ADA Price Drops Again as Crucial Indicator Points to Buying Opportunity - Crypto Economy

TL;DR ADA drops nearly 11% in the past twenty-four hours and trades at $0.3792, yet several technical indicators show early stabilization. The RSI remains below 30, pointing to a potential entry zone for...

TL;DR

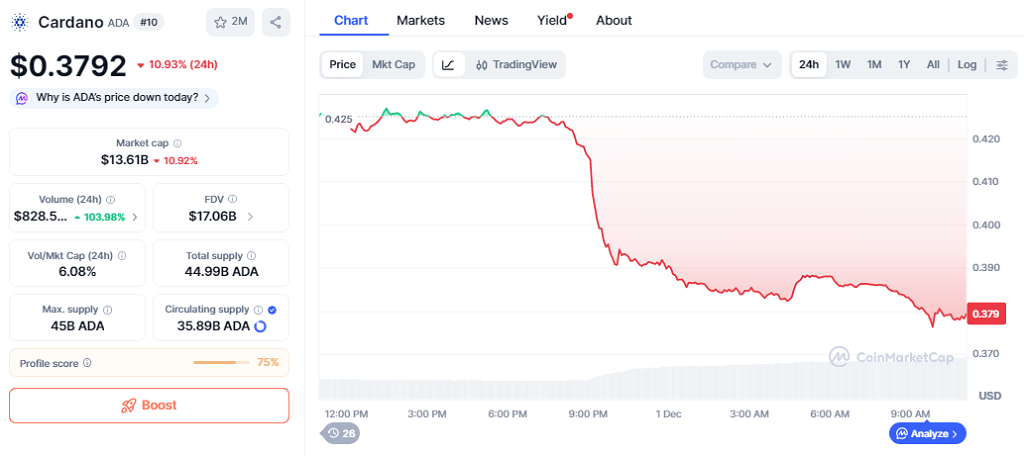

- ADA drops nearly 11% in the past twenty-four hours and trades at $0.3792, yet several technical indicators show early stabilization.

- The RSI remains below 30, pointing to a potential entry zone for accumulation-minded investors.

- Market cap falls to $13.61 billions, while sustained exchange outflows suggest reduced near-term selling pressure.

ADA faces another retracement, although a set of technical and on-chain signals suggests conditions that may favor buyers who maintain a pro-crypto outlook.

Market Pressure Intensifies As ADA Extends Its Decline

ADA deepens its short-term pullback with a 10.93% drop in the last twenty-four hours. The price holds near $0.3792, and market capitalization stands at $13.61 billions, its lowest level since September. The downturn affects multiple large-cap assets, yet Cardano’s trajectory reflects a longer phase of weakness that pushed it well below recent highs. Even so, several analysts note that compression cycles often precede sharp reversals once selling momentum softens, especially when liquidity thins and long-term holders remain firmly positioned.

Ali Martinez highlights that the TD Sequential indicates a favorable inflection for ADA, while Marcus Cornivus identifies the $0.38 to $0.40 demand zone as an important structural level. He argues that if this range holds, price momentum can rotate upward toward $0.55 or even $0.60. His view is that ADA’s structure remains intact and that recent pullbacks stay within normal parameters for an asset supported by long-term participation and ongoing developer activity across the Cardano ecosystem.

Crucial Indicator Strengthens A Possible ADA Rebound

The RSI below 30 reinforces the interpretation of oversold territory. This tool measures the speed and magnitude of price changes and often signals potential pivots when readings reach extreme levels. For many traders, the current RSI aligns with conditions typical of phases in which selling pressure fades and buyers start absorbing liquidity. Some market participants also point to rising on-chain engagement, suggesting steady interest despite the price decline.

Another element drawing attention is ADA’s exchange netflow, which shows withdrawals exceeding deposits for several weeks. This signals reduced immediate supply available for sale and a stronger inclination among holders to use self-custody, a recurring pattern ahead of volatility expansions.

Despite the latest decline, the combination of oversold indicators, concentrated demand zones and lower exchange supply forms a backdrop that several analysts view as constructive. If ADA maintains its current support region, bearish momentum may ease and the asset could regain stability while preparing for potential mid-term recovery flows.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!