Bitcoin Price Update: BTC Falls to $93K Amid Profit-Taking and Macroeconomic Concerns

An analyst has pointed out that Bitcoin (BTC) has flipped an old support level into resistance, indicating a possible prolonged correction. The ongoing bearings sentiment is reported to have been triggered...

- An analyst has pointed out that Bitcoin (BTC) has flipped an old support level into resistance, indicating a possible prolonged correction.

- The ongoing bearings sentiment is reported to have been triggered by profit-taking and macroeconomic factors.

Bitcoin’s (BTC) struggle to return to its all-time high price continues as it has declined by 2.8% in the last 30 days. Meanwhile, the asset is climbing up the price curve slowly as it records a 2.6% surge in its daily chart to trade at $95.4k at press time.

According to our market data, this sluggishness cuts across almost the entire top 20 large-cap cryptos as Ethereum (ETH) also declined by 7.98% in the last 30 days to trade at $3.4k. Within the same time frame, Solana (SOL) has declined by 18%, Dogecoin (DOGE) has declined by 24%, and Cardano (ADA) is down by 18%.

Looking at stocks of crypto-related companies, we observed a similar trend as MicroStrategy’s MSTR fell by 7% while Coinbase’s COIN declined by 5.3%. Renowned Bitcoin mining companies MARA Holdings (MARA) and Riot Platforms (RIOT) also declined by 7%.

