Chart of the Week: Cardano Could Rally 25%, Here's Why

Cardano gained 35% on November 10, and the altcoin held steady close to the $0.65 level. The Ethereum competitor token, ADA, is rallying alongside Bitcoin, Ethereum, Dogecoin, and other leading...

Cardano gained 35% on November 10, and the altcoin held steady close to the $0.65 level. The Ethereum competitor token, ADA, is rallying alongside Bitcoin, Ethereum, Dogecoin, and other leading cryptocurrencies, post BTC all-time high on Wednesday.

Cardano’s on-chain indicators signal price growth

Cardano (ADA) rallied alongside Bitcoin (BTC) as the largest cryptocurrency hit a new all-time high on November 12. BTC hit a record high at $93,265, while ADA climbed to a six-month high at $0.6599.

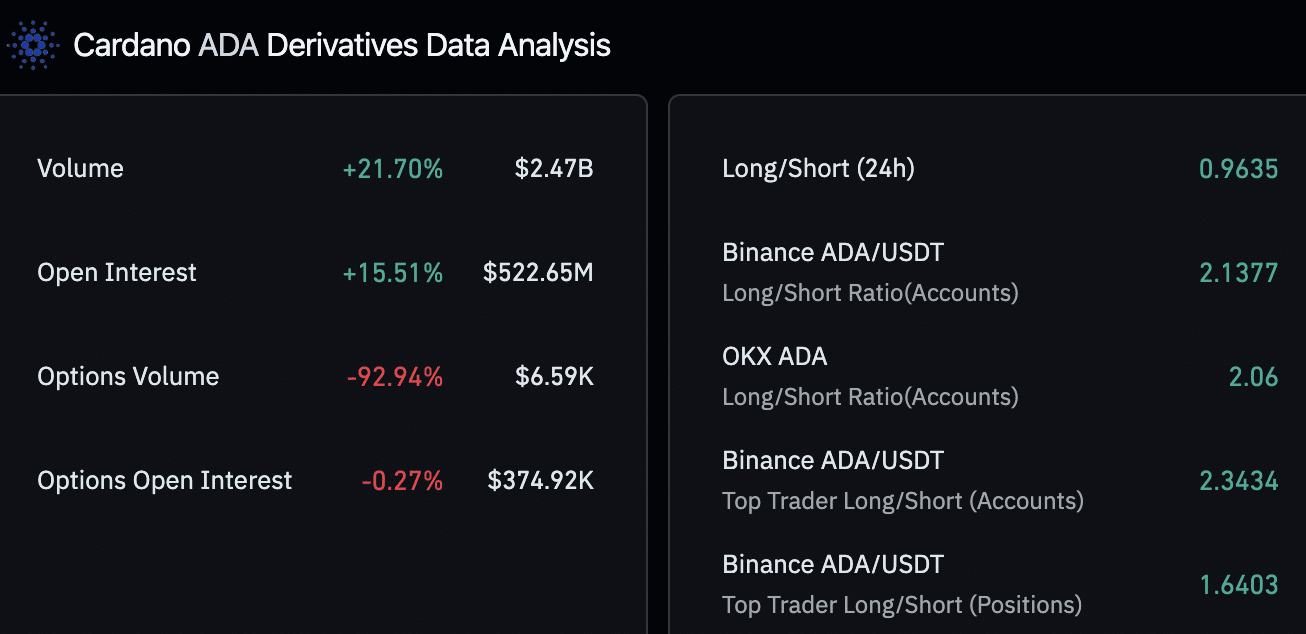

Open interest in ADA climbed 15.51% in the last 24 hours as the altcoin attempts a break past the March 2024 peak of $0.8104. This metric represents the open contracts held by Cardano’s derivatives traders, a sign of demand and relevance for ADA in futures markets.

