Cardano ($ADA) Could Be Entering Final Rally as Double-Bottom Analysis Points to $1.70–$2.10 Target

Cardano double bottom analysis: Cardano ($ADA) is forming a confirmed double bottom with a completed neckline retest, suggesting a final rally. Technical projections place a likely target zone between $1.70 and $2.10 if current structure and cycle symmetry hold. Double bottom respected: ADA com

Cardano double bottom analysis: Cardano ($ADA) is forming a confirmed double bottom with a completed neckline retest, suggesting a final rally. Technical projections place a likely target zone between $1.70 and $2.10 if current structure and cycle symmetry hold.

-

Double bottom respected: ADA completed a neckline retest, mirroring past cycles.

-

Current price action matches earlier post-retest advances, implying a final breakout stage.

-

Measured projections place a technical target zone at $1.70–$2.10, based on pattern and cycle symmetry.

Cardano double bottom analysis: Cardano ($ADA) shows a confirmed double bottom with a neckline retest; targets $1.70–$2.10. Read the technical outlook and trade implications now.

What is the Cardano double bottom pattern?

The Cardano double bottom is a bullish reversal pattern where price forms two lows at similar levels, followed by a break and retest of the neckline. This structure suggests a shift from downside pressure to upward momentum when the retest holds and volume/price confirm the breakout.

How has Cardano followed historical cycle patterns?

Cardano’s recent price behavior closely mirrors earlier cycles, with a lower low formed in 2022–2023 near the $0.4040–$0.4540 range. Past cycles showed a neckline breakout, a retest, then a steady advance into the strongest breakout phase. CryptoBullet published a cycle comparison noting a similar sequence and a projected final target at $1.70–$2.10 (CryptoBullet, August 26, 2025).

$ADA Cycle Comparison | Update

So far so good 👌

One last leg up is coming 📈

📍 $1.70-2.10 is my Final Target for $ADA

— CryptoBullet (Twitter) August 26, 2025

Why does the current phase suggest a final rally?

Front-loaded evidence: the structure passed its retest and has shown consistent post-retest support. Measured moves from the double bottom align with cycle symmetry, reinforcing the probability of a last upward leg. Confirming signals include steady higher lows, increasing relative strength on shorter timeframes, and pattern-based projection alignment.

How are technical targets calculated?

Measured move projection: take the distance from pattern lows to the neckline and project that from the breakout point. Cycle symmetry then refines the zone, producing a consensus target range. For this setup, projections converge on $1.70–$2.10, consistent with historical magnitudes observed in previous Cardano cycles.

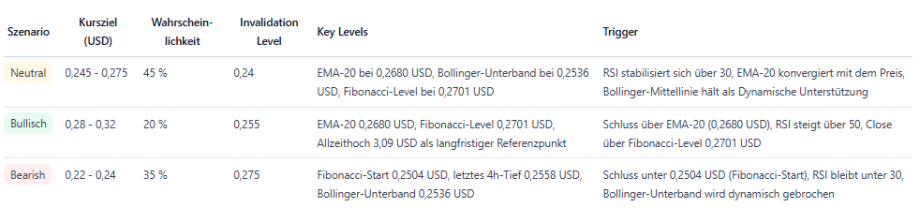

Comparative Cycle Summary

| Cycle | Pattern lows | Neckline | Projected target |

|---|---|---|---|

| 2018–2020 | $0.02–$0.03 | $0.05 | $0.12–$0.18 |

| 2022–2023 | $0.4040–$0.4540 | $0.60 (example) | $1.70–$2.10 (current) |

Frequently Asked Questions

How reliable is a double bottom on ADA?

When confirmed with a neckline breakout and a successful retest, a double bottom is a reliable technical reversal signal. Reliability improves with volume confirmation, higher timeframe alignment, and cycle symmetry matching past behavior.

When would the $1.70–$2.10 target be invalidated?

The target would be invalidated if ADA breaks below the pattern lows ($0.4040–$0.4540) with sustained selling, or if price fails to hold the neckline on a retest and momentum shifts bearish.

Key Takeaways

- Pattern confirmed: The double bottom has completed a breakout and retest, supporting bullish continuation.

- Target range: Measured moves and cycle symmetry align on a $1.70–$2.10 target zone.

- Risk management: Invalidate the bullish thesis if price falls below the pattern lows; use defined stops and position sizing.

Conclusion

Cardano’s current structure shows a textbook double bottom that passed a neckline retest, increasing the probability of a final rally toward the projected $1.70–$2.10 zone. Traders should watch retest confirmation, volume, and broader market context while applying disciplined risk management. This analysis is presented by COINOTAG and reflects pattern-based technical projection rather than price guarantees.

Don't forget to enable notifications for our Twitter account and Telegram channel to stay informed about the latest cryptocurrency news.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!