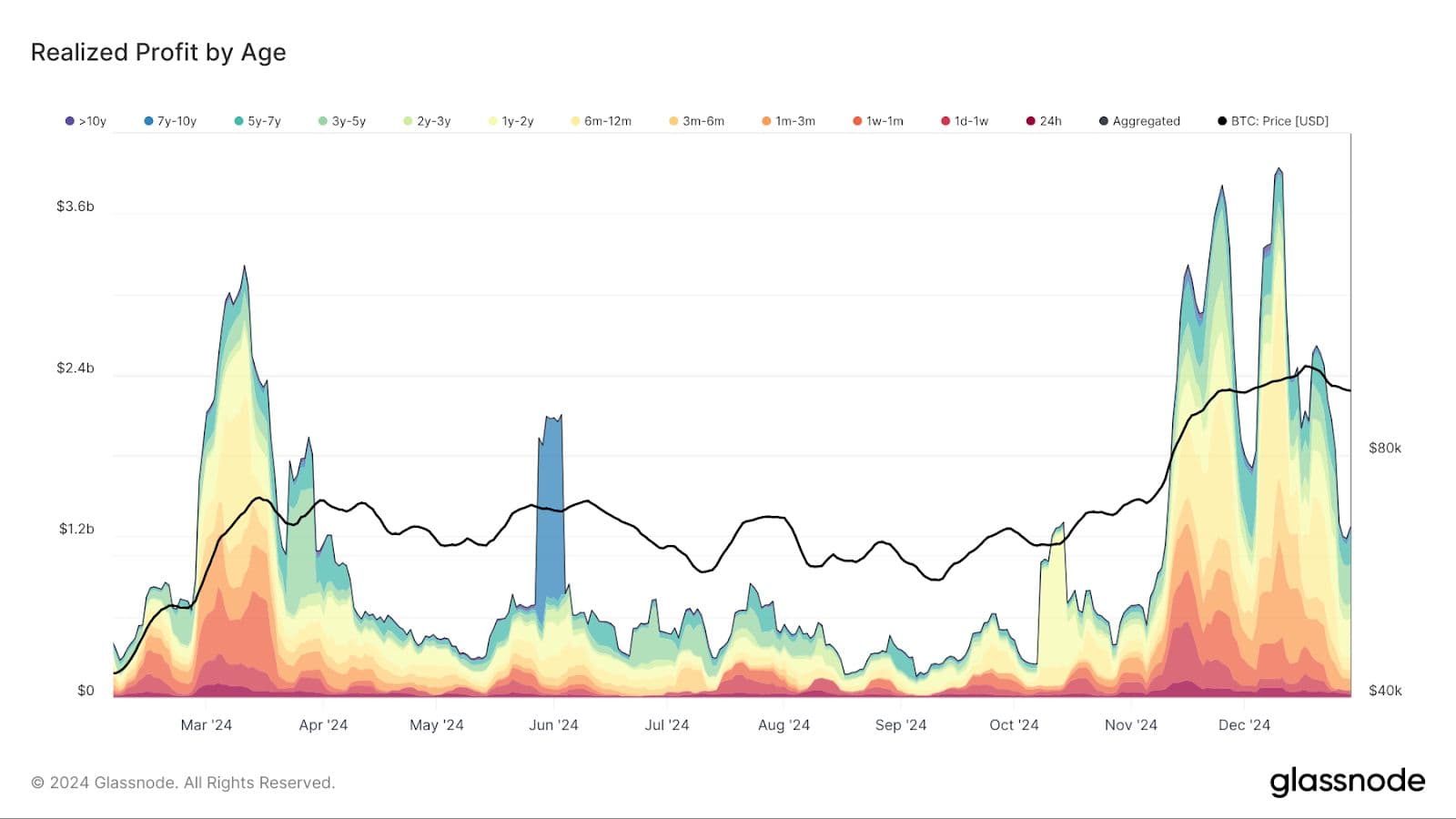

According to analysts, the recent pullback was triggered by a high level of profit-taking following the unprecedented move to hit an all-time high of $108k. Per data, profit-taking has exceeded $1.2 billion in the last seven days. Comparatively, profit taking was around $4 billion on December 11. Meanwhile, this activity is largely led by investors who have held Bitcoin for multiple years.

Other Bearish Factors Weighing Down the Bitcoin Price

Looking at other bearish factors, we observed that the lowest reading of the U.S. Chicago PMI contributed to the ongoing market condition. It is important to note that the PMI measures the performance of the manufacturing and the non-manufacturing sectors in Chicago. The reading recorded is said to be the lowest since May.

Another factor contributing to this bearish run is the uncertainty surrounding the Federal Reserve interest rates policy. Earlier, it was reported that the US central bank would pause rate cuts until at least March.

Commenting on this, a partner at Amundsen Davis, Joe Carlasare, highlighted that the market has already exceeded expectations in 2024. According to him, the market could stage a rebound in 2025.

Looking ahead to 2025, I’m optimistic but expect the path to diverge from consensus, as markets often do. Bitcoin’s adoption continues to grow, and I anticipate it will generally move in line with traditional markets. If the U.S. avoids a significant growth slowdown, bitcoin should perform well, though the ride may be bumpier than in 2024.

Meanwhile, analyst Rekt Capital believes that the market is shifting to a prolonged correction phase. According to him, Bitcoin has plunged below an old support level, turning it into resistance.

The Weekly support has been lost. The 5-week technical uptrend is over. Bitcoin is showing increasing signs of transitioning into a multi-week correction. Any relief rally, if at all needed, into these old supports could turn them into new resistance to confirm additional downside continuation.

Recommended for you:

This article is provided for informational purposes only and is not intended as investment advice. The content does not constitute a recommendation to buy, sell, or hold any securities or financial instruments. Readers should conduct their own research and consult with financial advisors before making investment decisions. The information presented may not be current and could become outdated.

John is a seasoned cryptocurrency and blockchain writer and researcher, boasting an extensive track record of years immersed in the ever-evolving digital frontier. With a profound interest in the dynamic landscape of emerging startups, tokens, and the intricate interplay of demand and supply within the crypto realm, John brings a wealth of knowledge to the table. His academic background is marked by a Bachelor's degree in Geography and Economics, a unique blend that has equipped him with a multifaceted perspective. This diverse educational foundation allows John to dissect the geographical and economic factors influencing the cryptocurrency market, offering insights that go beyond the surface. John's dedication to the crypto and blockchain space is not merely professional but also personal, as he possesses a genuine passion for the technologies that underpin this revolutionary industry. With his astute research skills and commitment to staying at the forefront of industry trends, John is a trusted voice in the world of cryptocurrencies, helping readers navigate the complex and rapidly changing terrain of digital assets and blockchain innovation. John Kiguru is an accomplished editor with a strong affinity for all things blockchain and crypto. Leveraging his editorial expertise, he brings clarity and coherence to complex topics within the decentralized technology sphere. With a meticulous approach, John refines and enhances content, ensuring that each piece resonates with the audience. John earned his Bachelor's degree in Business, Management, Marketing, and Related Support Services from the University of Nairobi. His academic background enriches his ability to grasp and communicate intricate concepts within the blockchain and cryptocurrency space. Business Email: [email protected] Phone: +49 160 92211628

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!