Ben Cowen Warns Ethereum Unlikely to Reach 2026 Highs

Key Highlights The outlook for Ethereum in 2026 is cautious and closely tied to Bitcoin’s market direction, says analyst Benjamin Cowen. Ether could hit $4,878, but Cowen warns it may be a short-lived “bull...

Key Highlights

- The outlook for Ethereum in 2026 is cautious and closely tied to Bitcoin’s market direction, says analyst Benjamin Cowen.

- Ether could hit $4,878, but Cowen warns it may be a short-lived “bull trap,” dropping back toward $2,000.

- Cowen sees Ethereum as the only altcoin with a realistic chance to revisit previous highs this cycle.

Ethereum is expected to face a challenging road in 2026, according to crypto analyst Benjamin Cowen. He believes the broader market environment may limit any major upside for the second-largest cryptocurrency.

Speaking on the Bankless podcast, Cowen said Ethereum’s price trajectory remains closely tied to Bitcoin. “If Bitcoin truly is in a bear market, which is what it feels like, it would be kind of hard for Ethereum to go up there,” he said.

Historically, Bitcoin has set the tone for the broader cryptocurrency market, with prolonged weakness often weighing on Ethereum and other digital assets.

Risk of a short-lived rally

Cowen also warned that even if Ether manages to reclaim its all-time high of around $4,878 in 2026, the move could be short-lived. He described such a scenario as a potential “bull trap,” where prices briefly surge, attract buyers, and then reverse sharply, possibly falling back toward the $2,000 level.

Ethereum last reached its record high in August before entering a prolonged decline that pushed prices below $2,800 by November.

According to CoinMarketCap, Ether was trading at around $2,966 at the time of writing, up about 0.73% in the last 24 hours. At these levels, Ether would need to gain over 40% to reach its previous peak, and Cowen noted that while such a rally is possible, it is unlikely to trigger a broad bull market next year.

Altcoins face a tougher cycle

Despite his cautious outlook, Cowen said Ethereum stands apart from most other cryptocurrencies. He described it as the only asset outside Bitcoin that he believes still has a realistic chance of revisiting previous highs this cycle.

“The only altcoin that I’m even considering this for is Ethereum. I don’t really consider Ethereum an altcoin, to be honest. A lot of the other altcoins are kind of cooked at this point for this cycle,” he said.

Beyond Ethereum, Cowen expressed a pessimistic view on the wider altcoin market, suggesting many smaller tokens may have already peaked and are unlikely to reach new highs if they haven’t already.

Similar concerns have been raised elsewhere in the market. A report attributed to Fundstrat Global Advisors and circulating on X warns of a “meaningful drawdown” in early 2026, projecting Bitcoin could fall to $60,000–$65,000, Ether to $1,800–$2,000, and Solana to $50–$75 before potential buying opportunities later in the year.

Also Read: Bitmine Surpasses 4 Million ETH Holdings After $128M Buying Spree

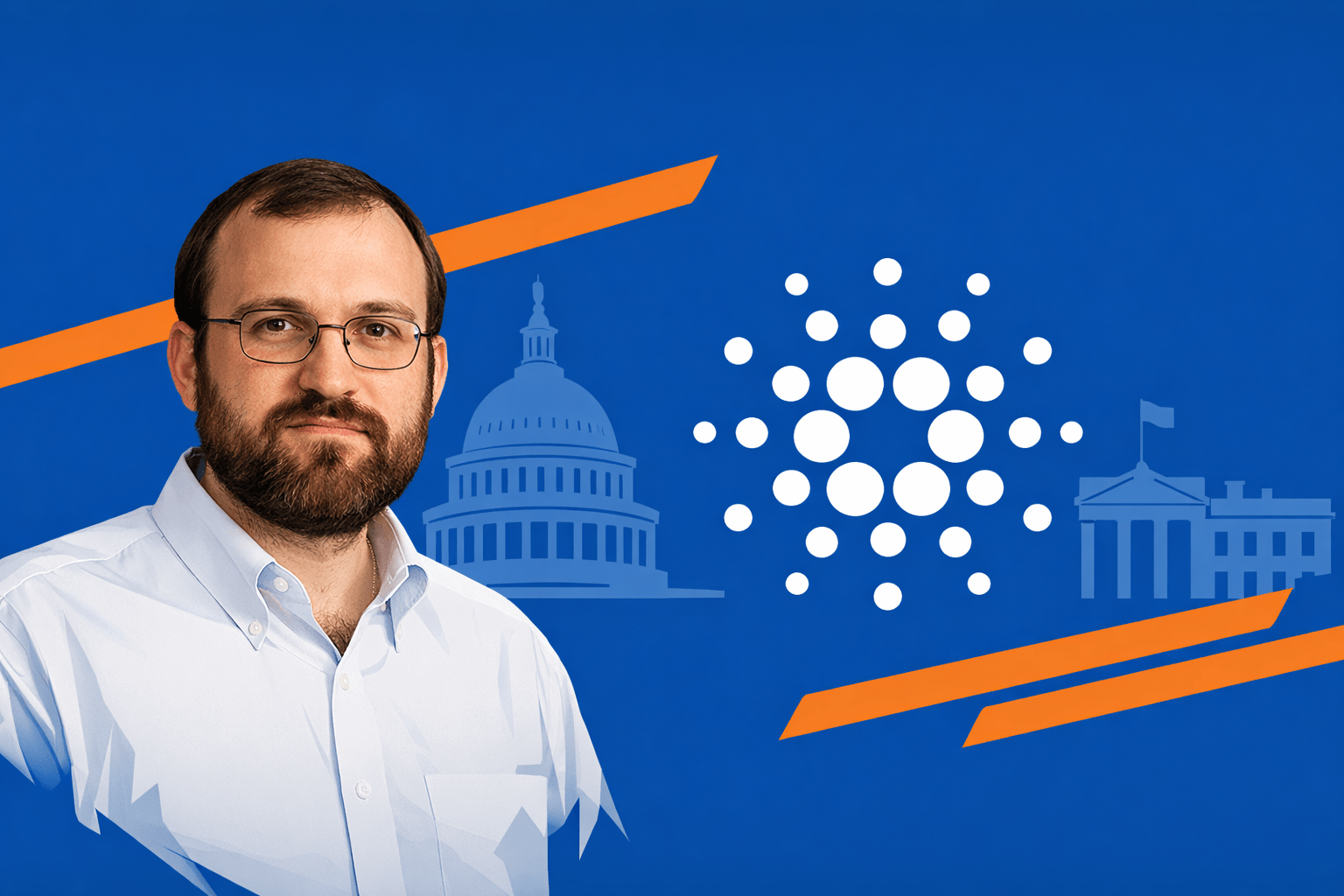

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!