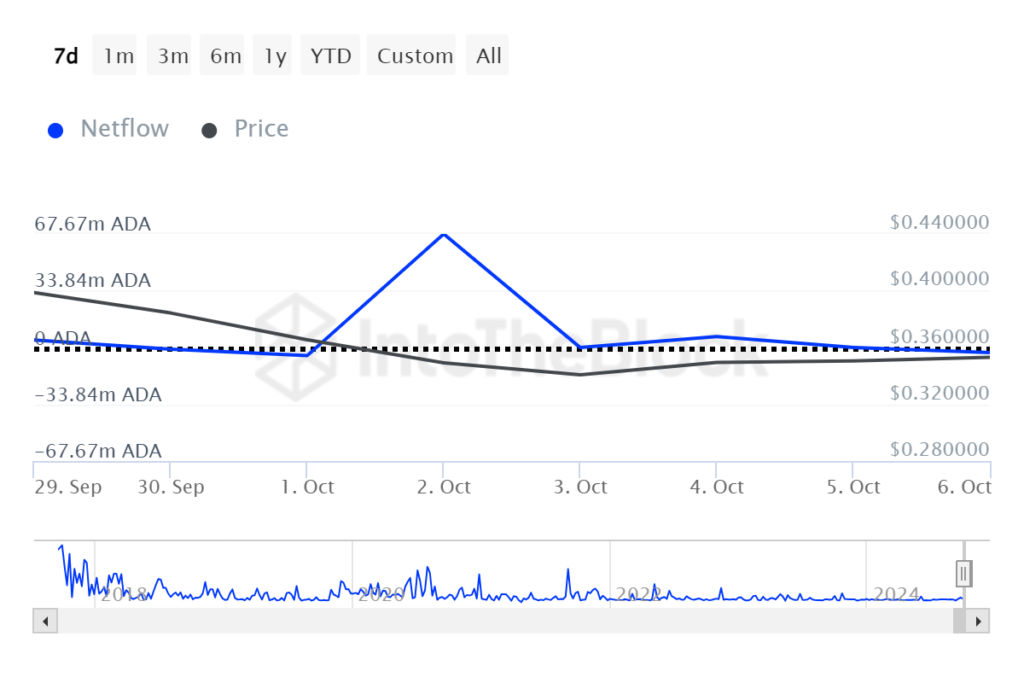

Whale Activity and Market Sentiment

Over the past 48 hours, there has been a noticeable uptick in whale activity surrounding Cardano. However, data from IntoTheBlock (ITB) reveals a concerning trend. While the total number of large transactions rose from 311 to 337 between October 5 and 6, the net whale inflows turned negative, dropping from 27,000 ADA to -3.11 million ADA (valued at $1.1 million). This shift implies that some major holders may be offloading their ADA positions.

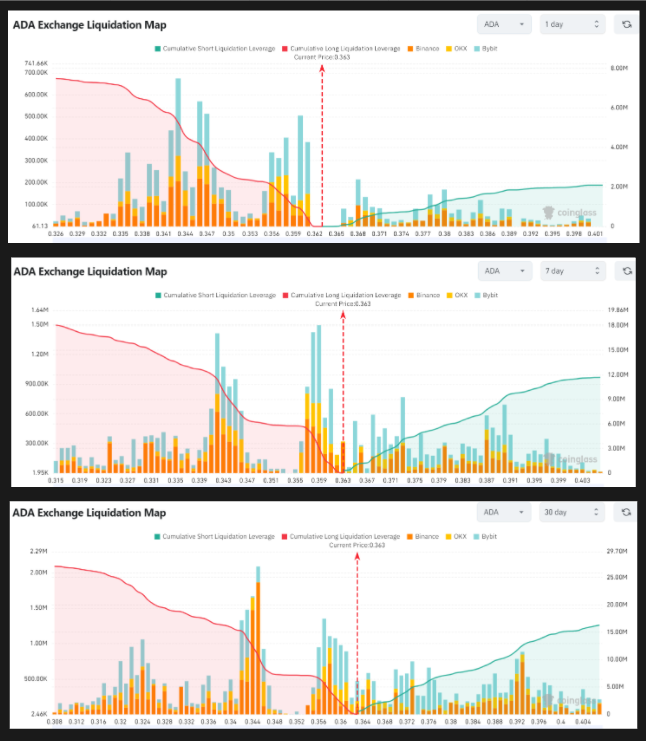

Adding to the bearish sentiment, data from Coinglass highlights that derivative traders are predominantly pessimistic about ADA’s future. Short positions outweigh long positions across daily, weekly, and monthly timeframes, suggesting traders expect further declines.

Given these indicators, Keiser’s prediction appears more plausible unless there is a significant change in market conditions. The current market sentiment points toward further downside for ADA in the near term.

ADA Price Outlook: What’s Next for Cardano?

At present, Cardano is trading within a narrow range, with a key resistance level near $0.37 and support at $0.32.

The $0.37 resistance zone has proven difficult to break through, and a larger resistance level around $0.40 remains a critical hurdle. On the downside, $0.32 has acted as a strong demand zone, providing support for the price in the past.

However, if ADA is rejected from current levels, it may retest the $0.32 support. A failure to hold above this crucial level could trigger further declines, with the next target potentially below $0.27.

For Keiser’s grim prediction to materialize, a black swan event or a massive rally in Bitcoin’s price would likely be required within the next six months. On the flip side, if ADA manages to break and sustain above $0.37, it could pave the way for a run toward $0.40. A decisive close above this level would shift momentum toward a more bullish outlook, potentially driving the price 29% higher to $0.50.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!