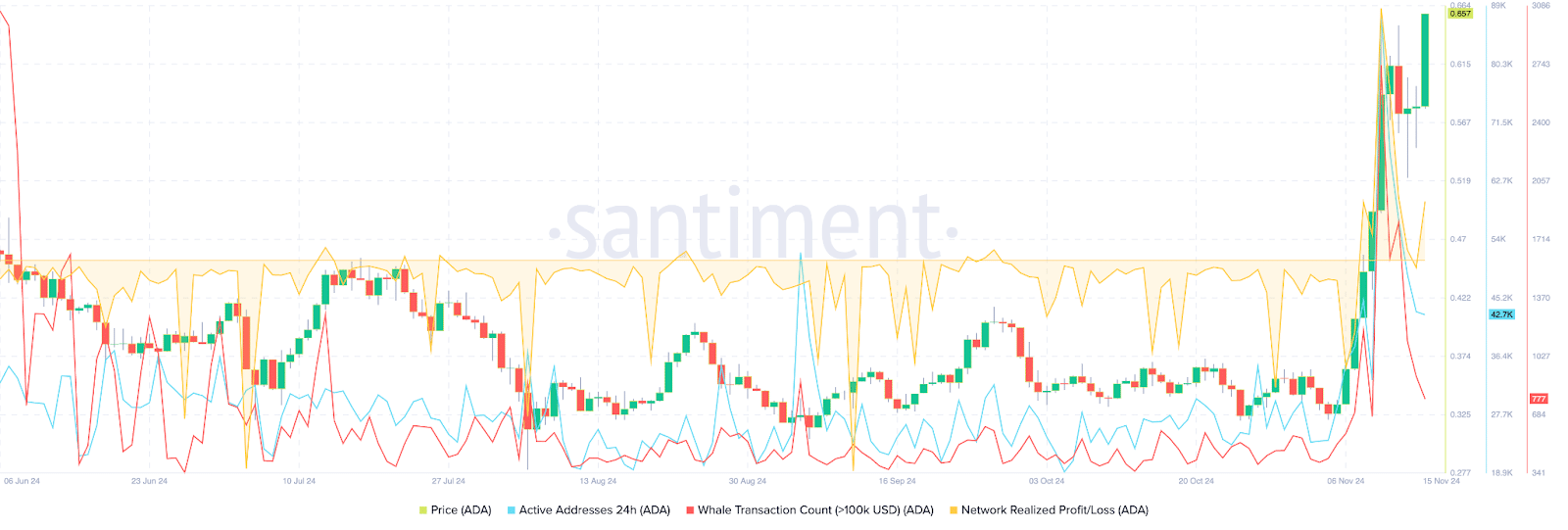

The top three on-chain indicators, active addresses, whale transaction count, and network, realized profit/loss support a thesis of gains in Cardano price. The count of active addresses climbed 42% in November, according to Santiment data.

In the same timeframe, the count of whale transactions valued at $100,000 and higher hit a peak of 2,737 on November 10, and large wallet investors remained relatively active throughout November.

Traders’ profit-taking has reduced from a peak of $93 million on November 10 to nearly $21 million on Friday, November 15. Typically, a reduction in profit-taking activities reduces the selling pressure on the token, paving the way for gains.

Cardano’s correlation with Bitcoin is 0.93, per IntoTheBlock data. Cardano’s gains are, therefore, influenced by the state of Bitcoin and the largest cryptocurrency’s price trend. A correction in Bitcoin could negatively impact Cardano.

