Cardano (ADA) Faces 30-Day Low as Whale Activity Declines

Cardano has dropped nearly 10% in the past week, facing increased selling pressure. Whale netflow has plummeted 90%, signaling reduced large-holder accumulation. If bearish momentum continues, ADA could test...

- Cardano has dropped nearly 10% in the past week, facing increased selling pressure.

- Whale netflow has plummeted 90%, signaling reduced large-holder accumulation.

- If bearish momentum continues, ADA could test $0.82, while a shift in demand may push it above $1.

Cardano (ADA) has struggled over the past week, declining nearly 10% amid broader market downturns. However, a deeper look at on-chain metrics reveals that ADA’s price drop is largely driven by a sharp decline in whale activity.

With mounting selling pressure and weakening investor confidence, ADA is at risk of hitting a 30-day low unless market sentiment shifts in favor of accumulation.

Cardano Whales Reduce Buying Activity

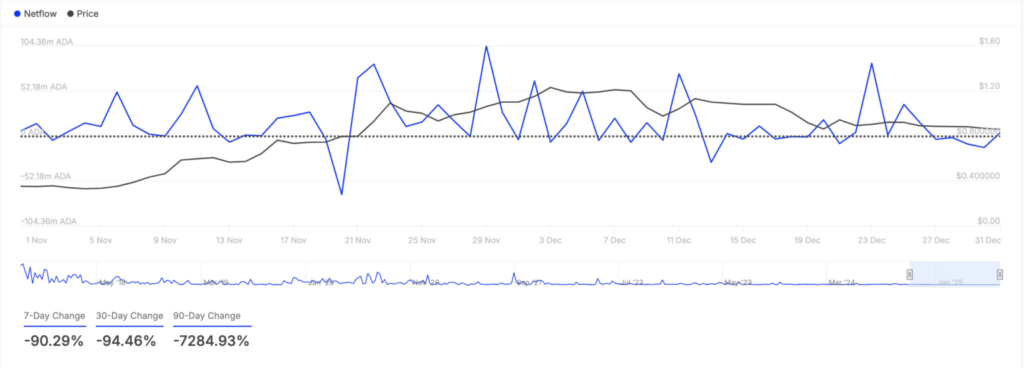

On-chain data from IntoTheBlock shows that Cardano’s large holders’ netflow has dropped by 90% over the past seven days. Large holders—whales who own more than 0.1% of ADA’s circulating supply—have significantly reduced their buying activity, indicating a shift toward selling.

Large holders’ netflow measures the balance of ADA moving in and out of whale wallets. A sharp decline suggests that whales are offloading their holdings, increasing supply and contributing to downward price pressure.

This decline in whale activity often leads to a ripple effect, with retail traders also hesitating to buy or selling their holdings in anticipation of further losses. This behavior exacerbates ADA’s price decline, making recovery more difficult.

Profit-Taking Accelerates Downtrend

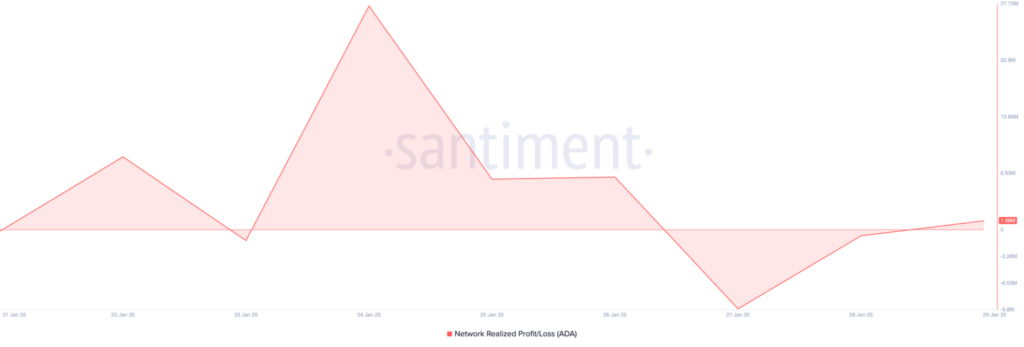

Beyond whale movements, Santiment data shows that Cardano’s Network Realized Profit/Loss (NPL) has turned positive, indicating a surge in profit-taking.

The NPL metric tracks the difference between an asset’s last movement price and its current market price. When the NPL is positive, more holders are selling at a profit than at a loss, leading to increased market supply.

This widespread sell-off suggests that ADA is facing heightened bearish sentiment, making it difficult to maintain key support levels.

If the current downtrend persists, ADA could drop to a 30-day low of $0.82. However, if market conditions shift toward accumulation and demand rises, ADA could reclaim the $1 level, invalidating the bearish outlook.

Seasoned Crypto Content Writer, Editor and Journalist who entered the cryptocurrency industry out of sheer passion and love for writing.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!