Cardano Analyst Uses AI to Map $7.50 Exit Strategy for Bull Cycle Peak

Dan Gambardello uses AI to decide Cardano profit-taking levels AI projects $7.50 target based on $270B market cap and historical cycle patterns Exit strategy suggests selling 40-50% holdings at target with...

- Dan Gambardello uses AI to decide Cardano profit-taking levels

- AI projects $7.50 target based on $270B market cap and historical cycle patterns

- Exit strategy suggests selling 40-50% holdings at target with staged approach

Cardano analyst Dan Gambardello has consulted Zero AI to develop an exit strategy for the current bull cycle, targeting $7.50 as the optimal profit-taking level for ADA holders.

The AI tool analyzed historical cycle patterns and market dynamics to determine realistic price targets and timing windows for Cardano’s anticipated rally.

Gambardello emphasized that altcoin season is building momentum following the typical cycle progression where Bitcoin leads, Ethereum follows, and alternative cryptocurrencies subsequently rally.

The analyst maintains his bullish stance on Cardano’s potential for extensive gains during this market phase.

AI Analysis Points to $270 Billion Market Cap Target

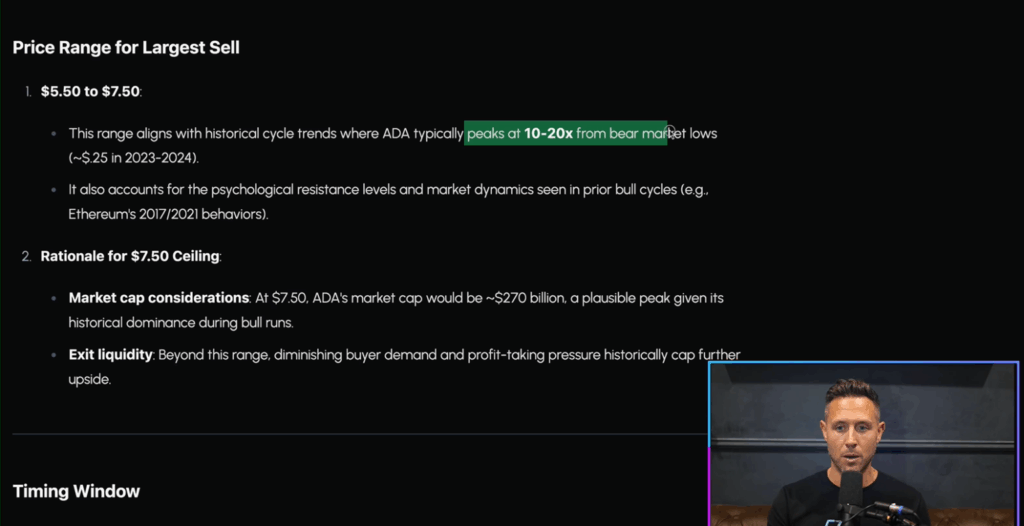

Zero AI identified $7.50 as the primary exit target based on Cardano achieving a $270 billion market capitalization, which the tool described as a “plausible” valuation peak considering historical market share in previous bull cycles. This price level aligns with psychological resistance zones observed in past market cycles.

The AI analysis noted that ADA historically reaches peak valuations after rallying 10 to 20-fold from bear market lows. The $7.50 target falls within this historical precedent while accounting for current market conditions and competitive positioning.

Zero AI warned that buyers above $7.50 would likely serve as exit liquidity for earlier investors, supporting Gambardello’s view that this level provides a realistic profit-taking opportunity. While ADA could potentially reach $10 or higher, the AI considers $7.50 a more achievable target for systematic profit realization.

Timeline Projects Mid-2026 Peak Following Bitcoin Cycle

The timing projection suggests Cardano will reach its cycle peak approximately three to six months after Bitcoin achieves its maximum price.

This timeline aligns with theories about extended bull cycles beyond traditional four-year patterns. Analysts including Michael Saylor and Bitwise CIO Matt Hougan have argued that historical cycle timing may no longer apply to current market conditions.

Additional top signals include ADA’s risk score approaching extreme greed levels of 85-90 and bull/bear indicators reaching 5, suggesting peak market sentiment conditions.

Using a 100,000 ADA demonstration account, Zero AI recommended selling 40-50% of holdings at $7.50 price. This approach would realize $300,000 to $375,000 while maintaining exposure for potential higher prices.

Seasoned Crypto Content Writer, Editor and Journalist who entered the cryptocurrency industry out of sheer passion and love for writing.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!