Cardano eyes return to March peak at $0.8104 per technical indicators

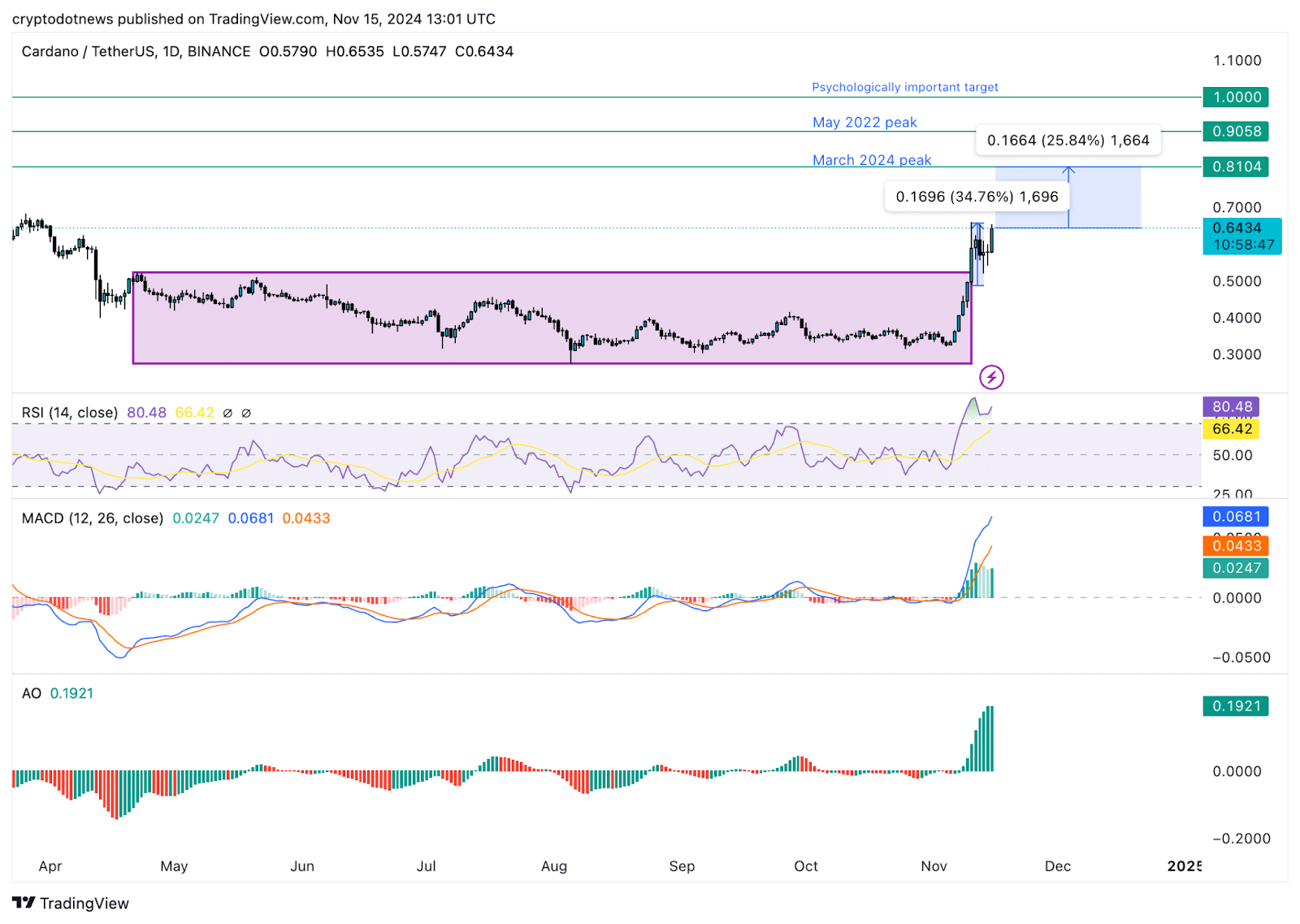

Cardano has traded in a range-bound manner for nearly six months, as seen on the daily price chart below. ADA was in a range between $0.5225 and $0.2756 throughout the last six months, and Cardano broke out of its sideways trend, ready to test resistance at the March 2024 peak of $0.8104.

A rally to the $0.8104 level marks nearly 25% gains for the altcoin. The next key resistances are the May 2022 peak of $0.9058 and the psychologically important $1 level.

The $1 level could act as a resistance for Cardano in its uptrend. A daily candlestick close above this level would bring back the all-time high of $3 in play, recorded in September 2021.

The moving average convergence divergence indicator flashes green histogram bars above the neutral line. This implies that Cardano’s price trend has an underlying positive momentum, and further gains are likely.

The awesome oscillator supports a bullish thesis for Cardano with no signs of reversal on the daily price chart.

A failure to close above support at $0.5785 could invalidate the bullish thesis. ADA could find support within the range, and sweep liquidity at $0.5225, the upper boundary of the range on the daily price chart.

Strategic considerations

Derivatives market data from Coinglass shows that the long/short ratio for Cardano is above 1, at 2.1377 on Binance, 2.06 on OKX exchange, and 2.3434 on Binance top trader accounts. A value higher than one implies that there are more long positions than short and that there is higher confidence among traders for a gain in the token in the short-term.

Data from derivatives markets is typically used to guide positions in the spot market, it is also considered indicative of the sentiment among traders.

The fear and greed index for Cardano, from cfgi.io, shows “extreme greed,” typically considered a sell signal or a sign of an upcoming correction. Traders should proceed with caution when adding to long positions in Cardano.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!