Cardano Ouroboros Upgrade Finalized As Accumulation Intensifies - The Market Periodical

Key Insights Cardano Ouroboros Linear Leios CIP has been finalized and merged. Cardano is the third-largest holding, with 18.55% allocated by Grayscale’s quarterly rebalance of their Smart Contract Fund. ADA...

Key Insights

- Cardano Ouroboros Linear Leios CIP has been finalized and merged.

- Cardano is the third-largest holding, with 18.55% allocated by Grayscale’s quarterly rebalance of their Smart Contract Fund.

- ADA price is currently in a high-timeframe accumulation zone on the 2-week chart. The token followed a deep multi-year correction from the 2021 all-time high (ATH).

Cardano (ADA) price was in accumulation but very much undervalued at a period when the ecosystem was undergoing various upgrades. The privacy layer of Midnight (NIGHT) on Cardano has already been integrated into a couple of blockchains.

Ouroboros, the latest upgrade, was positioning Cardano’s ADA as an institutional token with Grayscale at the forefront of accumulation. With that in mind, what were the specifics of these developments?

Cardano’s Ouroboros Linear Leios CIP Upgrade

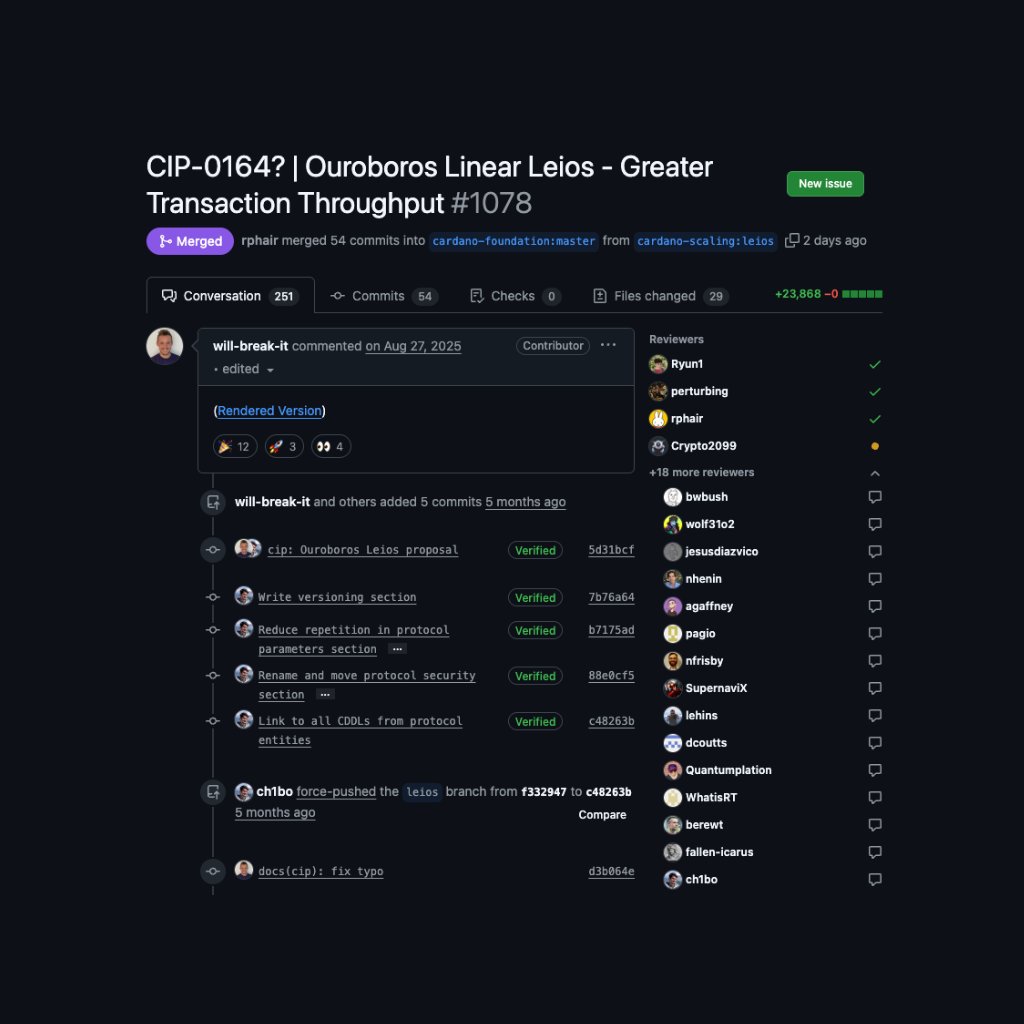

To speed up transactions, Cardano combined CIP-0164 with Ouroboros Linear Leios, a protocol upgrade. This development, which concluded and merged on January 6, 2025, described a two-tier block system as outlined in this article.

One was Endorser Blocks, which let you handle many non-sensitive transactions at the same time. The other was Reference Blocks for operations that depended on the order of things.

For instance, this referred to DeFi trading that maintained front-running resistance, similar to the current Ouroboros Praos.Q

The upgrade promised 30–60 times more capacity by using larger blocks and economic incentives. As such, it steered valuable transactions to secure channels, which lowered the risks of MEV.

Looking at the simulations, it showed that the system worked well. However, community reviews pointed out possible weaknesses in the certification and recovery processes. This step confirmed Cardano’s mainnet implementation.

It improved scalability without putting core security at risk. Developers had a clearer path for integration after the full deployment.

GrayScale Quarterly Rebalance: How Institutions Are Accumulating ADA

On the institutional front, ADA was embraced. Grayscale Investments rebalanced the Smart Contract Platform for the first time this year.

Cardano’s ADA was now 18.55% of the fund’s total, putting it in third place. The percentage was behind Solana at 29.55% and Ethereum at 29.00%.

This change showed how institutions were trying to increase their exposure to ADA. At the same time, spot whales were aligning with what institutions were doing.

This move was at a time when Cardano made progress in making proof-of-stake more efficient and compatible.

Other assets in the fund were Sui at 8.55%, Avalanche at 7.66%, and Hedera at 6.69%. This type of rebalancing revealed that large players were actively purchasing more ADA. They spread their investments beyond the largest chains to capitalize on growth in scalable smart contract platforms.

Cardano Price Prediction: Can ADA Price Break Past $1?

On the charts, analyst Crypto Patel of X predicted prices as high as $10. The 2-week timeframe scale showed the multi-year path of the ADA/USDT pair. ADA price was trading in a symmetrical triangle formation that had been pushing prices down since the all-time high in 2021.

A key part of the analysis was a descending resistance trendline formed by peaks around $3. This intersected with a macro ascending support line.

The accumulation zone was between $0.28 and $0.38. Technically, this was the demand zone for smart money, where they were building up their positions.

If ADA prices stayed above $0.30, a breakout point meant that prices would keep going up. The analyst sets targets at $2.60, $5.00, and $10.00. However, the target was only if the price broke through the $1.00–$1.20 resistance level.

An invalidation would happen if the weekly candle closed below $0.28. This setup stressed patience for spot holders, even though the market was volatile overall. However, the results depended on external factors, such as adoption and regulation.

Lennox is a professional financial market analyst who’s enthusiastic about blockchain, cryptos, and web3. He started blogging about cryptos back in 2019 and has since never looked back. His work revolves around looking at crypto-projects analytically on a technical and on-chain level, while also making sure it’s palatable to the general audience.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!