BlackRock dwarfs competitors with $150 million Ethereum purchase in a day

BlackRock’s dominance of the spot Ethereum (ETH) exchange-traded fund (ETF) was on display on September 4, when the world’s largest investment firm dwarfed competitors in the market. In this case, BlackRock...

BlackRock’s dominance of the spot Ethereum (ETH) exchange-traded fund (ETF) was on display on September 4, when the world’s largest investment firm dwarfed competitors in the market.

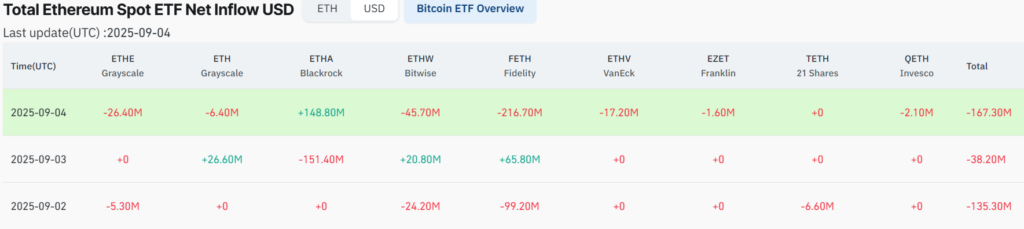

In this case, BlackRock recorded $148.8 million in net Ethereum ETF inflows, making it the sole major buyer and far outpacing rivals, according to data retrieved by Finbold from Coinglass.

In contrast, several competitors faced heavy redemptions. Particularly, Fidelity led the sell-off with $216.7 million in outflows, followed by Bitwise with $45.7 million.

Grayscale’s ETHE shed $26.4 million, while its separate Ethereum Trust saw another $6.4 million in redemptions.

On the other hand, VanEck, Franklin, and Invesco also posted smaller losses of $17.2 million, $1.6 million, and $2.1 million, respectively. Overall, the market registered $167.3 million in net withdrawals across all issuers despite BlackRock’s surge.

Ethereum ETF records more outflows

However, the picture was different on September 3, when the market outflow was a more modest $38.2 million. Fidelity attracted $65.8 million and Bitwise added $20.8 million, while BlackRock recorded a $151.4 million outflow.

On September 2, the trend was similarly negative, with $135.3 million in total redemptions driven by heavy selling at Fidelity and Bitwise.

It is worth noting that BlackRock’s Ethereum investments have played a central role in driving the asset’s price higher in recent weeks, with ETH climbing to a new all-time high of nearly $5,000.

In late August, BlackRock’s ETHA led sector inflows with $323 million in a single session, helping push cumulative Ethereum ETF inflows past $13 billion.

Indeed, BlackRock’s success in both Bitcoin and Ethereum has also fueled speculation about its next steps. Reports suggest the asset manager is considering broader crypto ETF offerings, potentially expanding into assets such as Solana and Cardano.

Featured image via Shutterstock

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!